- English

- ePUB (mobile friendly)

- Available on iOS & Android

529 and Other College Savings Plans For Dummies

About this book

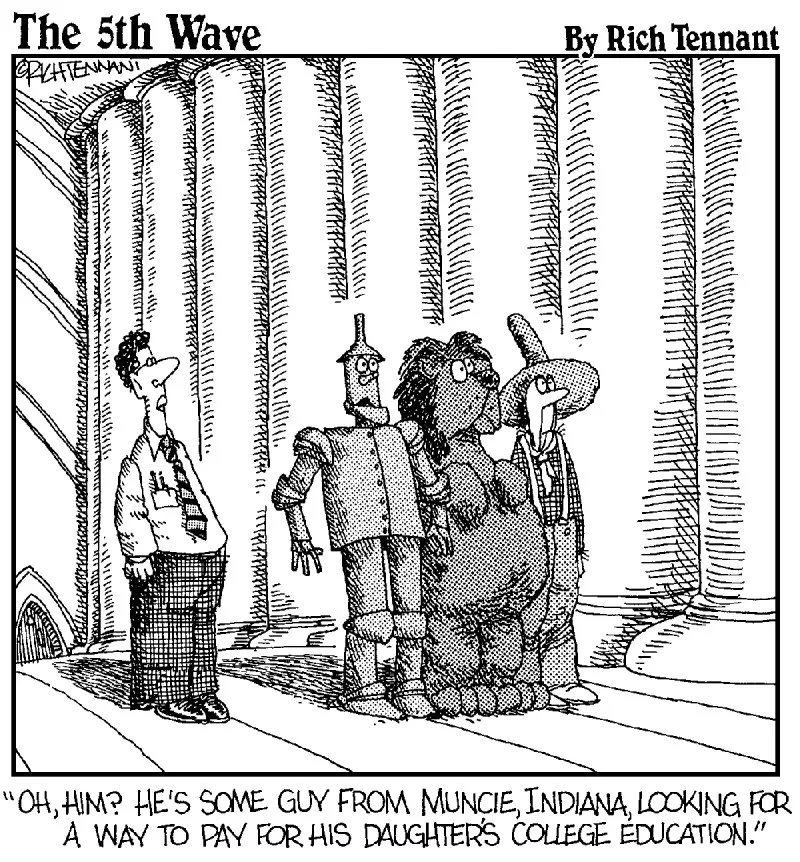

There's no question: The cost of college continues to soar, even when the rest of the economy stagnates, and this reality is not likely to change any time soon. Fortunately, everyone, including you, the various governments (federal and state), and the colleges themselves, are in on this secret, so everyone can plan and plot, well in advance of that eventual first day of your child's freshman year, ways to get that child there, and ways to help you pay the bills when they happen. Consider this book to be your accomplice.

529 & Other College Savings Plans For Dummies is simply a way to find a reasonable solution to a seemingly unreasonable problem: saving for future college costs in the sanest, least stressful way possible for you. In keeping with the theme of stress reduction, you can use this book in a variety of ways:

- As a reference: It's all here: the ins, the outs, the do's, and the don'ts. The world of college savings is one of very specific rules, and they're here, in all their glory, and they're all explained.

- As an advisor: It's a case of the very good savings techniques, the merely okay savings techniques, and the truly ugly techniques (which you really want to avoid), and this book highlights them all.

- As a little light reading: Amazingly enough, the topic of money can be mildly amusing, and college savings is no exception. Read this with an eye towards the absurd, and you won't go far wrong.

This down-to-earth book is designed to explain the strategies that are out there to help you save, save, save. There's no doubt that the bill will be large; there's also no question that, with planning, strategy, and purpose, you can achieve your goal. To help you get there, this book covers all these vital topics, and more:

- Evaluating all your resources

- Understanding the basics of Section 529 plans

- Working around the 529 shortcomings

- Contributing to Coverdell accounts

- Choosing savings bonds that work

- Looking at your investment options

- Searching for scholarships, fellowships, and grants

- Tapping into your Roth IRA

- Financial Aid 101

In this one-size-fits-all world, the powers that be have recognized that all people don't save money the same way. Some save more, some save less, some can live with risk, and others can't tolerate any risk. Clearly, no two are alike, but you're all savers, either present or potential. Numerous options exist that make saving possible and desirable for everyone. 529 & Other College Savings Plans For Dummies is here to tell you that it is possible to understand the costs associated with college, both right now and in the future, and then find ways to pay for those costs.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Part I

Figuring Out the Cost of College — and How to Pay It

Chapter 1

Braving the New World of College Savings

In This Chapter

Doing the Numbers

Figuring up the costs

Finding resources to help you save

Saving efficiently

Exploring Section 529 Plans

Following the rules

-plgo-compressed.webp)

Making your money work for you

Choosing the best options

Table of contents

- Title

- Contents

- Introduction

- Part I : Figuring Out the Cost of College — and How to Pay It

- Chapter 1: Braving the New World of College Savings

- Chapter 2: Checking Out the Cost of College

- Chapter 3: Realizing All Your Resources

- Chapter 4: Sharpening Your Savings Techniques

- Part II : Piecing Together Section 529 Plans

- Chapter 5: Laying Down the Basics of Section 529 Plans

- Chapter 6: Applying Section 529 Plans to Your Household

- Chapter 7: Weighing the Pros and Cons of Section 529 Plans

- Part III : Uncovering Coverdell Accounts

- Chapter 8: The Changing World of Coverdell Education Savings Accounts

- Chapter 9: The Mechanics of Coverdells

- Chapter 10: Figuring the Pluses and Minuses of Coverdell Accounts

- Part IV : Filling In the Gaps: More Ways to Save for College

- Chapter 11: Saving for College with Qualified U.S. Savings Bonds

- Chapter 12: Setting Up Personal Investment Accounts for Yourself and Your Kids

- Chapter 13: Saving for College in Trust Accounts

- Chapter 14: Saving in Your Retirement Plans: The IRA Dilemma

- Chapter 15: Selling or Refinancing Your Family’s House

- Chapter 16: Accessing Scholarships and Awards

- Chapter 17: Turning On the Financial Aid Faucet

- Part V : The Part of Tens

- Chapter 18: Ten Musts for Successful Savings

- Chapter 19: Ten Ways to Dodge the Tax Code Minefield

- Appendix: Section 529 Plans, State by State

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app