- 50 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

The Private Sector Operations—Report on Development Effectiveness series reviews and highlights the development effectiveness of private sector operations of the Asian Development Bank (ADB). This 10th edition reports on the performance of active projects of ADB's Private Sector Operations Department; examines the projects' contributions to ADB's new corporate results framework, Strategy 2030, and the Sustainable Development Goals; and spotlights ADB's new Operational Plan for Private Sector Operations, 2019–2024.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

CONTRIBUTIONS TO STRATEGY 2030 OPERATIONAL PRIORITIES

Solar driers for apricot farmers in Pakistan. ADB supports Kashf Foundation’s lending to low-income women, and female micro and small entrepreneurs in Pakistan (photo by ADB).

Strategy 2030 defines the operational priorities to achieve ADB’s vision of a prosperous, inclusive, resilient, and sustainable Asia and the Pacific. Given the critical role the private sector plays as a key contributor to economic growth in developing economies, ADB is committed to expanding its private sector operations to reach one-third of total operations in number by 2024. To achieve this objective, ADB will expand into new and frontier markets, scaling up operations beyond traditional infrastructure and finance sectors in such segments as environmental infrastructure, transport, ICT, agribusiness, and education and health. ADB will enhance its local currency offerings and further develop its equity investments platform while mobilizing more cofinancing through its credit enhancement, syndications, and asset management activities in line with its mobilization targets of $2.50 of long-term cofinancing for every $1.00 in own financing.

While the future of Asia and the Pacific depends upon a dynamic private sector, significant challenges in business environments and gaps in financial markets continue to prevent the region from realizing more inclusive and sustainable growth. In some parts of Asia, these challenges and gaps are massive. Developing Asia alone will require annual infrastructure investments of $1.7 trillion (or $26 trillion from 2016 to 2030). A notable 30% of the $1.5 trillion global trade finance gap originates from developing Asia.

Asian capital markets, especially in developing Asia, lag most of the world, and specialized, important financial products such as project bonds and climate bonds remain underdeveloped. The lack of long-term local currency financing impedes investment and reinforces a real gap in further growth and/or creates potential foreign exchange imbalances.

ADB is best suited to respond to and tackle these gaps and challenges by leveraging its sovereign and nonsovereign operations. For sovereign operations, policy advice, technical assistance, policy-based lending, and project lending help DMCs foster enabling market conditions and the institutional capacity required to attract private sector investment. Through its nonsovereign operations, ADB can help raise environmental, social, and governance standards; provide financing that may not be available from the market (either at all or on reasonable terms); improve project design and development outcomes; and mitigate perceived risks to design, accelerate, and achieve meaningful development results.

1. Addressing Remaining Poverty and Reducing Inequalities

In 2019, ADB’s private sector operations continued to assist DMCs in broadening access to financial services to support health care and education. ADB focused 21% of its private sector operations on inclusive business initiatives that provide economic opportunities to the poor.

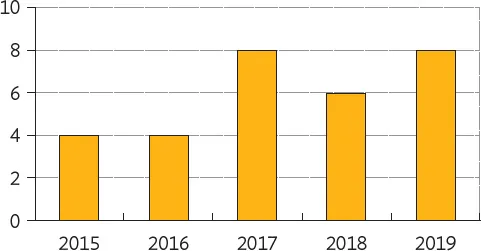

In 2019, PSOD signed agreements for eight inclusive business transactions (Figure 12).

Figure 12: Inclusive Business Projects Committed, 2015–2019

Source: Asian Development Bank (Private Sector Operations Department).

Most of these transactions focus on providing financial services to the underserved (Box 2), on improving rural livelihoods, or on providing health services to underprivileged segments of the population.

Box 2

India—Inclusive Business Finance and Gender Project in Lagging States

India—Inclusive Business Finance and Gender Project in Lagging States

Fullerton India Credit Company Limited extends financing to micro, small, and medium-sized enterprises (MSMEs). The Asian Development Bank (ADB) loaned $150 million to Fullerton so it can expand its lending particularly to borrowers in lagging areas, as well as women-led MSMEs. Fullerton aims to reach at least 2.9 million MSME borrowers, including 2.67 million women; and 950,000 MSME borrowers from underserved states.

MSME support. ADB’s loan to Fullerton will make loans accessible particularly to women entrepreneurs (photo by ADB).

Source: Asian Development Bank (Private Sector Operations Department).

In the PRC, Far East Horizon Limited, one of the PRC’s leading financial services groups, received a $150 million loan from ADB to provide lease financing to public hospitals in 12 least developed provinces, where the per capita income is the lowest among the 31 provinces of the PRC. Majority of the rural population will directly benefit from the project, which will reduce the need for long-distance travel to city hospitals as county hospital facilities are upgraded. Far East Horizon, which has over 20 years of experience in health care leasing, is expected to finance the lease or purchase of modern medical equipment; and the construction, expansion, or refurbishment of hospital buildings and associated medical facilities of 50 public hospitals. Also, the project is expected to reduce the regional disparity in health care standards, widen access to quality health care, and improve delivery of health services in rural areas. At present, local areas are significantly underserved by the health care system where average health care expenditure is only 40% of the level in urban areas.

In Southeast Asia, ADB invested a combined $12.5 million from its own fund and the Leading Asia’s Private Sector Infrastructure Fund (LEAP) to support PHINMA Education Holdings’ plan for capacity expansion and acquisition of new tertiary education institutions. PHINMA will improve access to quality tertiary education and increase employability, especially for students from low-income households in both countries. The project will focus on students from low-income households, to improve their access to quality tertiary education and increase their employability. PHINMA is expected to expand student enrollment from 68,819 to 114,000 during its first 5 years of operation.

In 2019, ADB ventured into its first satellite financing to provide wide access to broadband internet connections in remote areas in Asia and the Pacific, where internet coverage is limited or not available. Access to broadband internet connections can stimulate economic growth and generate employment, thereby reducing poverty and inequality between rural and urban areas, and between developed and developing countries.

ADB provided a $50 million financing package to Kacific Broadband Satellites International Limited to support the construction, launch, and operation of a shared, geostationary earth orbit, high-throughput satellite featuring Ka-band technology (Kacific-1). The satellite was successfully launched on 7 December 2019 from Cape Canaveral, Florida, and will have a minimum useful life of 15 years. It is expected to operate for 20–25 years.

This project demonstrates how ADB can contribute to the extensive use of technology and innovation by expanding internet access in Asia and the Pacific.

2. Accelerating Progress in Gender Equality

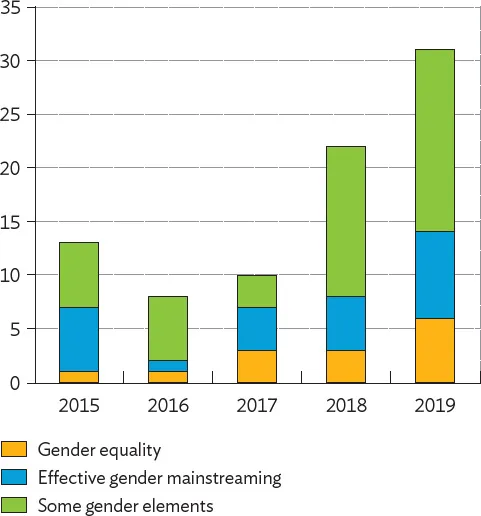

PSOD works with clients to enhance gender equity by supporting projects designed to benefit women. In 2019, PSOD committed 31 projects with gender elements to help women improve their livelihoods, or make the work environment more supportive of women and their needs (Figure 13).

Figure 13: Commitments with Gender Elements, 2015–2019

Source: Asian Development Bank (Private Sector Operations Department).

Eight of the 31 projects deliver outcomes that directly support gender equality and women’s empowerment by narrowing gender disparities. In Pakistan, ADB provided a $25 million loan to assist Kashf Foundation, one of the country’s leading microfinance service providers, to support lending operations to low-income households and women-led MSMEs. Through Kashf, women will be empowered economically through quality and cost-effective microfinance services, and greater access to finance.

In Mongolia, ADB provided a $30 million loan to XacBank, the country’s fourth largest commercial bank, to support its lending operations to MSMEs, including those led by women and located outside Ulaanbataar. Through its gender action plan, XacBank will incorporate measures to promote gender equality and/or women empowerment in its business activities; enhance its outreach campaigns targeting 1,000 women-led MSMEs; strengthen staff skills on gender sensitization and respectful work environment; and establish a comprehensive program to heighten awareness and support to women borrowers. The improved access to finance will support the expansion of MSMEs and diversification of the economy, which in turn will contribute to employment and poverty reduction. This is the second ADB loan to XacBank; however, this is the first time that ADB’s loan may be partially denominated in the local currency (togrog).

In Myanmar, ADB committed a $500 million loan to support the rolling out of fixed and wireless broadband services and upgrading of Ooredoo QPSC’s mobile telecommunications networks. The initiative will improve people’s access to quality telecommunication services that will enable better access to information, knowledge, and social and economic opportunities. In particular, the investment aims to reduce digital gender gaps by increasing women’s basic access to ICT and by facilitating the provision of ICT jobs, promotion, training, and health services for women. The investment will help Ooredoo increase its active subscribers to 15 million by 2023 of which almost 50% are expected to be women.

Box 3 illustrates how ADB-supported projects promoted gender equality in the Philippines and Georgia.

Box 3

Georgia and the Philippines—Support to Women Entrepreneurs and Borrowers

Georgia and the Philippines—Support to Women Entrepreneurs and Borrowers

ASA Philippines Foundation

The ASA Philippines Foundation is a microfinance nongovernment organization that provides financing solely to low-income women borrowers to meet their livelihood and business needs. The foundation is a recipient of a $30 million loan from the Asian Development Bank (ADB) meant to broaden access to finance for women-owned microenterprises especially in conflict-impacted and lagging areas. The foundation will expand its portfolio of business loans to microenterprises and strengthen its resource base for providing loans to micro-housing, water supply, and on-site sanitation for women borrowers. This will improve women’s income levels, savings, and overal...

Table of contents

- Front Cover

- Title Page

- Copyright Page

- Contents

- Tables, Figures, and Boxes

- Foreword

- Preface

- Abbreviations

- Weights and Measures

- Executive Summary

- ADB’s Private Sector Operations AT A GLANCE

- Introduction

- Operational Results

- Catalyzing and Mobilizing Cofinancing

- Contributions to Strategy 2030 Operational Priorities

- Other Approaches to Developing the Private Sector

- Post-Completion Evaluation of Transactions

- Awards Received by ADB, Its Investees, and Transactions

- Measuring ADB’s Private Sector Operations Contributions to the Sustainable Development Goals

- Footnotes

- Back Cover

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Private Sector Operations in 2019 by in PDF and/or ePUB format, as well as other popular books in Business & Corporate Governance. We have over one million books available in our catalogue for you to explore.