eBook - ePub

EIB Group Survey on Investment and Investment Finance 2020: EU overview

- 44 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

EIB Group Survey on Investment and Investment Finance 2020: EU overview

About this book

The annual EIB Investment Survey (EIBIS) gathers qualitative and quantitative information on investment activities by around 12 000 companies across the EU27 and an additional benchmark sample in the UK and US. It provides information on their financing requirements and the difficulties they face.This brochure provides an overview of 2020 results for EU.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Climate Change

CLIMATE CHANGE IMPACT

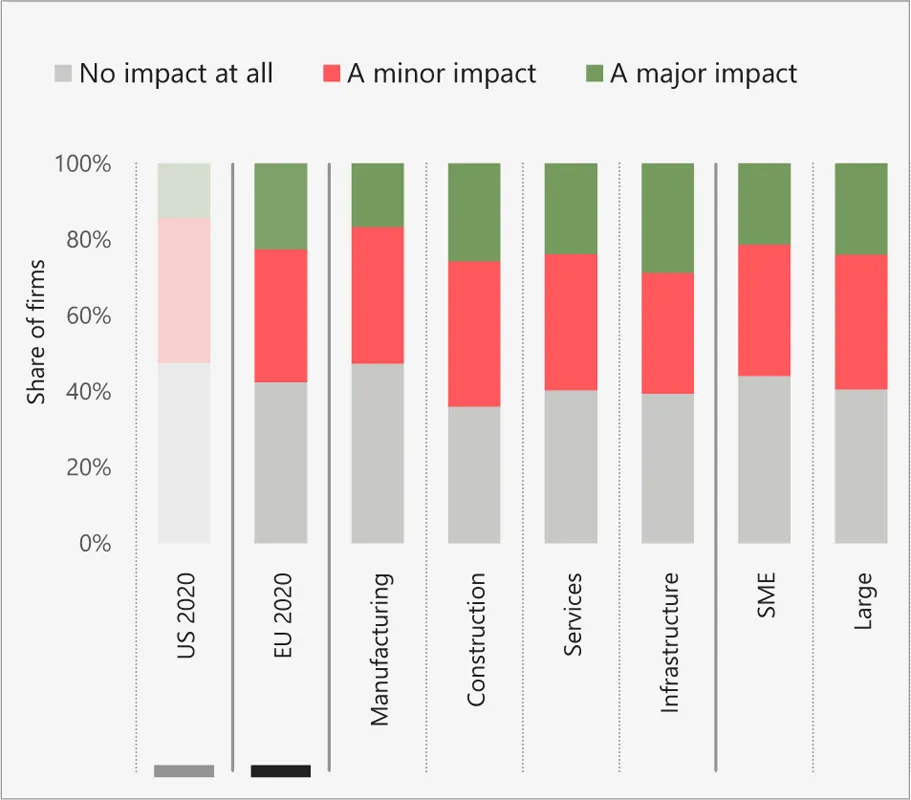

Across the EU, 23% of firms say that climate change is having a major impact on their business, with a further 35% saying it is having a minor impact. US firms are less likely to say that climate change is having a major impact on their business (14%).

Firms in the manufacturing sector are the least likely to say that that climate change is having a major impact (17%), but otherwise the proportion is consistent across sector and firm size.

Firms in Spain are by far the most likely to say that climate change is having a major impact on their business (48%), followed by those in France (31%). Firms are most likely to see there has been no impact at all in Belgium (61%), Malta and the Netherlands (both 56%).

Q, Thinking about climate change and the related changes in weather patterns, would you say these weather events currently have a major impact, a minor impact or no impact at all on your business?

Base: All firms (excluding don't know / refused responses)

CLIMATE CHANGE IMPACT BY COUNTRY

Q, Thinking about climate change and the related changes in weather patterns, would you say these weather events currently have a major impact, a minor impact or no impact at all on your business?

Base: All firms (excluding don't know / refused responses)

REDUCTION IN CARBON EMISSIONS OVER NEXT FIVE YEARS BY SECTOR AND SIZE (NET IMPACT %)

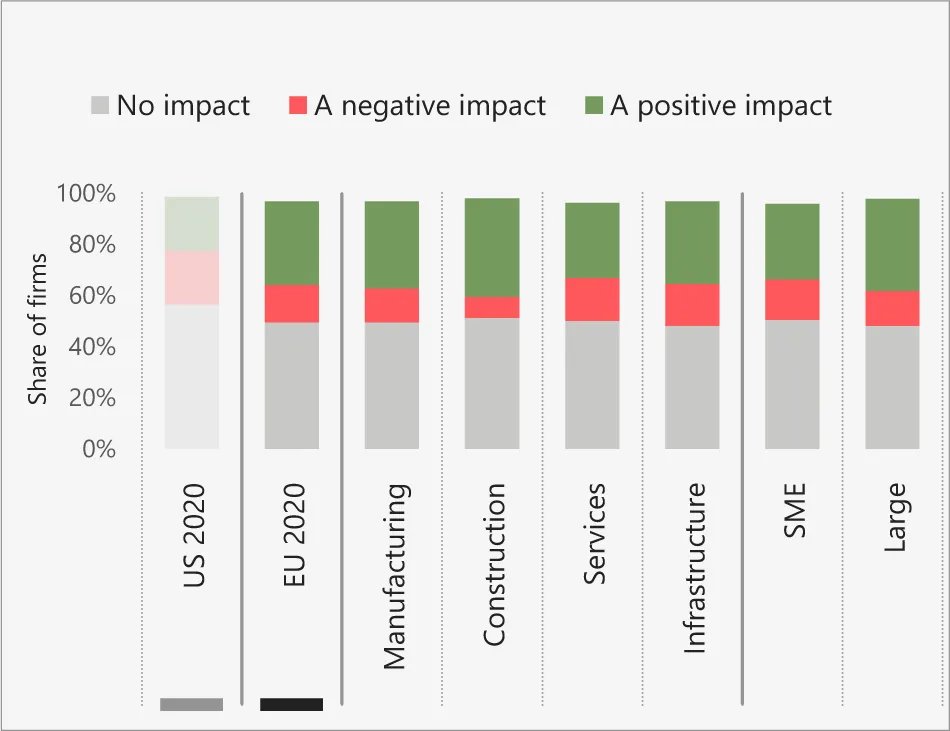

One in three firms across the EU (33%) think that the transition to a low-carbon future will have a positive impact on market demand over the next five years, while 15% think there will be a negative impact and 49% no impact for their business. EU firms have a more positive outlook on this issue than US firms.

Firms in the construction sector are most likely to predict a positive impact on market demand (38%), while large firms are more likely to expect a positive impact than SMEs (36% and 30% respectively).

Q. What impact will the transition to a reduction of carbon emissions have on market demand over the next five years?

Base: All firms (data not shown for those who answered don’t know / refused)

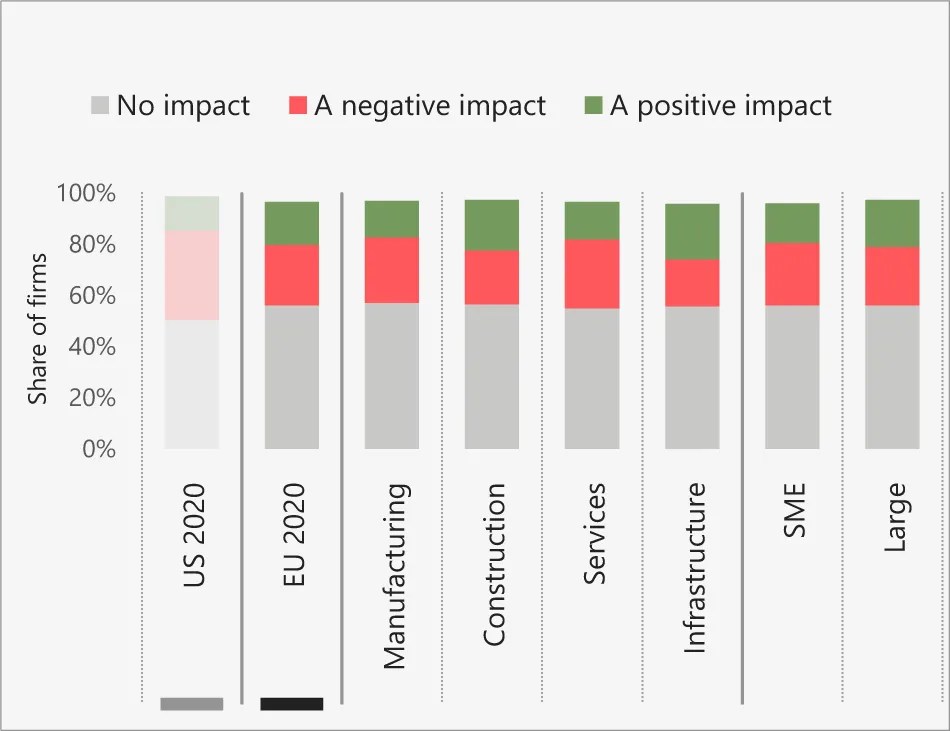

EU firms are more likely to say that the transition to a low-carbon future will have a negative rather than a positive impact on the supply chain over the next five years (24% and 17% respectively). US firms are more likely than EU firms to predict a negative impact (35%).

Firms in the infrastructure and construction sectors are most likely to predict a positive impact on their supply chain (22% and 20% respectively).

Q. What impact will the transition to a reduction of carbon emissions have your supply chain over the next five years?

Base: All firms (data not shown for those who answered don’t know / refused)

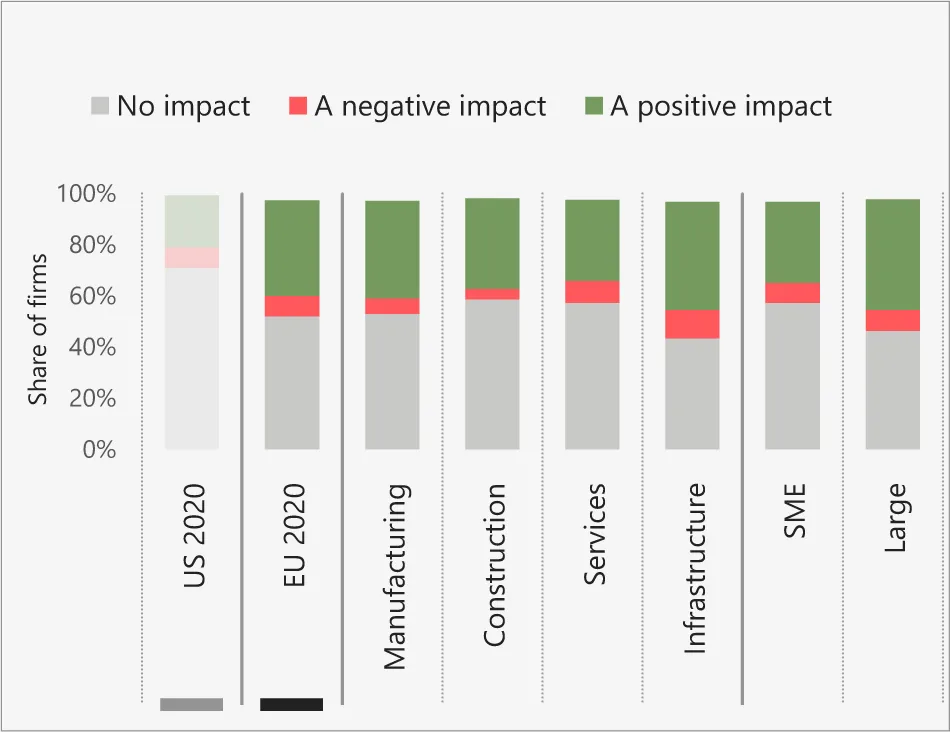

Across the EU, 37% of firms think that the transition to a low-carbon future will have a positive impact on their reputation over the next five years, while 8% think there will be a negative impact. EU firms again have a more positive outlook than US firms.

Firms in the infrastructure sector are most likely to predict a positive impact on their reputation (42%), while large firms are more likely to expect a positive impact than SMEs (43% and 32% respectively).

Q. What impact will the transition to a reduction of carbon emissions have on your reputation over the next five years?

Base: All firms (data not shown for those who answered don’t know / refused)

INVESTMENT PLANS TO TACKLE CLIMATE CHANGE IMPACT

Two in three EU firms (67%) have either made investments or plan to do so, to tackle the impacts of weather events and reductions in carbon emissions. This is higher than in the US (46%).

The proportion of firms that have made investments, or have plans to do so, is highest in the manufacturing and infrastructure sectors (both 71%), and is lowest among firms in the construction sector (55%). It is higher for large firms than SMEs (78% and 58% respectively).

Firms in Belgium (80%) and Finland (77%) are the most likel...

Table of contents

- Cover

- Contents

- Title

- EIBIS 2020 – EU Overview

- Investment Dynamics

- Investment Focus

- Investment Needs and Priorities

- Innovation Activities

- Drivers And Constraints

- Investment Finance

- Access To Finance

- Energy Efficiency

- Climate Change

- Profile of Firms

- EIBIS 2020 – EU Technical Details

- EIBIS 2020 – Technical Details

- Copyright

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access EIB Group Survey on Investment and Investment Finance 2020: EU overview by European Investment Bank in PDF and/or ePUB format, as well as other popular books in Business & Corporate Finance. We have over one million books available in our catalogue for you to explore.