![]()

CHAPTER 1

Welcome to the Red Pill of Finance

It was our first meeting with Keesia and Shawn. They were like many of our clients––in their 40s, married with children, halfway through their working years, feeling trapped in their careers and skeptical of financial advisors. They were reluctant to meet but had heard from some people that we weren’t like the other guys, so they showed up and were ready to talk.

They talked. We listened. We asked questions. They answered. We encouraged them as they started to rethink their plans and dream again!

We are all in the same position as Keesia and Shawn. We have amazing gifts, but most of us need someone to help us unlock our talents. All they needed was a plan created for their risk tolerance to enable them to do it.

Up to this point, Keesia was working at a marketing firm and struggling to go to work every day. Shawn was working in a family business and did not feel challenged. But when we started talking about the opportunities ahead, we noticed a change in their demeanor. The skepticism disappeared. They started sharing what they were passionate about and what they really wanted to do. They started getting excited about the possibilities. And we hadn’t even talked about money yet.

At the end of our meeting, we realized Keesia needed to start down a new path. She needed to create her own marketing firm. To do that, she needed a business plan, business name, targeted clientele, and a client acquisition plan. Meanwhile, we tasked Shawn with getting a handle on their spending and monthly expenses. We asked them to track their expenses for the next three months.

The next time we met, they knew what their monthly expenses were. Keesia had picked out a business name, mapped out a business plan, and identified her clientele. They did so much work in two months. Their enthusiasm about changing their lives was contagious. But halfway through the meeting, Keesia called a time-out. All the work she’d done had made her realize something: she didn’t want to start a marketing firm. She had figured out what she was passionate about and what she wanted to spend the rest of her life doing. She told us a story about her mother-in-law asking Keesia to write her obituary. She explained how honored she felt writing the final story of someone’s life and how she’d written obituaries for many loved ones. She realized she was an obituary expert. More importantly, she knew she wanted to help people write good obituaries and legacy stories for their family members. By the end of her story, we all had tears in our eyes and knew she’d made an amazing decision. “So that’s my idea. Is it crazy?” she asked.

“No!” we erupted. “It’s not crazy. It sounds incredible! How can we help?”

From then on, our meetings with Keesia and Shawn have been planning sessions to help them maximize their finances, streamline their budget, and empower Keesia to help as many people as she can creating digital products to help the masses. We are thrilled to report that she’s dominating at her new business and helping more and more people every day.

You can hear more about Keesia’s entrepreneurial story on our podcast, https://www.uncommonwealth.com/podcasts/keesia-wirt.

The final part of this story is a shout-out to Shawn, the spouse who believed in and supported his partner’s dream. It’s not easy stepping back and allowing your spouse to pursue her dreams. But that’s what he did. And we have seen time and again how influential a supportive spouse is to the success of the endeavor. Now that Keesia is on a new path, we’re so excited to help Shawn unlock his unique gifts and share them with the world. It is time for Shawn to start his Uncommon Path, and Keesia will be beside him to help achieve his Uncommon Wealth.

Welcome to the Path of Uncommon Wealth

Uncommon Wealth is the pursuit of monetizing your passion within a holistic financial plan. Uncommon Wealth will help you design the life you want to live right now while utilizing and building passive streams of income to provide for the future. Wealth transcends finances and encompasses your whole self, good and bad experiences, core values, and your give-back to society. Are your relationships, hobbies, spiritual, social, and physical well-being self-aligned and taken into account by your financial plan? Are you designing a life you are excited to live?

When it comes to planning for your present and future, there is a better way.

So many people dream of retirement, because that’s when you do what you really want, instead of someone else telling you what to do. What if you could do what you love every day?

When would you want to stop doing that? The answer is, “Never!”

Instead of just dreaming about retirement, what if you could stop dreaming and do what you want to do starting right now?

That is what we call Uncommon Wealth.

Let’s start redefining retirement.

We have been on this path for nearly a decade, both individually and together as a business. We are excited to share what we have learned with you.

Why We Wrote This Book

As we work with clients, it’s amazing what we discover together. Building wealth is about more than the standard set of investment products you’ve been told are the path to retirement and financial freedom.

We wrote this book from our personal experience and through the process of helping clients find their uniquely Uncommon Path.

Too often, financial planners make you feel guilty for not saving enough today so you can retire in 20 or 30 years. But what’s worse is looking back with regret on a path not taken. Finding a financial way forward based on what you are passionate about and good at is the heart of the uncommon path to time freedom.

Traditional financial planning can stifle people’s passions and interests in the name of saving for the last day of your life. How sad is that? Our philosophy is the exact opposite. We want to help you keep more money in your pocket now and think about the present and the future you want for yourself and your family. As you do, you will have more wealth and understanding of how to achieve time freedom faster and more sustainably.

Building wealth should be about more than saving for your distant future. Every single client we meet with has a story. They have something beautiful they want to accomplish. Often the goals we uncover together are for one to three years out, yet most financial planning is based on the idea of hiding money away for 20 to 30 years. Why? Because financial institutions and advisors are incentivized to take and invest your money for the long-term. Financial institutions profit from having your money for a long time. They want it consistently and to give you back as little as possible. A good example of this is your 401(k) withholding that is taken out of your paycheck every pay period.

We believe another way is possible. We believe there is something beautiful inside you. You have dreams, goals, and ideas that shouldn’t have to wait for retirement. Because here’s the thing we’ve learned: when you invest strategically in the way you were made, the way you are gifted, and what fires you up, you can actually make more money, have more joy, and live a life that you desire.

For many, the real problem isn’t dreaming or having ideas, it’s investing in yourself and organizing those ideas and your money to support your dreams. Traditional financial planning doesn’t support those ideas because the way the industry is set up, it can’t make money from them.

We want to give you tools throughout this book to help you down this path. More than anything, we want to help you unlock what is beautiful inside you. And we want to help you love your life and how you give back to the world right now.

Those dreams—and that drumbeat inside you that won’t let those dreams die—are why we wrote this book.

The Uncommon Wealth Path is a lot like parenting. It’s hard. Sometimes you will feel like you are making a mistake. It’s unpredictable, but as time passes and you stick to your guns and principles, you see a richer and deeper path. Soon it will be hard to imagine life any other way. Just like raising kids brings a lot of unexpected challenges, but mostly overwhelming joy, so does the Uncommon Path. That is why we had to write this book.

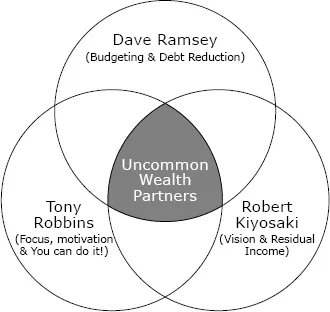

The Middle Ground between Dave Ramsey, Tony Robbins, and Robert Kiyosaki

This book is meant to be a guide for anyone wanting to build an Uncommon Wealth Path. For some context, here is a framework to understand where we are coming from in our approach to helping people plan for the immediate and distant future.

Obviously, we have learned a great deal from many people. There are a number of “gurus” people turn to when it comes to breaking through to financial and personal freedom. Three that come to mind are Dave Ramsey, Robert Kiyosaki, and Tony Robbins.

We get a lot of inspiration from them, but we also see how our approach fills in some gaps these men seem to leave. This book and our approach is a way of bridging those gaps.

Here’s what we mean: Dave Ramsey (no relation to Phillip) is really great at honing in on budgeting and paying down debt. That’s great. Living above your means is not a viable path for anyone in the long term. A budget is certainly like the front lines of a war. If you lose the front line, you are probably going to lose the war. Like Omaha Beach and our stand on D-Day, it was all about winning the front lines in Europe, to give us a foot hold, so the rest of our troops could move in. Dave Ramsey hates debt of all kinds and rails against its use or purpose. We would agree in relation to consumer-related debt, but there are ways of leveraging debt to your advantage when it is backed by an asset or business. We like to help people explore those possibilities if it makes sense for their plan and risk tolerance. Getting rid of debt might not always be the first step into this Uncommon Path.

Robert Kiyosaki’s book, Cashflow Quadrant, is one of our absolute must-read books for financial mastery. Kiyosaki does a great job of casting vision, but he’s a little bit light on how to get there. His Rich Dad/Poor Dad empire is all about finding sources of residual income. We are huge fans of residual income but want to help people find their own specifically customized path into those sources with tangible action steps. A myth of residual income is that it’s a one-time effort or push, and then the money will just roll in. That couldn’t be further from the truth. Residual income is hard. It takes patience, capital, and discipline, but it’s worth it in the end.

Tony Robbins is inspirational and motivational. He does an excellent job inspiring people and helps you pull out what’s inside of you and/or what’s blocking you from achieving your goals. He creates an environment for you to look inward and be honest with yourself. But beyond inspiration is the hard work you have to do to be successful in any endeavor.

We will bring all of that together and more in Uncommon Wealth.

In Uncommon Wealth: You are your best asset – Invest in yourself, we want to provide a path for you to embrace the Uncommon Mindset, to walk you through a process that will ultimately lead you to time freedom, and to share examples of those succeeding in going before you in pursuit of Uncommon Wealth.

Let’s begin your journey to fully realizing the Uncommon Life!

![]()

CHAPTER 2

The Problem with Building Wealth Today

There are plenty of established financial planning organizations out there, so why didn’t we just join the crowd in one of those companies? It’s simple. We saw firsthand how broken the current financial system can be. We were a part of it, and for us it was just not a good fit. We set out to create a different way.

At the end of the day, financial planning is about income. That is the endgame. The goal is financial freedom. Traditional financial planning is all about investing through the stock market, mutual funds, index funds, bonds, and annuities to provide that lifetime income in retirement.

But there are so many ways to produce income outside just investing in the stock market. That’s why we are so passionate, why we love to work with clients, and why we wanted to share our ideas for financial freedom with you.

Don’t get us wrong, investments in the stock market are not a bad thing. Every day we help clients with investments, with evaluating social security income, pension income, and investments to produce income. It’s just that there is so much potential for building wealth beyond these sources. Too often that potential goes untapped.

Many of our clients come to us saying things like:

“I don’t need any more of those kinds of investments.”

“My parents’ path of working one job and retiring at 65 worked for them, but that’s not what I want.”

“How do I retire sooner?”

“What can I do before age 59-and-a-half for income when the government tells me I cannot access those retirement plan funds?”

“How do I retire without relying on social security because I am not sure it will be there?”

“I have a great idea for a business. How do I start it, quit my job, and not go bankrupt?”

We started a podcast called, “The Uncommon Life Project.” We did this in part to highlight what we call the Seven Sources of Residual Income, which we will be digging into in later chapters. Through the podcast, we share stories of awesome people who are designing the life they want today by doing things that produce income now, not after they retire. We interview people who are building a bridge to the life they feel called to, and we find out how they did it.

This book is our way of sharing these principles at a high level so you can begin to imagine how to take your dreams and turn them into a plan for the present and future.

Here is an example to make this point crystal clear. Recently, we were meeting with another advisor who runs a successful retirement income practice. We respect him a lot. After talking for a while, he shared that he was investing in a brewery. It’s an interest of his, and he thought the return potential was really strong. He’s also part of a group starting a bottling company to bottle the beer, and openin...