- 86 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

The importance of development that provides for equitable economic growth and the sustainable use of natural resources has become increasingly apparent during the coronavirus disease (COVID-19) pandemic. COVID-19 has emphasized the need for a renewed focus on achieving the 17 Sustainable Development Goals (SDGs) as the global blueprint to ending poverty, protecting our planet, and ensuring prosperity. This publication provides an overview of SDG bonds as a mechanism to help mobilize the huge amount of financing required to meet the SDGs in developing Asia. It also proposes a new type of SDG bond that could contribute to accelerating sustainable development in the region.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

1 Overview

GMS Kunming–Haiphong Transport Corridor. Noi Bai–Lao Cai Highway Project in Viet Nam. (photo by ADB).

While public finance is core to the implementation of the United Nations (UN) Sustainable Development Goals (SDGs), capital markets likewise plays a key role. This publication provides an overview of how bonds that align with the SDGs, or SDG bonds, can serve as a mechanism to accelerate the scale of finance needed to meet the sustainability goals of countries in developing Asia. The publication presents current approaches that are being adopted, along with the challenges to a wider issuance of SDG bonds. It subsequently sets out a proposal for a specific type of SDG bond that could accelerate the required momentum, especially after the massive impact of the coronavirus disease (COVID-19) crisis.

A. The COVID-19 Factor

The importance of development that provides not just equitable economic growth, but also sustainable use of the planet’s natural resources, has perhaps never been more in focus than at this time of the COVID-19 pandemic. With over 175 million confirmed cases and over 3.8 million deaths worldwide (per the World Health Organization, 15 June 2021), governments are scrambling to spend funds on protecting incomes and providing urgent medical care to citizens. This is much needed, given International Labour Organization (ILO) early estimates that 305 million full-time jobs would be lost affecting 1.6 billion people in the informal sector, which have proved higher than originally forecasted with equivalent to 495 million full-time jobs lost globally only in the second quarter of the year.1 The United Nations Educational, Scientific and Cultural

Organization (UNESCO) estimates that 1.5 billion students or 52% of the world’s student population are or have been affected by the pandemic.2 The pandemic has also brought out sharply the huge unmet needs of the poorest and most vulnerable people in areas like healthcare, sanitation, water supply, affordable transport, and housing. Links are also being made between the emergence of viruses and diseases such as COVID-19 and climate change, ocean acidification, and biodiversity loss.3

B. A Renewed Focus on the SDGs

The year 2020 started the Decade for Action on achieving the 17 SDGs launched by the UN Agenda 2030. The 17 goals are the global blueprint to end poverty, protect our planet, and ensure prosperity. Prior to COVID-19, the Global Commission on the Economy and Climate had concluded that strong climate action has the potential to generate over 65 million new low-carbon jobs by 2030, deliver at least $26 trillion in net global economic benefits, and avoid 700,000 premature deaths from air pollution.4 The Global Commission on Adaptation estimated that investing $1.8 trillion globally from 2020 to 2030 in resilience building measures could generate $7.1 trillion in total new benefits.5 COVID-19 has served as a clear sign that a renewed focus on the SDGs is overdue. Aside from the weakness of health systems, the pandemic also exposes how far we are from achieving many of the SDGs, including the lack of education facilities, inadequate clean water and sanitation, and crises in poverty and food security. The World Bank estimates that COVID-19 will push an additional 71 million people into poverty in its baseline scenario and up to 100 million people in its downside scenario.6

Every developing country needs to renew its commitment to achieving the SDGs for equitable growth, conservation of natural resources, and reducing the impact of climate change, which is a cross-cutting theme across almost all the SDGs.7 This is strongly supported by the UN, multilateral development banks (MDBs), and other organizations working for global sustainable development.8 During the UN SG High-Level Meeting on Financing for Development in the Era of COVID-19 and Beyond on 8 September 2020, 50 heads of state affirmed their commitment to finding new ways to mobilize finance for the SDGs as a way out of the crisis.9

Challenges and Solutions

Achieving the SDGs was proving a challenge for many developing countries before COVID-19 for the following reasons:

(i)Massive amounts of financing needed. The UN has estimated that annual financing of $5 trillion to $7 trillion globally will be needed to meet the SDGs.10

(ii)Limited integration. The limited integration of the SDGs into infrastructure planning due to systemic lack of capacity, political will, and other challenges results in a lack of substantial national SDG project pipelines.

(iii)Substantial private finance required. The private finance share required is over 50% in most countries and made worse because government budgets have been diverted to COVID-19 emergency relief and recovery work.

(iv)Countries’ limited capacity. The limited capacity in countries to create bankable SDG projects that can attract commercial lending and/or private capital.

(v)Complexity of applying SDG indicators and frameworks at project levels. This results in deviations or inaccuracies which expose issuers to potential legal action, reputational damage, and eventual economic costs.

Solutions to the above challenges, especially those that can be applied to project development, for those that promote the SDGs and are bankable enough to attract private capital at scale, require institutional capacity building, along with national project funds. Several countries are undertaking such measures.

“As attention shifts from the immediate health and human effects of the pandemic to addressing its social and economic effects, governments and societies face unprecedented policy, regulatory, and fiscal choices. The SDGs—a commitment to eradicate poverty and achieve sustainable development globally by 2030—can serve as a beacon in these turbulent times”

Armida Salsiah Alisjahbana, United Nations (UN) Under-Secretary-General and Executive Secretary of the Economic and Social Commission for Asia and the Pacific; Kanni Wignaraja, UN Assistant Secretary-General and Director for Asia and the Pacific, United Nations Development Programme; and Bambang Susantono, Asian Development Bank Vice-President for Knowledge Management and Sustainable Development.

In this context, the application of UN standards and frameworks for the SDGs is required at national level. Clear and practical national SDG frameworks that can easily be applied to measure and monitor project and country SDG impacts and achievements can feed into a country’s investment and development planning. This can help create appropriate pipelines of projects that promote the SDGs. The UN Global Indicator Framework, with 231 unique indicators, can be applied in a local or national context to support governments and MDBs.11 Additionally, the Sustainable Development Investment Partnership (SDIP) Country Financing Roadmap initiative supports countries in public and private sector stakeholder engagement to produce national development financing road maps with integrated SDG outcomes.12

In terms of performance, the UN Sustainable Development Solutions Network, in collaboration with Bertelsmann Stiftung and Cambridge University Press, have created a prototype index that has been measuring annual country progress toward the 17 SDGs since 2015, showing their relative position between the worst and the best outcomes. The 2020 SDG index ranks 166 countries, as shown in Figure 1, and concludes that East, South, and Southeast Asia are the regions that have progressed most on the SDG Index since the adoption of the goals in 2015, based on the results of its 2020 SDG dashboard, as shown in Figure 2.13

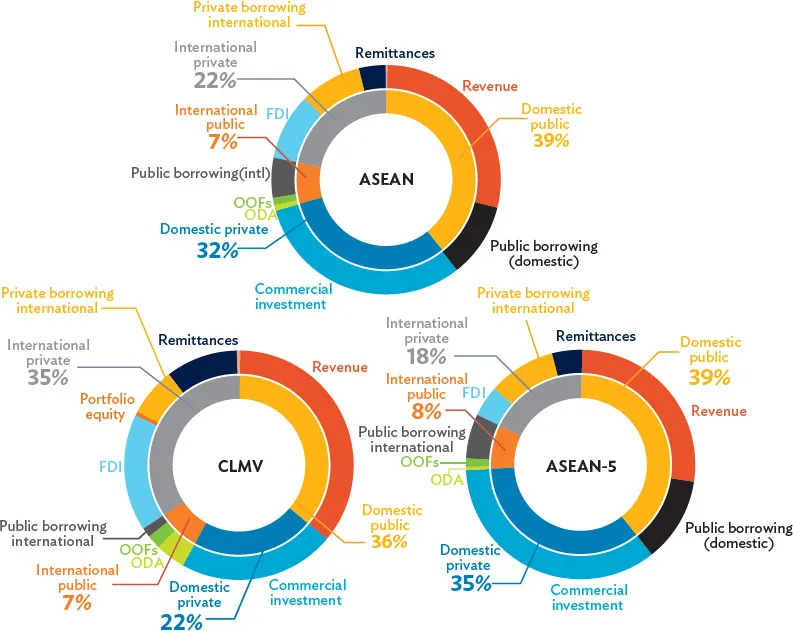

Looking into Southeast Asia, the region has made significant progress in the recent years toward achieving the SDGs, with increasing access to diverse channels of public and private, domestic and international financial options. This trajectory presents a potential opportunity if the funds can be judiciously raised and directed toward SDG projects. Reflecting the different opportunities and constraints across different countries, diversity of the financing landscape across the ASEAN region, CLMV countries (Cambodia, Lao PDR, Myanmar, and Viet Nam) and ASEAN-5 is presented in the Figure 3. While the aggregate resource growth is encouraging, the financial flows are limited, and are growing at a slower pace in a few countries. Domestic public finance continue to be the largest source across the region. The rise of domestic private finance is visible in all countries with 32% in the ASEAN, 22% in CLMV countries, and 35% in ASEAN-5.14

C. ADB’s Approach to the SDGs

The Asian Development Bank (ADB) is committed that its investments must meet the highest standards of sustainable development and deliver results that help its member countries realize the vision set out in Strategy 2030. Toward this objective, ADB ...

Table of contents

- Front Cover

- Title Page

- Copyright Page

- Contents

- Tables, Figures, and Boxes

- Foreword

- Key Messages from Peer Reviewers

- About the Authors

- Acknowledgments

- Abbreviations

- 1 Overview

- 2 Types of Thematic Bonds

- 3 SDG Bonds

- 4 Standards, Guidelines, and Frameworks

- 5 SDG Accelerator Bonds: A New Concept

- 6 Building Momentum for the Road Ahead

- Appendixes

- References

- Footnotes

- Back Cover

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Accelerating Sustainable Development after COVID-19 by in PDF and/or ePUB format, as well as other popular books in Economics & Sustainable Development. We have over one million books available in our catalogue for you to explore.