- 44 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

EIB Investment Survey 2021 - European Union overview

About this book

This unique insight into the corporate investment landscape in the European Union examines companies' finance needs and the constraints they face. The 2021 edition delves into the massive shock produced by the COVID-19 crisis, and the response and recovery programmes put in place by the European Union and by national governments. The report assesses the extent to which European firms are addressing the need make their businesses more green and digital. The survey is based on interviews with 12 000 companies across the 27 European Union countries, and it includes a benchmark sample from the United Kingdom and United States. This overview provides the aggregated results for the European Union. Results for individual countries will be published in January 2022.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Climate change and energy efficiency

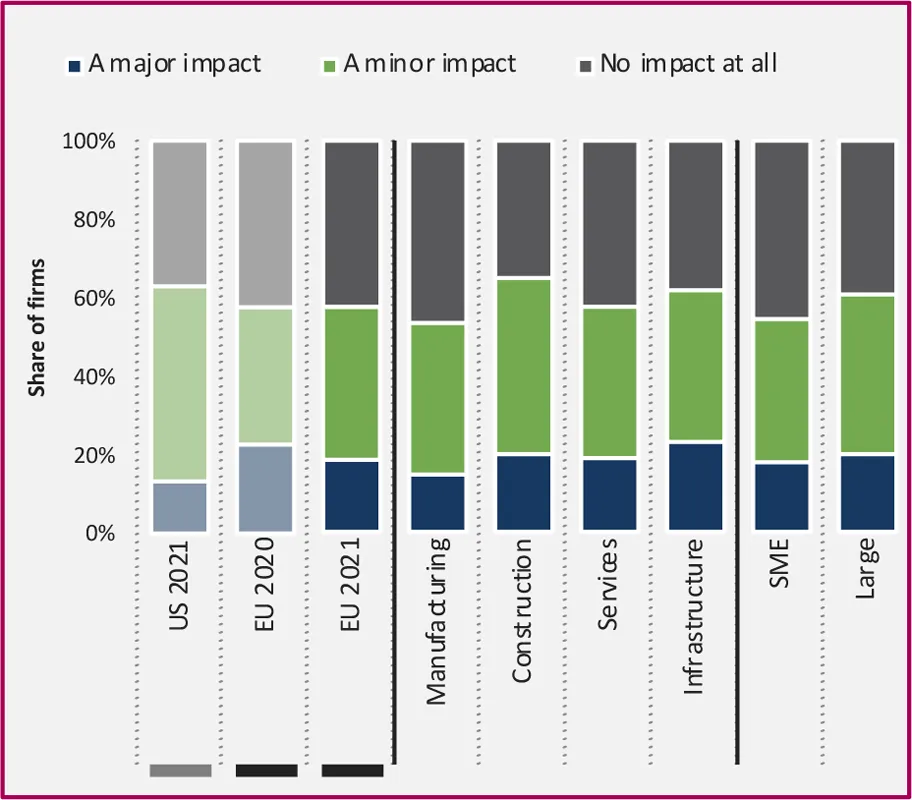

IMPACT OF CLIMATE CHANGE — PHYSICAL RISK

IMPACT OF CLIMATE CHANGE — PHYSICAL RISK BY COUNTRY

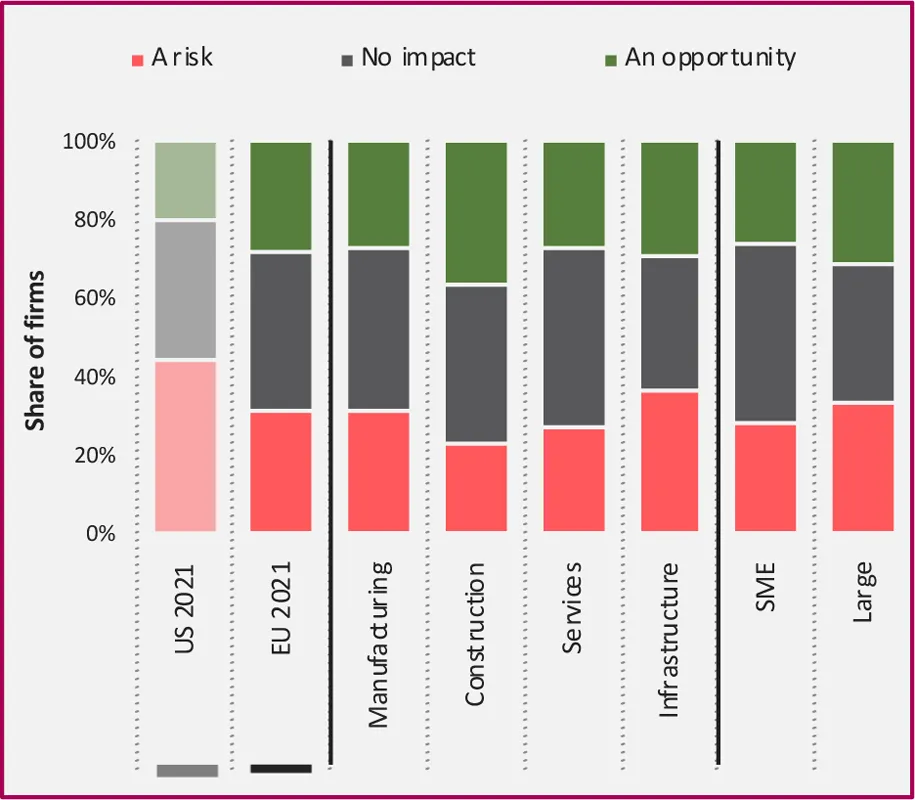

IMPACT OF CLIMATE CHANGE — RISKS ASSOCIATED WITH THE TRANSITION TO A NET ZERO EMISSION ECONOMY OVER THE NEXT FIVE YEARS

IMPACT OF CLIMATE CHANGE — RISKS ASSOCIATED WITH THE TRANSITION TO A NET ZERO EMISSION ECONOMY OVER THE NEXT FIVE YEARS BY COUNTRY

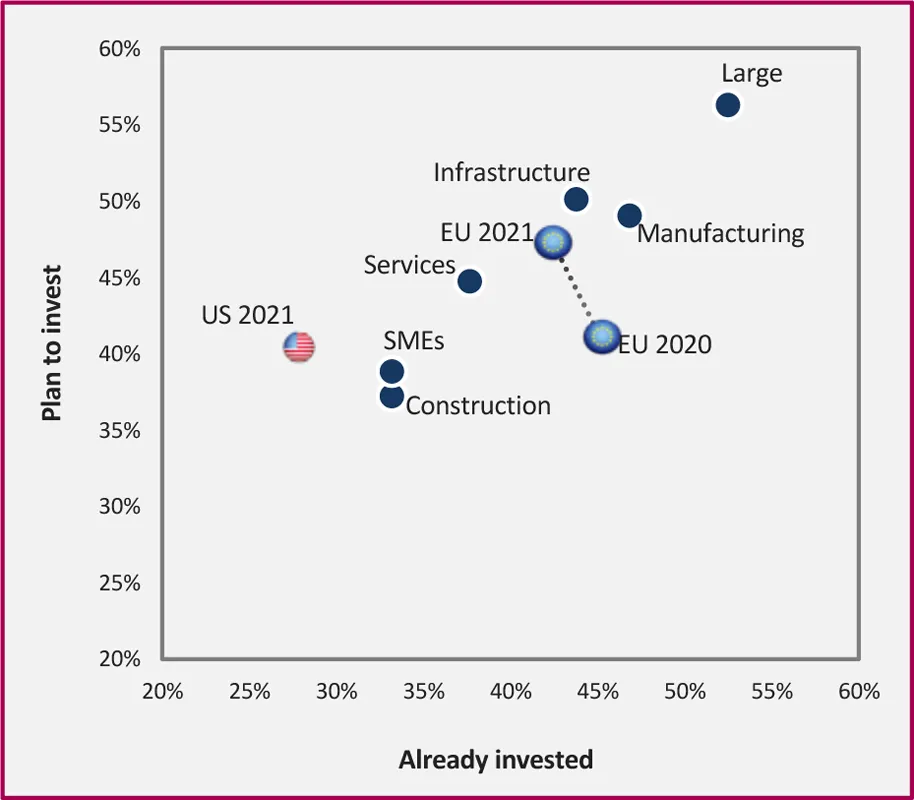

INVESTMENT PLANS TO TACKLE CLIMATE CHANGE IMPACT

INVESTMENT PLANS TO TACKLE CLIMATE CHANGE IMPACT BY COUNTRY

SHARE OF FIRMS INVESTING IN MEASURES TO IMPROVE ENERGY EFFICIEN...

Table of contents

- Cover

- Title

- EIBIS 2021 – European Union overview

- Investment dynamics

- Investment dynamics and focus

- Investment focus

- Impact of COVID-19

- Investment needs and priorities

- Innovation activities

- Drivers and constraints

- Investment finance

- Access to finance

- Climate change and energy efficiency

- Firm management, gender balance and employment

- EIBIS 2021: Country technical details

- Copyright

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app