eBook - ePub

EIB Investment Report 2021/2022 - Key findings

Recovery as a springboard for change

This is a test

- 32 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

EIB Investment Report 2021/2022 - Key findings

Recovery as a springboard for change

Book details

Book preview

Table of contents

Citations

About This Book

The massive resources the European Union is unleashing to rebuild after COVID-19 present a unique opportunity to deal with climate change and improve the ability of firms and individuals to compete in a more digital world. The Investment Report 2021-2022 examines how government interventions helped support investment and enabled firms to weather the crisis. The report's analysis is based on a unique set of databases and data from a survey of 12 500 firms conducted in the summer of 2021.These key findings, provide a short accessible summary of the main report's messages.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access EIB Investment Report 2021/2022 - Key findings by European Investment Bank, European Investment Bank in PDF and/or ePUB format, as well as other popular books in Business & Corporate Finance. We have over one million books available in our catalogue for you to explore.

Information

This time was different: A massive shock to the European economy mitigated by a bold policy response

The pandemic’s immediate economic impact was unprecedented

The pandemic caused the steepest drop in output in Europe’s post-war history. By mid-2020, EU real GDP had fallen 14% relative to a year earlier, while the primary income of households had declined by 7.3% over the same period. Corporate turnover hit a trough in May 2020, with manufacturing revenue falling as much as 30% since the start of the year. Since then, as public health measures have become more selective, the European economy has begun to recover. However, new waves of the virus have hit countries in different ways, making the recovery more uneven and uncertain. Asymmetries are now emerging among sectors and between larger and smaller firms, and therefore across regions.

Throughout Europe, real gross fixed capital formation — a measure of investment — declined substantially, but less than predicted. Moreover, it took only two years for investment to recover from the pandemic shock, compared to more than a decade after the global financial crisis. By the end of the second quarter of 2020, real investment in the European Union fell by a dizzying 14.6% relative to the fourth quarter of 2019.[1] It quickly rebounded, however, and returned to its 2019 level by the second quarter of 2021. Government investment rose steadily, with 2020 seeing an increase of 7% on 2019 in Southern and Central and Eastern Europe, and 1% in Western and Northern Europe. Household investment (mostly in dwellings) declined, but rallied quickly, supported by government action that protected jobs and disposable income, as well as by housing price developments. Corporate investment declined most strongly. At the end of the second quarter of 2021, corporate investment was still 0.22% below its level at the end of 2019, and 6.9% below its 2013-2019 trend. By asset type, investment in machinery and equipment declined the most severely, and recovered more slowly.

Some asymmetries in the shock and the recovery are becoming apparent. While the initial shock of the COVID-19 crisis was largely indiscriminate and all countries in the European Union were hit, the impact has now become more uneven with investment recovering at different speeds. By the second quarter of 2021, real gross fixed capital formation was above pre-pandemic levels (compared to the fourth quarter of 2019) in 20 EU members, and below pre-crisis level in seven countries.

The pandemic triggered a sharp drop in investment, particularly by firms

Nominal gross fixed capital formation in the European Union (2019Q4=100), by institutional sector

Source: Eurostat, EIB calculations.

Note:Data exclude Ireland.

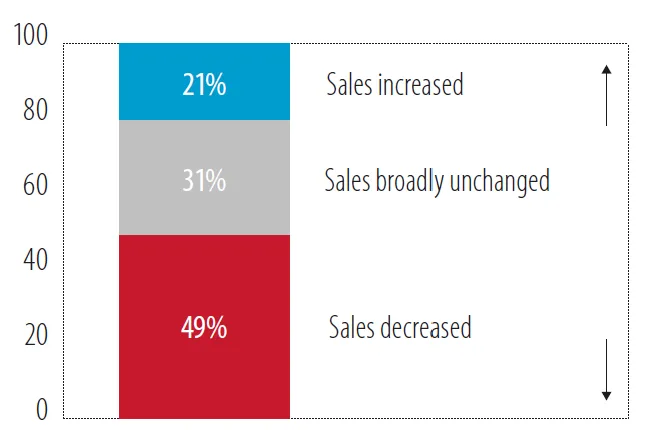

Sales fell dramatically at many European firms, triggering cuts to investment

Data from the European Investment Bank’s Investment Survey (EIBIS)[2] reveal the often uneven effects of the crisis on firms. Some 49% of EU firms suffered a drop in sales due to the pandemic, compared to 21% that showed an increase. Low (pre-crisis) productivity proved to be a strong predictor of lost sales, and more digital firms showed slightly more resilience. Sales at small firms declined considerably (at least 25%), and more often than at medium-sized and large firms. Sharp differences emerge among sectors. Losses at firms were concentrated in areas such as transport, in addition to hotels and restaurants. Breaking the data down by country shows that the share of firms recording a sales decline ranged from less than 40% in Denmark and Sweden to 60% in Malta.

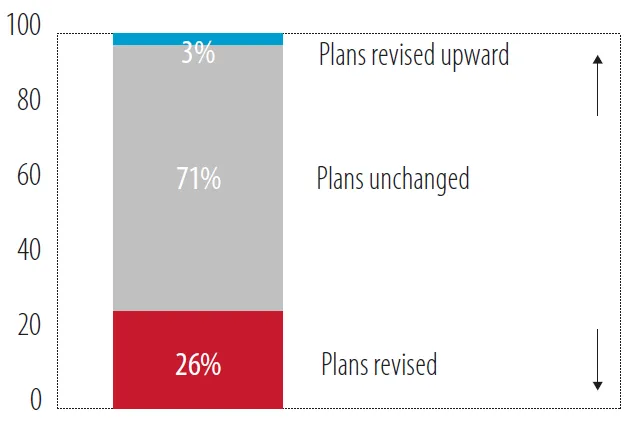

Many affected firms also delayed investment. The share of firms reporting investment activities in the previous year declined from 86% in the EIBIS 2020 survey to 79% in 2021. Faced with falling sales, 23% of firms revised down their investment plans, with only 3% expecting to invest more. The greater the loss of sales in 2020, the lower the likelihood that the firm planned to invest.

Nearly half of EU firms have suffered a drop in sales since early 2020 due to the pandemic

Share of firms

Source: EIBIS 2021.

One-quarter of EU firms revised down investment plans as a reaction to the pandemic

Share of firms

The policy response was effective, ensuring business continuity

The European Union’s timely response enabled its governments to absorb most of the income lost by households because of the pandemic, and to prevent companies from going out of business. With interest rates already ultra-low, three key measures taken at EU level enabled Member States to implement an effective response. The first was the suspension of the Stability and Growth Pact’s deficit and debt rules, enabling coordinated national fiscal responses. The second involved grants and subsidised lending facilities offered to firms and individuals at the national level and complemented by the SURE job protection facility, the European Guarantee Fund and the European Stability Mechanism’s crisis response. The third consisted of the European Central Bank’s large-scale purchases of euro area government bonds. As a result of these purchases, sovereign funding costs remained low or even declined, despite increasing debt levels. Firms responded to the first phase of the pandemic by cutting investment and issuing debt, enabling them to build up cash buffers, which also facilitated a fast rebound in investment in the second half of 2020.

Firms responded to the pandemic by cutting investment and issuing debt to build up cash buffers

Change in cash holdings and investment vs. the previous quarter (EUR billion)

Source: Eurostat, EIB calculations. Gross fixed capital formation is seasonally adjusted.

Public support compensated for the loss of primary income for households and helped to sustain demand. While households’ primary income declined by 7.3% in the second quarter of 2020 vs. a year earlier, their secondary income (from social security benefits and other transfers) rose on aggregate by 6.5% of gross income over the same period, largely offsetting the shortfall. Job retention schemes avoided the costs of job search and rehiring later on, while also protecting job-specific knowledge. With income stabilised and opportunities for spending reduced, households built up large sav...

Table of contents

- Cover

- Title

- Introduction

- This time was different: A massive shock to the European economy mitigated by a bold policy response

- Copyright