![]()

1 About ADB and the Sustainability Report

The Asian Development Bank (ADB)—the multilateral development bank for Asia and the Pacific—was established in 1966 pursuant to its Charter, the Agreement Establishing the Asian Development Bank (which accords legal status to ADB), to foster economic growth and cooperation in the region. ADB’s vision is of an Asia and Pacific region free of poverty. ADB’s mission is to help its developing member countries (DMCs) reduce poverty among their populations and improve their living conditions and quality of life.

ADB is not a commercial bank; rather, it focuses on transferring resources from global capital markets to its DMCs through government (public sector or sovereign) and private sector (nonsovereign) projects.

ADB provides its DMCs and borrowers (clients) loans, grants, equity investments, guarantees, and technical assistance. ADB also leverages financing, including from funds it administers; promotes innovation; and disseminates knowledge to maximize its development impact.

Headquartered in Mandaluyong City, Metro Manila, Philippines, ADB has 31 field offices. ADB is owned and governed by its 67 members (48 from Asia and the Pacific, and 19 from Europe and North America), which are its shareholders. They are represented by the Board of Governors and the Board of Directors; together these are referred to as the Board. The President is ADB’s legal representative and heads the management team, comprising six vice-presidents, as shown in ADB’s organization chart. The management team is responsible for supervising the overall work of ADB’s operational, administrative, and knowledge departments and offices.

Financing Development and Managing Risks

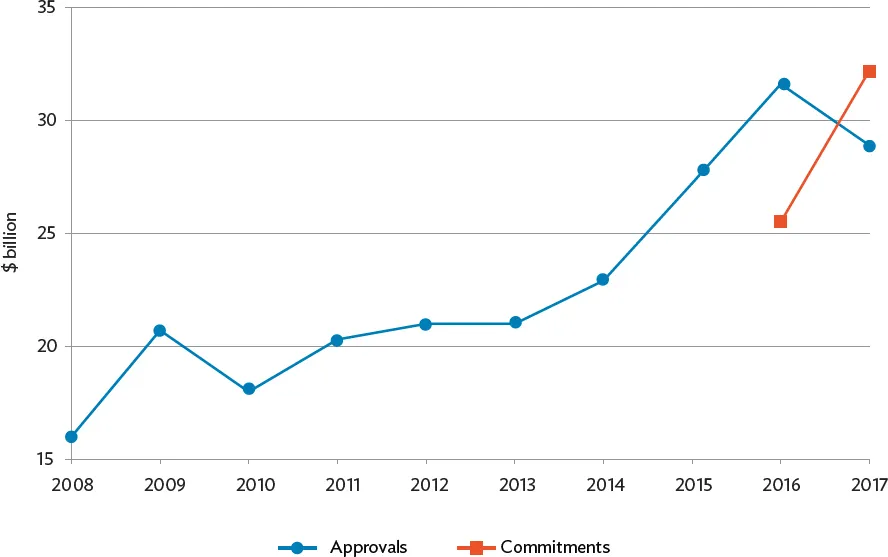

In 2016, ADB’s operations, including approved financing and cofinancing via loans, grants, equity investments, guarantees, and technical assistance, reached a record high of $31.6 billion (Figure 1.1 and Table 1.1). Although approvals fell by 9% in 2017 to $28.9 billion, commitments increased by 26%, from $25.5 billion in 2016 to $32.2 billion in 2017. In 2016, approvals formed the basis for measuring progress against ADB’s corporate results framework targets and reporting on its operational performance. In January 2017, the basis of measuring and reporting became commitments (financing approved by ADB for which the legal agreement has been signed by both parties).

Figure 1.1: ADB’s Operations, 2008–2017

($ billion)

Source: Asian Development Bank.

Table 1.1: ADB’s Approvals and Commitments, 2016 and 2017

($ billion)

ADB = Asian Development Bank, ADF = Asian Development Fund, OCR = ordinary capital resources.

Notes:

1. ADB’s operations includes financing and cofinancing via loans, grants, equity investments, guarantees, and technical assistance.

2. Components do not sum due to rounding.

Source: Asian Development Bank.

ADB’s lending is typically sourced from its ordinary capital resources (OCR). For sovereign operations, regular OCR loans are offered at near-market terms to governments of lower- to middle-income DMCs. As of 1 January 2017, concessional OCR loans are also offered at low interest rates to governments of lower-income DMCs. ADB also provides loans, grants and technical assistance from its Special Funds and Trust Funds. The Asian Development Fund (ADF), aimed at reducing poverty in ADB’s lower-income DMCs, is the largest of the Special Funds. In 2015, the ADB Board of Governors approved the OCR-ADF merger to boost total annual lending, equity investment and guarantee approvals. Effective 1 January 2017, ADB transferred loans and other assets totaling $30.8 billion from the ADF to its OCR balance sheet. Concessional lending continues with the same terms and conditions as prior to the merger. The ADF was retained as a grant-only operation with the 2017 ADF replenishment (ADF 12) covering grant operations in 2017–2020. In 2016, in preparation for the OCR–ADF merger, ADB approved amendments to its financial policies for its OCR operations and its ADF grant operations to optimize the financial management of its consolidated balance sheet and provide wider currency choices for recipients of concessional loans.

Considering the nature of its operations, ADB is exposed to many risks (including credit, equity investment, interest rate, currency, and operational risks) which it devotes significant resources to manage. Strong governance and conservative financial management, supported by a powerful balance sheet and backed by sovereign shareholders, provide the necessary security for investors. To control risks throughout the organization, ADB’s business processes allow departments and offices to monitor, manage, and mitigate specific risks associated with their operations.

The OCR–ADF merger expanded ADB’s lending capacity, enabling it to direct greater resources to DMC governments, particularly those most in need, as well as to the private sector. It also enhanced ADB’s risk-bearing capacity and strengthened its readiness to respond to future economic shocks and natural hazard events. In 2017, ADB completed a comprehensive review of the prudential risk management policies that anchor its AAA credit rating. ADB’s debt securities continue to carry a AAA investment rating from major international credit rating agencies. Therefore, ADB can raise funds regularly and at favorable rates through international capital markets and pass on low-interest financing to its sovereign borrowers. As part of the OCR–ADF merger-related comprehensive review of its financial policies, ADB updated its investment strategy and authority by implementing appropriate changes, including the introduction of a prohibited environmental and social investment list for managing its liquidity portfolio invested in government and nongovernment-related securities.

Financing is raised through public offerings, private placements, other transactions, and reflows from loans.

In 2016, ADB raised $20.6 billion in medium- and long-term funds through public issues and private placements; in 2017, it raised $28.6 billion. Consistent with its commitment to scale up climate finance, following the launch of its inaugural Green Bond in 2015, ADB maintains a regular presence in the Green Bond market with the aim of channeling more investor funds into investments that promote environmentally sustainable, low-carbon, climate-resilient development. Among its public offerings, ADB issued a dual tranche Green Bond in 2016, raising $1.3 billion. In 2017, ADB issued $1.7 billion in thematic bonds which channel investor funds into green, water, gender, and health-related investments (Table 1.2).

ADB must ensure the continuous availability of people, systems, and data to maintain continuity of operations and protect its shareholder value even in the event of a disaster. The International Organization for Standardization (ISO) 22301-certified Business Continuity Management program seeks to ensure ADB can recover and resume its critical processes (such as disbursement of funds) in the event of a disaster (such as typhoons and earthquakes) that could restrict access to the ADB headquarters or the movement of ADB personnel. ADB also seeks to ensure its long-term viability by becoming adaptable to changes in the development landscape in which it operates. In March 2016, an Organizational Resilience Unit was created to lead and manage resilience at ADB, building on the adoption of an Organizational Resilience Program in 2015.

Table 1.2: ADB’s Thematic Bond Issues, 2016 and 2017

($ million)

| Bond Type | 2016 | 2017 |

| Green | 1,300.0 | 1,469.2a |

| Water | n/a | 5.7 |

| Gender | n/a | 90.2 |

| Health | n/a | 96.9 |

| Total | 1,300.0 | 1,662.0 |

n/a = not applicable.

a Includes local currency issues.

Source: Asian Development Bank.

Strategic Approach to Development

To achieve its vision, ADB has three strategic development agendas—inclusive economic growth, environmentally sustainable growth, and regional integration. Approved in 2008, Strategy 2020: The Long-Term Strategic Framework of the Asian Development Bank 2008–2020 established the core operational areas and drivers of change. The 2014 Midterm Review (MTR) of Strategy 2020 reaffirmed ADB’s vision, mission, and the broad strategic directions of Strategy 2020 as well as its three strategic development agendas. The MTR outlined 10 strategic priorities to be implemented through the MTR Action Plan. All of ADB’s policies, strategies, plans, and resulting operations sit under the umbrella of Strategy 2020 and the MTR. The Operations Manual, updated as necessary to reflect changes in policies and financing modalities, lists policies and procedures for preparing and implementing projects. ADB’s Our People Strategy sets the principles to be followed for staff recruitment and retention, talent management, and improvement of the workplace environment, while ensuring it has the right staff to achieve ADB’s vision and mission.

Moving forward, ADB will continue to support its DMCs in meeting their global commitments. ADB recognizes that achieving the United Nations Sustainable Development Goals (SDGs) (Box 1.1) and the Paris Agreement on climate change will require increased public and private sector finance. More countries in the region are becoming middle-income DMCs with more sophisticated development needs. As a result, the need for infrastructure is outpacing the capacity of DMC governments to fund it. ADB’s research into Meeting Asia’s Infrastructure Needs (2017) identified that, factoring in climate change mitigation and adaptation costs, developing Asia will need to invest $1.7 trillion per year to maintain its growth momentum, eradicate poverty, and address climate change. In response to the new development landscape, and to meet the rapidly evolving changes in Asia and the Pacific, ADB is currently developing its new strategy referred to as Strategy 2030. Strategy 2030 will

Box 1.1: Supporting the Implementation of the Sustainable Development Goals

The Asian Development Bank (ADB) is committed to working with its developing member countries (DMCs) and development partners to help achieve the Sustainable Development Goals (SDGs) in Asia and the Pacific. Under a tripartite partnership with the United Nations Economic and Social Commission for Asia and the Pacific and United Nations Development Programme to support achievement of the SDGs in the region, data are regularly compiled on the region’s progress toward the SDGs. In 2017, a data portal was launched, the first four yearly SDGs’ outlook was published, and the first annual report, reflecting on the implications of the theme of the annual High-Level Political Forum on the SDGs for the region, was produced. ADB also responded to DMCs’ demand for support on the SDGs, and explored opportunities to accelerate implementation. For example, in Kazakhstan, ADB and Nazarbayev University convened the first donor and government brainstorming meeting on opportunities to achieve the SDGs. ADB’s sector and thematic groups support the SDGs as well; during 2016–2017, technical assistance projects to assist DMCs monitor SDG implementation, localize the SDGs, and implement the environment dime...