Handbook of Financial Risk Management

Simulations and Case Studies

Ngai Hang Chan, Hoi Ying Wong

- English

- ePUB (handyfreundlich)

- Über iOS und Android verfügbar

Handbook of Financial Risk Management

Simulations and Case Studies

Ngai Hang Chan, Hoi Ying Wong

Über dieses Buch

An authoritative handbook on risk management techniques and simulations as applied to financial engineering topics, theories, and statistical methodologies

The Handbook of Financial Risk Management: Simulations and Case Studies illustrates the practical implementation of simulation techniques in the banking and financial industries through the use of real-world applications.

Striking a balance between theory and practice, the Handbook of Financial Risk Management: Simulations and Case Studies demonstrates how simulation algorithms can be used to solve practical problems and showcases how accuracy and efficiency in implementing various simulation methods are indispensable tools in risk management. The book provides the reader with an intuitive understanding of financial risk management and deepens insight into those financial products that cannot be priced traditionally. The Handbook of Financial Risk Management also features:

- Examples in each chapter derived from consulting projects, current research, and course instruction

- Topics such as volatility, fixed-income derivatives, LIBOR Market Models, and risk measures

- Over twenty-four recognized simulation models

- Commentary, data sets, and computer subroutines available on a chapter-by-chapter basis

As a complete reference for practitioners, the book is useful in the fields of finance, business, applied statistics, econometrics, and engineering. The Handbook of Financial Risk Management is also an excellent text or supplement for graduate and MBA-level students in courses on financial risk management and simulation.

Häufig gestellte Fragen

Inhaltsverzeichnis

- Cover

- Series

- Title Page

- Copyright

- Preface

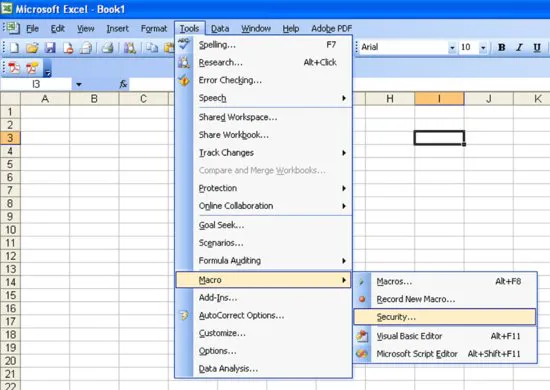

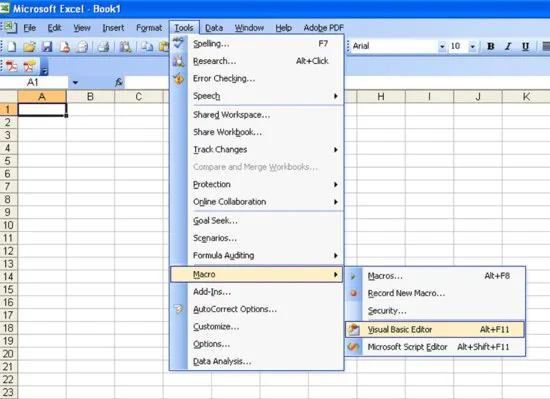

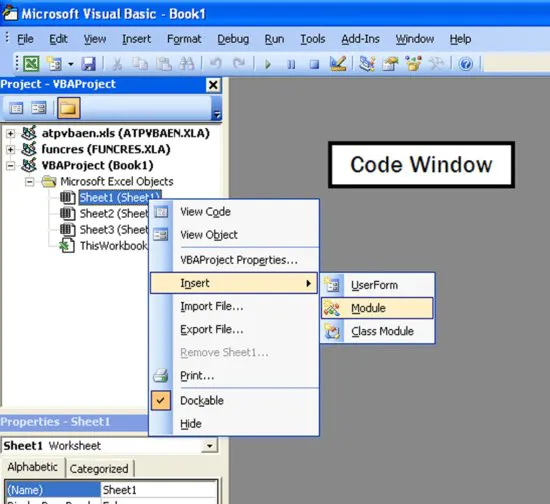

- Chapter 1: An Introduction to Excel VBA

- Chapter 2: Background

- Chapter 3: Structured Products

- Chapter 4: Volatility Modeling

- Chapter 5: Fixed-Income Derivatives I: Short-Rate Models

- Chapter 6: Fixed-Income Derivatives II: LIBOR Market Models

- Chapter 7: Credit Derivatives and Counterparty Credit Risk

- Chapter 8: Value-at-Risk and Related Risk Measures

- Chapter 9: The Greeks

- Appendix

- References

- Author Index

- Subject Index

- Wiley Handbooks in Financial Engineering and Econometrics