![]()

1

The FX Market

The foreign exchange (FX) market is an OTC market where each participant trades directly with the others; there is no exchange, though we can identify some major geographic trading centres: London (the primary centre, where the primary banks’ market makers are located; its importance has increased in the last few years), New York, Tokyo, Singapore and Sydney. This means that trading activity is carried out 24 hours a day, though in practice during London working hours the market has the most liquidity. Needless to say, the FX market experiences fierce competition amongst participants.

Most trades are currently carried out via interbank platforms (EBS is the most important). Anyway, the major market makers offer Internet platforms to their clients for quick trades and for leaving orders. The Reuters Dealing, which was the main platform in the past, has lately lost much of its pre-eminence. Basically, it is a chat system connecting the participants, capable of recognizing the deal implicit in typical conversations between two professional operators, and transforming it into an automatic confirmation for the transaction. Nowadays, the Reuters Dealing is used mainly by option traders.

1.1 FX RATES AND SPOT CONTRACTS

Definition 1.1.1. FX rate. An exchange (FX) rate is the price of one currency in terms of another currency; the two currencies make a pair. The pair is denoted by a label, made up of two tags of three characters each: each currency is identified by its tag. The first tag in the exchange rate is the base currency, the second is the numeraire currency. So the FX is the price of the base currency in terms of the numeraire currency.

The numeraire currency can be considered as domestic: actually, in what follows we will refer to it as domestic. The base currency can be regarded as an asset whose trading generates profits and/or losses in terms of the domestic currency. In what follows the base currency will also be referred to as the foreign currency. We would like to stress that these denominations are not related to the perspective of the trader, who can actually be located anywhere and for whom the foreign currency may turn out to be indeed the domestic currency, from a “civil” point of view.

Example 1.1.1. The euro/US dollar FX rate is identified by the label EURUSD and it denotes how many US dollars are worth 1 euro. The domestic (numeraire) currency is the US dollar and the foreign (base) currency is the euro.

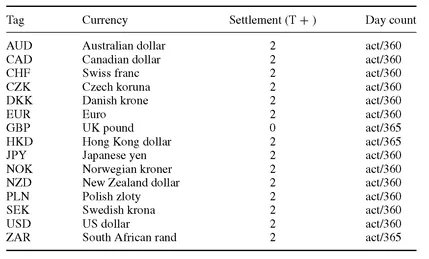

For each currency specific market conventions apply, and two of them are also important for the FX market: the settlement date and the day count. The settlement date (or delivery date) is the number of business days needed to actually transfer funds (if any are due) amongst interbank market participants after the closing of a deal; for most currencies it is two business days, but there are exceptions. In the market lore it is commonly referred to as “T + number of days”, where “T” stands for the time (day) when the deal is closed. The day count is the time factor used to calculate accrued interest between two dates in the money market of the relevant currency; it usually applies for simple compounding. A list of some currencies and their related settlement date and day count conventions is given in Table 1.1.

Table 1.1 Settlement date and day count conventions for some major currencies

The settlement date and the day count for each currency are useful to price forward (outright) and FX swap contracts. There is a settlement date specific for the spot contract though, and it is the number of days, after the trade date, when the two amounts denominated in the currencies involved are exchanged between the counterparties. The rules to determine the settlement date for a spot contract are a little more complex, since they need the intersection of three calendars: we list them below when we define the spot contract.

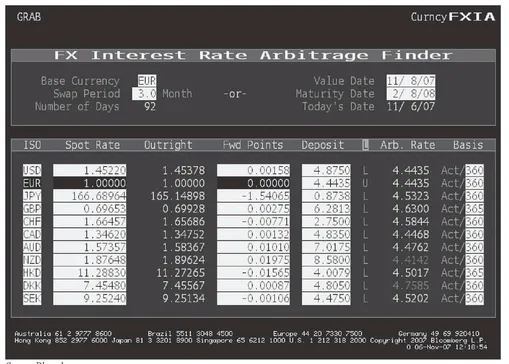

The FX rates are expressed as five-digit numbers, with no regard for the number of decimals; the fifth digit is named

pip: 100 pips make a

figure. As an example, the major FX rates for spot contracts (we will define

spot below) as of 29 October 2007 are shown in

Figure 1.1. Regular trades are for fixed amounts of the base currency. For example, if a trader asks for a spot price via the Reuters Dealing in the EURUSD, and they write

“I Buy (or Sell) 2 mios EURUSD at 1.3597”

this means that the trader buys (or sells) 2 million euros against 2 719 400 US dollars (1.3597 × 2 mios). Clearly, should one need exactly 1 million US dollars, it has to be specified as follows:

“I Buy 1 mio USD against EUR at 1.3597”

This means that the trader buys 1 million US dollars against 735 456 euros (1/1.3597 × 1 million). The two contracts closed in the examples are spot and the employed FX rate is also said to be spot. We define the spot contract as follows:

Definition 1.1.2. Spot. Two counterparties entering into a spot contract agree to exchange the base currency amounts against an amount of the numeraire currency equal to the spot FX rate. The settlement date is usually two business days after the transaction date (but it depends on the currency).

Figure 1.1 FX rates as of 29 October 2007 (Reproduced with permission)

Source: Bloomberg.

As mentioned above, the settlement date for a spot contract is set according to specific rules involving three calendars (collapsing to two if the US dollar is one of the currencies of the traded pair). Here they are:

1. As a general rule, the settlement date for a spot contract is two business days after the trade date (T + 2), if this date is a business day for each of the two currencies of the pair. If this is not the case, the date is shifted forward until the condition is matched. An exception to this rule is the USDCAD (i.e., the US dollar/Canadian dollar pair), for which the settlement date is one business day after the trade date.

2. The settlement date set as in (1) must also be a business day in the USA, otherwise the date is shifted one day forward and the condition that the new date is a business day for each currency has to be checked again.

3. When the date after the trade date is a holiday in the USA (except for weekends), but not in other countries, then this date is counted as a business day to determine the settlement date. In this case it happens that for two days spot contracts will be settled on the same date, and in the market lore we say that the “settlement date is repeated”.

We provide an example to clarify how to actually apply these rules.

Example 1.1.2. Assume we are on Tuesday 20

November 2007

; from market calendars it can be seen that Thursday 22

November is a holiday in the USA and Friday 23

November is a holiday in Japan. Consider three currencies: the US dollar, the euro and the yen. We consider the following possible trades with the corresponding settlement dates: • On 20 November we close a spot contract in EURUSD. The settlement date will be 23 November: two business days would imply 22 November, but this is a holiday in the USA, so the settlement date is shifted forward one day, a “good” business day for both currencies.

• On 21 November we close a spot contract in EURUSD. The settlement date will be 23 November (repeated): the holiday in the USA is one day after the trade and is not a weekend, so it is taken as a business day.

• On 20 November we close a spot contract in USDJPY. The settlement date will be 26 November: 22 November is a holiday in the USA, so the settlement date is shifted forward one day, but 23 November is a holiday in Japan, so the settlement date is shifted forward to the first available business day, which is Monday 26 November, after the weekend. The same calculation also applies if we traded in EURJPY.

• On 21 November we close a spot contract in USDJPY. The settlement d...