CHAPTER 1

The Intellectual Capital Agrarian

Never before in history has innovation offered promise of so much to so many in such a short period of time.

—BILL GATES

We are all farmers.

We mark our turf. We protect our property. We plant our seeds. We nurture the soil. We plow our land. We combat adverse weather and ecosystem conditions and overcome adversities. We prepare for our harvest. We carefully remove the frost from the vine. We hope for the best and prepare for the worst as the market sets a price for our efforts. We embrace the notion that our results will be directly tied to our levels of effort and expertise. We begin anew.

No matter what your profession, no matter what your company does, no matter what your life situation may be—we all follow this fundamental and deeply rooted agricultural process in some way throughout the days of our lives. We are all the new agrarians. But do we recognize ourselves as such? Have we learned from the successes and failures of the agrarian economies that preceded us? Can we learn to apply the traditional as well as the latest best practices of farming to our daily lives and in the growth of our companies? How can we make our lives more enjoyable and enriching and our companies more productive and profitable by adopting an agrarian approach to life planning, time management, resource allocation, innovation harvesting, and business model reshaping?

Consider the following questions as they apply to your life and to your business:

Have you carefully selected a territory that is fertile for growth and right for your type of crop?

Do you understand the dynamics of your ecosystem?

Have you done everything in your power to properly nurture the soil and enhance the land’s ability to produce?

What seeds will you plant, and why?

Are you ready to invest the time and energy to care for these seeds once planted?

Whom will you hire to help you raise, harvest, and sell the produce at your farm?

What tools, resources, and expertise will you require to maximize the fruits of your harvest?

What adverse weather or market conditions must you overcome to be successful?

Who else is growing these same crops? How does their experience compare to your own?

Do you have a keen sense for the cycles and timetables that will optimize your harvest?

What is your game plan for bringing your crops to the marketplace? Will you do it alone or join with others?

What are your distribution channels, and who are your target customers? On what basis and criteria will they select your harvest rather than others’? On the basis of price? Quality? Convenience? Availability?

How will you allocate the revenues that this year’s harvest will bring? Have you performed a sensitivity analysis based on high/expected/low target ranges?

What steps need to be put in place to set the stage for beginning the process again?

What have you learned from the successes and failures of last year’s process to make next year even better?

Each of these questions must be answered by every type of farmer every year in every country around the world. Every year, they “bet the farm,” overcoming the challenges of the wind, sun, drought, floods, and other conditions beyond their control to put food on all of our tables. But the questions also apply to each of us—in the growth and development of our companies and as applied to the growth and development of ourselves as humans and as an evolving society. And, just as with farming, if we care for the soil and harvest properly, we produce value. If we overwork or overtax the farm and add too many pesticides over too much irrigation, the outputs will be limited and potentially dangerous.

Farmers who strive to perfect this process and to learn from the successes and failures of each year’s harvest enjoy financial stability and wealth creation. They work hard to control the variables that are in their power and develop contingency plans around the variables that they can’t control. They see the crops as an extension of themselves and are happy as they see them grow and progress. They enjoy the process and connect with the land in a spiritual way. But at the very core and soul of their existence is the relationship between themselves and their land and between their tools and their seeds and between the quality of their harvest and the dynamics of the marketplace.

In building companies and fostering innovation, we must all embrace these same principles. We must put conditions in place that support a corporate culture likely to yield a productive harvest and be constantly planting the seeds of creativity, encouragement, curiosity, empathy, respect, challenge, and fulfillment. We must understand which tools will be most effective for reinforcing the underlying principles of this culture. We must take steps to manage the conditions that are within our control and develop “Plan Bs” for those that we can’t. Most important, we must fully invest in the growth and development of our human capital by providing education and training to our teams at all levels to teach how to become farmers inside our companies and in their own lives.

Time to Market

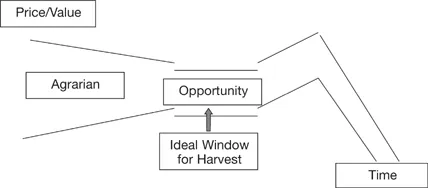

The agrarian mindset is that there is an ideal and defined window to bring a harvest to the marketplace. If you do it too soon, the product will not yet be ripe. Nobody will buy it. If you’re too late, then there will be rotting, spoilage, and waste. Why can’t we take the same approach to nonfungible products and services? As shown in Figure 1-1, for every new idea, there is a window of opportunity that parallels the harvest period. Intellectual capital agrarians must be sensitive to these cycles and shifts in market conditions and consumer demand patterns; otherwise, they run the risk of putting shareholder value in peril.

Figure 1-1. The window of opportunity for innovation.

This same window of time can be applied to a technology company’s new product or a services firm’s timetable for getting a deliverable to a client. Delivery too soon results in a lower value or price because the market is not ready for consumption. Delivery too late will yield stale ideas or be in violation of a client’s trust in the relationship by abusing the expected deadline.

Balance Sheets: An Archaic Measure of a Company’s True Intrinsic Value

There was a time when, if you needed a “quick” understanding of the net worth of a company, you could examine its balance sheet to determine its assets, subtract the sum of its liabilities, and come up with its net worth. You may have seen a small line item for goodwill to recognize the value of its brand and customer relationships. But, in today’s information-centric and intangible-asset-driven society, looking to the net worth line to determine a company’s value would be the strategic equivalent of telling a farmer that the total value of his farm is limited to the projected wholesale value of the harvestable crops he currently has in the field. Such a valuation methodology would fail to take into account the intrinsic worth of his know-how, his show-how, his distribution channels, his relationship with his team, his land, his future harvests, his systems, his processes, and his leadership skills.

The flaws in our 500-year-old double-entry accounting system for recognizing the value of intangible assets are at the heart of a current and pervasive debate in the accounting and finance professions. At the heart of this debate is NYU Stern School professor Baruch Lev, who has been actively writing and speaking about the flaws in the current GAAP as a way to recognize the true intrinsic assets of knowledge and information-driven companies. Current accounting best practices fail to take into account the dramatic shift in the value-creating functions of today’s modern corporations and organizations—most of which are intangible. “Goodwill” is no longer an adequate general utility bucket in which to throw any asset that does not fit neatly into a ledger column.

Lev points out that the problem is significant. He has studied the balance sheets of the Standard & Poor’s 500—500 of the largest companies in the United States, many of which are not in high-tech industries. The market-to-book ratio of these companies—that is, the ratio between the market value of these companies and the net asset value of the company (the number that appears on the balance sheet)—is now greater than 6 to 1. What this means is that the balance-sheet number—which is what traditional accounting measures—represents only 10 percent to 15 percent of the true intrinsic and strategic value of these companies. Even if the stock market is inflated, even if you chop 50 percent off the market capitalization, you’re still talking about a huge difference between value as perceived by those who pay for it day to day and value as the company accounts for it.

Another example: John Kendrick, a well-known economist who has studied the main drivers of economic growth, reports that there has been a general increase in intangible assets contributing to U.S. economic growth since the early 1900s: in 1929, the ratio of intangible business capital to tangible business capital was 30 percent to 70 percent, but in 1990, the ratio had shifted to 63 percent to 37 percent, and it continues to shift as we evolve deep into the information age.

The most relevant information to managers and investors concerns the enterprise’s value chain. By value chain, I mean the fundamental economic process of innovation that starts with the discovery of new products, services, or processes, proceeds through the development and the implementation phase of these discoveries and establishment of technological feasibility, and culminates in the commercialization of the new products or services. Lev recommends that GAAP include a “Value Chain Blueprint,” a measure-based information system for use in both internal decision making and disclosure to investors that reports in a structured and standardized way about the innovation process.

Lev also recommends that current financial accounting practices evolve around our intellectual-capital-driven society. The broad denial of intangibles as true assets detracts from the quality of information provided in the balance sheet. Even more serious is its adverse effect on the measurement of earnings. The matching of revenues with expenses is distorted by front-loading costs by the immediate expensing of intangibles and recording revenues in subsequent periods unencumbered by those costs. For example, as R&D projects advance from formulation through feasibility tests (such as alpha and beta tests of software products) to the final product, the uncertainty about technological feasibility and commercial success continually decreases. Accordingly, Lev proposes that accounting recognize as assets all intangible investments with attributable benefits that have passed certain prespecified technological feasibility tests. Managers should develop the capability to assess the expected return on investment in R&D, employee training, information technology, brand enhancement, online activities, and other intangibles and compare these returns with those of physical investment in an effort to achieve optimal allocation of corporate resources. Today, most business enterprises do not have the information and monitoring tools required for the effective management of intangible assets.

The Tomato Exercise

If instead of selling ______________ (whatever business you are in), how would your business model, windows of opportunity, and distribution channels change if your product were tomatoes? You might consider these points:

How long will it take to produce a tomato from seedling to young roots to harv...