![]()

CHAPTER 1

LEARNING TO SEE, TO ADAPT TO, AND TO VALUE UNCERTAINTY

Life can be understood backward, but … it must be lived forward.

—Søren Kierkegaard

Suppose there are two types of CEOs who differ in how they approach their investment decisions. The first we call the designers.1 These executives have a clear view of their desired competitive positioning and of the means and metrics of success in their chosen competitive playing field, and intend to design and execute premeditated strategic paths. The others—named opportunists—may also have a clear view of how value is created in their chosen playing field, but are not committed to a master plan, preferring instead to continuously take advantage of any opportunities that fit their value criteria as they emerge and when conditions are favorable to them.

Both of these CEO types have their shortcomings. For designers, successfully executing an envisioned acquisition strategy without any apparent mistakes will be a difficult task. The flaw in their logic is that the world—including their competitors—will sit back and permit them to execute their planned strategy unhindered. In the real and uncertain competitive world, macroeconomic change, evolving customer needs, or competitor preemption may render apparently realistic targets unavailable or unattractively expensive. At the same time, a pure opportunist approach cannot provide an organization with the strategic and organizational direction it requires to function successfully, or even to survive in the long term.

We have often seen these seemingly opposing views competing in the boardroom at the moments when key decisions are made—sometimes even in the mind of a single decision maker when deliberating an acquisition, for example. Indeed, there appears to be a recurring dilemma when designing and executing acquisition strategies: for designers, on the one hand, designated targets embody the risk of overpayment, which may be founded on unconscious irrational justifications—such as neglecting uncertainty, overoptimistically expecting synergies or growth opportunities, or becoming trapped in an escalating bidding contest. The designer, however, is aware that acquisition opportunities that fit the value criteria and the strategic pathway are limited—especially in consolidating industries—and the missed chance is a very real threat to a company’s future competitive position. On the other hand, for the opportunist, the risk lies in waiting for a better deal or even in underbidding—failing to pay the price required to secure a critical target. Pure opportunists may frame an opportunity too narrowly—may tend to consider it in isolation, and so fail to recognize the impact of new long-term growth options the target may bring, or to fully appreciate its value as part of a broader strategy. This applies equally to organic growth and other options available to an organization.

Successful resolution of this CEO acquisition conundrum—especially in the context of uncertainty—can determine the firm’s future success, market value, and even survival. Yet too often managers make these decisions based on intuition and experience alone, leaving them vulnerable to the pitfalls of cognitive biases when making them under uncertainty, with little guidance from objective tools to analyze and assist their investment decisions.

In this book we offer a set of approaches and tools that resolve the conundrum, bringing together the best aspects of design and opportunism in a way that recognizes the need for organizational objectives; a clear strategic framework, which includes the selection of where the organization will elect to compete; value metrics; and even one or more strategic paths aimed at moving the organization toward their desired goal—while at the same time accounting for the inherent uncertainty which the future represents.2 Strategic opportunism—as we have elected to call this new approach to strategy—represents melding the two CEO caricatures of designer and opportunist into a single powerful methodology for designing and executing strategy at the corporate, business unit, and operational levels by augmenting the existing strategic tools and frameworks with those from behavioral and corporate finance and from decision science.

In this book, we illustrate our approach to strategic opportunism by focusing on the design, valuation, and execution of an acquisition strategy. So how can you know whether a deal is beneficial? Given the uncertain future, you can’t. Fortunately, both the designers and opportunists among us are biased in predictable ways. You can stack the odds in your favor by limiting the degree to which your own biases influence your valuation analysis and your decisions. For this purpose this book integrates insights from behavioral finance with (rational) decision models—such as real options and game theory—to counter these biases in an effort to estimate uncertainty in strategic value and price rigorously and objectively.

In this overview chapter we provide the reader with a helicopter view of a quantitative value-based framework. A key argument in this book is that volatility is always present, and rather than ignoring it in our analysis, we acknowledge its inevitability—even embrace it to our advantage—and adjust our approach to decision making accordingly. Uncertainty means that today’s successful CEOs and their executive teams need to be able to act simultaneously as strategists—that is, designers of corporate strategy—and opportunists—with the ability to grasp opportunities that meet their value criteria as they arise. In essence, this requires the setting of clear strategic goals, but—given the reality of uncertainty—also being willing to revise intended decisions, seeking to continually maximize the organization’s options to appropriate value. While uncertainty generally deters investment, executives who reframe their roles as strategic opportunists can actually benefit from uncertainty. Once you learn to see uncertainty, you can learn to adjust to uncertainty and benefit by reducing exposure to specific sources of uncertainty, effectively limiting downside vulnerability, while fully exploiting opportunities presented by high uncertainty and change. The goal of valuing uncertainty in an acquisition strategy using option games is to improve the organization’s decision making so as to counter known biases and, by enhancing the value of optionality within and external to the organization, to allow for flexibility to revise intended decisions.

LEARNING TO SEE UNCERTAINTY

Consider the two lines in the picture of Figure 1.1. Which one is longer? For most of us, the line on the right seems longer. But if you measure them you will see they are exactly the same length—it is the background perspective that can deceive your objective vision. If perspective can affect our objective visual judgment, it is not hard to imagine how easily we can be deceived in the much more elusive judgments involved in acquisitions. The length of estimation horizons, the sheer complexity of deals, and the uncertainties and ambiguities inherent in valuing targets can make executives’ acquisition decisions vulnerable to their personal biases.3 Grounded in psychology, behavioral theory describes how bounded rationality and personal-level behavioral limitations can distort how we perceive the uncertainty that surrounds our decisions.4 Interestingly, psychological experiments have highlighted some stereotypical deceptions to which we are inherently vulnerable. For instance, experimental and empirical studies have repeatedly found that bidders tend to overpay in hot markets, synchronously execute deals, and are—too often—influenced by high stock market valuations. It is also likely that individual framing infects objective valuation analyses.

Figure 1.1 The Ponzo Illusion: How Perspective Can Bias Vision

Source: Walt Anthony, 2006, used with permission. The Ponzo Illusion: http://opticalillusions4kids.blogspot.nl.

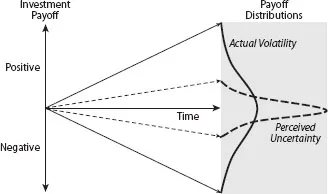

Psychology has been applied to managerial practices to test the existence and implications of managerial biases in real-life business situations. Although, traditionally, we expect decision makers to make decisions founded on rational arguments—accurately portraying and weighing the possible benefits and risks—there is evidence of deviation from rationality that results in the under-estimation of uncertainty.5 Schematically presented by the two rotated bell-shaped distributions in Figure 1.2, perceptions of uncertainty (inner distribution) can differ from true volatility (outer distribution) from person to person, depending on how each frames the opportunity, explaining the differences in competing firms’ strategic actions. Cognitive biases such as executive overconfidence can result in underestimating firm-level uncertainty, which may otherwise be controllable and resolvable through corporate actions (endogenous uncertainty). This includes overconfidence in the potential realization of synergies or ignoring the threat of rival bidders. Biases can also distort our perception of uncontrollable environmental uncertainty (exogenous uncertainty), such as uncertainty in demand, macroeconomic shocks, and financial crises.6 Furthermore, self-attribution can bias our perception of the controllable. In hindsight we often attribute successful corporate actions to our unique insight, but blame exogenous uncertainty when transactions fail. To see uncertainty-related biases in a broad perspective, behavioral theory offers three warnings for CEOs and management teams who aim to pursue acquisitions.

Figure 1.2 Perceived Uncertainty in the Payoff of Acquisitions (Inner Distribution) Is Lower Than Actual Uncertainty (Outer Distribution)

Source: Kil and Smit (2012).

1. YOUR INTENDED STRATEGIC PATH IS MORE UNCERTAIN THAN YOU PERCEIVE

When CEOs project the future, like most of us they tend to rely too heavily on their familiarity with the status quo, and underestimate uncertainty: this perspective may limit their awareness of optionality. Macroeconomic or industry demand uncertainty is easily underestimated, in particular because managers have trouble predicting potential low-probability, high-consequence events,7 such as the potential for and impact of the global financial crisis. Not only do we tend to ignore exogenous extreme events, but we are also prone to underestimating controllable uncertainty—such as uncertainty regarding the realization of synergies or the existence of latent claims, which could be mitigated. Success and confidence can easily become overconfidence and influence CEOs’ perception of the uncertainty inherent in their strategic plans. Overconfidence—ignoring uncertainties that might influence the potential for success, postacquisition synergies, and target company value—is only one of the biases that executives need to overcome in executing transactions. In particular, when there is groupthink in the management team, executives may suffer from confirmation bias and seek data to confirm their prior convictions of the desired strategic path, and subconsciously resist actively seeking disconfirming data. As a result of these biases, the strategic paths they envision are likely to be more uncertain than they think.

2. THE TARGET VALUE YOU OBSERVE IS MORE UNCERTAIN THAN YOU MIGHT PERCEIVE

Bubbles, overpriced financial markets, and the deviation of prices from fundamental values have been with us for centuries. The tulip mania of 1636—often used to illustrate the first recorded economic bubble—was a period in the Dutch Golden Age during which contract prices for bulbs of the (then only recently introduced) tulip reached extraordinarily high levels compared to their intrinsic value, before suddenly collapsing. The price of some single tulip bulbs skyrocketed to 10 times the annual income of a skilled craftsman, close to the price of an Amsterdam canal house, until, suddenly, in February 1637, the buying frenzy instantly turned into a selling stampede.8

When people make decisions under uncertainty, they use familiar positions or known anchors—but they often make insufficient adjustments to their valuations from such starting points. When the value of an asset is hard to assess—as in high-tech, dot-com, or biotech ventures, for example—executives and financial analysts base estimates on relative or multiple valuations. As with many things, company or asset beauty is in the eye of the beholder. As a consequence, when comparable valuation methods are used, assets that are acquired for unique strategic reasons—and which, hence, command higher prices—can contribute to the misperception of the value of opportunities in an entire sector.

At times, stock prices in financial markets can reflect a common misperception phenomenon, when valuations may result from expectations of how others will perceive the value of a specific target who, in turn, also based their value on multiples. Anchoring is innate in human nature, and can cause the price of a single commodity or asset to soar to unsustainable heights as long as the expectation remains that it can be sold to a “greater fool” at a higher price. In such cases, prices deviate from fundamental value across the board, as happened in the tulip mania or the dot-com bubble that shook financial markets in the early 2000s. While executives seem to underestimate the volatility in a target’s value, irrational investors may cause exuberance, resulting in excess volatility of financial market prices.9

3. WINNING THE BIDDING PROCESS ON GOOD TERMS IS MORE UNCERTAIN THAN YOU THINK

Behavioral economists have illustrated that participants in company auctions are vulnerable to the winner’s curse when they underestimate uncertainty, because they don’t possess all the necessary information to value the target accurately or, alternatively, rivals have access to private information on the assets being sold. By d...