![]()

CHAPTER 1

Getting the Nest Egg Ready to Hatch

I’d like to live as a poor man with lots of money.

—Pablo Picasso

Like so many of my clients, Sharon came to me because she was worried sick about her money. A 67-year-old retiree, Sharon was so convinced she would outlast her savings that she’d begun depriving herself of the basic comforts of life, canceling her cable and turning the heat down in the winter. Most ominously, she’d started taking unnecessary risks. On the advice of her stockbroker, who was more concerned with maximizing returns than determining her real needs, she had invested in aggressive growth mutual funds to supplement what she saw as an insufficient nest egg.

While Sharon’s stockbroker encouraged her to make risky investments, I took a different approach: I sat her down and comprehensively assessed every aspect of her financial situation. I looked at all her holdings—her pension, her retirement accounts, her 401(k), her Social Security—and the post-retirement income she’d been drawing from these resources. Next, we went over her monthly lifestyle expenses to determine what she needed to live comfortably through her golden years.

What I found was that Sharon’s worries were largely unfounded, and that reallocating her money into a number of low-risk investments would provide a comfortable and sustained income for years to come. Had she kept her money in high-risk stocks, she likely would have lost up to half her nest egg in the recent economic collapse. Instead, I was able to all but eliminate risk from her portfolio, putting her mind at ease and allowing her to enjoy her retirement years to the fullest.

A New Approach

Sharon’s story is not unusual. In fact, you might be in the same place. You’ve spent your entire career building your nest egg for retirement. Now you’re ready for it to hatch into what you hope will be a consistent, comfortable income for the rest of your life. You may be worried that it won’t be enough. You may wonder if you’re being too aggressive with your money—or not aggressive enough. You may wonder if your portfolio provides enough liquidity to prepare you for an emergency. When your livelihood is at question, it’s understandable to be concerned.

As my clients know, I take a comprehensive approach to financial planning that ensures that all your concerns are addressed. I begin by sitting down with you and exploring what you have—the sum total of your accounts, funds, holdings, assets, and liabilities. Then I work with you to determine your current and projected income and expenses (e.g., the monthly income, accounting for inflation and taxes, you require to live comfortably, for now and for the years to come). Finally, I work with you to develop an investment plan based on your needed rate of return, and then position your assets with the goal of minimizing risk and protecting your principal while providing sufficient growth to attain that needed rate of return.

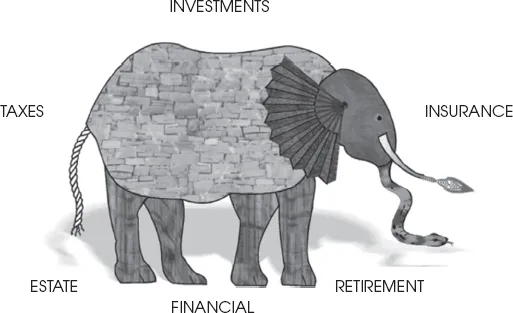

There is an old parable I remember from grade school I sometimes use to illustrate my comprehensive approach. It is about six blind men and an elephant. The story is that a wise king asked six blind men to approach an elephant staked out in his courtyard and to then describe the elephant to the king. The first blind man approached the elephant and touched its leg, and then told the king an elephant was like a tree. The second blind man approached the elephant and touched its side, and then told the king the elephant was like a large wall. The third blind man approached the elephant and touched its tail, and then told the king the elephant was like a rope. The fourth blind man approached the elephant and touched its ear and told the king the elephant was like a large fan. The fifth blind man approached the elephant and touched its tusk and told the king the elephant was like a spear. Lastly, the sixth blind man approached the elephant and touched its trunk and told the king the elephant was like a large serpent. The blind men all argued vehemently among themselves as to the true nature of the elephant, until the wise king explained to them that there was some truth in each of their perceptions yet none had grasped the whole truth of the elephant.

Think of the elephant as a metaphor for your life, large and complex, with many moving parts. (See Exhibit 1.1.) Think of working with a different adviser for each of these parts. Each adviser would have a different perspective, yet none would see the whole picture or how important it is for the different parts to work together.

All too often, I see other financial advisers and brokers behaving very much like those blind men. Some are concerned solely with selling stocks, mutual funds, and other securities; to them, financial planning is simply a matter of putting together an optimum stock portfolio. Have you ever had the experience of going to an investment adviser who has you fill out an investment risk tolerance questionnaire? Their goal is to attain the highest return based on your tolerance for volatility within your portfolio. Do they discuss what tax bracket you are in? Tax favored portfolio design may improve your net returns, especially for those in the highest brackets. After all it is not just what you make, it’s what you keep. Do they discuss your income needs, now or in retirement? This is extremely important when it comes to volatility in a portfolio as it can magnify losses and either dramatically reduces your income or the time your money will last. A comprehensive financial plan will accommodate your income needs and minimize volatility in your portfolio without sacrificing returns.

An insurance agent or adviser typically approaches planning from the perspective of minimizing risk. They may place a disproportionate emphasis on life insurance and annuities seeking the guarantees these products provide. Though these products may play an important role in a comprehensive plan they are not a complete solution.

Tax advisers and preparers typically seek to reduce your income taxes for the current year, when there may be instances wherein paying more taxes this year could save you much more in taxes in future years. What about state inheritance taxes and federal estate taxes? These are areas usually covered by your estate-planning attorney.

The ideal plan is one in which all your advisers are working together. Think of the elephant as a metaphor for your financial picture. If your advisers are focused on just one part—to the exclusion of your other goals—it may well have an adverse impact on your financial security.

If you’re focused on one aspect and remain blind to the rest you’re unlikely to devise anything resembling a comprehensive financial plan.

My approach considers the whole elephant, so to speak. While an insurance salesman might try to convince you of the virtues of annuities versus mutual funds, I have no interest in such debates. Just as the trunk is as crucial to the elephant as the tusks, annuities and mutual funds are two products that can and should play a complementary role in a complete financial plan. My process assesses where you are and where you want to be, and explores every available means to get you there.

In this chapter, I discuss the first step in the process: determining what assets you have available, where they are, and how they’re working for you. Like Sharon, you may be pleasantly surprised at how easy it is to attain and maintain the lifestyle you want!

What You’ve Got

Your retirement resources are most likely spread over various accounts: 401(k)s, Individual Retirement Accounts (IRAs), non-retirement accounts, your home, annuities, and Certificates of Deposit (CDs), just to name a few. You probably also have, or will have, sources of retirement income such as Social Security and possibly company pension plans. In addition, you may have earned income if you continue working into your retirement years. Today more than ever, people are finding ways to supplement their retirement income, whether through part-time work, setting their own hours as consultants, or simply pursuing their passions in ways that can keep them busy and bring in a little money on the side.

Here is a laundry list of the main retirement resources you may be able to draw upon:

- IRAs—Roth, Traditional, and inherited.

- Company-sponsored 401(k) or 403(b) plans, defined benefit plans, defined contribution plans, and profit sharing plans (PSPs).

- Social Security benefits.

- Annuities.

- Other assets, including inheritances and equity and capital gains in your investment/rental properties.

- Non-qualified (not part of an IRA or company retirement plan) savings and investments such as mutual funds, stock portfolios, bonds, Exchange Traded Funds (ETFs), and real estate investment trusts (REITs), as well as non-qualified accounts for liquidity needs such as CDs, savings/checking/money market accounts, and fixed annuities.

- Life insurance.

Each of these resources has the potential to contribute to your retirement income in different ways. Investment strategies will necessarily change as you grow older, and I develop plans for and with my clients that are flexible and allow for changes as we see what life brings their way. Once you are actually retired, your focus should shift more to generating income and maintaining your financial security by protecting the resources you’ve built up over the years.

Let’s take a quick look at each available retirement resource.

Company Retirement Plans

Many companies provide retirement plans as an employment benefit. There are two main types of company-sponsored plans: defined benefit and defined contribution.

Defined benefit plans, commonly known as pensions, are increasingly rare in the private sector, but still widely used for government employees. These plans provide you a specified monthly payment, the amount of which is typically based on your salary and the number of years you spent at the company or organization. You usually have the option of taking the payments over the course of your lifetime, or on a joint-life basis so your spouse can continue to get payments if you die first. The joint life option will result in a lower payout than the single life payout and if you die first, your spouse would typically get 50 percent of what you were receiving. If you wish to opt out of the joint-life provision, you will most likely have to get your spouse’s (or ex-spouse’s) permission in writing. You may also have the option of taking your pension as a lump sum. This has many advantages, such as putting you in control of this asset and how and where it is invested, choosing what income stream you wish to elect, and the ability to raise or lower it as needed. By rolling the lump sum into an IRA you can also control the tax consequences and thus increase the tax planning options available to you. This also allows your spouse to retain any remaining pension assets after your death and thus continue to provide for his or her income needs.

Defined Contribution plans, which include 401(k)s and 403(b)s, are established by your company, but rely on you to make contributions at your discretion; typically you can choose from investment options determined by your company. The money is yours, not the company’s, though some employers match a percentage of your contributions to the fund. When you leave the company, you can normally take your money and any vested employer contributions with you.

Since this is your money, there are fewer restrictions on it, giving you more control. For instance:

- Your spouse (or ex-spouse) gets little or no say in how the money is paid out (although a spouse may have to provide written consent if he or she is not named the primary beneficiary in the event of your death).

- Even if you are age 59½ and have started taking income from these accounts, you have the option of stopping, making changes, or even contributing more money if you meet certain income requirements.

- It can be re-allocated in a number of ways to manage and reduce your taxes, as well as to increase your retirement income stream.

- The money can also be invested in ways that can greatly enhance the safety of your principal, as I demonstrate in later chapters.

- When you leave your employer you can transfer your plan into an IRA, which provides more investment options, greater control, and additional tax planning options.

Defined Contribution plans, including such similar plans as Simplified Employee Pension (SEP) plans, are covered in greater depth in later chapters.

Individual Retirement Accounts

Individual Retirement Accounts (IRAs) are the most common personal retirement plans, and offer far more flexibility in investment options than a 401(k). Whether you have a traditional IRA (which is tax-deferred until withdrawal), a Roth IRA (in which taxes are paid up front, allowing for tax-free growth), or some combination of the two, you are the one who controls the money. IRAs have a greater breadth of investment options than Defined Contribution plans. You may increase or decrease distributions at your discretion without penalty after age 59½ (and for traditional IRAs after age 70½) as long as you at least take any required minimum distributions. The flexibility of IRAs also allows you more tax planning options, which can reduce the tax impact of your distributions.

IRAs, the b...