![]()

SECTION 1

AUDITING KNOWLEDGE

![]()

1

AUDITS – WHAT TO AUDIT AND WHY

CHAPTER SUMMARY

This chapter describes knowledge audits, in the larger context of knowledge assessments, as important management tools and their alignment with established protocols for conducting audits of financial and physical assets. A standard methodology for conducting knowledge audits explains how the methodology might be applied to the use of knowledge in business processes, to knowledge capabilities, and knowledge assets, stressing the importance of designing an audit strategy that balances rigor and relevance. The building blocks for selecting an audit target are established, setting expectations for audits, communicating and reporting results, and acting on those results. This chapter also highlights the importance of designing an audit strategy that balances rigor and relevance.

AUDITS – DEFINITIONS AND PURPOSE

Audit processes, methods, standards, and conventions are fairly well known – every organization routinely undergoes audits of its financial and physical assets. We might assume that applying those same methods to knowledge audits is straight forward. This is not a good assumption. We can audit physical and financial assets because we have well-established and widely accepted methods for identifying these assets, for managing them, and for accounting for them. Auditors – whether internal or external – rely on this foundation. They can make certain assumptions about the behavior and state of those assets and draw conclusions about variations they find.

What do we know about audits? We know that an audit is defined as an official inspection of an individual or an organization’s assets and accounts. Audits have protocols and are important organizational management tools. We know that an audit is not a scorecard, a rating or a “grade” but a management tool that helps you to fix what is lacking or what is deficient. Audits are typically conducted against a set of assumptions and standards about behavior and management of assets. Audits are internal management tools intended to inform organizational management and stakeholders about the performance of operations and assets according to expectations or standards. Audits are management tools that help you to expose gaps and areas that need to be improved. Audits are typically conducted with an expectation of a finding – handling or management according to standards as expected, handling or management with deficiencies to be corrected, and handling or management in excess of standards. We know that an audit should only be undertaken when you have a strong knowledge asset management foundation in place – and when you know what your expectations are for performance and operation. And, we know that audits are often, though not always, conducted by an independent body.

In general, capital is important to any organization regardless of whether your business is for, not-for, non-profit, or a simple social endeavor. It is important because regardless of what you do, who you do it for, and what your value proposition is – capital is a critical and primary input. Capital is what we transform to create value for our stakeholders. All organizations and communities understand the value proposition of capital and they devote resources to manage their capital assets.

Every business must leverage all three types of capital assets. Every business will assign a different priority and value to different kinds of capital. A manufacturing business might assign a higher value to physical (e.g., equipment) and financial (e.g., liquid cash) capital to keep its production line working. A software engineering business may assign greater value to its human capital in the form of the knowledge of its software engineers and developers, as well as to the customer relationships it has cultivated over the year. A financial services business will naturally assign a higher value to its financial resources and to the human knowledge of its analysts and clients

Audits generate a rich set of opportunities. Audits create opportunities for organizations to focus attention to how they manage their knowledge assets to increase their organizational effectiveness and efficiency. Audits create opportunities to raise awareness of knowledge assets as primary factors of production and a critical capital asset in the knowledge economy. To elevate knowledge as a capital asset, managers must have the tools and methods to identify and define their knowledge assets, to understand their behavior and properties, to describe how, when, why, and where they are leveraged in a business process and their useful business life, to understand how to manage knowledge assets, including investing in those assets and the risks and liabilities that result when they are not managed, and to understanding how to account for these assets, including assigning value, determining and managing costs, and estimating revenue and profits.

Before we can realize these opportunities, we must overcome several challenges. The current body of knowledge is either organization specific or theoretical in nature – they do not present practical solutions that an organization can draw from to develop a practical solution. Where there is some coverage, the solutions are ancillary to current methods for other kinds of capital assets – they are not on a par with current practices and are unlikely to be accepted by other executive-level managers. Every business and organization is unique. Each business and each organization develops and adopts practical solutions that suit its challenges and opportunities. A practical solution that works in one context may not work in another context. The current solutions for conducting a knowledge audit are suboptimal. Most discussions of audits are in actuality discussions of generalized assessments, analyses, or evaluations – not audits. Most discussions do not address critical management building blocks. There are gaps in treatment of preconditions. Where there is some coverage – such as in the financial standards for intangibles field – the coverage is too theoretical for businesses to understand or translate, is impractical for businesses to implement, and is ineffective as a management tool.

WHY ORGANIZATIONS CONDUCT KNOWLEDGE AUDITS

We audit knowledge assets and their use by organizations because they are valuable capital assets. First and foremost managers must know whether these assets are adding business value. This is a question only business managers can answer. An audit will tell us whether the organization is deriving business value from knowledge assets, and where and how improvements can be achieved. The business must drive the audit for us to gain a true picture of the current state.

Knowledge functions and capabilities must be managed like other institutional functions. An audit of knowledge functions and capabilities will help us to understand where we have missing or suboptimal practices. An audit of capabilities also can highlight remedies. Finally, knowledge assets can no longer be treated as ancillary assets whose value is less than that of physical and financial assets. There are many missing pieces in the management of knowledge assets. Audits can help us to identify these deficiencies and highlight remedies.

FRAMEWORK FOR KNOWLEDGE AUDITS

The authors present a generalized framework and methodology for knowledge audits. The framework is designed to allow organizations to develop a strategy that is relevant to their organization and is rigorous from an audit perspective. While the authors can explain how to establish the foundation for and how to conduct an audit, we cannot tell you what to audit and what the result should be. It is up to the organization to make these determinations.

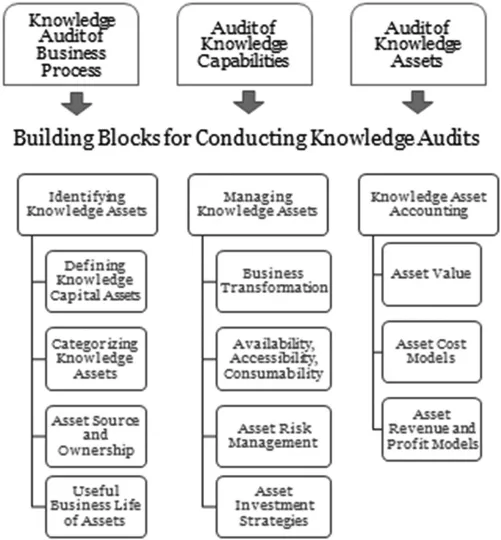

The framework has two components (Fig. 1). First, it calls out the three types of knowledge audits an organization might consider. Second, it identifies the conditions and processes that should be in place to support the three types of audits. The conditions and processes describe how an organization identifies, manages, and accounts for its knowledge assets. Audits may not be feasible where these conditions and processes are missing.

The authors have adapted a standard financial audit methodology to apply to knowledge audits. There are four steps involved in designing an audit methodology, including: (1) defining the client – the person or group the strategy is designed to serve – and the stakeholders; (2) defining the purpose of the audit – assurance of what and for whom; (3) defining evidence needed from the client; and (4) defining and verifying the client’s internal controls. A generic set of questions supports each step in the methodology. Those questions are listed below.

Fig. 1. Knowledge Audit Framework at the Foundation of the Book.

Step 1. Define the Client and the Stakeholders – Key Questions

Is the client committed to the audit and to hearing the results?

Is the client willing to participate in the audit or is this a justification exercise?

Does the client have the information you need for the audit? How much will you have to create or collect?

Is the audit feasible?

Can you complete the audit in an independent and objective way?

Who are all the stakeholders of the audit?

Is the client’s intent honest and true?

Does the client have the competence to understand and act upon the recommendations?

What are the responsibilities of the client?

What are the responsibilities of the audit team?

Step 2. Define the Purpose of the Audit – Assurance of What and for Whom – Key Questions

What are the stages of the process you intent to audit, that is, inputs, decision points, process tasks, outputs?

What knowledge assets are important to the activity?

What knowledge assets are currently used in the activity?

Do the knowledge assets contribute to the performance effectiveness?

Do the knowledge assets contribute to efficiency (i.e., doing things faster, and cheaper).

Step 3. Define Evidence Needed from the Client – Key Questions

What are the client’s assertions about the use of knowledge in the process? What is your starting point for the audit?

What information can the client provide to support the audit?

Is the client’s information sufficient – relevant – to the audit?

Is the client’s information sufficient – reliable – for the audit?

What additional evidence is needed from the client?

Step 4. Defining and Verifying the Client’s Internal Controls – Key Questions

How does the client define internal controls?

Where are they in place?

How are they monitored?

Are these internal controls consistently managed across processes and assets?

Are the controls managed with objectivity?

THREE TYPES OF KNOWLEDGE AUDITS

Knowledge audits – broadly defined – include three focus points:

The use of knowledge assets in business processes.

The effectiveness and efficiency of knowledge functions and capabilities, programs, and projects.

The management and use of knowledge assets as capital.

The methodology for auditing these three elements is consistent. The audit steps are consistent – and they align with audit protocols. The questions are adapted to suit the context, and the answers will always be unique to an organization.

AUDITING BUSINESS PROCESSES FOR KNOWLEDGE

The generalized methodology can be adapted to audit the use of knowledge in business processes. Before we can undertake this type of an audit, we need to have a consensus around the importance of knowledge assets to the business, who the stakeholders of this type of audit might be, what assurances we expect to offer those stakeholders, the expected value to the organization, and the audit process that will be followed. The detailed framework for designing and conducting this type of knowledge audit is discussed in Chapter 2.

AUDITING KNOWLEDGE MANAGEMENT FUNCTIONS, CAPABILITIES, AND PROJECTS

The generalized methodology can be adapted to audit the organizational knowledge functions and capabilities. These functions and capabilities are similar to the tactics referenced in the knowledge management literature. Before we can undertake this type of an audit, we need to have a consensus around the existence and important of those functions and capabilities, the stakeholders for those capabilities, the nature of the assurance we are offering those stakeholders about the performance of these capabilities, and the nature of the individual audits. The generalized methodology draws upon the same audit methodology used for other business processes.

The challenge for most organizations is that these functions and capabilities are not typically managed systematically at the organization level or represented as business processes. In order to conduct an audit an organization must have some grounds for the audit – some expectation of the results...