![]()

1 Pre-contract financial management

1.1 Project appraisal and developing the business case

It can be argued that the main role of the construction industry is to produce buildings or structures, mindful of cost, time, quality, health and safety and environmental constraints. Indeed many have argued that construction is fundamentally a production focused industry, whereby the outputs of the construction process are new or rehabilitated buildings, roads, bridges, railways or something similar. It could be argued that production is at the core of the service the construction industry provides to its customers and to society.

However, production is a very resource intensive process, not only in terms of the materials used to the construct buildings, or indeed the labour and plant involved in undertaking the construction process, but also in the amount of money customers need to commit to develop bespoke products. As a result, detailed project appraisals are often regarded as a critical stage in the evolution of construction projects. At this point the customer or employers will be faced with several fundamental decisions that will ultimately determine the success or otherwise of projects.

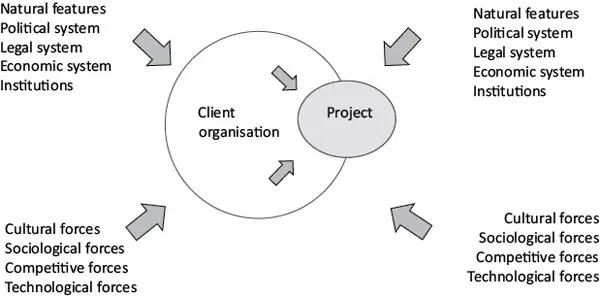

Immediately prior to this stage, employers should have identified and considered the need for the project at a very strategic level within their organisation, and aligned this with the overall strategic direction of their business. Figure 1.1 shows how this process will have required employer organisations to evaluate the potential benefits of projects and strategic fit with their overall organisation.

Project appraisals give employers and their senior management teams the opportunity to assess and question the potential options identified by project teams before resources are committed and production processes are commenced. It is project appraisals that will ultimately decide not only whether proposed projects are financially viable, but it will also influence the future direction of projects in terms of budget, project objectives and alignment with the overall business case of employers developed as part of project strategic definition.

Optional appraisal

For cost consultants or private quantity surveyors, option appraisals often represent the first major input they will have into projects. Forming a key part of overall project appraisals, option appraisals are undertaken at RIBA stage 0 ‘strategic definition’. During this stage in the evolution of projects, the RIBA plan of work suggests “the project will be strategically appraised and defined before a detailed brief is created” (RIBA, 2013). Introduced in 1963 the RIBA plan of work has been the definitive UK model for organising the process of briefing, designing, constructing, maintaining, operating and using building projects into a number of key stages (RIBA, 2013). The latest iteration of the RIBA plan of work, the RIBA plan of work 2013, is designed to align with current industry best practice in terms of digitalisation and sustainable development.

Figure 1.1 Project/business interface considerations at strategic definition.

At this point, it is highly likely option appraisals will be undertaken by project teams; this is likely to require “a review of a number of sites or alternative options such as extensions, refurbishment or new build” (RIBA, 2013). In terms of the role of cost consultants, these reviews will involve detailed financial evaluation of options available to employers, through the production of ‘order of cost estimates’, which in essence are assessments of the affordability of all options and the establishment of realistic cost limits.

Option appraisals will typically be applied at project level, and will either consider the viability of developing a building type on various sites, or will consider the viability of varying levels of quality or levels of refurbishment for proposed buildings to establish how these align with employer overall budgets, something that will have been identified as part of business case development.

For the rest of this chapter, the example of a budget hotel development will be used to demonstrate the key processes in pre-contract financial management.

Budget Hotel Development Scenario: AZX Property Ltd has recently completed the purchase of an old 1960s office building with a view to developing a budget hotel. Structural analysis of the existing building discovered it was unsuitable for rehabilitation. Consequently the existing office building will be demolished, the site remediated and a 5-storey, 64-bedroom hotel constructed on the site.

The building will have a GFA of 2,225m2, with a standard double bedroom having a GFA of 14.70m2.

Discussion point 1.1: How could the findings from a detailed option appraisal influence the employer’s non-financial decisions about the project?

1.2 Introduction

The chapter considers the initial exposure of quantity surveyors to financial management, throug...