For this prolepsis of being equal to God had blazed a trail for all philosophical knowledge and legislative justice. This forceful seizing was the first lie of the first attempt to displace our senses from simplicity in words, and to oversalt the peace of God on earth to the debauched taste of reason.

—Johann Georg Hamann

This is a book about economics. But it is also a book about human limitations and the difficulty of gaining true insight into the world around us. There is, in truth, no way of separating these two things from one other. To try to discuss economics without understanding the difficulty of applying it to the real world is to consign oneself to dealing with pure makings of our own imaginations. Much of economics at the time of writing is of this sort, although it is unclear such modes of thought should be called ‘economics’ and whether future generations will see them as such. There is every chance that the backward-looking eye of posterity will see much of what today’s economic departments produce in the same way as we now see phrenology: a highly technical, but ultimately ridiculous pseudoscience constructed rather unconsciously to serve the political needs of the era. In the era when men claiming to be scientists felt the skull for bumps and used this to determine a man’s character and his disposition, the political discourse of the day needed a justification for the racial superiority of the white man; today our present political discourse needs a Panglossian doctrine that promotes general ignorance, a technocratic language that can be deployed to cover up certain political aspects of governance and tells us that so long as we trust in those in charge everything will work itself out in the long-run.

But the personal motivations of the individual economist today is not primarily political—although it may well be secondarily political, whether that politics turns right or left—the primary motivation of the individual economist today is in search to answers to questions that they can barely formulate. These men and women, perhaps more than any other, are chasing a shadow that has been taunting mankind since the early days of the Enlightenment. This is the shadow of the mathesis universalis, the Universal Science expressed in the abstract language of mathematics. In this case, they aim at a Universal Science of Man. They want to capture Man’s essence and understand what he will do today, tomorrow and the day after that. To some of us more humble beings that fell once upon a time onto this strange path, this may seem altogether too much to ask of our capacities for knowledge. And this book is undoubtedly written for them. But it is worth empathising to some extent with what these men and women seek in their daily activities. Is it a noble cause, this Universal Science of Man? Some might say that if it were not so fanciful, it might be. Others might say that it has roots in extreme totalitarian thinking and were it ever taken truly seriously, it would lead to a tyranny with those who espouse it conveniently at the helm. These are moral and political questions that will not be explored in too much detail in the present book.

What we seek to do here is more humble again. There is a sense today, nearly six years after an economic catastrophe that few still understand and only a few saw coming, that there is something rotten in economics. Something stinks and people are less inclined than ever to trust the funny little man standing next to the blackboard with his equations and his seemingly otherworldly answers to every social and economic problem that one can imagine. This is a healthy feeling and we as a society should promote and embrace it. A similar movement began over half a millennia ago questioning the men of mystery who dictated how people should live their lives from ivory towers; it was called the Reformation and it changed the world. But this book is not an updated version of Martin Luther’s Ninety-Five Theses. We are not so much interested in the practices of the economists themselves, as to whether they engage in simony, in nepotism and—could it ever be thought?—the sale of indulgences to those countries that had or were in the process of committing grave sins. Rather, we are interested in how we gotten to where we are and how we can fix it.

The roots of the problems with contemporary economics run very deep indeed. In order to comprehend them, we must run the gamut from political motivations to questions of philosophy and methodology to the foundations of the underlying structure itself. When these roots have been exposed, we can then begin the process of digging them up so we can plant a new tree. In doing this, we do not hope to provide all the answers but merely a firm grounding, a shrub that can, given time, grow into something far more robust. Some of the material in this book is new but much of it has been excavated from the best work done in economics over the past two centuries, much of which was buried deep in the crevices where academic libraries keep the books marked ‘Withdrawn’. Before we begin our journey, let us first briefly discuss some questions that the reader might have before proceeding.

Down with Mathematics?

The reader of this book will likely have flipped through the pages and seen something that may well have put them off reading it, namely, equations, dreaded equations. There are not many in what follows but there are certainly a handful. If you are one of those people whose eyes glaze over when they see linear algebra, who find that mathematics is not generally conducive to understanding the social world, then I would implore you: please read on. You are, in a sense, the perfect reader. Economics needs more people who distrust mathematics when applying thought to the social and economic world, not less. Indeed, as will be argued in a moment, the major problems with economics today arose out the mathematisation of the discipline, especially as it proceeded after the Second World War. Mathematics became to economics what Latin was to the stagnant priest-caste that Luther and other reformers attacked during the Reformation: a means not to clarify, but to obscure through intellectual intimidation. It ensured that the common man could not read the Bible and had to consult the priest and, perhaps, pay him alms.

So, why are there dreaded equations in what follows? Because—and I plead with the sceptical reader to give me the benefit of the doubt here—mathematics can, in certain very limited circumstance, be an opportune way of focusing the debate. It can give us a rather clear and precise conception of what we are talking about. Some aspects—by no means all aspects—of macroeconomics are quantifiable. Investments, profits, the interest rate—we can look the statistics for these things up and use this information to promote economic understanding. That these are quantifiable also means that, to a limited extent, we can conceive of them in mathematical form. It cannot be stressed enough, however, the limited extent to which this is the case. There are always, as we shall see in this book, non-quantifiable elements that play absolutely key roles in how the economy works. We can only utilise mathematics productively and to some very limited extent if we keep this in the forefront of our minds. In what follows, I have tried my best to do this.

In addition to this, I have written the chapters that do have equations in such a way that I believe they can be understood by those who do not want to bother with the mathematics. In the section of his General Theory which had extensive mathematics, Keynes wrote in a footnote (much to the chagrin of certain other people in the profession at the time): ‘Those who (rightly) dislike algebra will lose little by omitting the first part of this chapter’ (Keynes 1936a, b, Chapter 20). We are here trying to do something similar. The mathematics is there if the reader cares to understand it. But it is secondary to the argument which is purely textual. And if your eyes glaze over when you encounter the equations, fear not because so long as you have understood the text (and perhaps a few simple numerical examples provided), you will lose little.

The mathematisation of the discipline was perhaps the crucial turning point when economics began to become something entirely other to the study of the actual economy. It started in the late nineteenth century, but at that time many of those who pioneered the approach became ever more distrustful of doing so. They began to think that it would only lead to obscurity of argument and an inability to communicate properly either with other people or with the real world. Formulae would become synonymous with truth and the interrelation between ideas would become foggy and unclear. A false sense of clarity in the form of pristine equations would be substituted for clarity of thought. Alfred Marshall, a pioneer of mathematics in economics who nevertheless always hid it in footnotes, wrote of his distress in his later years in a letter to his friend.

[I had] a growing feeling in the later years of my work at the subject that a good mathematical theorem dealing with economic hypotheses was very unlikely to be good economics: and I went more and more on the rules—(1) Use mathematics as a shorthand language, rather than an engine of inquiry. (2) Keep to them till you have done. (3) Translate into English. (4) Then illustrate by examples that are important in real life. (5) Burn the mathematics. (6) If you can’t succeed in (4), burn (3). This last I did often. (Pigou ed. 1966 [1906], pp. 427–428)

The controversy around mathematics appears to have broken out in full force surrounding the issue of econometric estimation in the late 1930s and early 1940s. Econometric estimation, for those who do not know, is the practice of putting economic theories into mathematical form and then using them to make predictions based on available statistics. We will discuss this at some length in Chap. 10, but for the moment we should say that it is a desperately silly practice. Those who championed the econometric and mathematical approach were men whose names are not known today by anyone who is not deeply interested in the field. They were men like Jan Tinbergen, Oskar Lange, Jacob Marschak and Ragnar Frisch (Louçã 2007). Most of these men were social engineers of one form or another; all of them left-wing and some of them communist. The mood of the time, one reflected in the tendency to try to model the economy itself, was that society and the economy should be planned by men in lab coats. By this they often meant not simply broad government intervention but something more like micro-management of the institutions that people inhabit day-to-day from the top down. Despite the fact that many mathematical economic models today seem outwardly to be concerned with ‘free markets’, they all share this streak, especially in how they conceive that people (should?) act.

Most of the economists at the time were vehemently opposed to this. This was not a particularly left-wing or right-wing issue. On the left, John Maynard Keynes was horrified by what he was seeing develop, while, on the right, Friedrich von Hayek was warning that this was not the way forward. But it was probably Keynes who was the most coherent belligerent of the new approach. This is because before he began to write books on economics, Keynes had worked on the philosophy of probability theory, and probability theory was becoming a key component of the new mathematical approach (Keynes

1921). Keynes’ extensive investigations into probability theory allowed him to perceive to what extent mathematical formalism could be applied for understanding society and the economy. He found that it was extremely limited in its ability to illuminate social problems. Keynes was not against statistics or anything like that—he was an early champion and expert—but he was very, very cautious about people who claimed that just because economics produces statistics these can be used in the same as numerical observations from experiments were used in the hard sciences. He was also keenly aware that certain tendencies towards mathematisation lead to a fogging of the mind. In a more diplomatic letter to one of the new mathematical economists (Keynes, as we shall see in later chapters, could be scathing about these new approaches), he wrote:

Mathematical economics is such risky stuff as compared with nonmathematical economics, because one is deprived of one’s intuition on the one hand, yet there are all kinds of unexpressed unavowed assumptions on the other. Thus I never put much trust in it unless it falls in with my own intuitions; and I am therefore grateful for an author who makes it easier for me to apply this check without too much hard work. (Keynes cited in Louçã 2007, p. 186)

This book is written in the spirit of Keynes. There is no inherent problem with jotting down a formula or an equation if this helps us clarify matters. But this must always be kept firmly in perspective, and these should never be relied upon as a crutch; indeed, it would be preferable for the reader to skip the equations than to take them up as something to lean their entire weight on. It is for this reason that much of the first half of the book is implicitly or explicitly about how we think about the economy and to what extent certain tools that work in other sciences work or do not work in economics.

Mathematics, like the high Latin of Luther’s time, is a language. It is a language that facilitates greater precision in some instances and greater obscurity in others. For most issues economic, it promotes obscurity. When a language is used to obscure, it is used as a weapon by those who speak it to repress the voices of those who do not. A good deal of the history of the relationship between mathematics and the other social sciences in the latter half of the twentieth century can be read under this light. If there is anything that this book seeks to do, it is to help people realise that this is not what economics need be or should be. Frankly, we need more of those who speak the languages of the humanities—of philosophy, sociology and psychology—than we do people who speak the language of the engineers but lack the pragmatic spirit of the engineer who can see clearly that his methods cannot be deployed to understand those around him.

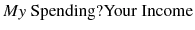

Before we proceed, a quick note on two of the formal expressions used in this book. The great Polish economist Michał Kalecki once said that economics was the ‘science of confusing stocks and flows’. If he were alive during our time—the economic Dark Ages—he might have gone on to say that it was also the ‘science of confusing identities and causal arguments’. This has a lot to do with the nature of the mathematical formalism that economists use. You see, there are two types of mathematical expressions in economics. One expression are what we call ‘identities’, while the other are what we call ‘causal arguments’. An identity is a tautology that is true by definition. It is like an accounting norm. We use these a lot in macroeconomics. For example, the calculation of GDP is an accounting norm. Once we agree on what make up its components, there is no real debate about what the GDP figure for any given year is. Thus the GDP accounting norm is an identity. Think of it this way: if I hand you $100 and you perform work for me, my spending is equal,

by identity, to your income. I spend $100 and you receive $100 in income. There is really no debate to be had here. When we equalise something in the form of an identity—that is, something true

by definition—we will use the mathematical identity sign: ≡. As the reader can see, it is sort of like an equals sign but with an extra bar. So, in the example where I spend $100 and you receive it as income:

Causal arguments are entirely different. They imply that one side of a given equation is determining the other side of the equation in some sort of causal manner. These are not true by definition but are rather hypotheses we form about reality. If I say that the interest rate offered by the bank will determine (or ‘cause’) the amount of money that you save at that bank, then I am making a causal argument, one that is not true by definition and depends if your behaviour responds to the interest rate offered by the bank. These sorts of arguments are the ones we debate in economics and we will denote them in this book by the standard equals sign: =. So, in the case of our example above:

Note that we also try to keep the ‘variable’ that causes...