Making Money Simple

The Complete Guide to Getting Your Financial House in Order and Keeping It That Way Forever

Peter Lazaroff

- English

- ePUB (apto para móviles)

- Disponible en iOS y Android

Making Money Simple

The Complete Guide to Getting Your Financial House in Order and Keeping It That Way Forever

Peter Lazaroff

Información del libro

Simplify your financial life and ensure financial success into the future

Feeling paralyzed by the overwhelming number of complex decisions you need to make with your money?

You don't need to be an expert to achieve financial freedom. You just need a framework that makes the right choices simple and easy to make. Making Money Simple provides that much-needed process so you can get on the right track to long-term financial security.

This valuable resource provides a solid foundation for all the nuanced personal finance decisions you need to make as you go through your career, hit major life milestones, and look to grow wealth. It's a blueprint for financial achievement—even through tough-to-navigate situations where there are no clear-cut rules.

After you read Making Money Simple, you'll be able to create your personal plan for success using proven wealth management methods and real-world financial strategies. From basic financial principles to advanced investing techniques, you'll get comprehensive coverage of fundamental financial topics with easy-to-follow advice from author Peter Lazaroff, who draws from his expertise as the Chief Investment Officer of a multi-billion-dollar wealth management firm to give you the tools you need to simplify your financial situation and make the right moves at every opportunity.

Getting your finances in order doesn't have to be hard. It doesn't require fancy, convoluted investment strategies. Nor does it require keeping track of detailed spreadsheets. You just need this step-by-step process to get your financial house in order and keep it that way forever.

It doesn't matter what your specific situation is. We all need to understand our money—and what to do with it. Making Money Simple shows you how to:

- Develop clear financial goals and plan for your future

- Understand the three crucial elements of building a strong financial house

- Implement effective investment strategies to grow your wealth and avoid costly mistakes

- Learn ten smart questions to ask when hiring financial professionals

For those seeking to secure a solid financial future, Making Money Simple: A Complete Guide to Getting Your Financial House in Order and Keeping It That Way Forever is the roadmap to get you there.

Preguntas frecuentes

Información

CHAPTER ONE

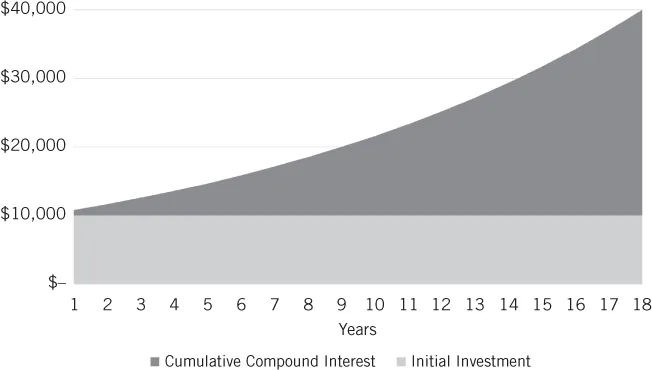

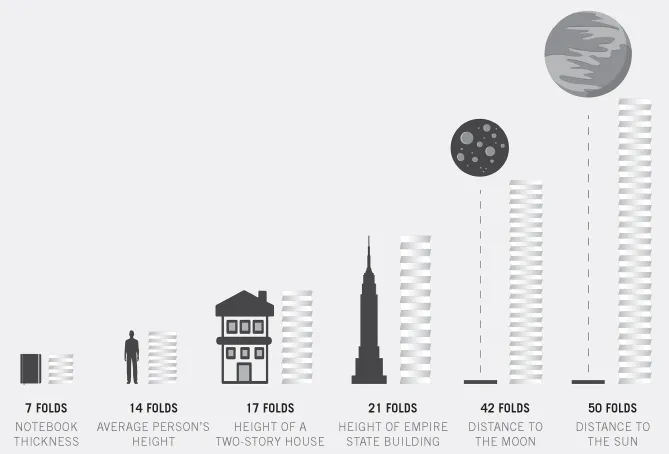

The Power of Time and Compounding

THE POWER OF COMPOUND INTEREST