eBook - ePub

Monetary Policy and the Economy in South Africa

M. Ncube,E. Ndou

This is a test

- English

- ePUB (adapté aux mobiles)

- Disponible sur iOS et Android

eBook - ePub

Monetary Policy and the Economy in South Africa

M. Ncube,E. Ndou

Détails du livre

Aperçu du livre

Table des matières

Citations

À propos de ce livre

Monetary Policy and the Economy in South Africa covers both modern theories and empirical analysis, linking monetary policy with relating house wealth, drivers of current account based on asset approach, expenditure switching and income absorption effects of monetary policy on trade balance, effects of inflation uncertainty on output growth and international spill overs. Each chapter uses data and relevant methodology to answer empirical and pertinent policy questions in South Africa. The book gives new insights into understanding these areas of economic policy and the wider emerging-markets.

Foire aux questions

Comment puis-je résilier mon abonnement ?

Il vous suffit de vous rendre dans la section compte dans paramètres et de cliquer sur « Résilier l’abonnement ». C’est aussi simple que cela ! Une fois que vous aurez résilié votre abonnement, il restera actif pour le reste de la période pour laquelle vous avez payé. Découvrez-en plus ici.

Puis-je / comment puis-je télécharger des livres ?

Pour le moment, tous nos livres en format ePub adaptés aux mobiles peuvent être téléchargés via l’application. La plupart de nos PDF sont également disponibles en téléchargement et les autres seront téléchargeables très prochainement. Découvrez-en plus ici.

Quelle est la différence entre les formules tarifaires ?

Les deux abonnements vous donnent un accès complet à la bibliothèque et à toutes les fonctionnalités de Perlego. Les seules différences sont les tarifs ainsi que la période d’abonnement : avec l’abonnement annuel, vous économiserez environ 30 % par rapport à 12 mois d’abonnement mensuel.

Qu’est-ce que Perlego ?

Nous sommes un service d’abonnement à des ouvrages universitaires en ligne, où vous pouvez accéder à toute une bibliothèque pour un prix inférieur à celui d’un seul livre par mois. Avec plus d’un million de livres sur plus de 1 000 sujets, nous avons ce qu’il vous faut ! Découvrez-en plus ici.

Prenez-vous en charge la synthèse vocale ?

Recherchez le symbole Écouter sur votre prochain livre pour voir si vous pouvez l’écouter. L’outil Écouter lit le texte à haute voix pour vous, en surlignant le passage qui est en cours de lecture. Vous pouvez le mettre sur pause, l’accélérer ou le ralentir. Découvrez-en plus ici.

Est-ce que Monetary Policy and the Economy in South Africa est un PDF/ePUB en ligne ?

Oui, vous pouvez accéder à Monetary Policy and the Economy in South Africa par M. Ncube,E. Ndou en format PDF et/ou ePUB ainsi qu’à d’autres livres populaires dans Negocios y empresa et Negocios internacionales. Nous disposons de plus d’un million d’ouvrages à découvrir dans notre catalogue.

Informations

Sujet

Negocios y empresaSous-sujet

Negocios internacionales1

Introduction: South African Monetary Policy Regimes

Since 1970, South African monetary policy has consisted mainly of direct controls, which ranged from credit ceilings to cash reserve requirements and interest rate controls. These direct controls were aimed at curbing the growth of monetary aggregates to deal with inflation (Aziakpono and Wilson 2010). Of note is the recommendation of the De Kock commission, formed in 1977: market oriented monetary policies.1 The policy recommendations included using a discount policy known as an ‘accommodation’ policy, which was complemented by open market operations, and variable cash reserve requirements.2

Between 1960 and 1981, the liquidity asset ratio-based system was used with quantitative restrictions on interest rates and credit. This was followed by a mixed system during the transition period between 1981 and 1985 (Aron and Muellbauer 2001). Subsequently, between 1986 and 1998, a pre-announced M3 monetary target was used with emphasis on using the discount rate to influence the market interest rate. However, from 1998, the South African Reserve Bank (SARB) used daily tenders of liquidity through repurchase transactions while monetary growth guidelines were announced on a three-year basis, including target ranges for core inflation.3 Targeting money supply was made difficult due to financial liberalization, which began in the 1980s, and the increasing openness of the capital account since 1995 (Aziakpono and Wilson 2010).

The most recent monetary framework, adopted in February 2000, relates to inflation targeting. The inflation targeting framework use a repo system and initially targeted consumer price inflation (CPI), excluding mortgage rates (CPI-X), which was changed to a headline inflation measure as from January 2009. Under inflation targeting, the SARB framework does not have goal independence but does have operational independence in monetary policy. The South African government sets and adjusts the inflation target. The SARB’s operational independence implies it can elect the use of any available monetary policy instrument in its pursuit of targets. The adoption of the inflation targeting framework heralded the beginning of a change in exchange rate policy: the bank stopped intervening in foreign exchange market but continued to buy foreign exchange to supplement the foreign exchange reserve holdings.

1.1 The exchange rate policy

The South African exchange rate was fixed until 1979, with the rand pegged either to the US dollar or the British pound sterling (Aron and Muellbauer 2001). Moreover, policy-makers determined changes in this rate in discrete steps.4 Also in 1979 came the emergence of greater flexibility in the exchange rate through the dual currency exchange rate system. After this period, the official exchange rate was announced daily as determined by market forces, while the financial exchange rate was applied to non-resident portfolio and direct investment transactions. The dual system intended to break the direct link between domestic and foreign interest rates, while insulating the capital account from certain types of capital flows. The dual rates were unified following the report of the De Kock commission.5 After problems with the unified rand between 1983 and 1985, during the debt freeze, the financial rand was reintroduced and capital controls on residents were tightened. The dual currency remained in place until March 1995.

As circumstances required, and for a variety of reasons, the SARB intervened in the spot and forward foreign exchange markets. However, from time to time the bank encountered problems (Aron and Muellbauer 2001). The SARB made use of an oversold foreign exchange position , which usage ceased after the bank abandoned its focus on the exchange rate. Since 1979, foreign exchange markets interventions have occurred despite low reserves, which limited the steps the bank could take to intervene. The interventions between 1979 and 1988 were partly to maintain the profitability and stability of the gold mining industry.6 However, after August 1989, the SARB actively sought to stabilize the real effective exchange rate (REER) to deal with the international competitiveness of the country’s exports.7 Foreign exchange rate intervention decreased, and was successful at stabilizing exchange in the presence of huge capital outflows in 1994.

The inflation targeting framework adopted in February 2000 saw management of the exchange rate become a low priority issue. In addition, labour movements argued for foreign exchange rate intervention to achieve a weaker currency to support the competitiveness of exporters and the manufacturing sector.

1.2 Current account

The SARB dealt with matters regarding the balance of payments and the current account. Surcharges were introduced, due to a decline in capital flows following the 1976 Soweto uprisings (Aron and Muellbauer 2001). These surcharges remained in place until 1980, when high price of gold alleviated pressure on the current account. The use of import surcharges over and above tariff regulations implied a restrictive trade policy in 1977. Surcharges on imports were reintroduced between February 1982 and November 1983. Due to the debt freeze (1985-Q3–1989-Q2), the requirements to pay back capital and interest on existing debt implied that the capital account remained in deficit until 1994.

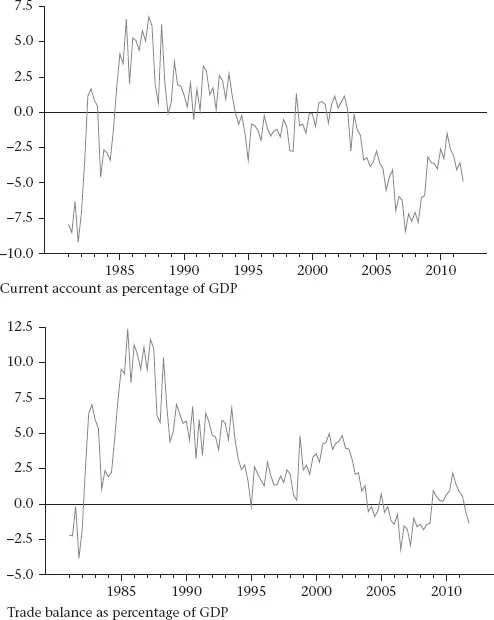

The pressure on the current account led to a sharp depreciation of the currency. At the same time, trade policy experienced large increases in tariffs and the reintroduction of large import surcharges in September 1985, which were phased out after 1995 (Aron and Muellbauer 2001). Capital flows increased after elections in 1994; accelerated by the removal of exchange controls on non-residents in March 1995 and due to large proportion of inflows being short-term, this made the economy vulnerable to flow reversals. The additional pressure on the balance of payments was due to progressive liberalization of trade policy as trade volumes responded strongly to the cessation of trade sanctions. The adoption of a new growth plan in around 2010 suggests that the net trade balance could be the main driver of economic growth. This action identified the exchange rate as being important and suggests that the monetary situation was playing a much bigger role. The resurgence in gold prices between late 1986 and 1988 led to a current account deficit in 1988-Q2, leading to a tightening in trade policy. It is possible that during these periods, monetary policy was influenced by balance of payments considerations. Figure 1.1 shows the movements in the current account and its trade balance component. It is evident that the current account has deteriorated significantly since 2003. This book explores the drivers of the current account.

1.3 Inflation and economic growth

South Africa formally adopted inflation targeting as its monetary policy framework on 23 February 2000. The SARB adopted a continuous target, to be achieved on a monthly basis since 2003. During this period, the bank targeted CPI-X, which is CPI excluding mortgages interest costs with imputed rent in the calculation of owner-occupied housing.

Figure 1.1 South African current account and trade balance as percentage of GDP

Source: South Africa Reserve Bank.

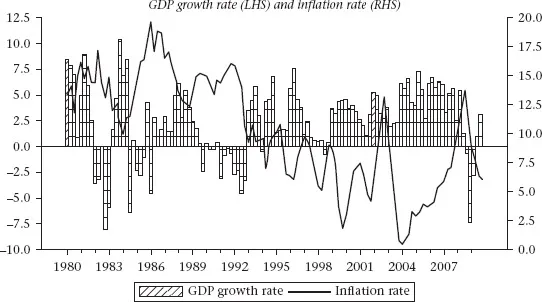

In October 2008, the bank announced it would target changes in CPI from January 2009. For the most part, the bank managed to bring inflation within the 3–6 per cent band, but there were periods when inflation fell outside these boundaries. The targeted inflation rate up until mid-2010 hovered around 6.2 per cent per annum: 1.4 per cent was recorded in 2004, and a high of 11.5 per cent in 2008. Inflation targeting also saw periods of prolonged economic growth. Figure 1.2 shows the relationship between the gross domestic product (GDP) growth rate and the inflation rate. It seems that the periods of declining inflation are associated with high economic growth, suggesting a negative relationship between the two variables. However, the strength of this relationship will be investigated econometrically in the chapters that follow.

Figure 1.2 South African GDP and inflation rates

Source: South Africa Reserve Bank.

Notes

1.This represented a shift in policy orientation from a control regime.

2.The accommodation policy included variations in terms and conditions taking the form of changes in quantities of liquidity provided to the market and the interest rate costs of accommodation. This included the use of a discount policy, known as an ‘accommodation’ policy, and was complemented by open market operations and variable cash reserve requirements.

3.The repo system involves regular repurchase transactions between the SARB and the bank’s clients, and caters for shortfalls in bank liquidity using a borrowing window for the SARB related to various securities that are tendered to the bank on a daily or intra-day basis.

4.In 1976, the system was changed to allow for the transfers of assets between non-residents (Aron and Muellbauer 2001), and 1979 saw the emergence of greater flexibility in the exchange rate with the dual currency exchange rate system.

5.The controls on resident capital movements were removed residents could apply to make direct investments abroad.

6.The intervention was aimed at smoothing the real price of gold despite large fluctuations in the dollar price of gold.

7.This happened despite the absence of an official policy position regarding the stabilization of the real exchange rate. The main objective of the intervention was to prevent excessive real appreciation of the rand when the nominal value was appreciating in nominal terms.

Part I

Output

2

Effects of Monetary Policy on Output

2.1 Introduction

We will investigate the effects of an unanticipated contractionary monetary policy shock on output in South Africa. Certain economic theories suggest that only an unexpected monetary policy response has real impact, and could magnify the impact of systematic response. In this context, a change in monetary policy that comes as no surprise to private economic agents (such as investors, firms and consumers) would not change their expectations and would exert little, if any, effect on output. However, a policy change that has not been anticipated and that is expected to be long-term influences the expectations of future interest rates and economic activities such as investment and the stock market, which influence the future output (Blanchard 2006).

There are channels through which globalization may have influenced both the transmission and effectiveness of South African monetary policy. What is the effect of globalization on monetary policy? The financial environment in which South African monetary policy is made is seriously cha...

Table des matières

- Cover

- Title

- 1 Introduction: South African Monetary Policy Regimes

- Part I Output

- Part II Housing

- Part III Components of the Balance of Payments

- Part IV International Transmission

- Bibliography

- Index

Normes de citation pour Monetary Policy and the Economy in South Africa

APA 6 Citation

Ncube, M., & Ndou, E. (2013). Monetary Policy and the Economy in South Africa ([edition unavailable]). Palgrave Macmillan UK. Retrieved from https://www.perlego.com/book/3486675/monetary-policy-and-the-economy-in-south-africa-pdf (Original work published 2013)

Chicago Citation

Ncube, M, and E Ndou. (2013) 2013. Monetary Policy and the Economy in South Africa. [Edition unavailable]. Palgrave Macmillan UK. https://www.perlego.com/book/3486675/monetary-policy-and-the-economy-in-south-africa-pdf.

Harvard Citation

Ncube, M. and Ndou, E. (2013) Monetary Policy and the Economy in South Africa. [edition unavailable]. Palgrave Macmillan UK. Available at: https://www.perlego.com/book/3486675/monetary-policy-and-the-economy-in-south-africa-pdf (Accessed: 15 October 2022).

MLA 7 Citation

Ncube, M, and E Ndou. Monetary Policy and the Economy in South Africa. [edition unavailable]. Palgrave Macmillan UK, 2013. Web. 15 Oct. 2022.