![]()

Dubium sapientiae initium.

René Descartes

1.1 Who should read this book

In the last two decades an extensive selection of books on interest rate or equity derivatives modelling became available through various publishers. We therefore take the opportunity to say a few words on the main texts out there and how our work complements the current literature.

On the interest rate derivatives side, probably the most sophisticated book to date is the collection Interest Rate Modeling I, II, III by Andersen and Piterbarg (2010). Split into volumes I, II and III, it is a comprehensive piece of work, covering not only standard techniques but also discussing more complex topics such as the Markovian projection. Another book, which has become a standard reading for quantitative analysts working on interest rate derivatives is Interest Rate Models – Theory and Practice: With Smile, Inflation and Credit by Brigo and Mercurio (2006). It is strongly recommended for those seeking an applied practical approach, both for those with enough mathematics for a thorough understanding, yet without being off-putting for less mathematically minded readers. However, both these titles provide a limited overview of the SABR model, and although the first one covers term structure models with stochastic volatility, neither provide materials related to the SABR LIBOR Market Model (SABR LMM).

A third book, which completes the interest rate modelling spectrum is The SABR/LIBOR Market Model: Pricing, Calibration and Hedging for Complex Interest-Rate Derivatives, Rebonato et al. (2009). This publication covers very thoroughly the SABR LMM. It is however addressed to a seasoned public with very good foundations in the interest rate derivatives market.

A common factor of the three titles mentioned is that they all show a great depth of mathematical details but lack code examples or implementation ‘recipes’. As a reminder, a large part of a typical quantitative analyst job is implementing models, adjusting calibration procedures, perfecting calendar grids. It is worth mentioning at this point that there are books showing code snippets, such as the great review of stochastic volatility by Lewis (2000), but the use of the coding language and the snippets remain rather impractical.

We aim to bridge the gap between the understanding of the models from a conceptual and mathematical perspective and the actual implementation by supplementing our review of the interest rate theory with working code. We do this by providing clear, specific, code examples for interest rate modelling written in Python. The code should bring the equations to life and lift the reader’s understanding of models to a higher and clearer level. The mathematical complexity and model sophistication presented targets mainly new entry quants and risk managers. We emphasize however that the book can add value to any quantitative analyst who is interested in understanding the major concepts and the application of the LIBOR Market Model, the SABR model and the combined SABR LMM.

1.2 Outline

The main goal of this book is to teach the reader a practical and useful approach to modelling interest rates. In particular, we will go into detail on the stochastic alpha-beta-rho (SABR) model and the SABR LMM. By providing a clear coverage of these two models, together with their implementation, the reader will be able to add a wide tool set to her or his skills, in an enjoyable and stimulating way.

Besides the obvious application by exotic trading desks in pricing and hedging vanilla (SABR), complex and path-dependent derivatives (SABR LMM), these models could be also used by hedge funds speculating on the volatility space, mortgage traders arbitraging prepayment models or insurance companies managing the embedded optionalities in life insurance policies.

Throughout the book we will present examples and tests performed on real market data, sourced from Thomson Reuters Eikon, and collected in the period June–December 2013. The reference markets are CHF and EUR. The former has been chosen because it is particularly challenging from a modelling point of view. It has in fact been characterized by negative rates and very high implied volatility. The latter has been chosen due to its leading role in the interest rate derivatives space, where most exotic and structured instruments, along with a very high volume of vanilla products, are traded.

We introduce in Chapter 3 the mathematical foundation for the following chapters and define the basic financial instruments and their valuation in a deterministic world. Throughout the book, all valuations will be proposed in a multiple curve framework. This now almost standard curve setup emerged shortly after the 2007–2008 financial crisis when most derivatives required collateral to be posted. In short, cash flows in this framework are discounted using a curve that replicates the costs of collateral funding, that is an appropriate overnight risk free curve, and forwards are projected using a LIBOR projection replicating an unsecured funding.

To facilitate the entrance into the modelling of derivatives, we will be introducing the reader, in Chapter 4, to simplistic approaches needed for the pricing of caps, floors and swaptions.

Following this rather extensive introduction, we dedicate ourselves to the most popular stochastic volatility model for interest rates, the SABR model, in Chapter 5. The SABR model was first introduced to a wider audience by Hagan, Kumar, Lesniewski and Woodward in Hagan et al. (2002). In this model, the forward (LIBOR or swap) rate is modelled stochastically with a stochastic volatility process. The model is widely used for vanilla pricing and interpolation in the rates derivatives world due to closed form approximations that have been refined further in recent years. Perhaps due to its simplicity and the intuitive nature by which one can interpret its parameters, the model has caught the imagination of many academics and practitioners. This has resulted in many solutions, usable or not usable in practice. The model will be crucial later in the book when we cover the SABR LMM: a LIBOR Market Model with a stochastic volatility process for each forward rate.

In Chapter 6 we provide an analysis of the LIBOR Market Model (LMM). We will also cover in this chapter newer topics such as how one can use adjoint methods to compute Greeks in a quick way, and we will also spend time discussing how one calibrates correlation and volatility in this modelling setting. On reading this chapter and working through the provided code, the reader will be in a good position to understand the material related to the SABR LMM. We explain two approaches known in the literature and explicitly show our implementation of one of them in Chapter 7.

1.3 Python, NumPy and SciPy

Typically a large part of the day to day work of a quantitative analyst is to implement a model and integrate this into the pricing environment. Understanding the model and writing its complete set of dynamics is certainly one part of the job, but an arguably equally important and rewarding step is coding it. The readers of this book will come from many backgrounds, some very mathematically oriented and others perhaps have a computer science background, and so by providing the reader with the equations and code examples, both communities will be able to take something from the book. Python (see, e.g., Martelli 2006) is widely used in banking, often as a language for interfacing data feeds to a system or as an API to the pricing/risk library developed in C++. The advantages of providing examples in Python are multifold. It is easy to read for someone who already has some experience programming in other languages, offers object oriented structures, is open source, and has several excellent and well developed numerical libraries, notably SciPy and NumPy (see Jones et al. 2001–). Python also has the graphing capabilities comparable with R or Matlab, thanks to the matplotlib library (see Hunter 2007), which has been employed to produce most of the charts appearing in this book.

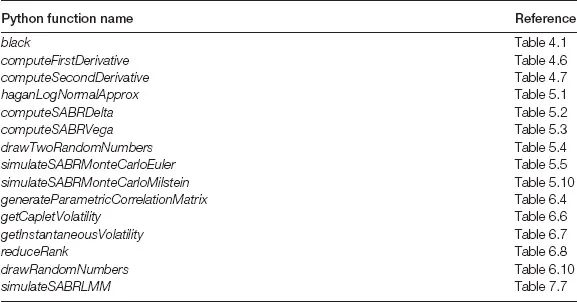

Table 1.1 Python functions list

We will present a series of Python functions (Table 1.1) throughout the book, many of which will be used and referenced within more complex code examples in later chapters. The code presented should not be considered the unique, most efficient or fastest implementation available to solve the problem at hand. We rather focus on trying to convey an easy to grasp and propaedeutic solution.

![]()

2 | | Interest Rate Derivatives Markets |

2.1 Interest rates

There are today, many different interest rates, and since this can be confusing for newcomers to the area, we will spend some time discussing the various types; we will concentrate only on a small number of them, which will form the building blocks for the derivatives markets. The money market has become the predominant source for providing liquidity funding for financial institutions, and allows them to manage their operational cash requirements up to a time horizon of one year. Various instruments exist, such as deposits, certificates of deposits, commercial papers, bills and repurchase agreements. To learn more about all these short-term instruments, the reader is referred to Choudhry (2010).

A major component of the money market is called the overnight market, which involves the shortest possible term loan. The money is lent overnight, so that they have to be repaid at the start of the next business day. The amount to be repaid is equal to the amount borrowed plus a small interest on top. The money is literally attributed to the other party the same day and withdrawn, including the payable interest, the next day. Given the short period of the loan, the interest rate charged in the overnight market, known as the overnight rate, is, generally speaking, the lowest rate at which banks lend money.

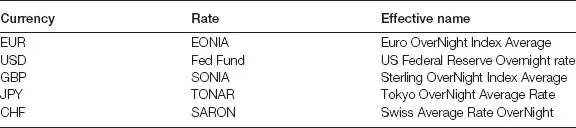

We will discuss shortly why this type of interest rate has been brought to direct relevance for the pricing of a wide range of products, and how it plays an important role in the multiple curve (also known as the dual curve) framework. In this book we will refer to the overnight rate as the uncollateralized rate for overnight borrowing. As a concrete example, the EONIA, that is the European Overnight Index Average, is the average of all unsecured lending transactions between contributing panel banks in the Euro countries from the target day to the next banking day. The average is calculated by the European Central Bank and is quoted using the day count convention ACT/360 up to three decimal places. In the United States, the Fed Fund rate, or better the daily effective federal funds rate, is a volume-weighted average of rates on trades between the major market participants. The rate is calculated by the Federal Reserve Bank of New York using data provided by the brokers. The day count convention is ACT/365. Some examples of currencies with an established overnight market are shown in Table 2.1

Table 2.1 Overnight rates in major currencies

Another possibility for short-term cash-flow exchange is by going one day further; this is called the tomorrow-against-next-day, or tom-next, business, abbreviated T/N. In this case, money is exchanged the following day and returned the day after with the additional agreed upon interest. Extending this by another day brings us to the spot-against-next-day, or spot-next, business, abbreviated as S/N. Here money is exchanged at the spot date (often just called “spot”), which is delayed by zero to two days, depending on the market; for CHF and EUR, it is two days and the money is returned the day after with the agreed upon interest rate. The next iteration up brings us to another class of short dated contracts, referred to as call money. This is usually a bank deposit that can be called every two days. The duration of the call money can therefore be as short as two days, but is typically longer (with durations up to two months or more with an initial non-call period).

The most prominent of all rates however is probably the spot LIBOR (London Interbank Offered Rate) rate L. LIBOR denotes the short-term rate at which the major investment banks can borrow money unsecured from each other for a short period of time. Therefore, the important time points defining the LIBOR rate (which is settled at spot) are the actual date t and the time to maturity T, which can vary from overnight to one year. To illustrate the contract, we pay the notional at spot and receive the notional plus the LIBOR rate earned in return. The rate is annualized through the year fraction specified according to the day count convention (for most LIBOR rates this is ACT/360).

2.2 What you need for trading: ISDAs, netting agreements and CSAs

In order to trade over-the-counter derivatives, a contract needs to be drawn up between the two parties. These contracts have been standardized under the name of a service agreement called an ISDA master agreement.1 We will not go into details here on the ISDA master agreements but feel we should highlight the necessity and the benefits of using them.

One of the successes of the ISDA master agreement has been the ability to net exposures of different trades. Netting allows parties to calculate their financial exposure under over-the-counter (OTC) transactions on a netted basis (i.e., a party calculates the difference it owes to the counterparty minus what the counterparty owes to it), so that, under the ISDA master agreement, only the net cash is exchanged. Depending on the usage, there are three different types of netting: “close-out netting”, “netting for novation” and “payment netting”. The close-out netting is probably the most common and covers the case of a bankruptcy where all trades are netted and a net balance is calculated. These calculations are made on a mark-to-market basis, meaning they r...