![]()

1 | | Synopsis of Selected Energy Markets and Structures |

1.1 Challenges of modeling in energy markets

Although it is more than ten years old at the time of this writing, Eydeland and Wolyniec (2003, hereafter denoted by EW) remains unparalleled in its presentation of both practical and theoretical techniques for commodity modeling, as well as its coverage of the core structured products in energy markets.1 We will defer much discussion of the specifics of these markets to EW, as our focus here is on modeling techniques. However, it will still be useful to highlight some central features of energy markets, to provide the proper context for the subsequent analysis.2

1.1.1 High volatilities/jumps

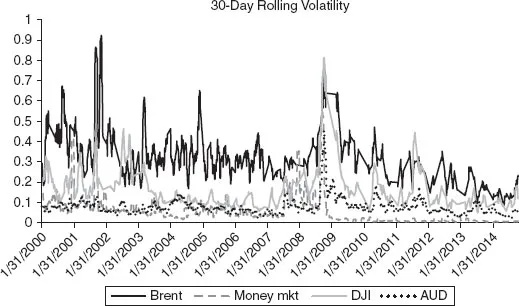

Energy markets are characterized by much higher volatilities than those seen in financial or equity markets. Figure 1.1 provides an illustration.

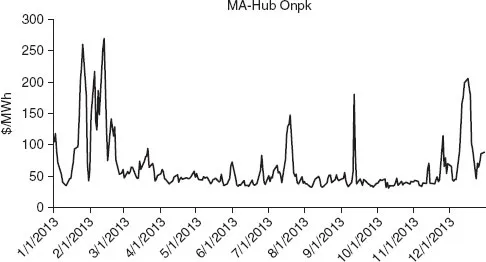

It is worth noting that the general pattern (of higher commodity volatility) has persisted even in the post-crisis era of collapsing volatilities across markets. In large part, this situation reflects the time scales associated with the (physical) supply and demand factors that drive the dynamics of price formation in energy markets. These factors require that certain operational balances be maintained over relatively small time horizons, and that the arrival of new information propagates relatively quickly. Demand is a reflection of overall economic growth as well as stable (so to speak3) drivers such as weather. Supply is impacted by the marginal cost of those factors used in the production of the commodity in question. A familiar example is the generation stack in power markets, where very hot or very cold weather can increase demand to sufficiently high levels that very inefficient (expensive) units must be brought online.4 See Figure 1.2. for a typical example.

The presence of high volatilities makes the problem of extracting useful information from available data much more challenging, as it becomes harder to distinguish signal from noise (in a sample of a given size). This situation is further exacerbated by the fact that, in comparison to other markets, we often do not have much data to analyze in the first place.

Figure 1.1 Comparison of volatilities across asset classes. Resp. Brent crude oil (spot), Federal funds rate, Dow Jones industrial average, and Australian dollar/US dollar exchange rate.

Source: quandl.com.

Figure 1.2 Spot electricity prices.

Source: New England ISO (www.iso-ne.com).

1.1.2 Small samples

The amount of data, both in terms of size and relevance, available for statistical and econometric analysis in energy markets is much smaller than that which exists in other markets. For example, some stock market and interest rate data go back to the early part of the 20th century. Useful energy data may only go back to the 1980s at best.5 This situation is due to a number of factors.

Commodity markets in general (and especially energy markets) have traditionally been heavily regulated (if not outright monopolized) entities (e.g., utilities) and have only relatively recently become sufficiently open where useful price histories and time series can be collected.6 In addition (and related to prevailing and historical regulatory structures), energy markets are characterized by geographical particularities that are generally absent from financial or equity markets. A typical energy deal does not entail exposure to natural gas (say) as such, but rather exposure to natural gas in a specific physical location, e.g. the Rockies or the U.S. Northeast.7 Certain locations possess longer price series than others.

Finally, and perhaps most importantly, we must make a distinction between spot and futures/forward8 prices. Since spot commodities are not traded as such (physical possession must be taken), trading strategies (which, as we will see, form the backbone of valuation) must be done in terms of futures. The typical situation we face in energy markets is that for most locations of interest, there is either much less futures data than spot, or there is no futures data at all. The latter case is invariably associated with illiquid physical locations that do not trade on a forward basis. These include many natural gas basis locations or nodes in the electricity generation system. However, even for the liquidly traded locations (such as Henry Hub natural gas or PJM-W power), there is usually a good deal more spot data than futures data, especially for longer times-to-maturity.

1.1.3 Structural change

Along with the relatively recent opening up of energy markets (in comparison to say, equity markets), has come comparatively faster structural change in these markets. It is well beyond the scope of this book to cover these developments in any kind of detail. We will simply note some of the more prominent ones to illustrate the point:

• the construction of the Rockies Express (REX) natural gas pipeline, bringing Rockies gas into the Midwest and Eastern United States (2007–09)

• the so-called shale revolution in extracting both crude oil and natural gas (associated with North Dakota [Bakken] and Marcellus, respectively; 2010–present)

• the transition of western (CAISO) and Texas (ERCOT) power markets from bilateral/zonal markets to LMP/nodal markets (as prevail in the East; 2009–2010).

These developments have all had major impacts on price formation and dynamics and, as a result, on volatility. In addition, although not falling under the category of structural change as such, macro events such as the financial crisis of 2008 (leading to a collapse in commodity volatility and demand destruction) and regulatory/political factors such as Dodd-Frank (implemented after the Enron scandal in the early 2000s and affecting various kinds of market participants) have amounted to kinds of regime shifts (so to speak) in their own right. The overall situation has had the effect of exacerbating the aforementioned data sparseness issues. The (relatively) small data that we have is often effectively truncated even more (if not rendered somewhat useless) by structural changes that preclude the past from providing any kind of guidance to the future.

1.1.4 Physical/operational constraints

Finally, we note that many (if not most) of the structures of interest in energy markets are heavily impacted by certain physical and operational constraints. Some of these are fairly simple, such as fuel losses associated with flowing natural gas from a production region to a consumer region, or into and out of storage. Others are far more complex, such as the operation of a power plant, with dispatch schedules that depend on fuel costs from (potentially) multiple fuel sources, response curves (heat rates) that are in general a function of the level of generation, and fixed (start-up) costs whose avoidance may require running the plant during unprofitable periods.9,10 Some involve the importance of time scales (a central theme of our subsequent discussion), which impact how we project risk factors of interest (such as how far industrial load can move against us over the time horizon in question).11

In general, these constraints require optimization over a very complex set of operational states, while taking into account the equally complex (to say nothing of unknown!) stochastic dynamics of multiple drivers. A large part of the challenge of valuing such structures is determining how much operational flexibility must be accounted for. Put differently, which details can be ignored for purposes of valuation? This amounts to understanding the incremental contribution to value made by a particular operational facet. In other words, there is a balance to be struck between how much detail is captured, and how much value can be reasonably expected to be gained. It is better to have approximations that are robust given the data available, than to have precise models which depend on information we cannot realistically expect to extract.

1.2 Characteristic structured products

Here we will provide brief (but adequately detailed) descriptions of some of the more popular structured products encountered in energy markets. Again, EW should be consulted for greater details.

1.2.1 Tolling arrangements

Tolling deals are, in essence, associated with the spread between power prices and fuel prices. The embedded optionality in such deals is the ability to run the plant (say, either starting up or shutting down) only when profitable. The very simplest form a tolling agreement takes is a so-called spark spread option, with payoff given by

with the obvious interpretation of P as a power price and G as a gas price (and of course x+ ≡ max(x,0). The parameters H and K can be thought of as corresponding to certain operational costs, specifically a heat rate and variable operation and maintenance (VOM), respectively12 The parameter T represents an expiration or exercise time. (All of the deals we will consider have a critical time horizon component.)

Of course, tolling agreements usually possess far greater operational detail than reflected in (1.1). A power plant typically entails a volume-independent cost for starting up (that is, the cost is denominated in dollars, and not dollars per unit of generation),13 and possibly such a cost for shutting down. Such (fixed) costs have an important impact on operational decis...