eBook - ePub

Advances in Mergers and Acquisitions

Sydney Finkelstein, Cary L. Cooper, Sydney Finkelstein, Cary L. Cooper

This is a test

- 300 pages

- English

- ePUB (adapté aux mobiles)

- Disponible sur iOS et Android

eBook - ePub

Advances in Mergers and Acquisitions

Sydney Finkelstein, Cary L. Cooper, Sydney Finkelstein, Cary L. Cooper

Détails du livre

Aperçu du livre

Table des matières

Citations

À propos de ce livre

Advances in Mergers and Acquisitions stands out from the competition due to its focus on three key characteristics: studies from scholars in different countries, with different research questions, relying on different theoretical perspectives. Such a broad and inclusive approach to mergers and acquisitions is not easily replicated in academic journals, with much narrower mandates and metrics. The chapters published in this volume provide cutting edge ideas by leading scholars, and help to inform mergers and acquisitions research around the world.

Foire aux questions

Comment puis-je résilier mon abonnement ?

Il vous suffit de vous rendre dans la section compte dans paramètres et de cliquer sur « Résilier l’abonnement ». C’est aussi simple que cela ! Une fois que vous aurez résilié votre abonnement, il restera actif pour le reste de la période pour laquelle vous avez payé. Découvrez-en plus ici.

Puis-je / comment puis-je télécharger des livres ?

Pour le moment, tous nos livres en format ePub adaptés aux mobiles peuvent être téléchargés via l’application. La plupart de nos PDF sont également disponibles en téléchargement et les autres seront téléchargeables très prochainement. Découvrez-en plus ici.

Quelle est la différence entre les formules tarifaires ?

Les deux abonnements vous donnent un accès complet à la bibliothèque et à toutes les fonctionnalités de Perlego. Les seules différences sont les tarifs ainsi que la période d’abonnement : avec l’abonnement annuel, vous économiserez environ 30 % par rapport à 12 mois d’abonnement mensuel.

Qu’est-ce que Perlego ?

Nous sommes un service d’abonnement à des ouvrages universitaires en ligne, où vous pouvez accéder à toute une bibliothèque pour un prix inférieur à celui d’un seul livre par mois. Avec plus d’un million de livres sur plus de 1 000 sujets, nous avons ce qu’il vous faut ! Découvrez-en plus ici.

Prenez-vous en charge la synthèse vocale ?

Recherchez le symbole Écouter sur votre prochain livre pour voir si vous pouvez l’écouter. L’outil Écouter lit le texte à haute voix pour vous, en surlignant le passage qui est en cours de lecture. Vous pouvez le mettre sur pause, l’accélérer ou le ralentir. Découvrez-en plus ici.

Est-ce que Advances in Mergers and Acquisitions est un PDF/ePUB en ligne ?

Oui, vous pouvez accéder à Advances in Mergers and Acquisitions par Sydney Finkelstein, Cary L. Cooper, Sydney Finkelstein, Cary L. Cooper en format PDF et/ou ePUB ainsi qu’à d’autres livres populaires dans Negocios y empresa et Fusiones y adquisiciones. Nous disposons de plus d’un million d’ouvrages à découvrir dans notre catalogue.

Informations

Sujet

Negocios y empresaSous-sujet

Fusiones y adquisicionesDISSECTING POST-MERGER INTEGRATION RISK: THE PMI RISK FRAMEWORK

ABSTRACT

The PMI Risk Framework (PRF) is introduced as a guide to classifying and identifying risks which can be the source of post-merger integration (PMI) failure — commonly referred to as “culture clash.” To provide managers with actionably insight, PRF dissects PMI risk into specific relationship-oriented phenomena, critical to outcomes and which should be addressed during PMI. This framework is a conceptual and theory-grounded integration of numerous perspectives, such as organizational psychology, group dynamics, social networks, transformational change, and nonlinear dynamics. These concepts are unified and can be acted upon by integration managers. Literary resources for further exploration into the underlying aspects of the framework are provided. The PRF places emphasis on critical facets of PMI, particularly those which are relational in nature, pose an exceptionally high degree of risk, and are recurrent sources of PMI failure. The chapter delves into relationship-oriented points of failure that managers face when overseeing PMI by introducing a relationship-based, PMI risk framework. Managers are often not fully cognizant of these risks, thus fail to manage them judiciously. These risks do not naturally abide by common scholarly classifications and cross disciplinary boundaries; they do not go unrecognized by scholars, but until the introduction of PRF the risks have not been assimilated into a unifying framework. This chapter presents a model of PMI risk by differentiating and specifying numerous types of underlying human-relationship-oriented risks, rather than considering PMI cultural conflict as a monolithic construct.

Keywords: Merger and acquisition; post-merger integration (PMI); integration risk; relational risk; employee perceptions; organizational conditions

MANAGING POST-MERGER INTEGRATION

Immediately following the consummation of a merger, the combined organization is exposed to an amplified level of business risk. Research has established that the merger-and-acquisition (M&A) strategy is accompanied by a high likelihood of failure (Haspeslagh & Jemison, 1991a, 1991b), thus it frequently results in lower organization performance (Schweiger & Walsh, 1990). Astoundingly, managers continue to rely on M&A as a strategy for increased performance, despite past outcomes (Lubatkin & Lane, 1996). Evidently, harsh lessons from others’ experience are not espoused; there is discord between the reality of others’ past and the outlook for one’s own future. Certainly there are a multitude of factors and pressures that organizations face perhaps forcing management to take such a high-risk path – one with odds for success well below a coin-flip – but perhaps the clichéd “failed due to culture clash” is not meaningful enough to activate a manager’s flight response. It seems the notices dispatched by scholars and the business news media are not resonating. Therefore, the motivation for presenting this chapter is the author’s conviction that the phrase culture clash (Siehl, Ledford, Silverman, & Fay, 1988; Wilson, 2013) is too vague; the phrase is too ambiguous and does not have sufficient actionable meaning embedded within. Particularly at the post-merger integration (PMI) stage, managers may be under informed about the risks being presented to them. This chapter presents the PMI Risk Framework (PRF) which highlights integration phenomena that are sources of high-risk leading to what is often labeled as culture clash.

A plausible scientific explanation for taking a course of action that likely will fail is that organizational leaders are overestimating their own competence or that of the organization (DeAngelis, 2003; Zollo, 2004). As it pertains to PMI, heightened management skills and attention are called for. Regrettably, responsibility for integration classically falls into the realm of supervisory managers, whom likely have little training on the particulars and risks of PMI, or have previously given little thought about how to manage organizational transformations that stretch their day-to-day responsibilities, processes, and workload. Indeed, managers may be inadequately skilled at overseeing the unique aspects of PMI and because of this inexperience may overestimate their ability to execute successfully (Burson, Larrick, & Klayman, 2006; Kruger & Dunning, 1999). In short, integration managers may be underskilled or unaware of the unique challenges brought about by PMI and may not fully recognize the subtle and downside risks posed by the task of combing two workgroups into one.

For example, overseeing PMI necessitates cultural leadership (Trice & Beyer, 1991) and complex systems thinking (Allen, Ramlogan, & Randles, 2002), which are not part of traditional management education but are necessary skills to the task (Appelbaum, Gandell, Shapiro, Belisle, & Hoeven, 2000). Managers may be unaware of the dynamics entrenched in the integration process (Allen et al., 2002). In an age of unbounded complexity (Frantz & Carley, 2009; Lauser, 2010), integration managers remain generally unprepared for unexpected that extended beyond day-to-day management problems (Sutcliffe, 2006; Weick & Sutcliffe, 2006). For decades, scholars and practitioners have prescribed guidelines and imperatives for PMI success (Appelbaum, Gandell, Shapiro, et al., 2000; Bert, MacDonald, & Herd, 2003; Epstein, 2004; Trautwein, 1990) without improvement in the success rate. However, even with such guidance, an integration manager requires situation-specific advise from an interdisciplinary perspective (Schweiger & Walsh, 1990). Integration managers need to be advised of specific risks that need to be focused upon in order to succeed. The framework presented in this chapter directs attention to areas of high risk that integration managers must monitor.

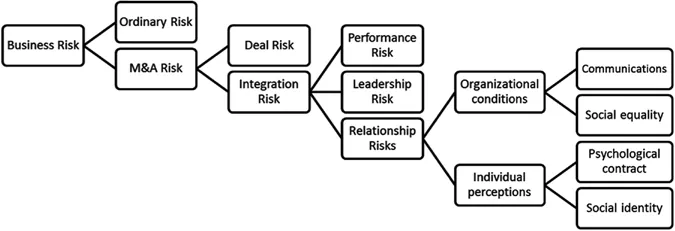

Fig. 1 illustrates the hierarchy of risk classifications that are accentuated by the PRF. The model directs attention toward the human-centric aspects of PMI. This hierarchy also serves the reader as a guidepost for the sections following in this chapter.

Fig. 1. The PMI Risk Framework (PRF).

Attention-Based View of PMI Risk

An inspiration behind developing the PRF is an eight-year ethnographic study of the PMI process of a health care system that indicated a pattern of management attention being directed toward recurring points of conflict rather than attending to superseding organizational goals attached to the merger or to integration-specific tasks (Yu, Engleman, & van de Ven, 2005). In practice, managers often do not adequately attend to PMI-related issues; instead, attention is directed elsewhere, except when manager’s personal circumstance is threatened (Walsh, 1989). In present-day business, managers are challenged with being presented with more information than they can comprehend (Cyert & March, 1992) and their attention can effortlessly be diverted away from important strategic tasks (Ocasio, 1997, 2011), including PMI (Cho & Hambrick, 2006; Nguyen & Kleiner, 2003).

An aim of PMI is to realize the outcomes that are stated – ideally explicitly – during the M&A deal-making process. M&A objectives can generally be reduced to two items: improve performance and unify the organization (people and systems). PMI involves the extraordinary management task of combining two previously independent groups into a cohesive singular unit; it is vital to recognize that PMI is a social process as much as an economic (Risberg, 2003) and it should be managed accordingly. One embedded assumption is that the organization integration will support the performance goal(s), which are the reason to be for an organization and thus are paramount by default. Often managers will manage toward regular business objectives and fail to be explicit about softer issues that can derail best designed M&A deal (Walter & Barney, 1990). Often integration issues are lost in the daily and reactive decision-making process (Vaara, 2003). In the particular case of the health care system noted in the paragraph above integration-related decisions can be avoided for many years.

Overall PMI involves integration of technology (Bannert & Tschirky, 2004; Tanriverdi & Uysal, 2011; Wijnhoven, Spil, Stegwee, & Fa, 2006), suppliers (Fee & Thomas, 2004; Kato & Schoenberg, 2012, 2014), customers (Fee & Thomas, 2004; Homburg & Bucerius, 2005; Kato & Schoenberg, 2012, 2014; Lowe, 1998), and, of course, employees (Ellis & Lamont, 2004), among numerous other facets of organizations and business activity. For the purposes herein, the success of a merger or acquisition during the PMI period relies on the cooperation between the various employees of the two original organizations, management not excepted. Moreover, the environment remains a factor in the success just as it does during normal operations. For this reason, PMI should not be ignored. To focus attention on PMI, ordinary risks are excluded from this discussion. Following Das and Teng (1996), attention is limited to two categories: performance risk and relational risk.

Empirical studies have revealed that PMI demands significant amounts of managerial attention, thus diverting attention from regular managerial functions and core activities (Yu et al., 2005), such as R&D (Hitt, Hoskisson, & Ireland, 1990; Hitt, Hoskisson, Ireland, & Harrison, 1991). For M&A to be successful, managers must not allow their attention to PMI wane (Nguyen & Kleiner, 2003). This may be an explanation for the routineness of merger failure. Managers simply are not paying attention to the high level of risks, perhaps through hubris, inherent in M&A (Hayward & Hambrick, 1997) and specifically PMI (Foote & Suttie, 1991), or simply overcommitting (Hayward & Shimizu, 2006), for example. Risk is present when an asset is exposed to an uncertain future amounting in loss; it is a highly contextual construct with numerous in-practice meanings. A situation becomes at risk when it is exposed to an uncertain loss-possible event, which can rise from a limitless number and variety of sources. To complete an understanding of the term: consider that ...

Table des matières

- Cover

- Title Page

- Alliances to Acquisitions: A Road Map to Advance the Field of Strategic Management

- Pre-M&A “Leadership”?: Might Behavioral Due Diligence Assessment Be the Answer?

- The Decision to Retain and Reduce Human Resources in Mergers and Acquisitions

- Strategic Investment Appraisal: Multidisciplinary Perspectives

- Can SPACs Ensure M&A Success?

- Mergers and Acquisitions Revisited: The Role of Business Model Relatedness

- Training During Transitions: The Context of a Developing Economy

- Dissecting Post-Merger Integration Risk: The PMI Risk Framework

- Getting Beyond Culture Clashes: A Process Model of Post-Merger Order Negotiation

- A Stakeholder Framework for Evaluating the Impact of Mergers and Acquisitions

- Index

Normes de citation pour Advances in Mergers and Acquisitions

APA 6 Citation

Finkelstein, S., & Cooper, C. (2017). Advances in Mergers and Acquisitions ([edition unavailable]). Emerald Publishing Limited. Retrieved from https://www.perlego.com/book/519699/advances-in-mergers-and-acquisitions-pdf (Original work published 2017)

Chicago Citation

Finkelstein, Sydney, and Cary Cooper. (2017) 2017. Advances in Mergers and Acquisitions. [Edition unavailable]. Emerald Publishing Limited. https://www.perlego.com/book/519699/advances-in-mergers-and-acquisitions-pdf.

Harvard Citation

Finkelstein, S. and Cooper, C. (2017) Advances in Mergers and Acquisitions. [edition unavailable]. Emerald Publishing Limited. Available at: https://www.perlego.com/book/519699/advances-in-mergers-and-acquisitions-pdf (Accessed: 14 October 2022).

MLA 7 Citation

Finkelstein, Sydney, and Cary Cooper. Advances in Mergers and Acquisitions. [edition unavailable]. Emerald Publishing Limited, 2017. Web. 14 Oct. 2022.