![]()

Section I

THE PEOPLE’S REPUBLIC OF CHINA

![]()

FamilyMart’s China Expansion

TsingHsuan Kuo

“ We are transforming FamilyMart from a Japanese into a global brand—

for faster growth, on a bigger stage.”

Shiro Inoue, Managing Director (2010)

The first convenience store (CVS) that opened in Japan was Seven-Eleven in 1974. The convenience store concept innovated grocery shopping in Japan. The self-service sales system of the supermarket that offers a wide variety of food and household merchandise with a low price had been broadly received by the consumers.

Despite being an American retail concept, Japanese consumers embraced the idea of shopping for groceries 24/7 and CVS became a common site in Japanese cities. The CVS concept had been dramatically refined by Japanese’s know-how on CVS chain operations allowing customers not only to buy products, but also to pay bills, buy baseball tickets, fax, print, copy and send parcels. Even during the depression and low consumption rates after the bursting of the bubble, the convenience store industry had grown rapidly and developed tremendously, becoming “the life infrastructure” in Japan. A new retail shop type, the Japanese convenience story conquered Japan.1 The new shopping concept became very popular and the traditional retail stores were left behind.

During the depression and low consumption rates after the bursting of the bubble, the CVS had grown rapidly and developed tremendously, becoming “the life infrastructure” in Japan. The CVS industry was dramatically refined by the Japanese and their know-how on CVS chain operations. According to the Japan Franchise Association, the number of the convenience stores in Japan had reached 43,291 by the end of 2010.2 Among them, the three largest chains are Seven-Eleven, Lawson and FamilyMart.

The CVS industry relies heavily on the point of sales in which food is the main product. Since the unit price of its products is low, the CVS chain makes low margins. As their stores sizes are limited, there is not much room for stock, and thus products have to be delivered multiple times per day. As a result, a well-constructed distribution system is important for running a convenience store chain. In many cases, several stores from the same chain operate in neighboring areas in order to make distribution to each store cheaper. It also makes multiple distributions per day possible.

Recently, the CVS industry in Japan has been approaching saturation and the Japanese CVS chains have found themselves under increasing pressure to grow their business in the domestic market. To strengthen its competence, the Japanese CVS chains expanded their businesses overseas in other Asian nations since the 1980s. With their know-hows, the Japanese CVS chains succeeded in growing their businesses and became the main market players in these regions. For example in Taiwan, Seven-Eleven and FamilyMart are the two largest CVS chains, while in Korea, FamilyMart and Lawson are the main players.3

Since the year 2000, however Japanese CVS chains have found themselves under increasing pressure over the past few years due to the market saturation and aging problems. Overseas expansion seemed a good solution for FamilyMart, one of the main players in the Japanese CVS market. In order to help increase its competitive competence in the challenging domestic market, FamilyMart has been expanding to other Asian nations since 1980. Twenty years after the overseas expansion began with the entry into the Taiwanese market in 1988, the number of the oversea stores (8,948 stores as the end of 2010) had exceeded the domestic ones. FamilyMart has the largest number of stores overseas in comparison to its Japenese competitors.4

While the businesses in Taiwan and Korea have grown successfully, the Chinese market, which is regarded as the main driver of the future growth, proved to be more difficult. The company not only has expansion hurdles brought on by local infrastructure and Chinese business practices, it also faces competition from other local and foreign chains. The goal under the Pan-Pacific plan that ‘aimed to build a global network of 20,000 stores by fiscal Year 20085’ had failed with only a store number of 14,651 as of February 2009.6 FamilyMart had to modify its plan and aim to reach a total of 25,000 stores worldwide by fiscal year 2015.7

FAMILYMART PROFILE

The first FamilyMart store opened in Saitama, Japan. It was a test store under the Seiyu Group’s plan to operate a mini-store chain. The name “FamilyMart” represents the company’s philosophy of hospitality. In addition, it also means that “the entire chain is a strong bond akin to family ties, in which both the head office and the partners strive together to achieve mutual prosperity and growth”. Under the slogan “FamilyMart, Where You Are One of the Family”, FamilyMart wants to ensure that the customers enjoy every moment they spend in a FamilyMart store through developing the “FamilyMart Feel”.8

With the establishment of Family Co., Ltd. in 1981, FamilyMart became independent form the Seiyu Group. Being able to stand on its own feet, FamilyMart started to expand the network in Japan. Attitudes towards spending shifted during the economic fluctuations of Japan’s bubble economy, FamilyMart increased its number of outlets and took an innovative approach toward its products and service offerings.

FamilyMart had been grown rapidly during the 1980s. Beginning with a store number of less than 100, FamilyMart became a CVS chain with more than 1,000 stores in 1987. The customer base was growing as well. In the same year, FamilyMart became a listed company and introduced the FamilyMart brand with a standardized FamilyMart design. Product development was included into FamilyMart’s business, and various in-store services such as delivery, copying and photo printing was provided.

During the 1990s, FamilyMart further improved the store functions, and aimed to construct itself as a “life infrastructure”. Through developing a new concept for CVS operations, FamilyMart wanted to provide its customers a feeling that “conbini nanoni kokomadeyaruno” (tr. Although it’s (only) a CVS, you can do it all here).

In the 21st century, FamilyMart has grown into the third largest CVS chain in Japan behind Seven-Eleven and Lawson. To accelerate the growth pace, the company has been aggressively exploring the overseas market and aims to develop “FamilyMart” into a global brand.

One of FamilyMart’s store functions in Japan is providing the “Osaifu Service”. As the pioneer of e-money service in Japan’s retail industry, FamilyMart further innovated the payment process by cooperating with NTT DoCoMo, Japan’s leading telecommunications company. Thus, in 2007 FamilyMart formed a strategic alliance with NTT DoCoMo and began accepting mobile credit via DoCoMo’s iD platforms enabling customers to complete the payment process simply by waving their phones over a reader/writer.

To build customer’s loyalty, FamilyMart joined in the T-Point Loyalty Program in 2007, which is one of the largest joint-point programs in Japan, combining the previous Famima Cards with the new point-loyalty T-cards with a 34 million member base nationwide. In that way FamilyMart could not only improve its customer relations, but also increase its customer base.

After the acquisition of the 7th largest CVS am/pm chain in 2010, the market share of FamilyMart in Japan further increased. Despite the success in the domestic market, FamilyMart considers overseas expansions as the chain’s main driver for growth. As the most aggressive chain in exploring the overseas market, FamilyMart expects itself to develop a “global standard” and a broader standpoint to continuously deal with all the challenges in the continually internationalizing global market.

FIRST GLOBAL OPERATIONS

Since the 1980s, FamilyMart began constructing its global network to shift its focus away from the saturated Japanese market. In 1988, in its first wave of overseas expansion, FamilyMart chose Taiwan as the first foreign market, and entered the Korean market in 1990 and Thailand in 1992. The chain overseas had been growing and the store number in these three regions exceeded 2,000 in 2001. With its successful operations in the overseas market, the overall number of FamilyMart stores reached 10,000, with 6,102 in Japan and 3,898 overseas, at the end of 2003.

At this point of time, FamilyMart started to focus on developing overseas markets for further expanding its business. Thus, the next stage of network expansion included setting up stores in regions FamilyMart has not yet entered, while increasing the number of stores where FamilyMart already has a presence.

The first FamilyMart store in China opened in Shanghai with the establishment of Shanghai FamilyMart Co., Ltd. The next year, FamilyMart entered the American market with a “Famima” store in Los Angeles. To accelerate the pace of expansion, Guangzhou FamilyMart and Suzhou FamilyMart were established in China in 2006 and 2007 (See Table 1). As the latest step of its global expansion, FamilyMart set up a business in Vietnam in 2009.

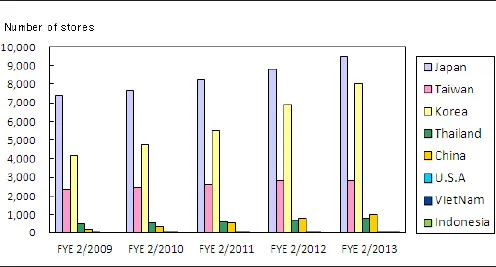

Table 1. The growth of FamilyMart Chains.

Source: FamilyMart Homepage (http://www.family.co.jp/english/investor_relations/stores.html)

With the goal of reaching a total of 25,000 stores worldwide by 2015, FamilyMart expanded its business simultaneously in Japan and overseas.

Taiwan was FamilyMart’s first overseas market. Entering in year 1988, FamilyMart had reached a successful operation ...