Handbook of Market Risk

Christian Szylar

- English

- ePUB (adapté aux mobiles)

- Disponible sur iOS et Android

Handbook of Market Risk

Christian Szylar

À propos de ce livre

A ONE-STOP GUIDE FOR THE THEORIES, APPLICATIONS, AND STATISTICAL METHODOLOGIES OF MARKET RISK

Understanding and investigating the impacts of market risk on the financial landscape is crucial in preventing crises. Written by a hedge fund specialist, the Handbook of Market Risk is the comprehensive guide to the subject of market risk.

Featuring a format that is accessible and convenient, the handbook employs numerous examples to underscore the application of the material in a real-world setting. The book starts by introducing the various methods to measure market risk while continuing to emphasize stress testing, liquidity, and interest rate implications. Covering topics intrinsic to understanding and applying market risk, the handbook features:

- An introduction to financial markets

- The historical perspective from market

- events and diverse mathematics to the

- value-at-risk

- Return and volatility estimates

- Diversification, portfolio risk, and

- efficient frontier

- The Capital Asset Pricing Model

- and the Arbitrage Pricing Theory

- The use of a fundamental

- multi-factors model

- Financial derivatives instruments

- Fixed income and interest rate risk

- Liquidity risk

- Alternative investments

- Stress testing and back testing

- Banks and Basel II/III

The Handbook of Market Risk is a must-have resource for financial engineers, quantitative analysts, regulators, risk managers in investments banks, and large-scale consultancy groups advising banks on internal systems. The handbook is also an excellent text for academics teaching postgraduate courses on financial methodology.

Foire aux questions

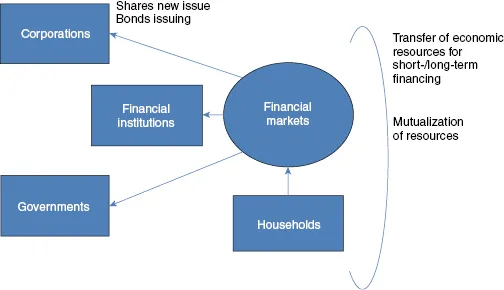

- Borrowing and Lending. Financial markets permit the transfer of funds (purchasing power) from one agent to another for either investment or consumption purposes. Borrowers can be either government or companies. Borrowers are driven by costs when accessing financial markets where Investors (institutional or non-institutional investors) are looking for return and profit. Financial markets bring them together.

- Price Determination. Financial markets provide vehicles by which prices are set both for newly issued financial assets and for the existing stock of financial assets. An asset is any item of value that can be owned. A financial instrument is an asset that represents a legal agreement. There are numerous financial instruments—for example, stocks, bonds, T-bills, personal loans, futures, forwards, options, swaps, and so on. An asset class is a group/classification of financial instruments that share similar characteristics—for example, equity-based assets, debt-based assets, and cash-based assets (money market, etc.).

- Information Aggregation and Coordination. Financial markets act as collectors and aggregators of information about financial asset values and the flow of funds from lenders to borrowers.

- Risk Sharing. Financial markets allow a transfer of risk from those who undertake investments to those who provide funds for those investments.

- Liquidity. Financial markets provide the holders of financial assets with a chance to resell or liquidate these assets.

- Efficiency. Financial markets reduce transaction costs and information costs.

- The stock (equities) market

- The bond (fixed-interest) market

- The derivatives market (futures, options, etc.)

- The foreign exchange market

- Securities Act of 1933

- Securities Exchange Act of 1934

- Trust Indenture Act of 1939

- Investment Company Act of 1940

- Investment Advisers Act of 1940

- Sarbanes–Oxley Act of 2002

- Credit Rating Agency Reform Act of 2006

- Dodd–Frank Wall Street Reform and Consumer Protection Act of 2010 as a result of the credit and financial crisis2

1.1 The Money Market

Deposits and Loans.

Commercial Paper.

Bankers' Acceptances.

Treasury Bills (T-Bills).

Certificate of Deposit (CD).

Repurchase Agreements (Repos).

1.2 The Capital Market

1.2.1 The Bond Market

Table des matières

- Cover

- Title page

- Copyright page

- Dedication

- Foreword

- Acknowledgments

- About the Author

- Introduction

- Chapter One: Introduction to Financial Markets

- Chapter Two: The Efficient Markets Theory

- Chapter Three: Return and Volatility Estimates

- Chapter Four: Diversification, Portfolios of Risky Assets, and the Efficient Frontier

- Chapter Five: The Capital Asset Pricing Model and the Arbitrage Pricing Theory

- Chapter Six: Market Risk and Fundamental Multifactors Model

- Chapter Seven: Market Risk: A Historical Perspective from Market Events and Diverse Mathematics to the Value-at-Risk

- Chapter Eight: Financial Derivative Instruments

- Chapter Nine: Fixed Income and Interest Rate Risk

- Chapter Ten: Liquidity Risk

- Chapter Eleven: Alternatives Investment: Targeting Alpha, Idiosyncratic Risk

- Chapter Twelve: Stress Testing and Back Testing

- Chapter Thirteen: Banks and Basel II/III

- Chapter Fourteen: Conclusion

- Index

- Wiley Handbooks in Financial Engineering and Econometrics