Funds

Private Equity, Hedge and All Core Structures

Matthew Hudson

- English

- ePUB (adapté aux mobiles)

- Disponible sur iOS et Android

Funds

Private Equity, Hedge and All Core Structures

Matthew Hudson

À propos de ce livre

Investment funds are the driving force behind much global private economic development, and yet the world of investment funds can be complex and confusing.

Funds: Private Equity, Hedge and All Core Structures is a practical introductory guide to the legal and commercial context in which funds are raised and invest their money, with examinations of the tax and regulatory background, and an analysis of the key themes and trends that the funds industry face following the financial crisis. The book looks at asset classes, investor return models, the commercial and legal pressures driving different structures and key global jurisdictions for both fund establishment and making investments. It also contains a comprehensive analysis of fund managers, from remuneration, best practice through to regulation.

The book is written for readers from all backgrounds, from students or newcomers to the industry to experienced investors looking to branch out into alternative asset classes, or existing asset managers and their advisers wanting to know more about the structures elsewhere within the industry.

Foire aux questions

Informations

Chapter 1

Introduction to Funds

1.1 WHY THIS BOOK?

1.2 ALTERNATIVE ASSETS

1.3 WHAT IS A FUND?

- a fund or ‘stable’ of pop artists, managed by an expert pop promoter, manager or agent. The more stars under management, the greater the diversification

- a fund or ‘library’ of knowledge or

- a fund or ‘team’ of football stars (where the assets are footballers) that are bought and sold.

1.4 CATEGORIES OF FUNDS

1.4.1 Ways to categorize

| Drawdown and distribution model Most private equity funds The fund ‘draws down’ money from investors when required for investment. Drawing down funds only when required as opposed to in their entirety in advance should have the effect of enhancing the fund’s internal rate of return (IRR) when measured against the date of exit or realization of a particular investment. On exits, the original cost and the capital gain or profits relating to each asset are then ‘distributed’ to investors and are seldom re-invested. The fund usually has a fixed life, and the intention is to invest and then ‘return’ the entire capital and profits, before winding up the fund. A share of the fund profits (‘carried interest’ or ‘carry’) is distributed to the management team. In a drawdown and distribution model fund, assets remaining after distribution at the end of the life of a fund can be sold on the ‘secondary market’, as can an investor’s position. Income generated from investments is usually distributed as it arises, for example, net yield from real estate, rental receipts or fixed-income gilts. The fund is usually ‘closed’ and not ‘open’ (meaning that the number of investors and amount invested are fixed and have a fixed life). | Tradable model Many retail or tax-driven funds A tradable fund is one where the shares or units in the fund are traded, usually on a public market. The capital is not distributed to investors although regular and larger one-off dividends can be made. The funds may or may not have a fixed life and gains and profits made within the fund should cause the fund’s share price to increase. However, tradable funds are subject to the ups and downs of trading and:

What this often leads to is a tradable fund trading at a premium to embedded value at moments of investor exhilaration, but at a discount the rest of the time. Sentiment or recognition can bear little correlation to actual asset value. | NAV or redemption model Most hedge funds This fund redeems or prepays units held by investors in the fund and on (or within a defined time of) redemption also pays investors any profit ‘attaching’ to those units. A share of the profits is paid as a performance fee to the fund’s management team. Units are often redeemed at, or correlated to, the net asset value (NAV) of that unit. A unit’s NAV is the total of the fund’s gross assets, less leverage and liabilities, divided by the number of units in the fund. It is typically the manager or administrator and also third party valuers that calculate NAV. The fund is usually ‘open’ and not ‘closed’ (meaning the number of investors and amount invested fluctuate as investor commitments are made and redeemed) and can exist for an undetermined period of time, unless the fund is wound up. |

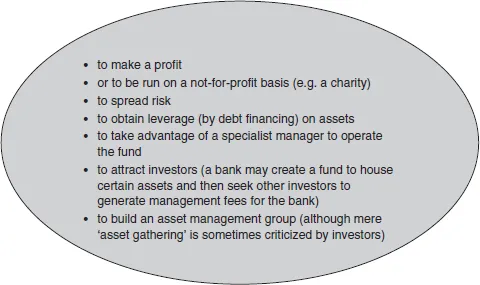

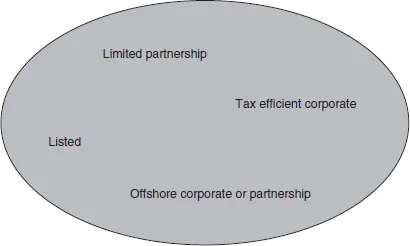

1.5 CHOOSING A VEHICLE

- the vehicle that is most tax efficient for the target investor base and for the fund’s management team (taking into account the fund’s likely asset...

Table des matières

- Cover

- Half Title page

- Title page

- Copyright page

- Chapter 1: Introduction to Funds

- Chapter 2: Limited Partnerships – Use in Alternative Asset Funds

- Chapter 3: Hedge Funds

- Chapter 4: Structural Variants and Alternative Structures to Chapters 2 and 3

- Chapter 5: Investment-specific Strategies

- Chapter 6: Stock Markets and Listed Funds

- Chapter 7: Principal ‘Offshore’ Fund Locations

- Chapter 8: Principal ‘Onshore’ Fund Locations

- Chapter 9: Sovereign Wealth Funds, State-sponsored Funds, Pension and Superannuation Schemes and Charities

- Chapter 10: Investment Manager Structures

- Chapter 11: Taxation Principles in Funds

- Chapter 12: Regulatory Environment

- Chapter 13: Comparisons and Conclusions

- Appendix I: Definitions

- Appendix II: Abbreviations

- Appendix III: Acknowledgements

- Index