eBook - ePub

Essentials of Mineral Exploration and Evaluation

S. M. Gandhi,B. C. Sarkar

This is a test

Condividi libro

- 410 pagine

- English

- ePUB (disponibile sull'app)

- Disponibile su iOS e Android

eBook - ePub

Essentials of Mineral Exploration and Evaluation

S. M. Gandhi,B. C. Sarkar

Dettagli del libro

Anteprima del libro

Indice dei contenuti

Citazioni

Informazioni sul libro

Essentials of Mineral Exploration and Evaluation offers a thorough overview of methods used in mineral exploration campaigns, evaluation, reporting and economic assessment processes. Fully illustrated to cover the state-of-the-art exploration techniques and evaluation of mineral assets being practiced globally, this up-to-date reference offers balanced coverage of the latest knowledge and current global trends in successful mineral exploration and evaluation. From mineral deposits, to remote sensing, to sampling and analysis, Essentials of Mineral Exploration and Evaluation offers an extensive look at this rapidly changing field.

- Covers the complete spectrum of all aspects of ore deposits and mining them, providing a "one-stop shop" for experts and students

- Presents the most up-to-date information on developments and methods in all areas of mineral exploration

- Includes chapters on application of GIS, statistics, and geostatistics in mineral exploration and evaluation

- Includes case studies to enhance practical application of concepts

Domande frequenti

Come faccio ad annullare l'abbonamento?

È semplicissimo: basta accedere alla sezione Account nelle Impostazioni e cliccare su "Annulla abbonamento". Dopo la cancellazione, l'abbonamento rimarrà attivo per il periodo rimanente già pagato. Per maggiori informazioni, clicca qui

È possibile scaricare libri? Se sì, come?

Al momento è possibile scaricare tramite l'app tutti i nostri libri ePub mobile-friendly. Anche la maggior parte dei nostri PDF è scaricabile e stiamo lavorando per rendere disponibile quanto prima il download di tutti gli altri file. Per maggiori informazioni, clicca qui

Che differenza c'è tra i piani?

Entrambi i piani ti danno accesso illimitato alla libreria e a tutte le funzionalità di Perlego. Le uniche differenze sono il prezzo e il periodo di abbonamento: con il piano annuale risparmierai circa il 30% rispetto a 12 rate con quello mensile.

Cos'è Perlego?

Perlego è un servizio di abbonamento a testi accademici, che ti permette di accedere a un'intera libreria online a un prezzo inferiore rispetto a quello che pagheresti per acquistare un singolo libro al mese. Con oltre 1 milione di testi suddivisi in più di 1.000 categorie, troverai sicuramente ciò che fa per te! Per maggiori informazioni, clicca qui.

Perlego supporta la sintesi vocale?

Cerca l'icona Sintesi vocale nel prossimo libro che leggerai per verificare se è possibile riprodurre l'audio. Questo strumento permette di leggere il testo a voce alta, evidenziandolo man mano che la lettura procede. Puoi aumentare o diminuire la velocità della sintesi vocale, oppure sospendere la riproduzione. Per maggiori informazioni, clicca qui.

Essentials of Mineral Exploration and Evaluation è disponibile online in formato PDF/ePub?

Sì, puoi accedere a Essentials of Mineral Exploration and Evaluation di S. M. Gandhi,B. C. Sarkar in formato PDF e/o ePub, così come ad altri libri molto apprezzati nelle sezioni relative a Physical Sciences e Mineralogy. Scopri oltre 1 milione di libri disponibili nel nostro catalogo.

Informazioni

Argomento

Physical SciencesCategoria

MineralogyChapter 1

Metals and Minerals

Global Trends, Outlook, and Mineral Exploration

Abstract

Mineral deposits are not evenly distributed and a few nations in the world are self-sufficient in all commodities. Global distribution trends of some minerals/metals are given along with metals production and consumption patterns. Metals are recycled without losing their properties. Organized recycling can be beneficial and has its own efforts in environmental concern. New solutions for cheaper, lighter, better, noncorrosive, and high-quality substitutes are required to be developed. Global present flow and demand of metals up to 2050 are briefed. China had a robust GDP and growth rate till it busted out in mid-2015 and led to devaluation of its currency and consequent economic meltdown and the global volatility. India is likely to have better growth in the medium to long term as its macroeconomic parameters are very strong. In order to sustain industrial growth, concerted efforts are required to explore known occurrences as well as to locate new resources in the days to come.

Keywords

Distribution of minerals and metals; production and consumption pattern; metals recycling; quality substitution; demand of metals up to 2050; China’s great fall and global volatility; India’s gain; need to explore to locate new resources

1.1 General

From the prehistory to the present, mining has provided materials for fuel, shelter, and the acquisition of food. From the earliest man into the period of the first civilization, the products of the earth won by mining were essential for the requirement of the people for making implements, buildings, trade, jewelry, cosmetics, and treasure. Today, the standard of living of the people of the world is compared on the basis of per capita consumption of various metals. Transportation, communication, and construction have been revolutionized partly because of the materials that have been derived from Earth resources. For the foreseeable future, the metal and mineral products will continue to play their vital role in meeting society’s needs.

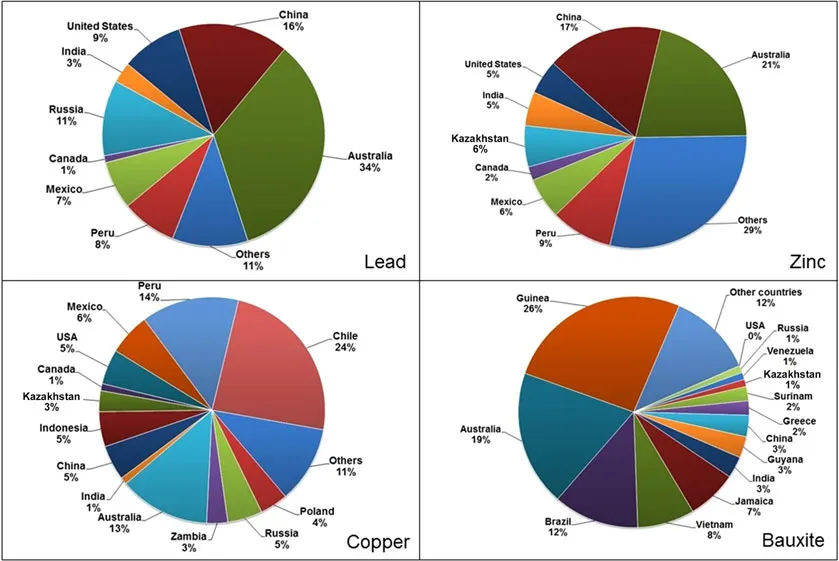

Mineral deposits are not evenly distributed and a few nations in the world are self-sufficient in all commodities. Individual mineral deposits become valuable for several reasons. They may be very rich, they may be more accessible than other deposits, the location may be more favorable, or the commodity is in great demand. Obviously technological advances have made deposits of lesser mineral content into economic deposit. Mineral deposits are a wasting asset. The minerals are irreplaceable, hence, the deposit, as it is mined, decreases in its value. Dependence of man in his mineral heritage long established will continue indefinitely. Global distribution of some metals is given in Fig. 1.1.

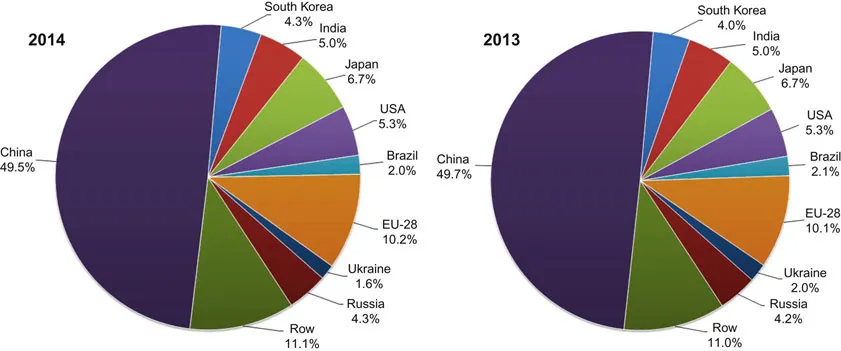

As per Worldsteel, the share of world steel production in 2014 and 2013, by country, is given in Fig. 1.2. China is the top producer both in 2013 and 2014, followed in decreasing order by European Union countries, Japan, the United States, Russia, South Korea, etc. The annual consumption of various metals in 2012 is given in Table 1.1 (Wagner and Wellmer, 2012). Copper tops the list followed by other base metals viz. zinc, lead, and nickel. The metals used for electronic industry are being consumed increasingly owing to vibrant growth in that sector.

Table 1.1

Annual Consumption of Metals, in tonnes, in 2012

| BASE METALS | |

| Copper | 14,427,000 |

| Zinc | 9,104,000 |

| Lead | 3,648,000 |

| Nickel | 1,277,000 |

| PRECIOUS METALS | |

| Silver | 26,000 |

| Gold | 3100 |

| Platinum | 198 |

| ELECTRONIC METALS | |

| Silicon metal | 915,000 |

| Rare earths | 81,400 |

| Selenium | 1400 |

| Indium | 220 |

| Tellurium | 160 |

| Gallium | 110 |

| Germanium | 58 |

Geosciences & Natural Sciences Federal Institute (BGR), Germany, Database.

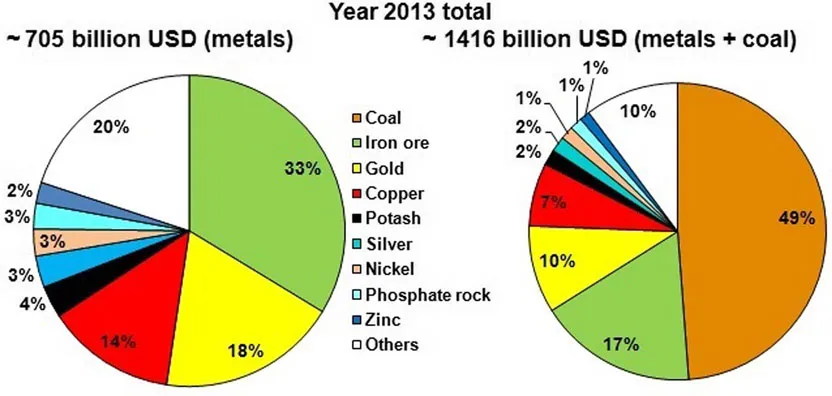

Human beings have been extracting the resources like minerals and metals from nature. The use of minerals and metals increased proportionately with the increase of population and economy. Such a growth in the consumption of minerals and metals has serious implications in both fronts of availability of resources and the degradation of environment, owing to the usage of metals. With the increase in population and industrialization in many nations, the demand of minerals and metals has become insatiable. Urbanization and spread of population areas and the increased pressure for environmental sustainability have compelled the exploration teams to look for economic prospects/deposits in more remote areas. Exploration companies have been forced to maximize the returns on the capital spent on exploration and concentrate on the cost consciousness, owing to the severe competition and investor’s cost consciousness. The procuring and processing of lower grade ores will not only facilitate metal availability over longer periods of time but also pose new challenges in their environmental impacts. The value of global production, by metals, in 2013 is given in Fig. 1.3.

1.2 Emerging Economies of the New World

The goal of industry innovators in the global metals industry is to ride out the economic slump and position themselves for an eventual market turnaround. Emerging economies, led by Asia, have driven demand growth for raw materials in recent years. History shows that economic cycles cause fluctuations in demand for raw materials. Until the turn of this century, the mining industry experienced a prolonged period of declining commodity prices. This was a result of low demand growth and reducing production costs due to increasing scale and efficiency of mines, bulk processing of ore, and significant near surface mineral discoveries in the most accessible parts of the earth’s crust. With high demand growth for products and resources now being depleted at unprecedented rates, every nation and major exploration companies are looking to secure a foundation for future growth. This growth will come from expanding existing operations, new mine developments in emerging regions, through technology, exploration, and mergers and acquisitions.

The big companies focus on large, long-life, low-cost, high-quality assets with wide diversification by commodity, by countries, and by markets which will safeguard them to remain profitable, despite the ups and downs of the economic cycles. North America, South America, Australia, and South Africa are the resource-rich regions in the world hosting many world-class mineral assets. In addition, they have unparallel expertise in exploration, development, and operation of mines in prospective regions elsewhere in the world facilitating to aggrandize the overall resource base of minerals.

The world population will double in about three decades. The industrial revolution will likely have phased into a scientific revolution. Coping with the growing dimension of mineral consumption will challenge the ability of the international mining industry to meet its most basic responsibility, the supply of metal and mineral products. Per capita consumption as well as the population is climbing at significantly higher rates. If many nations have to maintain the current ratio of production and consumption, the production index of the mining industry needs to be multiplied by a factor of 2 or more in ensuing three decades. If the demand does indeed escalate to the levels predicted by the study groups of various nations, there is no question about the technical ability of mining industry to meet it. If future supply problem develops, they will originate not from scarcity of reserves/resources, but from a tangle of political, social, and business circumstances which may cause shortage of mineral production centers (Tilton, 1990). Because of the long lead time required to find, delineate, and develop unknown ore bodies (in a time span of 15–25 years), it is utmost important to launch expansion plans of the undeveloped mineral resources. The studies imply for an enormous growth of mining industry. New materials will be needed to build, drill platforms, nuclear plants, gas pipes, petro refineries, mining equipment, and other components. The basic ingredients are the refined products of natural ores.

If the nations turn to increased imports, it will be faced with a steadily rising negative balance of payments in international mineral trade. There are many constraints, which if uncorrected could lead to vexing mineral supply problems in the days to come. The rising of third world is pushing for new economic order and redistribution and wealth. It is to be expected that nations will seek to exercise control over the production of resources from their lands. In the last decade, mines and oil producing facilities have been expropriated or nationalized with compensation based on a negotiated definition of back value—usually a fraction of true market value or replacement costs.

The needs of the hour are (1) to assemble knowledgeable exploration crews and risk the seed capital for searching out new deposits and (2) to thrash out the methods of mining and extraction, and finally, (3) to mobilize t...