Reservoir Management

A Practical Guide

Steve Cannon

- English

- ePUB (disponibile sull'app)

- Disponibile su iOS e Android

Reservoir Management

A Practical Guide

Steve Cannon

Informazioni sul libro

Reservoir management is fundamental to the efficient and responsible means of extracting hydrocarbons, and maximising the economic benefit to the operator, licence holders and central government.? All stakeholders have a social responsibility to protect the local population and environment. The process of managing an oil or gas reservoir begins after discovery and continues through appraisal, development, production and abandonment; there is cost associated with each phase and a series of decision gates should be in place to ensure that an economic benefit exists before progress is made. To correctly establish potential value at each stage it is necessary to acquire and analyse data from the subsurface, the planned surface facilities and the contractual obligations to the end-user of the hydrocarbons produced. This is especially true of any improved recovery methods proposed or plans to extend field life. To achieve all the above requires a multi-skilled team of professionals working together with a clear set of objectives and associated rewards. The team's make-up will change over time, as different skills are required, as will the management of the team, with geoscientists, engineers and commercial analysts needed to address the issues as they arise.?

This book is designed as a guide for non-specialists involved in the process of reservoir management, which is often treated as a task for reservoir engineers alone: it is a task for all the disciplines involved in turning a exploration success into a commercial asset. Most explorers earn their bonus based on the initial estimates of in-place hydrocarbons, regardless of the ultimate cost of production; the explorers have usually moved on to a new basin before the first oil or gas is produced! This book is not a deeply academic tome, rather the description of a process enlivened by a number of stories and case studies from the author's forty years of experience in the oil-patch.

Domande frequenti

Informazioni

1

Introduction

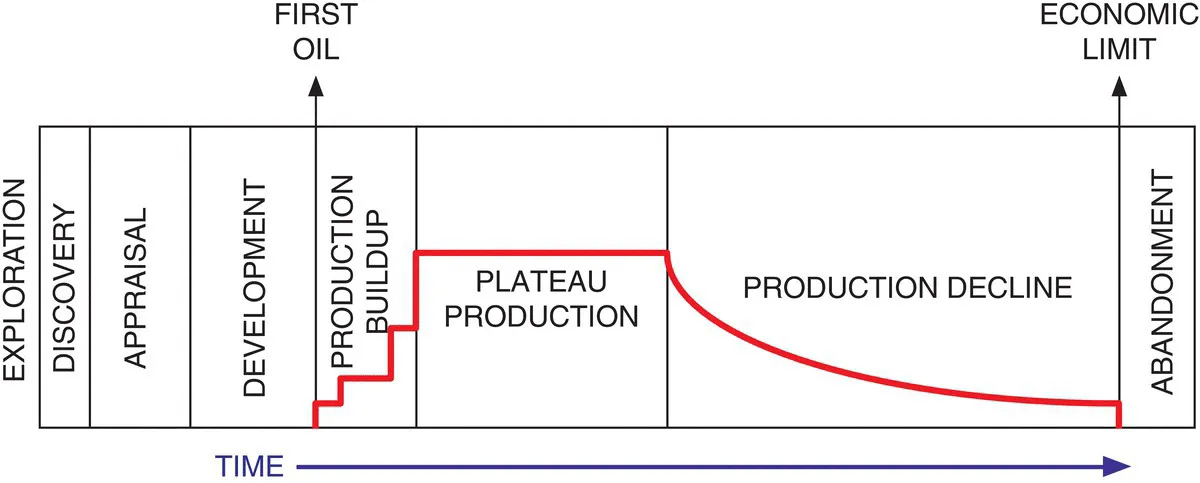

- Chapter 2 reviews the life cycle of an oil or gas field after discovery, looks at field development plans, monitoring and data acquisition requirements, and discusses these issues in the light of a number of case studies.

- Chapter 3 looks at the static and dynamic reservoir description around which the initial plans are built.

- Chapter 4 reviews the construction of the integrated reservoir model.

- Chapter 5 addresses reservoir performance and production forecasting, reviewing the dynamic estimation and uncertainty in future resources and reserves.

- Chapter 6 discusses some of the ways to improve or enhance hydrocarbon recovery with examples used to describe the methods.

- Chapter 7 focuses on the economic aspects of a successful field development and how active reservoir management through the field life can improve the returns on investment.

- Chapter 8 considers the way in which the reservoir management plan evolves with time from project sanction to abandonment. We will look at some of these issues in the real world of field development and secondary recovery projects through a series of case studies.

1.1 The Basics

- Maximizing the ultimate recovery of reserves from an oil or gas field

- Reducing the commercial risk associated with development plans

- Minimizing operating expenditure (OPEX) and capital expenditure (CAPEX)

- Increasing hydrocarbon production from wells

- Increasing the value of reserves through time (net present value – NPV)