![]()

1

Introduction: Financial Crises – An Inter-Temporal, Inter-National and Endogenous Capitalist Problem

The incidents of financial crises in emerging economies of the 1990s are numerous and of great interest for macroeconomists. The subject provides substantial material for the study of emerging economies, financial markets, liquidity movements, public and private debt dynamics, as well as macroeconomic policy design and application. This book presents a persuasive argument showing that high levels of financial flows together with low, if not absent, levels of capital controls are key in the generation of financial crises in newly liberalised economies.

A key question in development and financial economics is addressed: Does financial liberalisation when concurring along with high levels of international capital movement and little or no capital controls lead almost inescapably to financial crises? Concentrating on middle-income economies, and especially choosing three very different economies that all experienced financial crises in the 1990s, this book concludes that there are clear lessons to be learnt regarding financial fragility, volatility and failure given capital markets’ liberalisation.

One of the main propositions found in the work of John Maynard Keynes regarding the capitalist financial system being inherently unstable is examined throughout the book and applied to middle-income developing countries. This proposition has divided economists for several decades and has produced a large debate on the necessity, nature and appropriate extent of government regulation in financial markets and capital accounts. The book adopts a novel approach in applied economics with regard to the understanding of systemic causes of financial crises. Rather than investigate specific geographical regions or common policy patterns leading to crises, this research builds a wide array of all possible domestic policy scenarios that independently lead to crises in order to provide a holistic understanding of the crises’ intrinsic nature to the capitalist system of finance.

Through the analysis of three different economies in the context of domestic and international market liberalisation, this book explores the nature of systemic fragility in financial markets in middle-income countries with open capital accounts.

Specifically, it investigates the relationship between sudden surges of capital inflows and financial crises in a group of middle-income developing countries with recently liberalised capital accounts.

An inter-temporal capitalist issue

Given the current financial turbulence and the on-going discussion on the causes of the present crisis, this book re-introduces Keynes’ proposition regarding the endogeneity of disturbances to the financial system and intractable uncertainty of financing and investment decisions in the context of middle-income developing countries. This is achieved through an analysis of the validity of the above-mentioned proposition in the framework of three earlier crises (those of Brazil, Mexico and South Korea) which mainstream economic analysis has hitherto studied mostly in terms of misdirected, inadequate and unsuccessful domestic policies. The book investigates how the occurrence of a crisis is shaped by the interplay between exogenous surges in liquidity and the pursuit of domestic economic policies. To draw these investigations into broader focus, the susceptibility of the capitalist system to financial disturbances and crises in a broader economic climate of high international liquidity is explored, along with the impact of domestic policies which seek to liberalise the three economies’ capital accounts. This is delivered through an examination of the direction, character and volatility of international liquidity at the time. Though all three countries examined followed radically different routes to crises, all of them were preceded by policies of rapid financial deepening, liberalisation and deregulation.

The on-going world recession and continuously deepening Eurozone debt crisis bring to the forefront of discussion the need for economic policy designed to tackle financial instability. The question thus addressed in this book is essential for the identification of the nature and volume of intervention needed in financial markets. The hazard of financial instability has become central in development economics, and increasingly there has been discussion on the nature of required policy design and intervention. Creating a framework inimical to systemic financial crises has been historically a major concern of policymakers, but now more than ever this development is in need of urgent realisation. Understanding the mechanisms behind the occurrence of systemic financial crises and averting their incidence could be an important first step for policy towards this direction. It is exactly to this field that this research attempts to make a contribution.

To understand how capital flows can induce volatility in financial markets, and consequently to the whole of the economy, the book investigates a series of specific and inter-connected developments which, given the economies’ macroeconomic fundamentals, contributed to the crises that occurred. These are the causes of the abrupt increase in the stocks and flows of financial capital, the reasons behind their direction towards new outlets – specifically emerging economies – and the policies pursued in the recipient countries to deal with the inflows and the type and maturity-horizons assigned to the inflows. With regard to the factors causing the abrupt jumps in the generation and circulation of flows, we identify external and internal factors contributing to the changes and shaping the levels of financial capital in the emerging world. Following the work of distinguished scholars, a distinction is drawn between supply-push and demand-pull factors related to the jumps of capital flows (see Palma, 2003a, 2011a). The first are specific to the generation of liquidity through deregulation, financial engineering and lower profit opportunities manifested in the lower returns of US Treasury bonds and the overall slowdown of economic growth in the Western markets. The second are specific to changes applied to the overall economic policies and financial markets of emerging economies. This is delivered to set the background against the attraction of all capital inflows which when combined with an analysis of their type and maturity allows us to shape conclusions on the real causes of the crises.

The aim of the book

The book aims to assess the following two questions: how are injections of international liquidity absorbed in middle-income developing countries and do they contribute to the genesis of financial crises? And how do policies of capital account liberalisation are associated to financial fragility? These questions are addressed in reverse order. The first question is approached through the breakdown of the stock of financial assets in these countries (into bank deposits, stock market capitalisation figures, public and private bonds) and the analysis of the significance and implications of the evolution of each form of liquidity in each country. The second question is addressed through investigating the reasons for the post-1980s’ rapid increase in international liquidity levels through an overall political economy framework and through exploring the economic policies of each country in the context of their general performance. The outcome of this analysis will be used to determine the reasons behind liquidity inflows in the countries studied and, more broadly, the implications of unrestrained liquidity injections with regard to the fuelling of financial booms. Through determining these two elements, it will be possible to establish the impact of one more critical Keynesian concept, that of expectations.

The questions, set out above, raise the following additional avenues of investigation that contribute to a more rounded understanding of the research question.

- Why has the world economy experienced such an increase in international liquidity since the 1980s?

- Why did middle-income developing countries suddenly become attractive as an outlet for this liquidity in the late 1980s and early 1990s?

- Why did a sudden surge in inflows create so much domestic havoc in middle-income developing countries?

- How does the study of three different middle-income developing economies, which have all suffered from financial crises, illustrate the problems brought about by abrupt liquidity injections following capital account liberalisation policies?

- What kind of theoretical and policy lessons result from such a study?

The book examines whether nations with radically different economic policies vis-à-vis surges in inflows all suffered from financial crises as an unavoidable outcome of their capital account liberalisation given the magnitude of global liquidity stocks and flows. The answers to the questions set out above can provide a useful background when investigating the causes of the current crisis and most importantly when designing a set of policies targeted at curtailing the impact of any crisis re-emergence.

The structure of the book

The book consists of this introduction and nine additional main chapters. The second chapter presents an overview of Keynesian and post-Keynesian theoretical concepts that are relevant to financial markets’ behaviour, volatility and vulnerability – as well the neo-classical concepts that they are opposed to. This chapter is key for the understanding of the book’s discussion but optional to readers with a good knowledge of post-Keynesian economic principles. The third chapter provides a brief analysis of global liquidity data since 1980 in order to investigate the causes behind their exponential growth. The fourth examines the structural causes of liquidity generation in the financial centres of the world and the endogenous causes behind the external direction of financial liquidity. The fifth chapter analyses the historical evolution of emerging financial markets and examines the causes of liquidity movements from the financial centres of the world towards the emerging markets that were exogenous to developments in the former. The sixth, seventh and eighth chapters study the three different routes to financial crisis followed by each of Mexico, Brazil and South Korea, respectively. What features can we extrapolate from the three different routes to financial crises? The ninth and the last chapters of the book place all data and case studies together and draw conclusions on the veracity and potential consequences of the asserted relationship between high levels of financial mobility, absence of capital controls and emergence of financial crises. Throughout the book a Keynesian and post-Keynesian analytical framework is adopted and tested as the best fit to theoretically frame the postulated relation.

Post-1980 liquidity study

The third, fourth and fifth chapters of the book explore the reasons behind the rapid increase of global financial liquidity after 1980. These chapters attempt to determine the reasons for the change in the relationship between global financial assets and global output post-1980. The overall international financial background of increased capital transactions is initially presented, and two major influences are then discussed – each one of these two influences is presented in a separate chapter. These were the dimensions and development of the economic deregulation policies and the generation of new liquidity flows via, among others, the establishment and expansion of complex structured financial instruments in the Western economies first and the world’s emerging markets second. The fourth chapter sets out the variables related to the jumps in the generation and circulation of financial liquidity in the West. It includes an investigation of how the direction of liquidity shifted from productive investment to the trading of financial instruments as a result of these developments and also suggests that the innovation of new financial products produced, by itself, its own liquidity. The fifth chapter outlines the reasons behind developing countries appearing to be highly attractive to surges of global liquidity flows after the 1980s. In this chapter Palma’s proposition that developing countries provided a market of last resort for international liquidity flows will be investigated (Palma, 1998, 2003a). This proposition suggests that the rapid drainage of highly profitable activities in the developed world directed liquidity into developing economies in the pursuit of higher returns. The timing and direction of liquidity shifts to the developing world is examined together with the overall economic and political background of the recipient economies. This will be delivered in order to understand the reasons underpinning the purported attractiveness of developing economies.

The “three routes”– Chapters 6, 7 and 8

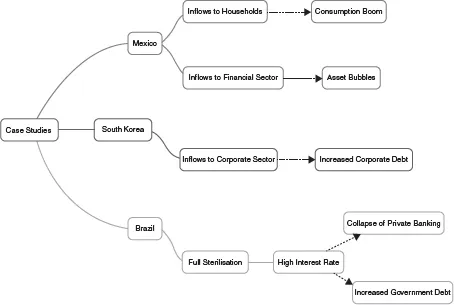

The sixth, seventh and eighth chapters of the book explore the way in which three different middle-income developing economies – those of Mexico, Brazil and South Korea – drove themselves to financial crises in the 1990s. These three economies have been specifically chosen as characteristic examples of different economic policy-making developed, systematically or intrinsically, to deal with the problem of the absorption of foreign flow surges. Palma’s concept of the “Three Routes” to financial crises (Palma, 2000, 2002a, 2003a) is adopted throughout this book to refer to the distinctive domestic economic policies followed in the three economies studied, all of which manifested themselves in financial crises. All three economies implemented structural reforms and liberalisation policies in the same decade, but with different paths and intensities. The routes followed by Mexico and Brazil are considered as the two extreme case studies in the analysis. Mexico followed a policy of absolute financial liberalisation while Brazil, in order to purposefully avoid a Mexican-type crisis, fully sterilised capital inflows. The Korean case was at neither extreme as it followed a policy of freely allowing capital inflows while channelling them into an ever-increasing private-debt business sector. Figure 1.1 provides a brief overview of the “three routes argument” by portraying each economy’s domestic policy and consequent economic problems. Large “big bang” style liberalisation reforms were implemented in all three economies, with the Latin American ones being the most resolute followers of the neoliberal doctrine of full deregulation of the capital account and the domestic financial markets, and South Korea following quite an idiosyncratic Asian interpretation of the WC. Chapter 6 portrays the case of Mexico as a characteristic example of an economy with a mostly laissez faire policy vis-à-vis the surge of inflows. The non-interventionist policy implemented by its central bank resulted in asset bubbles (both in the stock market and real estate) and a consumption boom that eventually induced a vast increase in non-performing household debt (Palma, 2011a). Brazil is then analysed in Chapter 7 as an economy adopting instead a nearly full sterilisation policy and at the same time embracing full liberalisation and an opening of its capital accounts. It is selected as a characteristic example of an economy whose central bank sold government bonds to withdraw the increased liquidity created by foreign exchange inflows. Brazil, trying to avoid a Mexican-type downturn, engaged in the policy of costly sterilisation that eventually led to public sector Ponzi finance. The full sterilisation policy that followed was attached to financial instability through the high interest rate required for its operation. This eventually led to the collapse of the domestic private banking system due to an increase in non-performing debt, and to a further increase in public debt resulting, among other things, from the government’s rescue plan for these failing banks. Lastly, Chapter 8 examines South Korea as an example of an economy where even though the additional finance created by inflows was used productively by the corporate sector (and, as a result, no asset bubble or consumer booms were immediately generated), the economy still experienced a severe crisis, this time via an excessive increase in corporate debt. In South Korea, the collapse of profitability in the corporate sector (mainly due to falling micro-electronic prices) meant that corporations required the additional finance for investment. An additional problem of the economy finally precipitating the negative developments was that the Korean central bank was caught at the apex of the crisis with low levels of reserves (Palma, 2000).

Figure 1.1 The “3 routes to crisis” and their early manifestations

The rationale behind choosing such contrasting economies in terms of the ways in which they formulated policies to deal with surges of inflows, is to emphasise the difficulties of dealing with such large surges of inflows once an open capital account has allowed entry. These chapters explore the domestic policy changes in each of the three economies prior to the crises with regard to the elements relevant to the absorption, structuring and distribution of liquidity inflows.

Theory, policies and data: putting everything together – Chapters 9 and 10

Chapter 9 combines the policy changes pursued and the financial data explored in all three cases with selective parts of post-Keynesian theory. Analytically, it discusses whether the initial proposition – that open capital accounts at times of high international liquidity can lead to surges in capital inflows that tend to create unsustainable macro-economic imbalances irrespective of domestic policies devised for their absorption – can be validated by the three cases studied. All three crises studied are analysed in the framework of finance and trade liberalisation preceding their occurrence. In each economy the sudden increase in capital flows and the simultaneous jump in private and public indebtedness were followed by a sharp reversal in the flow of capital. The domestic and international insights regarding the importance of the economies’ 1990s’ structural reform and stabilisation plans are challenged here via the analysis of the boom and bust cycles that the economies experienced. This establishes a thorough reassessment of their development strategies. The penultimate chapter therefore summarises and formalises the results of the entire research and affirms that the surge of inflows has been found to make the three economies in question susceptible to financial crises as a result of the policy of opening their ca...