INTRODUCTION

This chapter intends to describe the recent history of Sustainability Indices in three Latin American countries: Brazil, Mexico, and Chile. A Sustainability Index is a selection of shares quoted in a particular stock market. Differently to conventional stock indices, in a Sustainability Index shares are chosen according to environmental, social or governance (ESG) criteria. Thus, these indices do not select companies according to size or industry but in relation to ESG criteria. Usually the purpose of a Sustainability Index is to provide a benchmark (i.e., a comparison between a conventional index and a Sustainability Index in the same stock market). Additionally, if the composition of the Sustainability Index is publicly available, investors could take that information into consideration for their investment decisions. By this doing, Sustainability Indices can contribute to the growth and development of Socially Responsible Investment (SRI).

In each of those three aforementioned countries, local Stock Exchanges have been recently launching their own Sustainability Indices: Brazil in 2005, Mexico in 2011 and Chile in 2015. This ongoing surge of Sustainability Indices in three Latin American countries is remarkable as SRI is still quite new in the region. This situation largely contrasts with that of developed markets, where SRI has become a common investment practice. For instance, the US SIF (Forum for Sustainable and Responsible Investment) estimates that one sixth of funds invested by professional managers in the United States are related to some approach of SRI (US SIF, 2014).

As Giamporcaro and Gond (2016) emphasized, the cornerstone of SRI markets is “calculability,” which is the measurement of CSR performance of quoted firms. In developed markets, this measurement is done by expert analysts, either employed by investment funds or by social rating agencies. For instance, Crifo and Mottis (2016) survey SRI analysts working at asset management companies and institutional investors in France, while Sakuma and Louche (2008) present analysts at the core of the SRI market in Japan and Bengtsson (2007) illustrates a similar picture for SRI in Scandinavian countries. In all these descriptions, there is a collection of market actors (i.e., investors, advisors, companies) who collectively develop “calculability” for SRI at the core of their respective markets.

However, the situation seems to be quite different in Brazil, Mexico, and Chile. While some differences exist, all three countries share a similar approach: an index created by the stock market (not by investors or fund managers), whose composition is freely distributed (so that any investor could use that information at no cost) and that aims to be the cornerstone of the SRI industry in each country. Thus, “calculability” in these countries would not be performed by a collective effort of many actors (as it is the case in developed markets), but through the impulse of a Sustainability Index created by local Stock Exchanges. The fact that three different countries in Latin America share a similar approach suggests that the region may be developing a particular way of addressing SRI.

Consequently, the purpose of the chapter is to explain how those Latin American indices operate, and to discuss their potential impact on the development of SRI practices in those local markets. Additionally, the perspectives for SRI in these three markets are contrasted with those of developed markets, as Latin American stock markets tend to have smaller size, less liquidity and lack (or scarcity) of ESG rating agencies.

Regarding methods, the chapter relies on secondary data, mainly documents published by the Stock Exchanges themselves. Academic and practitioner oriented articles will be also cited. While the chapter would include tables and figures, its focus is not quantitative, as it intends instead to provide an introduction to SRI in Latin America from the viewpoint of Sustainability Indices.

THE CONTEXT: STOCK EXCHANGES IN LATIN AMERICA

In order to explore how Sustainability Indices can contribute to SRI in Latin America it is necessary first to understand how Stock Exchanges in that region are. Schneider (2013) points out that Latin American countries can be considered as hierarchical economies – a particular type of capitalism which is different from that of Anglo-Saxon countries. In hierarchical economies, companies are largely financed by owners themselves (e.g., families, States, foreign investors). Consequently, share ownership is usually concentrated among few investors and the role of stock exchanges is relatively small (Schneider, 2013). Thus, while stock exchanges exist in Latin America and can be quite active in some countries, the bulk of corporate financing is still done directly through private owners – in a “hierarchical” way.

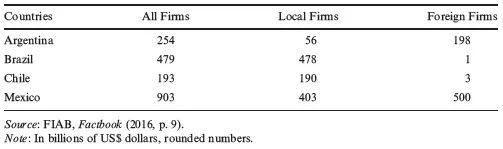

This limited role of stock exchanges in Latin American economies can be illustrated by the information produced by the Federation of Iberoamerican Stock Exchanges (FIAB), which regularly produces statistical information about those markets. Drawing from their 2016 Factbook (FIAB, 2016), data was selected for four of the largest markets in the region. While there are many more other stock markets in Latin America, this analysis of these four markets can be extended to the other remaining markets in the region. Table 1 presents market capitalization for the stock markets in Argentina, Brazil, Chile, and Mexico.

Table 1. Market Capitalization – End of Year 2015.

While these numbers may seem large, they can compare with those of a relatively mid-sized European market. For instance, the market capitalization for local companies in Spain amounted to 783 billion dollars (FIAB, 2016). As an additional comparison, the New York Stock Exchange (NYSE) had a market capitalization of more than 19 trillion dollars in June 2016 (www.nyxdata.com, accessed in August 2016).

This is not only a matter of size; it is also an issue of how much each stock exchange represents the economy of its country. For instance, less than a half of the market capitalization for Mexico corresponds to local firms, and the proportion is even smaller for the Argentinean market (approximately 22% of that market capitalization corresponds to local companies). Furthermore, some of the most relevant industries for each country are not represented in those stock markets. For instance, Brazil, a country with a long tradition of agricultural production, has no local agricultural firms quoted in its market for the year 2015 (FIAB, 2016). A similarly curious situation happens with Chile, the largest producer of copper in the world, which has no local mining firm quoted in its stock market (FIAB, 2016). While Mexico has a more diversified set of industries quoted, there are no utilities companies in its stock market. As a consequence, any Sustainability Index (or for that matter any index) from those markets will not be able to include companies that correspond to large parts of the economic activity of those countries.

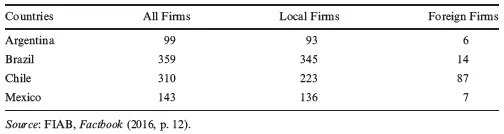

Another problem in Latin American stock exchanges is the scarce opportunity for diversification. This issue can be illustrated with the following two tables. Firstly, as Table 2 indicates, few companies are quoted in each stock exchange. For instance, the Argentinean exchange has less than a hundred firms listed. This implies that any Sustainability Index (or for that matter any index) in those stock markets would have a hard time selecting stocks while keeping some diversification in the index. This issue can be particularly difficult when selection criteria are related to ESG and not only to conventional criteria (e.g., size, industry). Otherwise said, a Sustainability Index that selects stocks form such a limited amount of possibilities may end up with scarcely diversified portfolio, which implies higher risks for investors.

Table 2. Number of Companies Quoted – in 2015.

Secondly, as Table 3 indicates, only a few companies represent a relatively large part of market capitalization for each of these markets. For instance, the 10 largest local companies in Chile represent 46% of the market capitalization for domestic firms in that market and this figure increases to 63% for Argentina. As these stock exchanges have such a high concentration of their market value in only a few large companies, leaving aside any of these large firms would greatly reduce the diversification of any index – either a sustainable or a conventional one.

Table 3. Share of 10 Largest Local Firms by Market Capitalization – in 2015.

Argentina | 63 |

Brazil | 51 |

Chile | 46 |

Mexico | 56 |

Source: FIAB, Factbook (2016, p. 18).

Finally, Latin American stock markets tend to be less liquid than stock markets of developed countries (Agudelo, Giraldo, & Villarraga, 2015; Galdi & Lopes, 2013), a feature shared with emerging markets of other regions of the world (Bekaert & Harvey, 2003). Liquidity is important for two reasons. Firstly, all investors prefer liquid stock markets, as they can enter and exit more easily from those markets. Economists have long emphasized investor’s preference for more liquid investments under uncertain conditions (Baldwin & Meyer, 1979). Particularly in the case of emerging equity markets, the positive link between liquidity and return has been documented (Jun, Marathe, & Shawky, 2003). Besides investor preferences, less liquid markets tend to have higher transaction costs (Marshall, Nguyen, & Visaltanachoti, 2016). As stock indices periodically change their portfolio composition (i.e., they “rebalance”), investors that track any stock index would have to adapt their invested portfolio to the new index composition. Consequently, those higher transaction costs would make this periodical rebalance process more expensive in a less liquid market.

Table 4 includes two indicators of market liquidity: turnover velocity and total value of stocks traded. Turnover Velocity corresponds to the value of transactions in a given year (in this table, the year 2015) compared to the average market capitalization for the same year. The larger the ratio of Turnover Velocity, the more liquid the market is. It can also be noted that this figure can be computed for the entire stock market (as it is the case here) or for an individual stock. For the four stock markets, only the Brazilian one is relatively liquid (80.90%), a figure that can be compared with that of the Spanish stock exchange (110.48%), (FIAB, 2016). Furthermore, this comparison can be illustrated by market capitalization figures (in Table 1). While the Mexican market almost doubles the Brazilian market in terms of market capitalization, the Brazilian exchange has traded four times more than the Mexican one. It can also be seen that the Chilean and Argentinean exchanges are far less liquid.

Table 4. Indicators of Market Liquidity.

Country | Turnover Velocity, Domestic Shares (Percentage) | Total Value of Stock Trading (Billions of US$ – Rounded) |

Argentina | 5.23 | 5 |

Brazil | 80.9 | 487 |

Chile | 8.06 | 22 |

Mexico | 24.67 | 110 |

Source: FIAB, Factbook (2016, pp. 14, 17).

This issue of lower market liquidity is not necessarily a limitation for creating an index, as a set of stocks can still be selected in a less liquid market. However, lower market liquidity remains a challenge for investing in an index, as transaction costs may be higher in a less liquid market (Amihud, Hameed, Kang, & Zhang, 2015; Marshall et al., 2016)