![]()

Chapter 1

THE FIRM AND THE VALUE

SPHERE: HOW DO WE MAXIMIZE

THE CREATION AND RETENTION

OF VALUE?

1. The Individual and the Firm

We are routinely inundated with news about exciting new growth companies and stellar mature firms that are earning astronomical returns on their investments. Perhaps the most celebrated picker of such firms is Warren Buffett, CEO of Berkshire Hathaway. Money magazine, in its August 2002 issue, reported,

“But Buffett's strategy of buying and holding big growth stocks with strong franchises has paid off handsomely, with a compound annual return of 24%.”

Many believe that one of the secrets of America's economic success is the environment it provides companies to flourish. Indeed, economic growth and national and individual prosperity are commonly viewed as being synonymous with the growth of companies, both mature and new.

But why are firms so important for economic growth?

That is actually a pretty deep question. So, let us step back and first ask: What is a firm? Why do we need firms?

Why we may need firms should become apparent when we answer this first question.

1.1. Jerry's lemonade stand

To think about this, suppose we have a fellow named Jerry who wants to go into business selling lemonade. He has got all sorts of dreams about his business growing into a national network of lemonade stands and related products with the name “Jerry's Lemonade, Inc.” Sort of like Starbuck's Coffee.

But before Jerry invests a lot of his time and money in opening this firm, he must ask himself: “Why should anybody buy my lemonade?” After all, it is not that difficult to imagine potential customers buying lemons and sugar from the grocery store, and going home and making their own lemonade. What can Jerry do for them?

If Jerry is a shrewd businessman, he will realize that his proposed firm is nothing more than an intermediary between the grocery store that sells lemons and sugar — which is itself an intermediary between the farmers who grow lemons and buyers like Jerry — and consumers of lemonade. Sort of like your local bank intermediating between borrowers and savers, accepting deposits at 5% interest and lending the same money out at 10%.

Thus, the answer for Jerry is simple. His firm has a reason to exist if he can add value for the customer beyond what the customer can do on his/her own.

How can Jerry's firm add value?

• By producing a glass of lemonade at a lower cost than the customer can.

Jerry now begins to think about how his firm can produce lemonade cheaper than an individual customer can. This is easy, thinks Jerry, I will buy lemons in large quantities directly from lemon growers rather than grocery stores, and get volume discounts.

Of course, what Jerry must also realize is that the customer's definition of cost includes not just the cost of the materials — lemons, sugar, ice, water, etc — that go into the lemonade, but also the cost of labor. Going to the store, buying lemons and sugar, and then making fresh lemonade at home takes time and effort. By offering the convenience of ready-made lemonade, the customer's time and effort could be spent more enjoyably on other things.

So, if Jerry can buy lemonade-making equipment and train people to make large quantities of fresh lemonade fast, he can reduce the labor that goes into making each glass of lemonade.

Jerry has now discovered two ways to make cheaper lemonade — buy inputs in bulk at volume discounts and train people to mass-produce the output at a lower labor cost per unit.

But is there any other way to add value?

• By producing a better glass of lemonade than the customer can himself/herself.

That is simple enough, thinks Jerry, but what is better? I suppose it means better quality, but how do I know what that is?

Little does Jerry realize what a profound question he has just asked. In the teachings of W. Edwards Deming about total quality management (TQM), there are many definitions of quality.1

In practice, many firms use manufacturing defects as an operational measure of quality. For example, Motorola is famous for its “Six Sigma” quality initiatives. In plain English, this means that the manufacturing goal is no more than 3.4 defects per one million opportunities. Variants of this initiative have since been adopted by various firms, including General Electric and Whirlpool.

Should Jerry use this definition of quality to determine how to make a better glass of lemonade? Perhaps he should hear a story before he decides.

RJR Nabisco, the maker of Oreo cookies, was very concerned about the number of broken cookies in each box. After all, such defects indicated shoddy workmanship. People might think Oreo cookies were of low quality. So, the company spent millions of dollars on a comprehensive quality improvement program to reduce the number of broken cookies in each box. And they succeeded in fixing the “problem.”

Did it help? Not really. Sales did not change much, and neither was Nabisco able to charge a higher price.

What went wrong?

The answer is that Nabisco misdiagnosed the problem. They adopted an engineering definition of quality. This definition says that quality is consistency or absence of variation. Thus, quality is the pursuit of ever smaller numbers of “defects” or smaller tolerances.

But what is the only definition of quality that matters?

By now, Jerry has caught on. “It is obvious,” he says, “the only thing that matters is what the customer defines as quality.”

This is known as user-based quality. It is a subjective definition of quality, and it says that the sole legitimate judge of quality is the customer. In the case of Oreo cookies, Nabisco ultimately discovered that its customers did not care about the broken cookies. It was how the cookies tasted to them that mattered most. In fact, many parents liked to eat just the broken cookies and leave the whole ones for their kids. After all, there are no calories in broken cookies, are there?

So, why do not more firms rely on user-based quality in their TQM programs?

Because it is hard! Engineering-based definitions of quality are easy to quantify and set targets for. Human nature is such that it is easier for people to focus their attention on measurable and quantifiable things. On the other hand, operationalizing user-based quality requires a deep understanding of the customer. In particular, it calls for understanding how the customer makes purchase decisions.

But Jerry is not daunted by such challenges. He realizes that understanding his customers is the key to his future success. He is going to have to think about how to do this. And while he is at it, he is also going to have to understand how the different parts of his future organization are going to work together in a harmonious process to create value. For this, he is going to have to understand the concepts of value creation and organizational process maps.

2. Organizational Process Maps and Value Creation

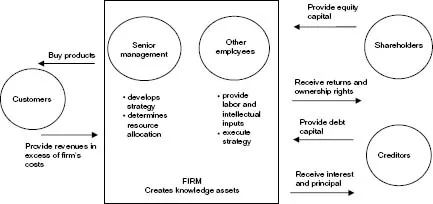

An organizational process map is a pictorially descriptive summary of the manner in which value is created by an organization, and the value-added roles played by different agents.

Every organization should have one. Few have really good ones.

A good organizational process map should help the organization to:

• clearly link its strategy to the various activities that add value, so as to define the role of each activity in adding value through execution of the strategy;

• communicate to its employees the danger in people optimizing their piece of the value-added chain at the expense of the entire value-added chain and

• quickly pinpoint activities that have, over time, become peripheral to the value-added chain, and should be candidates for divestiture.

An overall organizational process map for any firm would look like Fig. 1.1.

Fig. 1.1. An organizational process map.

Of course, an operationally useful process map would be loaded with far more detail than this.

What our aspiring business tycoon, Jerry, has to understand is that any firm is merely an intermediary between its customers on the one hand and the providers of capital (financiers) on the other.

Financiers will not provide debt and equity capital unless they expect to earn a return on that capital that is at least as great as that which they can earn elsewhere if they took the same risk.

Not all financiers are the same, of course. Jerry's Lemonade has to promise a higher expected return to its shareholders than to its creditors (banks and bond-holders) because the shareholders bear more risk; creditors have priority over shareholders in receiving payment from the firm. But the point is that shareholders will not provide Jerry with equity capital unless they are promised an expected rate of return commensurate with the risk they are taking. The same holds true for the creditors.

So Jerry has to work backwards, in a sense. He must first figure out how much it is going to cost him to produce the volume of lemonade he wants to sell. This requires estimating all of his operating costs, including materials and labor. He must then figure out how much capital he will need to invest, and how much of it will come from outside shareholders (equity) and how much from creditors (debt).

Once he has a handle on all his costs and his capital outlay, Jerry can calculate the revenues he will need to generate to ensure that his shareholders and creditors receive the returns they are expecting. Capital has a cost too.

Since Jerry also knows the number of glasses of lemonade he hoped to sell when he began this exercise, he now knows the price he must charge for each glass of lemonade so that he can earn the desired revenue.

If Jerry provides good products and services, his customers may be willing to pay this price.

But what if they are not? After all, this is a brutally competitive world, and people watch every penny they spend. It is not easy to charge customers what you would like, especially when the market is served by many able competitors.

This is where Jerry must open his organizational process map, and look carefully at each value-added activity and what it costs:

• Can some of these activities be cut out or reorganized? (Process rationalization).

• Can we make more lemonade with fewer people? (Labor rationalization).

• Can we outsource some of the things we planned to do in-house? (Asset rationalization).

Jerry has only two (not mutually exclusive) choices. He can either bring his costs down so that the price at which customers are willing to buy his lemonade is high enough to generate a revenue sufficient to yield his financiers their desired returns. Or he can figure out a way to get customers t...