eBook - ePub

Balanced Scorecard

Step-by-Step for Government and Nonprofit Agencies

Paul R. Niven

This is a test

Share book

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Balanced Scorecard

Step-by-Step for Government and Nonprofit Agencies

Paul R. Niven

Book details

Book preview

Table of contents

Citations

About This Book

This book provides an easy-to-follow roadmap for successfully implementing the Balanced Scorecard methodology in small- and medium-sized companies. Building on the success of the first edition, the Second Edition includes new cases based on the author's experience implementing the balanced scorecard at government and nonprofit agencies. It is a must-read for any organization interested in achieving breakthrough results.

Frequently asked questions

How do I cancel my subscription?

Can/how do I download books?

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

What is the difference between the pricing plans?

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

What is Perlego?

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Do you support text-to-speech?

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Is Balanced Scorecard an online PDF/ePUB?

Yes, you can access Balanced Scorecard by Paul R. Niven in PDF and/or ePUB format, as well as other popular books in Business & Management. We have over one million books available in our catalogue for you to explore.

1

Introduction to the Balanced Scorecard

Roadmap for Chapter 1 Before you can begin developing a Balanced Scorecard for your organization, we must ensure that you have a solid foundation of Scorecard knowledge and understanding from which to build. This chapter will provide that base.

We’ll begin by considering just why measurement is so important to the modern public and nonprofit organization. We’ll then look at three factors that have led to the rising prominence of the Balanced Scorecard since its inception over seventeen years ago. You’ll learn that our changing economy, which places a premium on intangible assets, demands more from our measurement systems. Financial measurements and their significant limitations will then be examined. The final factor escalating the growth of the Balanced Scorecard is the inability of most organizations to effectively execute their strategies. We’ll review a number of barriers to strategy implementation.

The Balanced Scorecard has emerged as a proven tool in meeting the many challenges faced by the modern organization. The remainder of the chapter introduces you to this dynamic tool. Specifically, we’ll examine the origins of the Scorecard, define it, and look at the system from three different points of view: as a communication tool, measurement system, and strategic management system.

WHY MEASUREMENT IS SO IMPORTANT

One of the themes of this book is that regardless of what sector your organization represents, there is a role for measurement to improve your performance. So it is in the vein of connecting measurement to virtually any field of endeavor that I offer this historical account to begin our expedition together. In the dense fog of a dark night in October 1707, Great Britain lost nearly an entire fleet of ships. There was no pitched battle at sea; the admiral, Clowdisley Shovell, simply miscalculated his position in the Atlantic and his flagship smashed into the rocks of the Scilly Isles, a tail of islands off the southwest coast of England. The rest of the fleet, following blindly, went aground and piled onto the rocks, one after another. Four warships and 2,000 lives were lost.

For such a proud nation of seafarers, this tragic loss was distinctly embarrassing. But to be fair to the memory of Clowdisley Shovell, it was not altogether surprising. Although the concept of latitude and longitude had been around since the first century B.C., still, in 1700, no one had devised an accurate way to measure longitude, meaning that nobody ever knew for sure how far east or west they had traveled. Professional seamen like Clowdisley Shovell estimated their progress either by guessing their average speed or by dropping a log over the side of the boat and timing how long it took to float from bow to stern. Forced to rely on such crude measurements, the admiral can be forgiven his massive misjudgment. What caused the disaster was not the admiral’s ignorance, but his inability to measure something that he already knew to be critically important—in this case longitude.1

We’ve come a long way since Clowdisley Shovell patrolled the seas for his native Great Britain. If you’re a sailor, today’s instrumentation ensures that any failure of navigation may be pinned squarely on your own shoulders. But for those of you who spend your days leading public and nonprofit organizations, how far have you come in meeting the measurement challenge? Can you measure all those things you know to be critically important? Today’s constituents and donors are better informed than at any time in history. That knowledge leads to a demand of accountability on your part to show results from the financial and human resources entrusted to you. To do that, you must demonstrate tangible results which are best captured in performance measures.

Over 150 years ago the Irish mathematician and physicist Lord Kelvin reminded us that “When you can measure what you are speaking about, and express it in numbers, you know something about it; but when you cannot measure it, when you cannot express it in numbers, your knowledge is of a meager and unsatisfactory kind ...” The goal of this book is to help you do just that: to measure all those things that you know to be important. Those areas that truly define your success and allow you to clearly demonstrate the difference you’re making in the lives of everyone you touch. Welcome to your Balanced Scorecard journey!

WHY THE BALANCED SCORECARD?

In the span of the Balanced Scorecard’s lifetime—some 17 years—hundreds, if not thousands, of business ideas, fads, and fetishes have been paraded in front of a beleaguered, change-weary organizational world searching for the secret that will elevate them above the rest. Promising near instant success in a hyper-competitive world, most of these panaceas have come and gone with barely a whisper and yet the Scorecard drumbeat marches on, gaining momentum with each successive beat. The question is, why?

Before we explore the Balanced Scorecard in detail, it’s important to examine some of the factors that have given rise to this proven framework for tracking organizational performance and executing strategy. Understanding these pillars of the Balanced Scorecard’s success will not only enhance your appreciation of the tool, but the insights gained will also assist you as you begin implementing the system within your own organization. In the pages ahead, we’ll examine these three factors that are fundamental to the success of any organization, whether public sector, nonprofit, or private: the increasing role of intangible assets in creating value in today’s economy, our long-standing over-reliance on financial measures of performance to gauge success, and most importantly, the challenge of executing strategy. Let’s look at each of these and discover how they’ve contributed to the need for a Balanced Scorecard system. We’ll then return to an overview of the Balanced Scorecard and learn how this deceptively simple tool has revolutionized the management of performance (see Exhibit 1.1).

THE RISE OF INTANGIBLE ASSETS IN VALUE CREATION

As you read the heading for this section, what images flashed through your mind? An assembled throng of twenty-first century pocket-protector-wearing geeks at Google creating the next killer app of the Internet perhaps? Or maybe you wondered what the Red Bull-driven minds at Apple or Microsoft might dream up next? I can almost guarantee you didn’t think about unloading timber ships at the London docks in 1970. But as much of a revolution occurred there as we’re seeing in the halls of Silicon Valley today. In 1970, when a timber ship dropped anchor at the dock in London, it took 108 men about five days to unload it, equating to 540 man days. Today, that same ship would be stripped of its cargo in one, yes one, day. That’s eight man days, meaning that over the past 37 years, workers have registered a whopping 98.5% improvement in the time to unload a ship. What could possibly account for this extraordinary enhancement? Steroid-popping stevedores? Hardly. The diminishing time requirement is a function of three things: containerization, modern processes for swift unloading, and enabling technology. Two out of those three of are quintessential examples of the power of intangible assets: processes and technology. They both emanate from and harness the only power we’ll never run out of: brain power!2

Exhibit 1.1 The Balanced Scorecard Solves Fundamental Business Issues

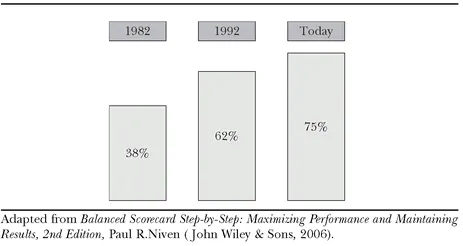

From barnacle-laden docks to computer-controlled manufacturing facilities to meeting rooms around the world, this scenario is transforming the way work is done in today’s organizations. While this switch is probably evident to anyone working in today’s frenzied times, it is also borne out of research findings by the Brookings Institute. Take a look at Exhibit 1.2 that illustrates the transition in value from tangible to intangible assets. Speaking on National Public Radio’s Morning Edition, Ms. Margaret Blair of the Brookings Institute suggests that tangible assets have continued to tumble in value:

If you just look at the physical assets of the companies, the things that you can measure with ordinary accounting techniques, these things now account for less than one-fourth of the value of the corporate sector. Another way of putting this is that something like 75% of the sources of value inside corporations is not being measured or reported on their books.3

Exhibit 1.2 The Increasing Value of Intangible Assets in Organizations

Being keen-eyed denizens of the public and nonprofit sectors, I’m sure you noticed Ms. Blair’s use of the term “corporations.” Believe me, your organizations are being affected every bit as much as your corporate counterparts. The challenges represented by this switch are not going unnoticed in Washington, DC. David M. Walker, Comptroller General of the United States, said in a February 2001 testimony to the U.S. Senate that “human capital management is a pervasive challenge in the federal government. At many agencies, human capital shortfalls have contributed to serious problems and risks.”4 President George W. Bush, in his President’s Management Agenda, echoes Walker’s comments and adds that: “We must have a Government that thinks differently, so we need to recruit talented and imaginative people to public service.”5 Talented people, armed with the tools necessary to succeed and operating in an environment conducive to growth and change is the recipe for twenty-first century success.

Unfortunately, our measurement systems have failed to keep pace with the rate of change occurring in the workplace. As we’ll see in the next section of the chapter, our performance measurement systems have focused almost exclusively on financial measures, and more specifically, they’ve relied on counting tangible things—inventory, monetary exchanges, and so on. However, the new economy, with its premium on intangible value creating mechanisms, demands more from our performance measurement systems. Today’s system must have the capabilities to identify, describe, monitor, and fully harness the intangible assets driving organizational success. As we will see throughout this book, particularly in our discussion of the Employee Learning and Growth perspective, the Balanced Scorecard provides a voice of strength and clarity to intangible assets, allowing organizations to benefit fully from their astronomical potential.6

Financial Measurement and Its Limitations

Despite the changes in how value is created today, estimates suggest that 60% of metrics used for decision-making, resource allocation, and performance management in the typical organization are still financial in nature.7 It seems that for all we’ve learned, we remain stuck in the quagmire of financial measurement. Perhaps tradition—where the measurement of all organizations has been financial—is serving as a guide unwilling to yield to the present realities. Bookkeeping records used to facilitate financial transactions can literally be traced back thousands of years. At the turn of the twentieth century, financial measurement innovations were critical to the success of the early industrial giants like General Motors. The financial measures created at that time were the perfect complement to the machine-like nature of the corporate entities and management philosophy of the day. Competition was ruled by scope and economies of scale with financial measures providing the yardsticks of success.

Over the last one hundred years, we’ve come a long way in our measurement of financial success, and the work of financial professionals is to be commended. Innovations such as Activity-Based Costing (ABC) and Economic Value Added (EVA) have helped many organizations make more informed decisions. However, as we begin the twenty-first century, many are questioning our almost exclusive reliance on financial measures of performance, suggesting that these measures may be better served to report on the stewardship of money entrusted to management’s care rather than a means to chart the organization’s future. Here are some of the criticisms levied against the over-abundant use of financial measures:

• Not consistent with today’s business realities. Tangible assets no longer serve as the primary driver of enterprise value. It is employee knowledge (the assets that ride up and down the elevators), customer relationships, and cultures of innovation and change that create the bulk of value provided by any organization—in other words, intangible assets. If you buy a share of Microsoft’s stock, are you buying buildings and machines? No, you’re buying a promise of value to be delivered by innovative people striving to continually discover new computing pathways. Traditional financial measures were designed to compare previous periods based on internal standards of performance. These metrics are of little assistance in providing early indications of customer, quality, or employee problems or opportunities.

• Driving by rear view mirror. This is perhaps the classic criticism of financial metrics. You may be highly efficient in your operations one month, quarter, or even year. But does that signal ongoing financial success? As you know, anything can, and does, happen. A history of strong financial results is not indicative of future performance. As an illustration of this rear view mirror principle, look no further than the storied Forbes lists, regaling spellbound executives since 1917 with drool-inducing tales of heroic capitalism. Forbes published a 70th anniversary issue in 1987, and of the 100 companies that graced the inaugural roll, 61 were dead and gone, with only memories of their former fiscal glory remaining. Of the 39 companies that existed, many were on life support, with only 18 still named on the list. Similar statistics can be trotted out for the Standard and Poor’s 500 list of top companies. Forty years after it began in 1957, only 74 of the initial 500 companies existed. More than 80% failed to survive.8

• Tendency to reinforce functional silos. Working in mission-based organizations, you know the importance of collaboration in achieving your goals. Whether it’s improving literacy...