![]()

CHAPTER 1

The Financial Crisis and Housing Markets Worldwide

Similarities, Differences, and Comparisons

ASHOK BARDHAN

Fisher Center for Real Estate and Urban Economics, University of California–Berkeley

ROBERT H. EDELSTEIN

Haas School of Business, University of California–Berkeley

CYNTHIA A KROLL

Fisher Center for Real Estate and Urban Economics, University of California–Berkeley

INTRODUCTION

The subprime crisis that began in the United States in 2007 sent the world into a financial crisis of unprecedented proportions. In the United States, this was manifested in a boom-bust cycle in residential real estate markets, the near shutdown of the country's financial sector in 2008, and a prolonged Great Recession of a magnitude not seen in the country in any cycle since the 1930s. The contagion in financial markets became clear very quickly, affecting countries around the world, including Singapore, New Zealand, Iceland, the United Kingdom, Germany, France, and Ireland, to name a few, as well as a some fast-growing emerging economies to a lesser extent. Both residential and commercial real estate markets as well as stock, bond and asset markets appeared vulnerable worldwide.

As the dust settles, it has become clear that some countries were more vulnerable than others. In particular, impacts on residential real estate ranged from unnoticeable in countries as far apart as Australia, Germany, and Israel to sharp downturns in Ireland, Spain, and the United Kingdom; the latter group at a level that at a cursory glance appears to closely mirror the U.S. experience. This book was conceived for the purpose of examining if and how the contagion spread to housing markets throughout the world, what were the paths and transmission mechanisms by which it spread (through financial markets, directly through global real estate markets), and what was the institutional and regulatory context in which policy measures were adopted in response to the spreading financial crisis. The timeline in most of the papers in this volume covers the period starting with the run-up prior to the crisis, the unfolding months of the crisis itself, and the post-crisis recovery period up to the present time (summer 2011). The widely varying experiences of both the housing and mortgage markets in the countries described here provide evidence of the complex interplay of the roles of economic conditions, the institutional setting, regulatory framework and policy responses in directing and responding to the flow of the catastrophe.

The financial crisis was global; housing markets are local; and the primary geographic unit of analysis in the chapters in this book is national, albeit with numerous examples of subregional and urban housing markets in those countries. The institutional structure of housing markets and the policy domain in most countries is national, as was the political and economic response to the crisis. It is the interaction of the global linkages of the crisis, the economic fundamentals at the local and national level, and the policy issues being played out on the national stage that is the recurring theme of this book.

The book is organized in five sections, and each primarily groups together nations along geographic lines, although there are also other shared characteristics among the national market settings in each section. Part I is devoted to the housing market experience of the United States, as the epicenter of the global financial crisis (hereafter referred to as GFC). Part II includes chapters on six different European countries that experienced widely varying effects from the financial crisis, ranging from Germany, which continued its long-term but gradual downward trend in home sales and prices; to Denmark and the Netherlands, which, although affected, were able to contain the impact and did not need banking bailouts; to Ireland, Spain, and the United Kingdom, each of which experienced different combinations of financial and housing market woes.

Part III includes three chapters on Eastern European transition economies. Two of the chapters examine various aspects of the housing market and mortgage finance system in Russia, while the third describes the transformation of the Serbian housing market since the political situation stabilized at the beginning of the twenty-first century.

Part IV is divided into two sections. The first consists of papers on the largest Asian economies. Two chapters look at two critical urban housing markets—Beijing and Shanghai—and the financial system in the People's Republic of China. Two other chapters analyze the housing market and financial system in India, one focusing on the transformation of the mortgage finance system and its implications for housing India's population with all of its diverse needs, and the other focusing in more detail on the evolution of its housing market and its experience during the GFC. This subsection of Part IV is rounded out by a paper describing the Japanese experience over a series of real estate cycles and economic challenges that began long before the GFC and continue through to the present day.

The remainder of Part IV includes chapters on other, smaller Asian markets. In terms of institutional setting, Hong Kong, Taiwan, Singapore, and Korea are even more diverse than the European markets described in Part II. However, these countries all came into the GFC after enduring the common and painful experience of the Asian Financial Crisis (hereafter referred to as AFC) more than a decade earlier. Each chapter describes not only the GFC from the country's perspective but also the manifestations of the current crisis in comparison to the AFC.

Part V is the only section of the book that is not based on a common geographic region. Instead, this section covers four countries from around the globe—Australia, Brazil, Canada, and Israel—whose housing markets showed various levels of immunity to the consequences and contagion effects of the GFC.

In this chapter, we take the liberty of briefly summarizing some of the key points of each paper by the contributors in this volume and draw on their research, as well as on some other key studies that have provided a comparative context for examining housing markets and housing finance across countries, in order to describe the commonalities and differences in the behavior of these markets in the context of the GFC. We conclude the chapter with our observations on some common knowledge gleaned and lessons learned regarding the factors that made housing markets and financial systems in different countries more or less vulnerable to the consequences of the GFC, with particular attention to economic structure and institutions, role of the public sector, global financial and economic linkages, housing market specifics, and regulatory stance as key elements.

A COMPARATIVE LOOK AT HOUSING AND FINANCIAL SYSTEMS

Earlier research has compared housing finance systems across different parts of the globe and housing price trends before and during the GFC. Green and Wachter (2005), Ben-Shahar, Leung, and Ong (2009), Kim and Renaud (2009), Duca, Muellbauer, and Murphy (2010), and Lea (2010 and 2011) deal with a selective, comparative analysis of mortgage and housing markets worldwide. To our knowledge, our book stands out in two respects: (1) It is set against the backdrop of the financial crisis, which helps to bring out the differences and commonalities of markets and institutions across the world in a vivid fashion; and (2) it is very broadly representative, with examples from every major continent and most significant markets, particularly those with important distinguishing characteristics and structural attributes in their housing systems.

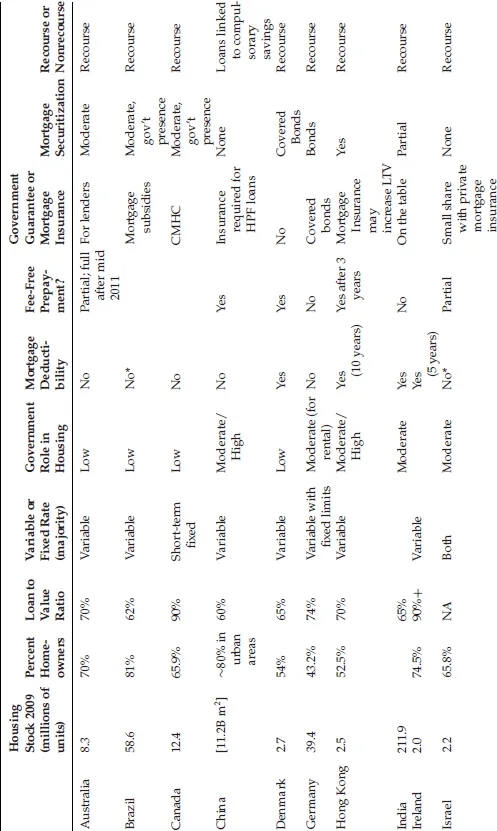

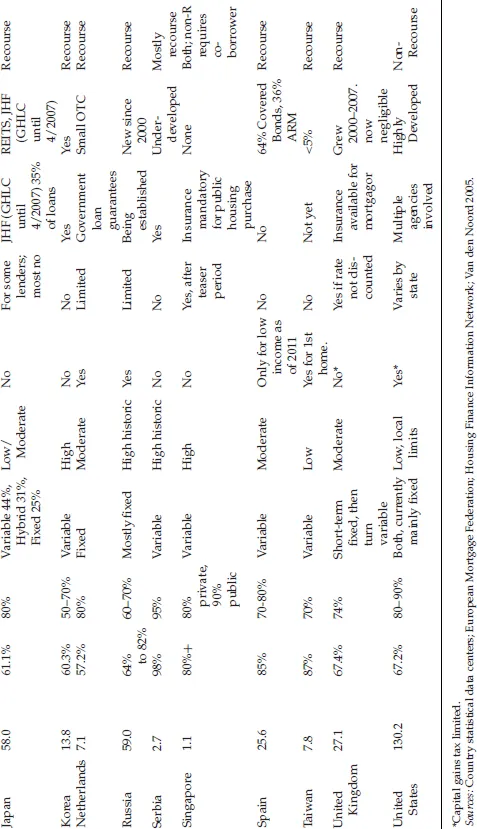

The countries examined in this volume vary along several important dimensions, including size of the economy, role of government in economic and housing affairs, structure of financial institutions, the role of the private sector in housing production and finance, and the history of the housing market. Several of these dimensions are summarized in Exhibit 1.1. The group of countries includes two city states with a housing base on the order of a million units, small countries with approximately 2 to 8 million housing units, mid-sized countries with housing stock in the range of 12 to 30 million units, and larger countries, with stock ranging from close to 60 million to over 200 million. Owner occupancy ranges from only 42 percent in Germany to close to 100 percent in Serbia, with many countries averaging between 60 and 70 percent.

Exhibit 1.1 Comparative Data on Housing Market and Housing Finance Systems

The institutional setting also varies widely, with some governments heavily involved in either the ownership, control, and distribution of land (as in China), the construction of housing (Singapore), or the privatization of previously public housing stock (Serbia and Russia), while others rely primarily on market mechanisms and the private sector to take the lead in housing construction and sales. In some countries the government role involves encouraging homeownership through everything from subsidized transfer of government property to individual households, to tax relief from interest payments, down-payment support, or capital gains relief. Other countries focus instead on “social housing,” with an emphasis on using government subsidies for the rental sector. Similarly, in some countries the mortgage financing system for housing is largely government-operated or heavily regulated, whereas others provide extensive leeway to the private sector, and even opportunities for foreign lenders. The capital market for securitized mortgages is another dimension along which there is a great deal of variation. These institutional differences set the stage for the degree of vulnerability of individual housing and mortgage markets, the degree and direction of a country's policy response, and the extent of intervention in financial and real estate markets once the GFC began.

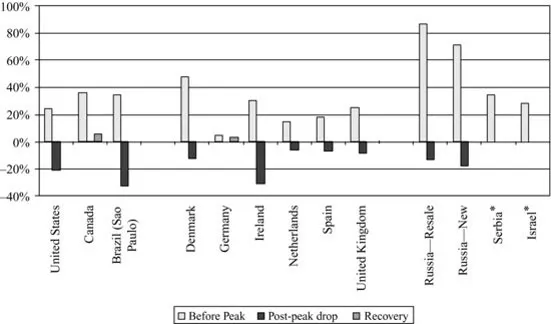

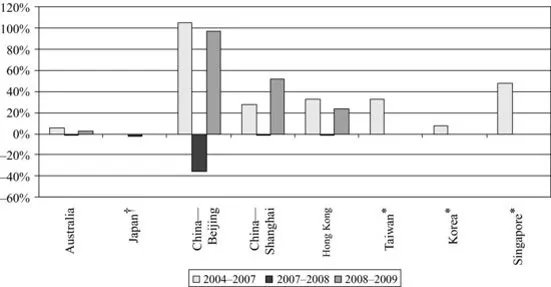

THE FINANCIAL CRISIS AND GLOBAL HOUSING MARKETS

It is not surprising, given the local and national attributes of housing markets, that the GFC had different degrees of impact around the world. Exhibits 1.2 and 1.3 provide a rough comparison of housing market reaction globally, by focusing on price gains during the run-up to the peak in a country's housing market, price declines in the period just following the GFC, and any subsequent price gains, through 2009. The comparison is tentative because housing market statistics are not directly comparable across countries, with measures varying from indices drawn from repeat home sales, to time series of average or median prices. What is most relevant here is the direction of change, rather than small differences among trends. The United States did not have the highest rate of growth in housing prices in the period leading up to the crisis, nor the highest rate of decline in prices in 2008 and 2009, but the pattern of price build-up and decline is apparent. Most European markets also had price increases in the mid-2000s, followed by a price decline, but only in Ireland did the magnitude of the decline come close to that of the United States. Canada had a much milder drop, and was already seeing price recovery in 2009. Sao Paulo, in Brazil, had large gains and losses, although these were explained as much by a change in mix of homes sold as by the GFC, as described later. Two other markets on the periphery of the European sphere, Serbia and Israel, have not as yet shown any price downturn.

The Asian and Pacific markets had a very different profile from that of the United States and most of Europe. With the exception of Japan, which did not participate in the upswing at all, all Asia/Pacific markets that had a downturn during the GFC have had recovery upturns by now. In general, the urban or city state markets (Beijing, Shanghai, Hong Kong, and Singapore) showed much larger percentage upswings. Beijing and Shanghai had relatively large downturns as well, but these were smaller than the previous price gains and were quickly counterbalanced by price recovery in 2009. The greater volatility of these concentrated urban markets is consistent with the experience in the United States, where the largest gains and losses were concentrated in a few metropolitan areas, and much of the rest of the country experienced much milder price changes. Australia had much smaller gains and dips, and as with many parts of Asia was also experiencing housing market recovery by 2009. The booming cities of India, such as Mumbai, Delhi, Bangalore, and others, saw significant price rises in the 1990s, continuing through in the twenty-first century, as well, as a result of economic growth, pent-up demand, and supply-side restraints, and, for most, the GFC proved to be a minor hiccup.

ONE WORLD, ONE CRISIS? DIFFERENCES AND SIMILARITIES BY REGION AND COUNTRY

Each of these chapters highlights the institutional and economic setting of the country and the interaction of these factors with the housing market and the global financial conditions.

United States

Bardhan, Edelstein, and Kroll highlight the factors that led the country into a situation where the financial sector and housing sector interacted to produce two bubbles that fed on each other. They describe the genesis and evolution of the crisis, including the role of federal policy in keeping rates low, the investor response leading to exotic and risky financial instruments, predatory lending, rampant speculation, the rise of household debt, leverage and other factors. They also present a cross-state analysis revealing the role of regulatory laxness in the growth of subprime mortgages and foreclosures. They point out that U.S. policy was reactive rather than proactive, and took many months to address the housing side of the problem. The crisis has led to a reworking of the mortgage finance system, with some stricter contro...