![]()

PART One

Risk Management Approaches and Systems

![]()

CHAPTER 1

Business Risk in Banking

1.1 CONCEPT OF RISK

Risk in banking refers to the potential loss that may occur to a bank due to the happening of some events. Risk arises because of the uncertainty associated with events that have the potential to cause loss; an event may or may not occur, but if it occurs it causes loss. Risk is primarily embedded in financial transactions, though it can occur due to other operational events. It is measured in terms of the likely change in the value of an asset or the price of a security/commodity with regard to its current value or price. When we deal with risks in banking, we are primarily concerned with the possibilities of loss or decline in asset values from events like economic slowdowns, unfavorable fiscal and trade policy changes, adverse movement in interest rates or exchange rates, or falling equity prices. Banking risk has two dimensions: the uncertainty—whether an adverse event will happen or not—and the intensity of the impact—what will be the likely loss if the event happens (that is, if the risk materializes). Risk is essentially a group characteristic; it is not to be perceived as an individual or an isolated event. When a series of transactions are executed, a few of them may cause loss to the bank, though all of them carry the risk element.

1.2 BROAD CATEGORIES OF RISKS

Banks face two broad categories of risks: business risks and control risks. Business risks are inherent in the business and arise due to the occurrence of some expected or unexpected events in the economy or the financial markets, which cause erosion in asset values and, consequently, reduction in the intrinsic value of the bank. The money lent to a customer may not be repaid due to the failure of the business, or the market value of bonds or equities may decline due to the rising interest rate, or a forward contract to purchase foreign currency at a contracted rate may not be settled by the counterparty on the due date as the exchange rate has become unfavorable. These types of business risks are inherent in the business of banks. Credit risk, market risk, and operational risk, the three major business risks, have several dimensions, and therefore require an elaborate treatment. These risks are dealt with in greater detail later in this book.

Control risk refers to the inadequacy or failure of control that is intended to check the intensity or volume of business risk or prevent the proliferation of operational risk. Inadequacy in control arises due to the lack of understanding of the entire business process, while failure in control arises due to complacency or laxity on the part of the control staff. Let us suppose that the bank has estimated an average loan loss of 5 percent in its credit portfolio as per its internal model. The actual loan loss will be more than 5 percent, if adequate control is not exercised on credit sanction and credit supervision. If the loan sanction standard is compromised or collateral is not obtained in accordance with the prescribed norms, or laxity in control prevails over the supervision of borrowers’ business and accounts, the level of credit risk will be higher than that estimated under an internal model. Business risk will be higher if the control system fails to detect the irregularities in time. Banks must have an elaborate control system that spreads over credit, investment, and other operational areas.

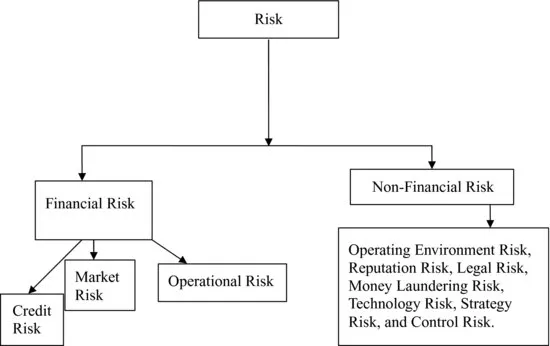

The risks can also be classified into two other categories: financial risk and nonfinancial risk. Financial risks inflict loss on a bank directly, while nonfinancial risks affect the financial condition in an indirect manner. Credit, market, and operational risks are financial risks since they have a direct impact on the financial position of a bank. For example, if the market value of a bond purchased by the bank falls below the acquisition price, the bank will incur a loss if it sells the bond in the market. Reputation risk, legal risk, money laundering risk, technology risk, and control risk are nonfinancial risks because they adversely affect the bank in an indirect manner. Business opportunities lost, and consequently income lost, on account of negative publicity against a bank that impairs its reputation, or compensation paid to a customer in response to an unfavorable decree from a court of law against the bank, are examples of nonfinancial risk.

The impact of financial risks can be measured in numerical terms, while that of nonfinancial risks is most often not quantifiable. The impact of nonfinancial risks can be assessed through scenario analysis and indicated in terms of severity such as low, moderate, and high. Business risks comprise both financial and nonfinancial categories of risks, whereas control risk is only a nonfinancial risk as it impacts a bank in an indirect way. Consequently, risk management in banking is concerned with the assessment and control of both financial and nonfinancial risks. Bank regulators and supervisors caution banks about the dangers of ignoring risks and want them to understand the implications of financial and nonfinancial risks and develop methods to assess and manage those risks.

A typical risk can occur from multiple sources. For example, credit risk occurs from loans and advances, investments, off-balance-sheet items including derivative products, and cross-border exposures. Likewise, market risk occurs from changes in the interest rate that affects banking book and trading book exposures, changes in bond/equity/commodity prices, and change in the foreign exchange rate. The boundaries between different types of risks are sometimes blurred. A loss due to shrinking credit spreads may be either credit risk loss or market risk loss. Credit risk and market risk may sometimes overlap. Capital risk and earning risk are not risks by themselves for a bank. They are the two financial parameters that absorb the ultimate loss from the materialization of risks. The minimization (or optimization) of the impact of business risk and control risk on the capital and earnings of banks is the ultimate goal of risk management.

Different types of financial and nonfinancial risks are shown in Figure 1.1.

1.3 CREDIT RISK

What Is Credit Risk?

The Basel Committee on Banking Supervision (BCBS) has defined credit risk as the potential that a bank borrower or counterparty will fail to meet its obligations in accordance with the agreed terms.1 Credit risk, also called default risk, arises from the uncertainty involved in repayment of the bank's dues by the counterparty on time. Credit risk has two dimensions: the possibility of default by the counterparty on the bank's credit exposure and the amount of loss that the bank may suffer when the default occurs. The default usually occurs because of inadequacy of income or failure of business. But often it may be willful, because the counterparty is unwilling to meet its obligations though it has adequate income. Credit risk also signifies a decline in the values of credit assets before default that arises from deterioration in portfolio or individual credit quality.

What Does Credit Risk Denote?

Credit risk denotes the volatility of losses on credit exposures in two forms: the loss in the value of the credit asset and the loss in the earnings from the credit. Let us assume that a bank has lent U.S. $1 million to a customer at 5 percent annual interest repayable in eight quarterly installments beginning one year after the date of the loan. The credit risk on the exposure of U.S. $1 million is denoted by a risk grade, either derived through the bank's internal model or taken from an outside rating agency. The rating assigned to the borrower will reveal the level of risk associated with the exposure, such as high risk, moderate risk, or low risk. The rating will give an idea of whether the counterparty is likely to default on its repayment obligation over the life of the loan or within some specified time horizon. The amount of loss that the bank may suffer on the exposure will have to be assessed separately through the risk measurement model. In the event of default by the counterparty to repay the amount of U.S. $1 million together with the interest on the due dates, either in part or in full, credit risk has actually materialized. It does not matter whether the default is intentional or unintentional. If the counterparty does not pay the installments at the contracted interest rate, the loss suffered by the bank will include both principal and interest. But if he or she agrees to repay the principal and requests the bank to waive the interest amount due on the loan, partly or fully, due to the inadequacy of income, loss of earning on the credit has occurred. Thus, credit risk denotes uncertainty in the recovery of the principal value of the loan and the contracted interest amount, either in part or in full.

What Is Intermediate Credit Risk?

Credit risk occurs in different intensities. The most severe is the risk of default in repayment of the principal and the interest. An intermediate credit risk occurs when the creditworthiness of the counterparty deteriorates causing a decline in the market value of the credit exposure. In such a situation, credit risk appears in the form of a rating downgrade. When the credit quality declines, credit risk may be deemed to have materialized before the occurrence of default. The extent of credit risk can be assessed from the current risk grade assigned to the exposure. In a market, where loans are traded between lending banks, deterioration in credit quality will fetch a lower amount when the asset is put up for sale. The estimated loss in the asset value before default is an intermediate form of credit risk.

What Is Country Risk?

Another element of credit risk, which arises from cross-border lending and investment, is “country risk.” The latter term denotes the possibility that a sovereign country is unable or unwilling to meet its commitments to foreign lenders. The risk is greater in countries where the economy is weak and the financial system is fragile and not well regulated. Country risk arises from exposures both to the sovereign government and the private borrowers who are resident in that country and have borrowed money from banks located in other countries. The default on obligations can arise due to the restrictions imposed by the government for conversion of domestic currency into foreign currency on account of depletion in foreign currency reserves, or it can arise from very adverse movement in the foreign currency exchange rate that increases substantially the amount repayable in domestic currency on foreign currency loans. The default can also occur due to political changes or economic policy changes. Sometimes, the government itself may renege on its liability, or the borrower located in the foreign country may refuse to repay.

1.4 MARKET RISK

What Is Market Risk?

BCBS has defined market risk as:

The risk of losses in on or off-balance-sheet positions arising from movement in market prices. The risks subject to this requirement are:

- The risk pertaining to interest rate related instruments and equities in the trading book.

- Foreign exchange risk and commodities risk throughout the bank.2

Market risk refers to the possibility of decline in the market values of assets or earnings that arise from changes in market variables. Market risk arises from financial transactions undertaken by banks to build up inventories of financial assets or take up positions deliberately in expectation of favorable movements in interest rates, exchange rates, and bond/equity prices to make gains. Banks may build up positions in securities and shares or off-balance-sheet items, like forward contracts in foreign exchange or futures in commodities, and so on.

1.5 OPERATIONAL RISK

What Is Operational Risk?

BCBS has defined operational risk “as the risk of loss resulting from inadequate or failed internal processes, people and systems or from external events. This definition includes legal risk, but excludes strategic and reputation risk.”3 Operational risk is sometimes perceived as “residual risk” and arises in almost all departments of the bank—credit department, investment and funds department, treasury, information technology department, and so on.

Causes of Operational Risk

The causes of operational risks are many, and it is difficult to prepare a complete list of the causes because sometimes the risk occurs from unknown and unexpected sources. If we are clear about the causes and sources of credit and market risks, we can understand why risks emerging from failed people, processes and systems, and from external events are grouped under operational risk. Risks from people arise on account of incompetency or wrong positioning of personnel and misuse of powers. The bank faces risks if the staff handling certain transactions do not have adequate knowledge or technical skills to handle those transactions, or the staff who are known to have doubtful honesty and integrity are placed in sensitive areas of operations, or the staff misuse their loan sanction powers. The employees may commit fraud by themselves or in collusion with outsiders, or they can access computers without authorization and manipulate or alter data and information. In all these situations, the bank will incur financial loss from the dishonesty and irregular actions of its employees.

Process-related risks arise from possibilities of errors in information processing, data transmission, data retrieval, or inaccuracy of ...