eBook - ePub

Teaching Money Applications to Make Mathematics Meaningful, Grades 7-12

Elizabeth Marquez, Paul Westbrook

This is a test

Share book

- 168 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Teaching Money Applications to Make Mathematics Meaningful, Grades 7-12

Elizabeth Marquez, Paul Westbrook

Book details

Book preview

Table of contents

Citations

About This Book

Offers teachers engaging ways to weave real-life financial issues and personal money management into NCTM standards–based secondary mathematics lessons while meeting equity and accountability requirements.

Frequently asked questions

How do I cancel my subscription?

Can/how do I download books?

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

What is the difference between the pricing plans?

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

What is Perlego?

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Do you support text-to-speech?

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Is Teaching Money Applications to Make Mathematics Meaningful, Grades 7-12 an online PDF/ePUB?

Yes, you can access Teaching Money Applications to Make Mathematics Meaningful, Grades 7-12 by Elizabeth Marquez, Paul Westbrook in PDF and/or ePUB format, as well as other popular books in Education & Teaching Mathematics. We have over one million books available in our catalogue for you to explore.

Information

1

Cars, Cars, and More Cars

Paying for Your Wheels

When buying a used car, punch the buttons on the radio. If all the stations are rock and roll, there’s a good chance the transmission is shot.

—Larry Lujack, Chicago Disc Jockey

Buying cars is one of the most engaging American activities. As such, it is a subject that should hold students’ interest enough to teach them some useful math. In doing so, there are a number of applications that address the National Council of Teachers of Mathematics (NCTM) standards.

NCTM STANDARDS APPLIED IN THIS CHAPTER

Content

- Number and Operations. Understand meanings of operations and how they relate to one another; compute fluently and make reasonable estimates.

- Algebra. Understand patterns, relations, and functions; represent and analyze mathematical situations and structures using algebraic symbols; use mathematical models to represent and understand quantitative relationships.

- Data Analysis and Probability. Select and use appropriate statistical methods to analyze data.

Process

- Problem Solving; Reasoning and Proof; Communication; Connections; Representation

BACKGROUND: BASICS OF BUYING CARS

Cars are one of the most expensive and important things we buy. We’ve all done it, either buying a new or used one, buying it outright, taking a loan, or leasing. And we will continue to do it for many more years.

The particular choice of car model we make can enhance our personal image, as well as affect our pocketbook, like few purchases we make in our lives. Because the cars we buy, in total, will be one of the most expensive items we will purchase over our lifetimes, it offers a chance to save money if we’re intelligent about it.

No, we’re not going to talk here about how to haggle with car dealers. Instead, we’re going to approach the subject from a mathematical point of view. In doing so, it is hoped that students will become more aware of the amount of money they will spend on these purchases, this year and over their lifetimes.

TEACHING EXAMPLE 1.1

Car Costs

NCTM Content Standards

Numbers and Operations; Algebra

Process Standards

Problem Solving; Reasoning and Proof; Communication; Connections; Representation

Money Applications

Students will

- Calculate the total cost of owning a car

- Calculate monthly car loan payments

- Calculate the depreciation of cars over time

Discussion and Questions

What a Deal! $12,500

2003 Honda Civic EX Coupe 2d

ABS, Air Conditioning, Cruise

Control, Single Compact Disc, Dual

Front Airbags, FWD, Power Door

Locks, Power Steering, Power

Windows, AM/FM Stereo,

Tilt Wheel,

Only 40,000 miles,

Original Owner, Kept in Garage,

Service Records Available

ABS, Air Conditioning, Cruise

Control, Single Compact Disc, Dual

Front Airbags, FWD, Power Door

Locks, Power Steering, Power

Windows, AM/FM Stereo,

Tilt Wheel,

Only 40,000 miles,

Original Owner, Kept in Garage,

Service Records Available

Photo by Paul Westbrook.

1. Ask students how much they think the car (in the above ad) would cost them on a monthly basis, considering all possible costs, including a $10,000 loan. Give them time to think about it, jot down their estimate on a piece of paper, and explain how they reached their estimate. Have them pair-share results, reaching consensus on expenses and the monthly amount of each. Ask a few pairs to present their results to the class. Then share the following facts to see how close their estimates were to those of Edmunds, one of America’s most authoritative sources of automotive information.

Monthly Auto Expenses

- $270 per month for the car loan. (Assuming $10,000 loan for 48 months: Range: good credit, 4% rate, and $226 a month or, if bad credit, 21% rate and $310 a month; let’s say somewhere in between, about $270 a month)

- $200 per month for auto insurance. (On average, about $2,400 annually or $200 a month, although it could be as high as $5,000 a year or $417 a month)

- $80 per month for maintenance. (On average, about $80 a month—oil change, tires, etc.)

- $107 per month for fuel. (On average, 1,000 miles a month for teens and assuming regular gas at $2.68 per gallon and MPG of 25)

- $7 per month for registration/license/inspection.

SOURCE: http://www.edmunds.com.

Ask students to find the minimum and maximum monthly cost of owning a car, based on the assumptions in the list.

They should tell you that the cost is anywhere from $600 to $900 per month, a fact that will probably surprise them. Make use of that surprise to follow up with this question: What are some of the ways that the cost of a car can be reduced, short of having your parents pick up the tab? Some possible answers are the following:

- Buy a car with a clean history and a brand name known for reliability.

- Make as large a down payment as possible (at least 20%) and take a loan for at most 48 months (so you never owe more than the car is worth).

- Maintain a history of safe driving so insurance will be minimized.

- Avoid speeding, rapid acceleration, and braking. In addition to putting you and others at risk, driving carelessly can increase MPG by 5% around town and by 33% at highway speeds.

- Each car reaches its optimal fuel economy at different speeds, usually decreasing after 60 MPH.

- Remove excess weight—an extra 100 lbs in your car could reduce MPG by as much as 2%.

- Use cruise control on the highway—maintaining a constant speed saves gas.

- Keep your tires filled at proper pressure and your car engine tuned.

2. Tell students that many people take out a loan in order to buy a car and that the interest rate for the loan depends on your credit history and prevailing interest rates at the time of the loan.

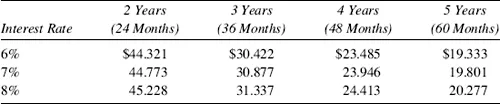

Show them this table of monthly payments based on the length of the loan and the interest rate and how to apply it:

Table 1.1 Monthly Payments per $1,000

To use Table 1.1, multiply the monthly figure by the number of $1,000s borrowed. For instance, say you wanted to buy a car for $17,000, put 20% down ($3,400), and financed the remaining $13,600 with a 36-month loan at a 7% interest rate. Multiply the amount in Table 1.1 by 13.6: $30.877 times 13.6 is $419.93 (rounded to two decimal places). Therefore, the monthly payment for this car loan would be about $420. This would be the payment for each of the 36 months.

Although this is the most common method of calculating car loan payments and may be the only loan type available, some loans are different. Some have a declining monthly payment because the interest payment is recalculated as the principal of the loan is paid off.

3. Tell students that as soon as a car is driven off the dealer’s lot, it declines in value. Ask them to guess how much it declines in value during the first years that you own it, then share the following table.

Table 1.2 Depreciation of a Car per Years of Use

| First Year | 30% |

| Second Year | 25% |

| Third Year | 20% |

| Fourth Year | 15% |

| Fifth Year | 10% |

Explain that although some cars depreciate faster, or slower, it has been calculated that the value of an average car in good repair and with average mileage (about 12,000 miles a year) depreciates roughly as shown in Table 1.2. ...