eBook - ePub

Return on Investment Manual

Tools and Applications for Managing Financial Results

Robert Rachlin

This is a test

Share book

- 352 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Return on Investment Manual

Tools and Applications for Managing Financial Results

Robert Rachlin

Book details

Book preview

Table of contents

Citations

About This Book

This is a book for presidents of all-size businesses, financial managers, and controllers, on how various decisions can be used to increase an owner's return. Each chapter focuses on specific strategies and their application and relation to risk analysis, and managing key ratios.

Frequently asked questions

How do I cancel my subscription?

Can/how do I download books?

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

What is the difference between the pricing plans?

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

What is Perlego?

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Do you support text-to-speech?

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Is Return on Investment Manual an online PDF/ePUB?

Yes, you can access Return on Investment Manual by Robert Rachlin in PDF and/or ePUB format, as well as other popular books in Commerce & Commerce Général. We have over one million books available in our catalogue for you to explore.

Information

1

Key Return on Investment Considerations for Developing Effective Decision-Making Strategies

As competition becomes tougher, small versus medium-sized companies, large versus large companies, products versus products, and markets versus markets, it becomes evident that success is largely based on financial performance. One universally accepted performance guide is return on investment. Why?

Return on investment (ROI) is the culmination of all activities of a company. For example, when expenses are incurred with no corresponding revenue benefits, profits decrease, as well as return on investment rates. When human resources are unproductive, profits decline, and return on investment rates decline. When capital investments do not live up to their expectations, declining return on investment rates can be expected. When too much money is expended for working assets (i.e., accounts receivable and inventories) without gains in revenues, both profits and return on investment rates will show downward trends. When marketing segments of a company fail to produce expected revenues and reasonable control of accounts receivable and inventories, overall company performance is affected.

These and many other factors tend to present challenges to operating managers of all sizes of companies. Whether a company is small, medium, or large, the common thread prevails—a manager must manage the company’s resources. The ability to do so will result in higher return rates. One can safely say that all activities of any organization ultimately have some impact on return on investment rates. The challenge to business executives is to manage in such a way that positive decisions outweigh negative decisions. Since return on investment results are looked upon as how well a company is managed and its potential expectations for the future, both private and public owners of companies look closely at these results.

Not only will the ROI concept measure the impact of decisions, but it will also reflect the many internal and external factors used to accomplish growth and financial objectives. For example, interest rates, labor and material costs, tax rates and changes, capital spending, capacity utilization, money supply, technological changes, market share, and industry growth are just a few of the contributing factors and decisions that ultimately end up in one or more parts of the return on investment equation, or

The Basic ROI Equation

In addition, many of these factors involve determining certain risk objectives and the ability to carry out these objectives with internal management skills.

The success or failure of an organization lies within the ability of internal management to make sound and profitable decisions and is usually within a business executive’s control. It is not always external factors that cause companies to earn less than expected on monies invested in the business. A key role is also played by such major internal decisions as allocating resources between major segments of the business to maximize earnings and growth, providing adequate funds at the lowest possible cost, providing adequate flows of funds in future years through long-term investments, developing human resource skills to coincide with the needs of the organization, and establishing controls, reviews, and reporting processes needed to monitor the business. It is obvious that the concept of return on investment is impacted by a series of external and internal factors, as well as the strategies employed in managing a business.

Why a Business Needs to Maintain an Adequate Return on Investment Rate

A survival test of any business is how well it can cover its risks and provide an adequate return to its owners. Three major ways of accomplishing this objective follow:

• Utilizing the funds of the company to ensure maximization of long-term profits given anticipated levels of risk.

• Maximizing other resources of the company to ensure that it obtains the highest possible return without assuming any excessive undue risks.

• Allocating resources between segments of the organization to produce the highest possible return on investment.

To increase owners’ wealth, an operating manager must simultaneously accomplish the following two activities:

• Maximize profits, which is accomplished by increasing revenues, increasing margins, and decreasing operational expenses.

• Minimize investment, which is accomplished by increasing inventory turnover, speeding up the collection of receivables, and minimizing unprofitable investments in property, plant, and equipment.

Although these activities seem fundamental, accomplishing them is not always possible. The internal and external environments are not always favorable. Most well-managed companies are continuously aiming to accomplish these two activities, but sometimes circumstances do not create the perfect environment. When both activities are accomplished, companies prosper and growth occurs. Nevertheless, one must keep in mind that other factors, such as cash flow, human resources, economic environment, market share, product quality, and the product life cycle also play a major role in the success or failure. From an ROI point of view, however, maximizing profits and minimizing investment are paramount.

It is important to recognize that ROI concepts will never replace sound business judgments but, instead will aid in supporting or raising questions as to the validity of these business judgment factors. Return on investment is what it is intended to be: a financial management tool that defines the problem, evaluates and weighs possible alternative investments, and brings into focus those qualitative factors affecting the decision that may not be expressed in quantitative terms.

The Vital Role of ROI

The concept of ROI assists management in maintaining the necessary growth for survival. It assists in highlighting historical performance and enables managers to use such data in projecting future performance. This use is easily seen in the evaluation of capital investments where future cash flows are projected and used to evaluate expected ROI. In addition, future overall company financial objectives are established using historical data as a base. Because ROI is recognized as an acceptable measurement technique, its value is unquestioned. It is used by investors, the business community, the financial community, economists, and students of business techniques and applications.

ROI is also important because it provides management with an easy and understandable mathematical calculation. This calculation is used to enhance the decision-making process through better planning, by assisting in the evaluation of investment opportunities, by evaluating management performance, and by evaluating the overall position of the company in relation to the marketplace.

What Is ROI?

Return on investment is a management tool that systematically measures both past performance and future investment decisions. In other words, it is a financial tool that measures historical and anticipated results. ROI rests on the assumption that the best alternative investment is one that maximizes profits.

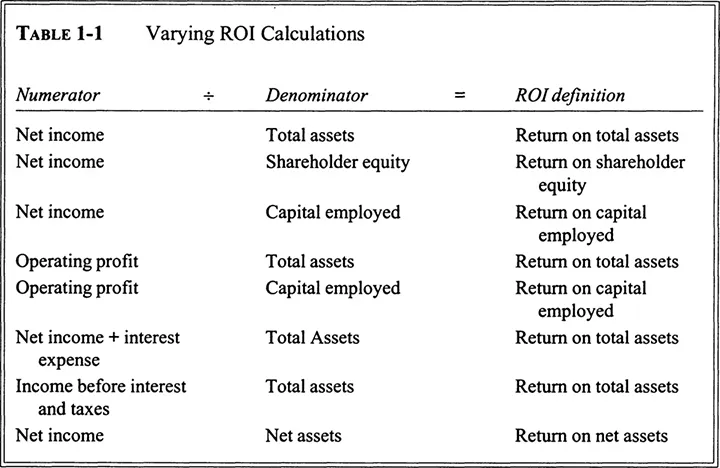

The definition of ROI depends upon the investment base used. If equity is used as the denominator base, the definition is “return on equity.” If assets are used as the base, the definition is “return on assets.” The numerator is the profit expected from that investment, such as before taxes or after taxes. Like the investment base, it can vary. The ratio for return on investment is earnings divided by investment.

Table 1-1 illustrates some of the variations that can exist and the differing titles used to describe the ROI concept. Note the various data used for the numerator and denominator. These are just a few of the examples of how return on investment is calculated. Therefore, ROI can be considered a generic term and must be specifically defined before calculations can be made. The key to remember is that the calculations must be consistent with historical data and with other comparative data. For example, you must be consistent with the same calculations when comparing return on assets of last year with those of this year. In addition, when trying to compare your own company’s results with industry standards, the same numerator and denominator must be used. Consistency of calculations is necessary to develop trends and to formulate company ROI objectives.

Five Key Reasons Why ROI Is Recommended

In today’s complex business environment, technological, economic, and competitive pressures tend to complicate managerial decision making. Return on investment provides management with an easy method of more effectively evaluating and communicating both past and anticipated future performance in an effort to increase growth and productivity. The ROI concept is unique in that it creates an atmosphere that is healthy for any organization. It defines a specific problem within the company, such as production efficiency, growing obsolescence of plant and machinery, lack of new product introductions, or decreasing share of market. Identifying problems is the first step toward solving them.

Once the problem is identified, alternatives are presented and weighed against each other. An action plan is developed to carry out the selected alternative, and the investment begins to materialize. Thus the ROI concept accomplishes many management tasks. The following list highlights why ROI is recommended and what the concept may do toward enhancing the decision-making process.

1. To force planning. Corporate management must have a plan, whether it be short term or long term, in order to measure efficiency and set goals.

2. To provide a basis for decision making. It takes certain decisions out of the realm of intuition into that of supportive and quantitative basis.

3. To evaluate investment opportunities. This can include not only initial capital investments but also the cost of additional working capital, the economic life of the investment, and the effect on company profitabil- ity. These investment opportunities will also include alternative investments or new product opportunities.

4. To aid in evaluating management performance. This includes performance of responsibility or profit-center heads, as well as total company performance against a common denominator or against planned measures of performance or predetermined objectives. It aids in eliminating inequities that might arise between managers or operating units resulting from differences in size and makeup of operations, that is, highly intensified capital operations versus distributive operations that may have very little capital investment. In addition, performance measurement can be used to evaluate management’s use of assets, cash flow, capital, equipment or other facilities, and internal control.

5. To measure responses to the marketplace. ROI measures management’s response to changes in the marketplace on pricing and need, as well as profitability and cost-reduction measures.

Managers must be involved at all levels of the organization, since ROI results occur from participation of all disciplines at all levels. It must be kept in mind that ROI is the concern of everyone involved in the business.

Major uses and Applications of ROI

That ROI is everyone’s concern is evidenced by the various uses an...