![]()

CHAPTER 1

Time Value of Money Toolbox

INTRODUCTION

One of the most important tools used in corporate finance is present value mathematics. These techniques are used to evaluate projects, make financial decisions, and evaluate investments. This chapter explains the time value of money, including present value (PV) and future value (FV), and how to adjust valuation formulas for various interest rate conventions. The chapter also presents several shortcuts to value a series of cash flows that fit a few standard patterns.

Readers should begin by developing an intuitive understanding of why it is necessary to incorporate interest rates into any analysis involving different periods of time. This understanding leads to a simple set of formulas expressing several time value relationships. After developing an intuitive understanding, readers will find it easy to incorporate interest rates by using the formulas for present value and/or future value in their analyses. Although this analysis shows up quite often, students will be relieved to find that its application is similar in most instances.

CASH FLOWS

Much of this text focuses on cash flows. Accountants realize the importance of cash; they devote an entire statement to the analysis of the sources and the uses of cash and cash balances. Accountants are interested in tracking cash flow in large measure because a company must have adequate cash to survive and prosper. Start-up companies may run out of cash before they have a chance to establish their businesses. Even established companies focus on both the profitability of the business and the flow of cash.

Corporate finance uses the same or similar measure of cash flow as accountants track in the statement of cash flows. However, this chapter and much of this book rely on cash flows for a completely different analysis and treat the cash flows from a project or even the cash flows of an entire corporation much like the cash flows of a bond. With a bond, investors transfer money today to borrowers, who in turn pay interest and eventually repay the loan. The size and timing of the cash payments and cash receipts determines the attractiveness of the bond investment. The techniques described herein will enable investors to evaluate the cash flows of any investment regardless of when the cash flows occur.

FUTURE VALUE

The future value of a cash flow is the value at some specified future time of a cash flow that occurs immediately. The concept of future value allows a company to decide whether cash flows that occur at two different times are equivalent. The way in which the two cash flows are equivalent is the subject of this chapter and will be explained subsequently.

Suppose that a company issues a bill that requires a customer to pay $100 upon receipt. The customer asks for extra time to pay. The company can borrow at an 8 percent interest rate. The company tells the customer that it will accept $102 instead in three months.

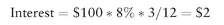

The company calculated the amount of cash it would accept that would be equivalent to getting $100 immediately. If the delay in receiving payment causes the company to borrow $100 for three months, the company must account for the interest on the loan. The formula for interest might look like Equation 1.1.

(1.1)

This is a formula for simple interest. Simple interest applies the interest rate to a principal balance for a period of time. The formula begins with the principal balance multiplied by the annual interest rate of 8 percent or $8. However, the rate applies only to three months or one-quarter of the year. Therefore, the interest for three months is $2, and the amount of the delayed payment would have to be $100 + 2 = $102 to compensate the company for the delay in payment.

The immediate payment of $100 in the preceding example is called the present value. The later payment is called a future value. As has been demonstrated, the two amounts are linked by the interest rate and the amount of time between the two payment dates.

In the preceding example, an 8 percent interest rate was used to determine an equivalent future payment from a present value. The method relied on a bank rate of interest. In fact, the company may still prefer the immediate payment of $100 to a deferred payment of $102. The deferred payment exposes the company to the risk of nonpayment for a longer period of time. The delay increases the amount the company must record as an account receivable in its financial statements and requires the company to include a liability on the balance sheet for the bank loan.

To address these concerns, the company may increase the interest rate used in determining the future value it will accept in lieu of the immediate payment of $100. Later, this text will explore factors that affect the interest rate or return that links present values to future values. This chapter, however, generally assumes that the company knows the required rate that incorporates these factors.

A more general formula for interest appears in

Equation 1.2.

(1.2)

where Time is the interval in years between the time of the present value and the time of the future value and Rate is the annual interest rate.

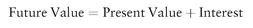

The value of a cash payment that occurs immediately is the present value. The future value of this cash flow is the present value plus interest, as set forth in Equation 1.3.

(1.3)

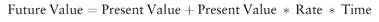

Substitute the formula for interest in Equation 1.2 into the formula for future value in Equation 1.3 to produce Equation 1.4.

(1.4)

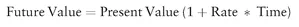

Finally, simplify Equation 1.4 by collecting terms. The result is Equation 1.5, which shows that the future value is related to the present value by a rate of interest that applies to the time from the present payments to the future payments.

(1.5)

Compound Interest

The formula for future value in Equation 1.5 is correct for short intervals of time, but most investments pay interest every three months, every six months, or annually. When investments pay interest between the time of the present value and the time ...