![]()

CHAPTER 1

CORPORATE GOVERNANCE

Rebecca T. McEnally, CFA

New Bern, North Carolina, U.S.A.

Kenneth Kim

Buffalo, New York, U.S.A.

LEARNING OUTCOMES

After completing this chapter, you will be able to do the following:

- Explain corporate governance, describe the objectives and core attributes of an effective corporate governance system, and evaluate whether a company’s corporate governance has those attributes.

- Compare major business forms and describe the conflicts of interest associated with each.

- Explain conflicts that arise in agency relationships, including manager-shareholder conflicts and director-shareholder conflicts.

- Describe responsibilities of the board of directors and explain qualifications and core competencies that an investment analyst should look for in the board of directors.

- Explain effective corporate governance practice as it relates to the board of directors, and evaluate the strengths and weaknesses of a company’s corporate governance practice.

- Describe elements of a company’s statement of corporate governance policies that investment analysts should assess.

- Explain the valuation implications of corporate governance.

1. INTRODUCTION

The modern corporation is a very efficient and effective means of raising capital, obtaining needed resources, and generating products and services. These and other advantages have caused the corporate form of business to become the dominant one in many countries. The corporate form, in contrast to other business forms, frequently involves the separation of ownership and control of the assets of the business. The ownership of the modern, public corporation is typically diffuse; it has many owners, most with proportionally small stakes in the company, who are distant from, and often play no role in, corporate decisions. Professional managers control and deploy the assets of the corporation. This separation of ownership (shareholders) and control (managers) may result in a number of conflicts of interest between managers and shareholders. Conflicts of interest can also arise that affect creditors as well as other stakeholders such as employees and suppliers. In order to remove or at least minimize such conflicts of interest, corporate governance structures have been developed and implemented in corporations. Specifically, corporate governance is the system of principles, policies, procedures, and clearly defined responsibilities and accountabilities used by stakeholders to overcome the conflicts of interest inherent in the corporate form.

The failure of a company to establish an effective system of corporate governance represents a major operational risk to the company and its investors.1 Corporate governance deficiencies may even imperil the continued existence of a company. Consequently, to understand the risks inherent in an investment in a company, it is essential to understand the quality of the company’s corporate governance practices. It is also necessary to continually monitor a company’s practices, because changes in management, the composition of its board of directors, the company’s competitive and market conditions, or mergers and acquisitions, can affect them in important ways.

A series of major corporate collapses in North America, Europe, and Asia, nearly all of which involved the failure or direct override by managers of corporate governance systems, have made it clear that strong corporate governance structures are essential to the efficient and effective functioning of companies and the financial markets in which they operate. Investors lost great amounts of money in the failed companies. The collapses weakened the trust and confidence essential to the efficient functioning of financial markets worldwide.

Legislators and regulators responded to the erosion of trust by introducing strong new regulatory frameworks. These measures are intended to restore the faith of investors in companies and the markets, and, very importantly, to help prevent future collapses. Nevertheless, the new regulations did not address all outstanding corporate governance problems and were not uniform across capital markets. Thus, we may expect corporate governance-related laws and regulations to further evolve.

The chapter is organized as follows: Section 2 presents the objectives of corporate governance systems and the key attributes of effective ones. Section 3 addresses forms of business and conflicts of interest, and Section 4 discusses two major sources of governance problems. In Section 5 we discuss standards and principles of corporate governance, providing three representative sets of principles from current practice. Section 6 addresses environmental, social, and governance factors. Section 7 touches on the valuation implications of the quality of corporate governance, and Section 8 summarizes the chapter.

2. CORPORATE GOVERNANCE: OBJECTIVES AND GUIDING PRINCIPLES

The modern corporation is subject to a variety of conflicts of interest. This fact leads to the following two major objectives of corporate governance:

1. To eliminate or mitigate conflicts of interest, particularly those between managers and shareholders.

2. To ensure that the assets of the company are used efficiently and productively and in the best interests of its investors and other stakeholders.

How then can a company go about achieving those objectives? The first point is that it should have a set of principles and procedures sufficiently comprehensive to be called a corporate governance system. No single system of effective corporate governance applies to all firms in all industries worldwide. Different industries and economic systems, legal and regulatory environments, and cultural differences may affect the characteristics of an effective corporate governance system for a particular company. However, there are certain characteristics that are common to all sound corporate governance structures. The core attributes of an effective corporate governance system are:

- Delineation of the rights of shareholders and other core stakeholders.

- Clearly defined manager and director governance responsibilities to stakeholders.

- Identifiable and measurable accountabilities for the performance of the responsibilities.

- Fairness and equitable treatment in all dealings between managers, directors, and shareholders.

- Complete transparency and accuracy in disclosures regarding operations, performance, risk, and financial position.

These core attributes form the foundation for systems of good governance, as well as for the individual principles embodied in such systems. Investors and analysts should determine whether companies in which they may be interested have these core attributes.

3. FORMS OF BUSINESS AND CONFLICTS OF INTEREST

The goal of for-profit businesses in any society is simple and straightforward: to maximize their owners’ wealth. This can be achieved through strategies that result in long-term growth in sales and profits. However, pursuing wealth maximization involves taking risks. A business itself is risky for a variety of reasons. For example, there may be demand uncertainty for its products and/or services, economic uncertainty, and competitive pressures. Financial risk is present when a business must use debt to finance operations. Thus, continued access to sufficient capital is an important consideration and risk for businesses. These risks, and the inherent conflicts of interests in businesses, increase the need for strong corporate governance.

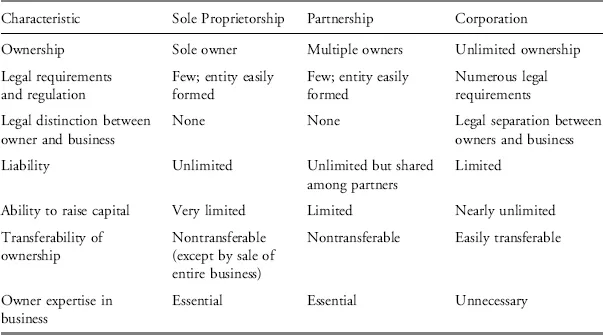

A firm’s ability to obtain capital and to control risk is perhaps most influenced by the manner in which it is organized. Three of the predominant forms of business globally are the sole proprietorship, the partnership, and the corporation. Hybrids of these three primary business forms also exist, but we do not discuss them here because they are simply combinations of the three main business forms. With regard to the three primary business forms, each has different advantages and disadvantages. We will discuss each of them, the conflicts of interest that can arise in each, and the relative need for strong corporate governance associated with each form. However, a summary of the characteristics is provided in Exhibit 1-1.

EXHIBIT 1-1 Comparison of Characteristics of Business Forms

3.1. Sole Proprietorships

The sole proprietorship is a business owned and operated by a single person. The owner of the local cleaner, restaurant, beauty salon, or fruit stand is typically a sole proprietor. Generally, there are few, if any, legal formalities involved in establishing a sole proprietorship and they are relatively easy to start. In many jurisdictions, there are few, if any, legal distinctions between the sole proprietor and the business. For example, tax liabilities and related filing requirements for sole proprietorships are frequently set at the level of the sole proprietor. Legitimate business expenses are simply deducted from the sole proprietor’s taxable income.

Sole proprietorships are the most numerous form of business worldwide, representing, for example, approximately 70 percent of all businesses in the United States, by number.2 However, because they are usually small-scale operations, they represent the smallest amount of market capitalization in many markets. Indeed, the difficulties of the sole proprietor in raising large amounts of capital, coupled with unlimited liability and lack of transferability of ownership, are serious impediments to the growth of a sole proprietorship.

From the point of view of corporate governance, the sole proprietorship presents fewer risks than the corporation because the manager and the owner are one and the same. Indeed, the major corporate governance risks are those faced by creditors and suppliers of goods and services to the business. These stakeholders are in a position to be able to demand the types and quality of information that they need to evaluate risks before lending money to the business or providing goods and services to it. In addition, because they typically maintain direct, recurring business relations with the companies, they are better able to monitor the condition and risks of the business, and to control their own exposure to risk. Consequently, we will not consider sole proprietorships further in this chapter.

3.2. Partnerships

A partne...