Sharp increases in asset prices are frequently followed by large and sudden collapses of its price. Some of these boom-bust episodes are so huge, quick and unexpected that they are popularly known as asset price bubbles

. Bubble episodes are frequent throughout history, from the Dutch Tulipmania

in 1636 (the earliest documented asset price bubble) to the housing bubble episodes in the mid-2000s in several developed economies. The bust of asset price bubbles tends to mark the end of economic expansions and it is not unusual that it coincides with the onset of a financial crisis

. It is thus important to have a good understanding of the origin and economic consequences of asset price bubbles. Even though all bubble episodes have elements in common, each bubble is different in its own way. In this book, we focus on one particular type of asset price bubble: housing bubbles

. There are two main reasons for this choice. First, bubbles in house prices are recurrent in different countries and over different periods of time. Second, housing bubbles tend to exacerbate the effects of asset price bubbles on the economic activity, as the bust of the recent housing bubbles illustrates.

We start the book with a formal definition of asset price bubble. Everyone recognizes a bubble after it has crashed. However, it is not easy to spot a bubble in real time. Chapter 2 defines the bubble component of an asset as the difference between the price and the fundamental value

of the asset. Unfortunately, given the uncertainty around the fundamental value of an asset, there is not a scientific procedure to be sure that there is a bubble in real time. Nonetheless, we construct a housing bubble

indicator to keep track of past episodes and analyze its evolution over time and across countries. We also review in Chapter 2 three of the most famous asset price bubble episodes in history: (i) the Dutch Tulipmania

, (ii) the South Sea Bubble and (iii) the Dot-Com Bubble

. By reviewing these episodes, we explain that these famous bubble episodes have some elements in common, which can be extrapolated to most asset price bubble episodes. In particular, their boom-bust behavior can be summarized by the title of the seminal work of Kindleberger

and Aliber

(2005): “Manias, Panics and Crashes”. Bubble episodes begin with a mania. For some reason, investors get excited about the prospects of purchasing an asset. This mania phase is followed by a panic in which a pessimistic sentiment is spread throughout investors. This pessimistic sentiment is transformed into a massive amount of sales orders, which derives into the ensuing crash of the price of the asset.

Once we are familiar with the notion of asset price bubble, Chapter 3 offers two theories on the origin of bubbles. The first theory is based on behavioral

economics. The idea is that some investors start to believe, for some unexplained reason, that the return on the asset will be very high. Actually, higher than what well-informed (rational) investors think. These (too) optimistic investors purchase the asset and push the price above its fundamental value. The second theory offers a “rational” view on the origin of bubbles. According to this view, asset price bubbles

are the optimal market response to a shortage of assets

. This theory implies that bubbles emerge when the demand of assets is very high, so that, the return on savings is very low. The bubble increases the supply of assets, thereby solving the shortage of assets problem. Finally, we apply this notion of rational bubble to the particular case of a housing bubble

.

One of the most remarkable facts of the world economy in the last two decades is the spread of financial globalization

. Chapter 4 explains how this globalization process may affect the emergence of asset price bubbles

. First, we show how, from a purely accounting identity, the current account

of a country is related to the emergence of asset price bubbles. When the bubble emerges in a country, it raises the supply of assets, which reduces the current account of the country. Suggestive empirical evidence is provided on this negative correlation between house prices and the current account for a large sample of countries. Then, we extend the model of rational housing bubbles

explained in Chapter 3 to understand the effect of financial globalization

on the rise of asset price bubbles. In this model, a financially developed country

would not have rational bubbles

in autarky. However, bubbles can arise in this country if it opens up to trade with financially underdeveloped

economies. Finally, we apply this model to explain the behavior of house prices at the municipality level and the current account deficit in the United States

in the mid-2000s.

After providing different theories of the origin of bubbles, Chapter 5 describes its economic consequences. House prices affect the economy both when they are rising and when they are falling. There are two main economic agents affected by changes in house prices: (i) households and (ii) firms. Housing wealth is an important determinant of household consumption

. Moreover, households can use the increase in house prices to borrow

more against their house. We explain how both effects were present in the United States

during the recent housing bubble

. This implies that households overborrowed and overconsumed during the housing boom. Similarly, an important component of the collateral

of firms is their real estate assets

. In theory, financially constrained firms can borrow and invest more when the value of their collateral increases. This theory is also confirmed by the data. Thus, the distortion

in house prices also resulted in a distortion in investment. Finally, we consider the case of Spain

. We discuss how the housing bubble distorted the allocation of capital and credit

and reduced the aggregate productivity

of the country.

We conclude the book with a discussion on how enhanced regulation could mitigate the emergence of housing bubbles

. First, we explain that the supply of credit played a determinant role in the buildup of the recent mortgage debt bubble. Then, we analyze the Spanish bubble to illustrate that a limit on loan-to-value ratios, heralded as a leading macroprudential

tool, is not a universal solution. Finally, we describe how the consensus among policymakers on the relevant indicators to assess the vulnerabilities of countries radically changed after the recent financial crisis

. Indeed, managing the financial globalization

, which is at the heart of this book, has been given a prominent role.

Reference

Kindleberger, C. P., & Aliber, R. (2005). Manias, Panics, and Crashes: A History of Financial Crises (5th ed.). Hoboken: Wiley. ISBN 0-471-46714-6.Crossref

2.1 Definition of Bubbles

Was there a bubble in the price of tulips in 1636 in the Netherlands? Was there a bubble in the price of Dot-Com stocks in 2000? Was there a bubble in house prices in the

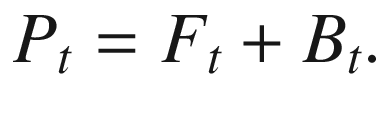

United States in 2006? Is there a bubble in the price of cryptocurrencies? Before answering these questions, it is necessary to agree on a definition of asset price bubble. Economists have shown that the price of any asset (with an infinite maturity) is the sum of two components: (i) fundamental and (ii) bubble.

1 The left-hand size of Eq. (2.1), Pt, is the actual price of the asset. This variable is very easy to find out. For example, if one wants to know the current price of a stock, one just needs to type the name of the company or index in Google Chrome. Historical data for stock prices and indices are also publicly available. Finding the price of other types of assets may be more cumbersome but it is also feasible. Therefore, to know whether there is (or there was) a bubble in the price of any asset, one just needs to compute the fundamental value of the asset, Ft. Once we know the fundamental price of the asset and the actual price, we just need to apply Eq. (2.1). If the fundamental value of the asset, Ft, is below the actual price of the asset, Pt, Eq. (2.1) implies that Bt > 0. You have found an asset price bubble!

The reader may wonder why there are discussions on the existence of asset price bubbles if the Eq. (2.1) is so conclusive. The answer is that the computation of the fundamental value of an asset is more an art than a science. To understand the concept of fundamental value is useful to think that investors live forever and that once they purchase the asset, they keep it forever. In the case of stocks, after acquiring a particular stock, the investor is entitled to receive dividends from the company in the future. Thus, the fundamental value of a stock is the sum of future ...