![]()

1

Cross-Asset Trend Following with Futures

There is a group of hedge funds and professional asset managers who have shown a remarkable performance for over 30 years, consistently outperforming conventional strategies in both bull and bear markets, and during the 2008 credit crunch crisis showing truly spectacular returns. These traders are highly secretive about what they do and how they do it. They often employ large quant teams staffed with top-level PhDs from the best schools in the world, adding to the mystique surrounding their seemingly amazing long-term track records. Yet, as this book shows, it is possible to replicate their returns by using fairly simple systematic trading models, revealing that not only are they essentially doing the same thing, but also that it is not terribly complex and within the reach of most of us to replicate.

This group of funds and traders goes by several names and they are often referred to as CTAs (for Commodity Trading Advisors), trend followers or managed futures traders. It matters little which term you prefer because there really are no standardised rules or definitions involved. What they all have in common is that their primary trading strategy is to capture lasting price moves in either direction in global markets across many asset classes, attempting to ride positions as long as possible when they start moving. In practice most futures managers do the same thing they have been doing since the 1970s: trend following. Conceptually the core idea is very simple. Use computer software to identify trends in a large set of different futures markets and attempt to enter into trends and follow them for as long as they last. By following a large number of markets covering all asset classes, both long and short, you can make money in both bull and bear markets and be sure to capture any lasting trend in the financial markets, regardless of asset class.

This book shows all the details about what this group does in reality and how the members do it.

The truth is that almost all of these funds are just following trends and there are not a whole lot of ways that this can be done. They all have their own proprietary tweaks, bells and whistles, but in the end the difference achieved by these is marginal in the grand scheme of things. This book sheds some light on what the large institutional trend-following futures traders do and how the results are created. The strategies as such are relatively simple and not terribly difficult to replicate in theory, but that in no way means that it is easy to replicate them in reality and to follow through. The difficulty of managed futures trading is largely misunderstood and those trying to replicate what we do usually spend too much time looking at the wrong things and not even realising the actual difficulties until it is too late. Strategies are easy. Sticking with them in reality is a whole different ball game. That may sound clichéd but come back to that statement after you finish reading this book and see if you still believe it is just a cliché.

There are many names given to the strategies and the business that this book is about and, although they are often used interchangeably, in practice they can sometimes mean slightly different things and cause all kinds of confusion. The most commonly-used term by industry professionals is simply CTA (Commodity Trading Advisor) and though I admit that I tend to use this term myself it is in fact a misnomer in this case. CTA is a US regulatory term defined by the National Futures Association (NFA) and it has little to do with most so-called CTA funds or CTA managers today. This label is a legacy from the days when those running these types of strategies were US-based individuals or small companies regulated onshore by the NFA, which is not necessarily the case today. If you live in the UK and have your advisory company in London, set up an asset-management company in the British Virgin Islands and a hedge fund in the Caymans (which is in fact a more common setup than one would think) you are in no way affected by the NFA and therefore not a CTA from their point of view, even if you manage futures in large scale.

DIVERSIFIED TREND FOLLOWING IN A NUTSHELL

The very concept of trend following means that you will never buy at the bottom and you will never sell at the top. This is not about buying low and selling high, but rather about buying high and selling higher or shorting low and covering lower. These strategies will always arrive late at the party and overstay their welcome, but they always enjoy the fun in-between. All trend-following strategies are the same in concept and the underlying core idea is that the financial markets tend to move in trends, up, down or sideways, for extended periods of time. Perhaps not all the time and perhaps not even most of the time, but the critical assumption is that there will always be periods where markets continue to move in the same direction for long enough periods of time to pay for the losing trades and have money left over. It is in these periods and only in these periods that trend-following strategies will make money. When the market is moving sideways, which is the case more often than one might think, these strategies are just not profitable.

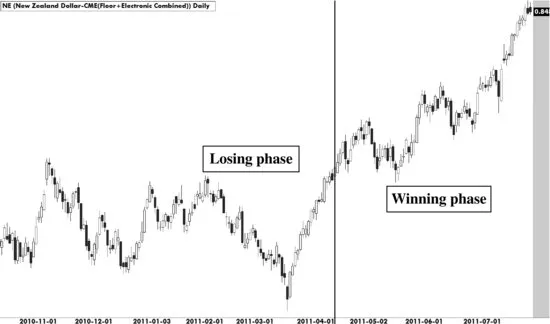

Figure 1.1 shows the type of trades we are looking for, which all boils down to waiting until the market has made a significant move in one direction, putting on a bet that the price will continue in the same direction and holding that position until the trend has seized. Note the two phases in the figure separated by a vertical line. Up until April there was no money to be made in following the trends of the NZ Dollar, simply because there were no trends around. Many trend followers would have attempted entries both on the long and short side and lost money, but the emerging trend from April onwards should have paid for it and then some.

If you look at a single market at any given time, there is a very high likelihood that no trend exists at the moment. That not only means that there are no profits for the trend-following strategies, but can also mean that loss after loss is realised as the strategy enters position after position only to see prices fall back into the old range. Trend-following trading on a single instrument is not terribly difficult but quite often a futile exercise, not to mention a very expensive one. Any single instrument or even asset class can have very long periods where this approach simply does not work and to keep losing over and over again, watching the portfolio value shrinking each time can be a horrible experience as well as financially disastrous. Those who trade only a single or a few markets also have a higher tendency of taking too large bets to make sure the bottom line of the portfolio will get a significant impact of each trade and that is also an excellent method of going bankrupt.

With a diversified futures strategy you have a large basket of instruments to trade covering all major asset classes, making each single bet by itself almost insignificant to the overall performance. Most trend-following futures strategies do in fact lose on over half of all trades entered and sometimes as much as 70%, but the trick is to gain much more on the good ones than you lose on the bad and to do enough trades for the law of big numbers to start kicking in.

For a truly diversified futures manager it really does not matter if we trade the S&P 500 Index, rough rice, bonds, gold or even live hogs. They are all just futures which can be treated in exactly the same way. Using historical data for long enough time periods we can analyse the behaviour of each market and have our strategy adapt to the volatility and characteristics of each market, making sure we build a robust and truly diversified portfolio.

THE TRADITIONAL INVESTMENT APPROACH

The most widely held asset class, in particular among the general public, is equities; that is, shares of corporations trading on stock exchanges. The academic community along with most large banks and financial institutions have long told the public that buying and holding equities over long periods of time is a safe and prudent method of investing and this has created a huge market for equity mutual funds. These funds are generally seen as responsible long-term investments that always go up in the long run, and there is a good chance that even a large part of your pension plan is invested in equity mutual funds for that very reason. The ubiquitous advice from banks is that you should hold a combination of equity mutual funds and bond mutual funds and that the younger you are, the larger the weight of the equity funds should be. The reason for the last part is that, although equities do tend to go up in the long run, they are more volatile than bonds and you should take higher financial risks when you are younger since you have time to make your losses back. Furthermore, the advice is generally that you should prefer equity mutual funds over buying single stocks to make sure that you get sufficient diversification and you participate in the overall market instead of taking bets on individual companies which may run into unexpected trouble down the road.

This all sounds very reasonable and makes for a good sales pitch, at least if the core assumption of equities always appreciating over time holds up in reality. The idea of diversifying by holding many stocks instead of just a few companies also sounds very reasonable, given that the assumption holds up that the correlation between stocks is low enough to provide the desired diversification benefits of lower risk at equal or higher returns. Of course, if either of these assumptions turn out to be disappointing in reality, the whole strategy risks falling like a proverbial house of cards.

In reality, equities as an asset class has a very high internal correlation compared to most other types of instruments. The prices of stocks tend to move together up and down on the same days and while there are large differences in overall returns between a good stock and a bad one, over longer time horizons the timing of their positive and negative days are often highly related even in normal markets. If you hold a large basket of stocks in many different countries and sectors, you still just hold stocks and the extent of your diversification is very much limited. The larger problem with the diversification starts creeping up in times of market distress or when there is a single fundamental theme that drives the market as a whole. This could be a longer-term event such as a dot com bubble and crash, a banking sector meltdown and so on, or it can be a shorter-term shock event like an earthquake or a surprise breakout of war. When the market gets single-minded, the correlations between stocks quickly approach one as everyone panic sells at the same time and then re-buys on the same euphoria when the problems are perceived to be lessened. In these markets it matters little what stocks you hold and the diversification of your portfolio will turn out to be a very expensive illusion.

Then again, if stocks always go up in the long run the correlations should be of lesser importance since you would always make the money back again if you just sit on the stocks and wait a little bit longer. This is absolutely true and if you are a very patient person you are very likely to make money from the stock markets by just buying and holding. From 1976 to 2011 the MSCI World Index rose by 1,300%, so in 35 years you would have made over ten times your initial investment. Of course, if you translate that into annual compound return you will see that this means a yield of just around 8% per year. If you had been so unlucky as to invest in 1999 instead, you would still hold a loss 13 years later of over 20%. Had you invested in 2007 your loss would be even greater. Although equities do tend to move up in the long run, most of us cannot afford to lose a large part of our capital and wait for a half a lifetime to get our money back. If you are lucky and invest in a good year or even a good decade, the buy-and-hold strategy may work out but it can also turn out to be a really bumpy ride for quite a low return in the end. Going back to the 1,000% or so made on an investment from 1976 to 2011, the largest drawdown during this period was 55%. Looking at the buy-and-hold strategy from a long-term return to risk perspective, that means that in order to get your 8% or so return per year, you must accept a risk of losing more than half of your capital, which would translate to close to seven years of average return.

You may say that the 55% loss represents only one extreme event, the 2008 credit meltdown, and that such scenarios are unlikely to repeat, but this is not at all the case. Let’s just look at the fairly recent history of these so-called once-in-a-lifetime events. In 1974 the Dow Jones Industrial average hit a drawdown of 40%, which took over six years to recover. In 1978 the same index fell 27% in a little over a year. The same thing happened again in 1982 when the losses amounted to 25% in about a year. From the peak in August 1987 to the bottom in October the index lost over 40%. Despite the bull market of the 1990s, there were several 15–20% loss periods and when the markets turned down in 2000 the index had lost about 40% before hitting the bottom. What you need to ask yourself is just how high an expected compound return you need to compensate for the high risks of the stock markets, and whether you are happy with single digit returns for that level of volatility.

If you do choose to participate in the stock markets through an equity mutual fund you have one more factor to consider, and that is whether or not the mutual fund can match or beat the index it is supposed to be tracking. A mutual-fund manager, as opposed to a hedge-fund manager, is tasked with trying to beat a specific index and in the case of an equity fund that index would be something like the S&P 500, FTSE 100, MSCI World or similar. It can be a broad country index, international index, sector index or any other kind of equity index, but the task is to follow the designated index and attempt to beat it. Most mutual-fund managers have very little leeway in their investment approach and they are not allowed to deviate much from their index. Methods to attempt to beat the index could involve slight over- or under-weights in stocks that the manager believes will perform better or worse than the index, or to hold a little more cash during perceived bad markets. The really big difference between a mutual-fund manager and a hedge-fund manager or absolute-return trader is that the mutual-fund manager’s job is to follow the index, whether it goes up or down. That person’s job is not to make money for the client but rather to attempt to make sure that the client gets the return of the index and it is hoped slightly more. If the S&P 500 index declines by 30% in a year, and a mutual fund using that index as a benchmark loses only 25% of the clients’ money, that is a big achievement and the fund manager has done a very good job.

There are of course fees to be paid, including a management fee and sometimes a performance fee for the fund as well as administration fees, custody fees, commissions and so on, which is the reason why very few mutual funds manage to beat their index or even match it. According to Standard & Poor’s Indices Versus Active Funds Scorecard (SPIVA) 2011 report, the percentage of US domestic equity funds that outperformed the benchmark in 2011 was less than 16%. Worst that year were the large-cap growth funds where over 95% failed to beat their benchmark. Looking over a period of five years, from 2006 to 2011, 62% of all US domestic funds failed to beat their benchmarks. Worst in that five-year period was the mid-cap growth funds where less than 10% reached their targets. The picture that the S&P reports paint is devastating for the mutual-fund business. If active mutual funds have consistently proved to underperform their benchmarks year after year, there is little reason to think that this is about to change any time soon.

There are times when it’s a good idea to participate in the general equity markets by buying and holding for extended periods of time, but then you need to have a strategy for when to get out of the markets when the big declines come along, because they will come along. It makes sense to have a portion of your money in equities one way or another as long as you step out of that market during the extremely volatile and troublesome years, but I’m personally not entirely convinced about the wisdom of putting the bulk of your hard-earned cash into this asset class and just holding onto it in up and down markets, hoping for the best. For participating in these markets, you may also want to consider investing in passive exchange-traded funds (ETFs) as an alternative to classic mutual funds, because the index-tracking ETFs hold the exact stocks of the index at all times and have substantially lower fees, making them track and match the index with a very high degree of precision. They are also very easy and cheap to buy and sell as they are directly traded on an exchange with up-to-the-second pricing.

THE CASE FOR DIVERSIFIED MANAGED FUTURES

There are many viable investment strategies that tend to outperform buy-and-hold equities on a volatility adjusted basis and I employ several of them. One of the top strategies is trend-following managed futures for its consistent long-term track record of providing a very good return-to-risk ratio during both bull and bear years. A solid managed futures strategy has a reasonably high expected yearly return, acceptable drawdown in relation to the yearly return and lack of significant correlation to world equity markets, and preferably slightly negative correlation.

The list of successful traders and hedge funds operating in the trend-following managed futures markets is quite long and many of them have been around for decades, some even from the 1970s. The very fact that so many trend traders have managed not only to stay in business for this long period, but to also make consistently impressive returns, should in itself prove that these strategies work.

Table 1.1 shows a brief comparison between the performances of some futures managers to that of the world equity markets. As mentioned, MSCI World has shown a long-term yield of 8% with a maximum drawdown (DD) of 55%, which would mean that over seven normal years of performance...