![]()

PART I: WARREN BUFFETT INVESTMENT PRINCIPLES

Before you start investing in the stock market, you should have a clear understanding of investment principles so that you can profit from the stock market’s cycles. A simple investing principle is “Buy low and sell high,” but most of the investing public does the opposite.

When good news about a particular company appears in the press, the stock goes up. When that happens, people get greedy and buy at the high price thinking that stock will keep going up, and they can profit by selling at an even higher price than they already paid. After a couple of weeks or months, some bad news comes out about the particular company or a bad economic report or political event happens, and the stock starts coming down in price. When the price goes to less than the price they paid, stockholders get fearful and want to limit their loss or protect their capital and sell at a loss. Unfortunately after they sold, the stock starts to come up in price. Now they are kicking themselves, feeling that they sold too early.

So how do you behave in this market environment? How do you profit from this kind of market behavior? The answer is that you should have a clear understanding of investment principles. The following chapters explain investing principles written by Ben Graham and practiced and improved upon by Warren Buffett. Warren Buffett experienced many boom and bust cycles in his investing career. Those basic principles are guided him during those market cycles and made him one of the greatest stock market investors in the world. Let the journey begin.

Key Points

- Investors should have sound investing principles, patience, and confidence in their own research and belief in themselves.

- Stock investing is part ownership in the company. A business-like investing approach will help you to make intelligent buying and selling decisions.

- Long-term investing includes buying stock at attractive prices, which are less than the intrinsic value of the business, and holding that stock as long as the company’s fundamentals are improving.

- Avoid permanent loss of capital. Never react to short-term price variations because of market gyrations. Analyze the underlying company fundamentals and make a rational decision.

![]()

CHAPTER 1

Replicating Warren Buffett’s Investment Success

Warren Buffett learned investing from Ben Graham. Initially he practiced Ben Graham’s teachings, then his principles evolved and he finally beat his mentor’s investment successes. When Graham died, he left an estimated $3 million dollars. As I write this book, Warren Buffett’s net worth is around $45 billion dollars. Graham once told California investor Charles Brandes, “Warren has done very well.”1

Buffett started with Graham’s cigar-butt approach, buying the stocks that are trading for less than net current asset value regardless of the company. He started reading Phil Fisher and was influenced by his partner Charlie Munger. He then slowly started to recognize the successes of growth companies. So, he started buying sustainable, competitive, growing companies with fair prices and holding them for the long term.

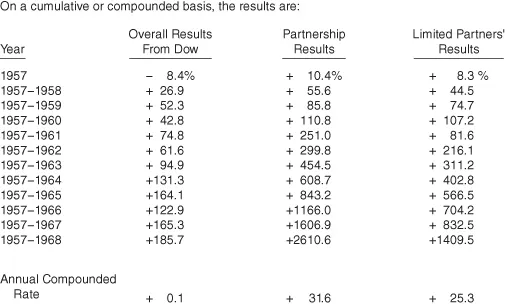

In this way Buffett learned investing from his mentor and eventually beat his mentor’s investment success. We can learn from Warren Buffett and replicate his investment success. The returns from when he ran Buffett Partnership from 1956 to 1969 are shown in Figure 1.1.2

As you can see, Buffett generated a gross return of 31.6 percent compound annual return, which excludes the general partner allocation. He generated 25.3 percent compound annual net return after expenses and general partner allocation. After Berkshire Hathaway, apart from investing in the stock market, he started buying whole companies and leaving the existing managers to run the companies. Warren Buffett allocated the money generated by the companies. Berkshire Hathaway’s book value increased 20.3 percent compounded annual return for 45 years from 1965 to 2009. Achieving such a great return for such a long time made Buffett the most successful investor of this twenty-first century.

Buffett has shared his investment principles in Berkshire Hathaway’s annual letters, numerous interviews, and in speeches at different universities. If you have a goal to replicate Warren Buffett’s investment success, you can do it by studying his investment principles and putting them to work for you. His overall investing principle is very simple, but execution of it requires patience and independent thinking. I am not advising you to go ahead and buy the stocks that Warren Buffett buys. Rather, you can learn Buffett’s investment principles and buy your own stocks and manage your portfolio the same way he manages his. You will be able to replicate his investment successes and find success in the stock market.

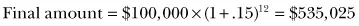

Because I am sure you have your doubts, I am providing the following calculation as an example. Your full-time profession may not allow you to become a fund manager or you may not believe you will be able to build an empire like Berkshire Hathaway, and that is fine. I can understand that. You do not need to be a fund manager or build a wildly successful company. In the following example, you can see how you can invest your own money without outside investors, starting with a modest investment amount of $100,000.

Buffett Partnership generated a 31.6 percent compound annual return for 12 years. You can apply the same return information to your initial investment of $100,000

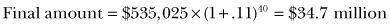

You may have more doubts about these calculations. You could argue that Buffett is a genius and others cannot generate an annual compound return like his. But, in fact, many of Warren Buffett’s followers did just that and I will explain this later. So, plan to replicate just 50 percent of his investment successes in your lifetime, a reasonable and attainable goal.

This example covers Buffett’s investing career of 52 years. Not everyone has that kind of time available. Depending on your age, you can adjust your final value depending on how many investing years you have left before your retirement. Just be confident that you, too, can make multimillions of dollars from the stock market, if you invest like Warren Buffett.

You do not need to be a genius to replicate, or at least partially replicate, Warren Buffett’s investment success. You do not need a Master’s degree in Business Administration (MBA) or even to run your own business. You should, at least, have interest in learning Warren Buffett’s investing principles and how to implement those principles. Those factors are explained in this book. Believe in yourself, you can do it.

Before reading books about Warren Buffett, I did not know the basics of stock investing. All of my investment knowledge has come from reading books written about Warren Buffett, Berkshire Hathaway’s annual letters, numerous interviews with Buffett, and the reverse engineering of his investments over many years. Each time as Warren Buffett buys new stock, I try to find out why he bought that company’s stock at that specific time. Basically, I try to understand his investment reasoning.

After successfully implementing his investing principles into actual trades with my own money, I was very confident that I could handle other people’s money and do the same. I did follow Buffett’s footsteps and started my own investment partnership fund, GJ Investment Funds, with the same rules that he used when he started his partnership. Nowadays, we call these partnerships hedge funds and only accredited investors are allowed into the funds. Normally, hedge funds charge 1-to-2 percent of the management fees and 20 percent of the profit. Even if the hedge fund is down a certain year, it still charges 1 to 2 percent of the management fees on assets under management. Buffett did not use that method; he didn’t charge a management fee at all. As general partner, he took 25 percent of the profit above a 6 percent hurdle rate with a high water mark. He believed he did not deserve to get paid if he did not make money for his limited partners above 6 percent. I felt the same way and used those same fund rules. When I started the fund in November 2008 using the Buffett principles, I was very successful. I beat Buffett Partnership returns with a wide margin and got to the top 5 percent of all mutual and hedge fund managers. I am very confident that Warren Buffett’s investment principles will continue to guide me to deliver great returns in the future, too. I have found, and so have many others, that it is possible to replicate Warren Buffett’s investment success.

For example, Edward Lampart of ESL Investments also used Warren Buffett’s investment principles to build his empire. He acquired Kmart from bankruptcy, acquired Sears, and then merged both firms to form Sears Holdings Corporation. He became chairman of the firm. Sears occupies more than 40 percent of his $9 billion dollar hedge fund. The other two biggest positions belong to AutoZone and AutoNation. His employees sit on both companies’ boards. These top three positions occupy more than 90 percent of the portfolio. Lampart learned investing by reverse engineering Warren Buffett’s investments. He managed to deliver more than 29 percent compound annual return using Buffett’s investing principles. Another example is Appaloosa Management’s David Tepper. Using distressed securities and debt, he was able to deliver more than a 28 percent compound annual return. Another example is Ian Cumming. He runs Leucadia National very similarly to the way Buffett runs Berkshire Hathaway. Leucadia stock compounded 33 percent from 1978 to 2004.

The examples are endless. I can keep going with the list, but I believe you get the point. If you are able to implement Warren Buffett’s investing principles and execute them properly, you can deliver excellent returns for your investment portfolio. As an individual investor, you are in a more advantageous position than Warren Buffett. Here’s why:

1. He manages a $50 billion investment portfolio and he can select only large-cap stocks. He cannot invest in small and mid-cap companies because those investments will not make much difference to his portfolio.

2. You can buy and sell your portfolio holdings faster without affecting the price of the stock; Buffett cannot do that. For example, he owns around 10 percent of Coca-Coca. If he feels that Coca-Cola’s stock price becomes overvalued at the current market price and decides to sell at that price, he will not be able to sell all of his holdings at that price. It is not likely there will be a buyer for such a large amount of stock. He needs to sell slowly, without affecting the price of the stock. If he tries to sell all his holdings in a couple of days, his selling alone will knock down the price of Coca-Cola st...