![]()

Chapter 1

How Long Will My Number Last?

Equation #1: Leonardo Fibonacci (1170–1250)

Leonardo had a problem. A close friend had invested some money a few years earlier in a local Italian bank, in Pisa, that promised him steady interest of 4% per month. (Yes, I wish I got 4% interest per month. I don’t even get that per year nowadays. Sounds shady to me.) Anyway, rather than sitting by and letting the money rapidly grow and compound over time, Lenny’s friend started withdrawing large and irregular sums of money from the account every few months. These sums were soon exceeding the interest he was earning and the whole process was eating heavily into his capital. To make a long story short, Leonardo—known to be quite good with numbers—was approached by this friend and asked how long the money would last if he kept up these withdrawals. Reasonable question, no?

Now, if Leonardo had been me, he’d have pulled out his handy Hewlett-Packard (HP) business calculator, entered the cash flows, pushed the relevant buttons and quickly had the answer. In fact, with any calculator these sorts of questions can be answered quite easily using the technique known as present value analysis—something all finance professors teach their students on the first day of class. Later, I’ll explain this important process in some detail.

Unfortunately, Leonardo didn’t have access to an HP business calculator that performed the necessary compound interest calculations. (He didn’t have a calculator at all because they hadn’t been invented yet.) You see, Leonardo was asked this question more than 800 years ago, in the early part of the 13th century. But to answer the question—which he certainly did—he actually invented a technique we know today as present value analysis. Yes, the one I mentioned we teach our students.

You might have heard of Leonardo by his more formal name: Leonardo Pisano filius (“family” in Latin) Bonacci, a.k.a. Fibonacci to the rest of the world, and probably the most famous mathematician of the Middle Ages.

In fact, Fibonacci helped solve his friend’s problem—writing the first commercial mathematics textbook in recorded history in the process—and introduced a revolutionary methodology for solving complicated questions involving interest rates. Let me repeat: his technique, with only slight refinements, is still used and taught to college and university students 800 years later. Now that is academic immortality! (He published and his name hasn’t perished yet.)

Everyone owes a debt of gratitude to Fibonacci. Had it not been for him, we would probably still be using Roman numerals in our day-to-day calculations. He helped introduce and popularize the usage of the Hindu–Arabic number system—the 10 digits from zero to nine—in the Western world by illustrating how much easier they were for doing commercial mathematics. Imagine calculating square roots or performing long division with Roman numerals. (Okay: What is XMLXVI times XVI?) Well, you can thank Leonardo.

Leonardo Fibonacci was the first financial engineer, or “quant” (translation: highly compensated, scary-smart guys and gals who use advanced mathematics to analyze financial markets) and he didn’t work on Wall Street or Bay Street. He worked in the city of Pisa. More on his well-known work, and lesser-known life, later.

The Spending Rate: A Burning Question

Let’s translate Fibonacci’s mostly hypothetical 800-year-old puzzles into a problem with more recent implications. Imagine you’re thinking about retiring and have managed to save $300,000 in your retirement account. For now, I’ll stay away from discussing taxes and the exact administrative classification of the account. (I’ll revisit this case in Chapter Seven, where I’ll add more realistic details.) Allow me to further assume you’re entitled to a retirement pension income of $25,000 per year. This is the sum total of your (government) Social Security plus other (corporate) pension plans—but the $25,000 is not enough. You need at least $55,000 per year to maintain your current standard of living. This leaves a gap of $30,000 per year, which you hope to fill with your $300,000 nest egg. The pertinent question, then, becomes: Is the $300,000 enough to fill the budget deficit of $30,000 per year? If not, how long will the money last?

As you probably suspected, your $300,000 nest egg is likely not enough. Think about it this way: the ratio of $30,000 per year (the income you want to generate) divided by the original $300,000 (your nest egg) is 10%. There is no financial instrument I’m aware of—and I’ve spent the last 20 years of my life searching for one—that can generate a consistent, guaranteed and reliable 10% per year. If you don’t want to risk any of your hard-earned nest egg in today’s volatile economic environment, the best you can hope for is about 3% after inflation is accounted for, and even that is pushing it. Sure, you might think you’re earning 5% guaranteed by a bank, or 5% in dividends or 5% in bond coupons, but an inflation rate of 2% will erode the true return to a mere 3%. Needless to say, 3% will only generate $9,000 per year in interest from your $300,000 nest egg. That is a far cry from (actually $21,000 short of) the extra $30,000 you wanted to extract from the nest egg.

You have no choice. In retirement you will have to eat into your principal.

Here’s a side note. In my personal experience talking to retirees and soon-to-be retirees, I find this realization is one of the most difficult concepts they must accept. Some people simply refuse to spend principal and instead submit to a reduced standard of living. Principal is sacred and they agree to live on and adapt to interest income. But in today’s low-interest-rate environment, once you account for income taxes, living on interest only will eventually lead to a greatly reduced standard of living over time.

Once you accept that actually depleting your nest egg is necessary, the next—and much more relevant—question becomes: If I start depleting capital, how long before there is nothing left? After all, if you eat into the $300,000 there’s a chance it might be gone, especially if you live a long time. This is exactly where Leonardo Fibonacci’s insight and technique come in handy, and why I’ve bequeathed to him Equation #1.

Time to roll up the sleeves and get to work. Let’s plug some numbers into Equation #1 and see what Fibonacci has to say.

(You might want to quickly flip back to the equation at the start of the chapter.)

Notice the right-hand side lists three variables (or inputs) that can affect the outcome. The first is the letter W, which represents the size of your nest egg, $300,000. The second variable is c, which captures the amount you would like to spend or consume, above and beyond any retirement pension you might be receiving. (This was $30,000 in the earlier example.) Although your spending takes place continuously (daily, weekly) it adds up to the value of c, per year. Think of it as a rate. The final variable, r, the trickiest to estimate, is the interest rate your nest egg is earning while it’s being depleted, expressed in inflation-adjusted terms. That was the 3% number I mentioned earlier. Now all that’s left is to compute the natural logarithm of the ratio, denoted by ln[] in the first equation.

Natural logarithms are close cousins of common logarithms. Both buttons appear on any good business calculator, but the latter uses a base of 10 and the former a base of 2.7183. If you’re unfamiliar with natural logarithms—or it has been a while since high-school mathematics—you can find a crash course on natural logs and how they differ from common logs in the appendix to this book.

For now, you can think (very crudely) of the natural logarithm as a process that shrinks numbers down to a compact size that is much easier to work with. Later you can worry about how exactly this shrinking works.

Back to the first equation. The mathematics proceeds as follows. The ratio inside the square brackets is 1.42857 written to five digits. In words, it’s the desired annual consumption rate of $30,000 (above and beyond the pension income you are receiving) divided by the same consumption rate, minus the nest egg value ($300,000), times the investment rate (3%). Sounds wordy? I agree. That’s why I—and most financial quants—prefer equations to words. But we’re not done yet. Looking back at the right-hand side of the equation, now take the natural logarithm of 1.42857, which leads to 0.35667 written to five digits. Finally, and for the last step, divide this number by 0.03, which is the interest rate, and voilà, t = 11.9 years.

In words, here is the harsh truth. Keep up this lifestyle, and you’ll be broke by the beginning of the 12th year of retirement spending. Not a good outcome, although you will still get your $25,000 pension for the rest of your life, which may (or may not) be enough. But the nest egg is blown. Don’t feign surprise. You knew that a yearly $30,000 withdrawal (i.e., spending from the nest egg) would be too much if all you’re earning is 3%. But what if you lower the withdrawal rate? Again, Fibonacci’s equation, Equation #1, divulges exactly how many years of income you’ll gain if you cut down on your planned spending.

Let’s do this with revised values. Assume you’re consuming (above the pension income you are receiving) $25,000 per year (instead of $30,000 per year), and earning the same 3% per year interest rate. In this case the item in the square brackets is 1.5625; its natural logarithm is 0.44629. When you divide by 0.03 you arrive at t = 14.9 years, a gain of almost three years. Here it is in words. Cut down on your planned spending by $5,000 per year and the money will last three years longer.

This standard of living is still not sustainable because there’s a very good chance you’ll be living in retirement more than 15 years. Okay, what if you reduce your annual (additional) withdrawals from the nest egg to $20,000? In this case the numbers are 1.81818 in the square brackets, then 0.59784 after you take natural logs and finally t = 19.9 years, eight years better than the original.

Is this good enough? Is it long enough? Well, that’s for you to decide. Hopefully you get the point of how to “use” the equation and can generate your own values for how long the money will last. In fact, you might want to try changing the interest rate, r, which I took to be 3%. For example, if you believe (I don’t) you can earn a guaranteed, safe 4% real interest rate per year, Equation #1 will result in the value of t = 22.9 years, if you withdraw c = $20,000 per year and start with a W = $300,000 nest egg. In contrast, if all you can earn guaranteed is r = 1.5% per year, your money will last t = 17 years. Personally, I’d lean toward using even lower values in this equation.

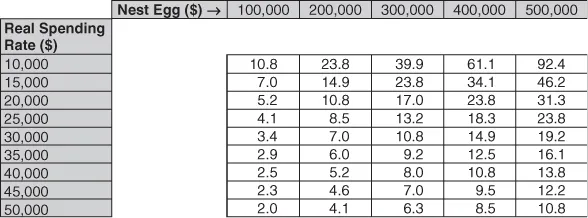

The input choices are infinite (no pun intended), so to help you get a better sense of the resulting values I’ve attached two tables with a range of output numbers. Table 1.1 assumes an investment return of 1.5%, adjusted for inflation, while Table 1.2 assumes a higher (3%) investment return, also adjusted for inflation. Again, you might think these are rather small numbers but remember these numbers are net of inflation, or what I call “real rates.” If your bank is paying you 3% on your savings account, but inflation erodes 2% per year, then all you’re really earning is (approximately) 1%.

Table 1.1 In How Many Years Will the Money Run Out If You Are Earning 1.5% Interest?

Some might argue this “equation”—nominal interest earned, minus inflation rate, equals real interest—is more important than all seven equations mentioned in this entire book! If you’re wondering, the person responsible for this insight is Irving Fisher, the early 20th-century American economist and champion of Equation #4. No rush. We’ll get to his story.

Back to the tables. The columns represent the size of your nest egg (W), and the rows represent the annual spending rate (consumption above any pension income)—also adjusted for inflation. Think of them as today’s dollars.

Looking at Table 1.1, if you start retirement with $300,000 in a bank account earning 1.5% interest every year and you plan to withdraw $35,000 every year, then according to Equation #1 the money will run out in exactly 9.2 years. This is 110 months of income. That’s it!

In contrast, if you reduce your spending withdrawals to $20,000 and start with the same $300,000 nest egg, your money will last 17 years. Sounds like a lot of time, but note if you retire at 65 this strategy will last (only) until you’re 82.

As you’ll see later in Chapter Two, when we explore patterns of longevity and mortality in retirement, there are better-than-even odds ...