![]()

Part I

IPO Fundamentals

![]()

Chapter 1

Getting IPO Shares

The most common question I get from investors is: How do I get shares in a hot initial public offering (IPO)? After all, many IPOs have strong gains on the first day of trading. During the dot-com boom of the late 1990s, there were many that more than doubled. The environment got so crazy that Barbra Streisand offered free concert tickets to get allocations of hot IPOs.

But even as things have calmed down, there are still IPOs that surge. And yes, they get lots of headlines.

Unfortunately, it is extremely difficult to get shares at the offering price. Instead, often individual investors have no choice but to buy the stock once it starts trading, which can be risky. If anything, it is usually a good idea to wait a few days until the trading activity subsides.

For the most part, the investors who get IPO shares at the offering price are large players—like wealthy investors, endowments, mutual funds, and hedge funds. They have the ability to buy large chunks of stock. Plus, these investors may be more willing to do heavy trading with other investments. In a way, IPOs are a nice reward for top clients.

Seems unfair? Perhaps so. But it is legal, and the Securities and Exchange Commission (SEC) actually encourages it. This is from the agency’s website at www.sec.gov:

Interestingly, though, even some large investors fail to get allocations of hot deals. The process can be hit-or-miss. In fact, it is often the case that a big investor will get only a portion of the shares requested. This is actually a way for the underwriters to create a sense of scarcity. After all, if you got all the shares you wanted, might this indicate there is not much demand for the IPO?

Despite all this, there are still ways to get in on the action. Let’s take a look.

Risk

Even if you can get shares in an IPO, this is no guarantee of getting profits. These types of deals are always risky. For example, on August 11, 2005, Refco went public, with the stock increasing 25 percent on its first day of trading. The company was a top broker for futures and options. It also had top-notch private equity investors, such as Thomas H. Lee Partners.

Unfortunately, Refco’s CEO, Phillip R. Bennett, had been cooking the books for at least 10 years and failed to disclose as much as $430 million in debt. By October 17, the company was bankrupt and the stock was worthless.

True, this is an extreme case. But it does happen, although a more common event is a broken IPO. This is when the stock price falls on the first day of trading. This is often a bad sign and may mean further losses down the road as institutional investors try to bail out.

Yet there is still a lot of opportunity when getting shares in an IPO. So in the rest of the chapter, we’ll look at some key strategies.

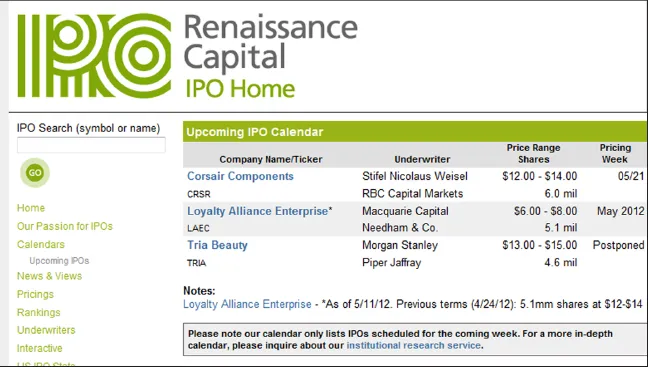

The Calendar

Before investing in IPOs, you need to track the calendar. This is a list of the upcoming IPOs. A good source is Renaissance Capital’s IPO Home at www.renaissancecapital.com, shown in Figure 1.1. It will show the upcoming IPOs for the next month or so. This gives you time to check out who the underwriters are so as to perhaps get an allocation of shares, as well as to do research on the companies.

As you follow the calendar, you’ll notice some things. First, there is seasonality to the IPO market. Generally there are no more IPOs during mid-December, and the market does not get started again until mid-January. The IPO market is also closed in August and does not get going again until mid-September.

Moreover, there will usually be five to 10 deals in a normal week. But when there is lots of instability in the market, there may be none. Keep in mind that during the fourth quarter of 2008—when the world was ensnared in the financial crisis—there was only one IPO.

Some deals may be postponed. And yes, this is not a good sign. A company will usually blame “adverse market conditions,” but the real reason is probably that investors are not interested in the deal. In many cases, a postponement will turn into a withdrawal of an offering.

Online Brokers

In the IPO market, there has been resistance to the changes in technology, and there are still many elements of the old boy network. However, the Internet has certainly made a huge impact.

A key was the emergence of Wit Capital.

In 1995, a beer company called Spring Street Brewery, a microbrewery that sells Belgian wheat beers, needed to raise money. Unfortunately, the company was too small to interest a Wall Street underwriter, and venture capitalists wanted to take too much control of the company.

So the founder of the company, Andrew Klein, decided to sell shares of the company directly to investors. One option was to sell directly to his growing base of customers—by putting a notice of the offering on the beer bottles.

Because Klein had considerable experience in finance (he was once a securities attorney at one of the most prestigious Wall Street firms, Cravath, Swaine & Moore), he decided to take another, more sophisticated, route. He organized the prospectus, made the necessary federal and blue-sky filings, and prepared to sell the offering over the Internet. He posted the prospectus online, and Spring Street raised $1.6 million from 3,500 investors. Overnight he became a celebrity, as the Wall Street Journal, the New York Times, CNBC, and many other media covered the pioneering IPO.

However, Klein did not stop with the Spring Street Brewery IPO. He recognized the need for a mechanism to buy and sell stock on the open market for companies such as Spring Street that are not on a regular stock exchange. So he created a trading system where buyers and sellers could make their transactions commission free.

The SEC stepped in and suspended trading, but to the surprise of many, within a few weeks, the SEC turned around and gave conditional approval of the online trading system. From there, Klein decided to build an online investment bank, called Wit Capital. It would be a place where individual investors had access to IPOs at the offering price and to venture capital investments. Before that, such services had been provided mostly to high-net-worth individuals and institutional investors.

But of course, a big driver for Wit Capital—as well as other IPO digital brokers—was the dot-com boom. Investors had a huge appetite for new issues, and the market exploded.

Yet after the market fell apart, so did many of the online brokerages. As a result, the main players in digital IPOs are the larger players, such as Fidelity, E*Trade, and Charles Schwab.

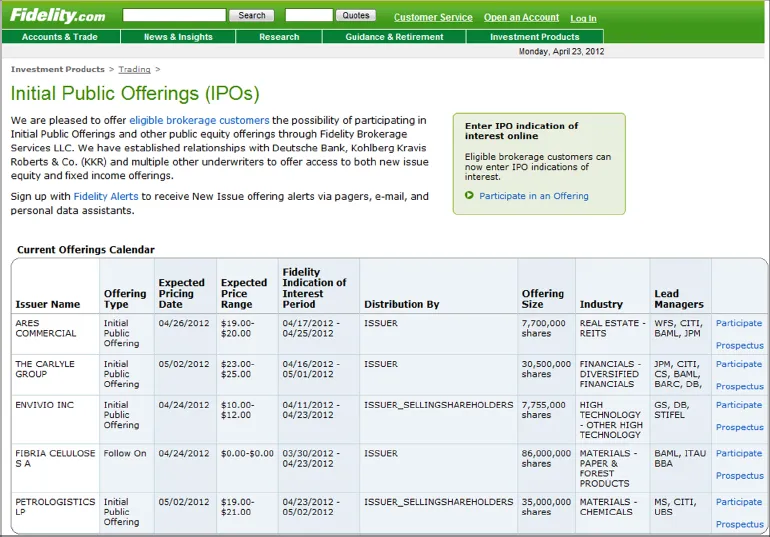

So it is worth checking out these firms and seeing what deals are available. But they all have eligibility requirements; take Fidelity (see Figure 1.2).

A customer must have a minimum of $100,000 in assets with the firm, or must have placed 36 or more stock, fixed-income, or option trades during the past 12 months. Also, there must be at least $2,000 in cash in the account.

Then there is the following process:

- Alerts. This is an e-mail system that will indicate when an IPO is available. There will also be e-mails for when offers are due, the effectiveness of the offering, the pricing, and the share allocation.

- Q&A. A customer must answer a variety of questions (which are based on securities regulations). Essentially, these are meant to flag a so-called restricted person, a customer who has some type of connection to the financial services industry that may forbid him or her from participating in the IPO.

- Review the preliminary prospectus. This is done by downloading the document.

- Enter an indication of interest. This is the maximum number of shares to buy in the offering. You will not be able to indicate a price since it has yet to be determined. Instead, the deal will have a price range, such as $12 to $14.

Keep in mind that you may not get the amount of shares requested—or any shares. The offer is not binding.

- Effectiveness. On the day the deal is declared effective, you will get an e-mail to confirm your indication of interest. You can also withdraw the offer before the transaction is priced, which usually happens within 24 hours.

- Allocation. You will receive an e-mail showing the number of shares you have purchased. In the case of Fidelity, the allocation is based on a propriety system that evaluates a customer’s relationship, such as the level of trading and other activities with the firm. According to the website at www.fidelity.com:

- Check your account. Make sure you received the allocation. Mistakes do happen.

There will also be a link to the final prospectus.

- Trading. You can sell the shares at any time. But again, you may be penalized for flipping them. According to Fidelity:

Build Relationships with the Syndicate Firms

A company will usually have two or more underwriters. They manage the offering. But they also form a syndicate of many other brokerage firms to sell the deal. You’ll find these firms in the prospectus. Interestingly, you will often see many boutique operators.

So a good idea is to contact them and learn about these firms. How do they allocate IPOs? Do they like to have a certain level of assets in your account? By building a relationship, you are likely to get allocations in IPOs. You may also get some deals for secondary offerings.

Dutch Auction

More and more, auctions are becoming a popular way for people and companies to do business on the web. It was the Nobel Prize–winning economist William Vickrey who developed the ingenious auction system. It’s the same system that the U.S. Treasury uses to auction Treasury bills, notes, and bonds. Why not use it for IPOs?

Actually, a firm called WR Hambrecht + Co does have an auction system set up for IPOs. ...