![]()

1

A visual introduction to quantile regression

Introduction

Quantile regression is a statistical analysis able to detect more effects than conventional procedures: it does not restrict attention to the conditional mean and therefore it permits to approximate the whole conditional distribution of a response variable.

This chapter will offer a visual introduction to quantile regression starting from the simplest model with a dummy predictor, moving then to the simple regression model with a quantitative predictor, through the case of a model with a nominal regressor.

The basic idea behind quantile regression and the essential notation will be discussed in the following sections.

1.1 The essential toolkit

Classical regression focuses on the expectation of a variable Y conditional on the values of a set of variables X, E(Y|X), the so-called regression function (Gujarati 2003; Weisberg 2005). Such a function can be more or less complex, but it restricts exclusively on a specific location of the Y conditional distribution. Quantile regression (QR) extends this approach, allowing one to study the conditional distribution of Y on X at different locations and thus offering a global view on the interrelations between Y and X. Using an analogy, we can say that for regression problems, QR is to classical regression what quantiles are to mean in terms of describing locations of a distribution.

QR was introduced by Koenker and Basset (1978) as an extension of classical least squares estimation of conditional mean models to conditional quantile functions. The development of QR, as Koenker (2001) later attests, starts with the idea of formulating the estimation of conditional quantile functions as an optimization problem, an idea that affords QR to use mathematical tools commonly used for the conditional mean function.

Most of the examples presented in this chapter refer to the Cars93 dataset, which contains information on the sales of cars in the USA in 1993, and it is part of the MASS R package (Venables and Ripley 2002). A detailed description of the dataset is provided in Lock (1993).

1.1.1 Unconditional mean, unconditional quantiles and surroundings

In order to set off on the QR journey, a good starting point is the comparison of mean and quantiles, taking into account their objective functions. In fact, QR generalizes univariate quantiles for conditional distribution.

The comparison between mean and median as centers of an univariate distribution is almost standard and is generally used to define skewness. Let Y be a generic random variable: its mean is defined as the center c of the distribution which minimizes the squared sum of deviations; that is as the solution to the following minimization problem:

The median, instead, minimizes the absolute sum of deviations. In terms of a minimization problem, the median is thus:

Using the sample observations, we can obtain the sample estimators

and

for such centers.

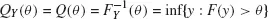

It is well known that the univariate quantiles are defined as particular locations of the distribution, that is the θ-th quantile is the value y such that P(Y ≤ y) = θ. Starting from the cumulative distribution function (CDF):

the quantile function is defined as its inverse:

for θ ∈ [0, 1]. If F (.) is strictly increasing and continuous, then F−1 (θ) is the unique real number y such that F(y) = θ (Gilchrist 2000). Figure 1.1 depicts the empirical CDF [Figure 1.1(a)] and its inverse, the empirical quantile function [Figure 1.1(b)], for the Price variable of the Cars93 dataset. The three quartiles, θ = {0.25, 0.5, 0.75}, represented on both plots point out the strict link between the two functions.

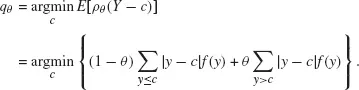

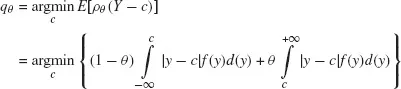

Less common is the presentation of quantiles as particular centers of the distribution, minimizing the weighted absolute sum of deviations (Hao and Naiman 2007). In such a view the θ-th quantile is thus:

where ρθ (.) denotes the following loss function:

Such loss function is then an asymmetric absolute loss function; that is a weighted sum of absolute deviations, where a (1 − θ) weight is assigned to the negative deviations and a θ weight is used for the positive deviations.

In the case of a discrete variable Y with probability distribution f (y) = P(Y = y), the previous minimization problem becomes:

The same criterion is adopted in the case of a continuous random variable substituting summation with integrals:

where

f (

y) denotes the probability density function of

Y. The sample estimator

for

θ ∈ [0, 1] is likewise obtained using the sample information in the previous formula. Finally, it is straightforward to say that for

θ = 0.5 we obtain the median solution defined in

Equation (1.2).

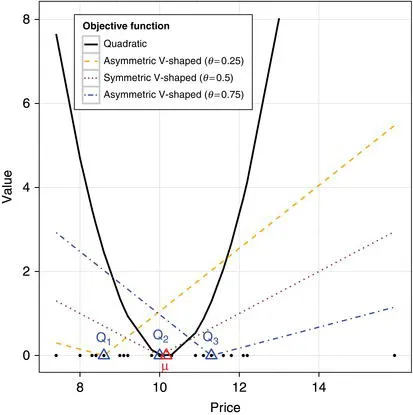

A graphical representation of these concepts is shown in Figure 1.2, where, for the subset of small cars according to the Type variable, the mean and the three quartiles for the Price variable of the Cars93 dataset are represented on the x-axis, along with the original data. The different objective function for the mean and the three quartiles are shown on the y-axis. The quadratic shape of the mean objective function is opposed to the V-shaped objective functions for the three quartiles, symmetric for the median case and asymmetric (and opposite) for the case of the two extreme quartiles.

1.1.2 Technical insight: Quantiles as solutions of a minimization problem

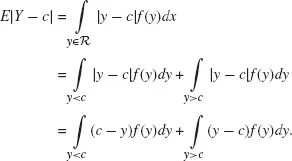

In order to show the formulation of univariate quantiles as solutions of the minimization problem (Koenker 2005) specified by Equation (1.5), the presentation of the solution for the median case, Equation (1.2), is a good starting point. Assuming, without loss of generality, that Y is a continuous random variable, the expected value of the absolute sum of deviations from a given center c can be split into the following two terms:

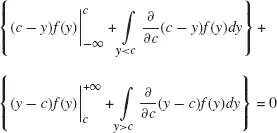

Since the absolute value is a convex function, differentiating E|Y − c| with respect to c and setting the partial derivatives to zero will lead to the solution for the minimum:

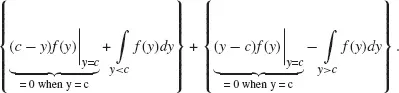

The solution can then be obtained applying the derivative and integrating per part as follows:

Taking into account that:

for a well-defined probability density function, the integrand restricts in y = c1:

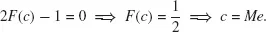

Using then the CDF definition, Equation (1.3), the previous equation reduces to:

and thus:

The solution of the minimization problem formulated in Equation (1.2) is thus the median. The above solution does not change by multiplying the two components of E|Y − c| by a constant θ and (1 − θ), respectively. This a...