![]()

Chapter One

The Schematics of Fraud and Fraud Analytics

Fraud analytics has become the emerging tool of the twenty-first century for detecting anomalies, red flags, and patterns within voluminous amounts of data that is sometimes quite challenging to analyze. The use of fraud analytic tools does not have to be complex to be effective. The techniques of criminals and fraudsters and their shenanigans are savvier due to technology and the means they use to hide fraudulent activities. While technology has played a role in increasing the opportunities to commit fraud, the good news is that it can also play a key role in developing new methods to detect and prevent fraud. In the past, a spreadsheet was the master of fraud analytics. However, a new revolution has taken us by force—new strategies, data mining techniques, and powerful new software are constantly evolving.

The term “fraud” is commonly used for many forms of misconduct even though the legal definition of fraud is very specific. In the broadest sense, fraud can encompass any crime for gain that uses deception as a principal modus operandi. More specifically, “fraud” is defined by Black's Law Dictionary as “a knowing representation of truth or concealment of a material fact to induce another to act to his or her detriment.”1 Consequently, fraud includes any intentional or deliberate act to deprive another of property or money by guile, deception, or other unfair means.

According to the American Association of Fraud Examiners (ACFE):

Health care fraud, identity theft, padded expense reports, mortgage fraud, theft of inventory by employees, manipulated financial statements, insider trading, Ponzi schemes—the range of possible fraud schemes is large, but at the core, all of these acts involve a violation of trust. It is this violation, perhaps even more than the resulting financial loss, that makes such crimes so harmful.2

Because fraud inherently involves efforts at concealment, many frauds go undetected and the criminals get away with them. For these cases, it is impossible to know the impact of the fraud.

How do we Define Fraud Analytics?

Fraud analytics is when analysis relies on “critical thinking” skills to integrate the output of diverse methodologies into a cohesive actionable analysis product. Analysis is used for various approaches, depending upon the type of data/information that is available and the type of analysis that is being performed. The analysis process requires the development and correlation of knowledge, skills, and abilities.

As we embark on the efforts to incorporate more fraud analytics within our organizations it is my hope that many develop a clear understanding of how imperative it is to start using the various tools that are available. There should be no excuse. A few years ago we were baffled after hearing that Bear Stearns had a liquidity problem and that perhaps it was one of the greatest financial scandals in history. The troubles deepened with Fannie Mae, Freddie Mac, AIG, Lehman Brothers, Bernie Madoff, WAMU and countless others. In my white-collar crime mind I often wonder if any fraud analytic tools were used and if so what might they have been? Up until now, the greatest financial debacle in history was perpetrated—believe it or not—in the 1700s. “The South Sea Bubble” scandal in 1720 caused the loss of over $500 billion translated to today's dollars. It took over 300 years to beat that record but is quite obvious that the 21st century has made its mark with fraud and the collapse of major companies that have for decades graced the pages of business magazines. Again, I'm curious to know what kind of fraud analytic tool those uncovered “The South Sea Bubble” scandal used. One would hope that it was a precursor to one of the tools mentioned in the chapters set forth.

Fraud analytics has aligned itself with more than one way to detect and deter, there are more definitions on fraud analytics than in the past and more organizations that are depending upon the most effective and efficient tools that can get the job done.

Report to the Nations on Occupational Fraud and Abuse

In 2012 the ACFE released its annual Report to the Nations on Occupational Fraud and Abuse. The international expansion allows the ACFE to more fully explore the truly global nature of occupational fraud and provides an enhanced view into the severity and impact of these crimes. Additionally, the ACFE compared the anti-fraud measures taken by organizations worldwide in order to give fraud fighters everywhere the most applicable and useful information to help them in their fraud prevention and detection efforts.

James D. Ratley, president of the ACFE, stated in the 2012 Report:

As in previous years, what is perhaps most striking about the data we gathered is how consistent the patterns of fraud are around the globe and over time. We believe this consistency reaffirms the value of our research efforts and the reliability of our findings as truly representative of the characteristics of occupational fraudsters and their schemes.3

Key Findings and Highlights of the 2012 Report to the Nations

Here are some key findings and statistics provided by the 2012 Report to the Nations:

Impact of Occupational Fraud

Survey participants estimated that the typical organization loses 5 percent of its revenues to fraud each year. Applied to the estimated 2011 Gross World Product, this figure translates to a potential projected global fraud loss of more than $3.5 trillion.

The median loss caused by the occupational fraud cases in our study was $140,000. More than one-fifth of these cases caused losses of at least $1 million.

4 Fraud Detection

The frauds reported to us lasted a median of 18 months before being detected.…

Occupational fraud is more likely to be detected by a tip than by any other method. The majority of tips reporting fraud come from employees of the victim organization.

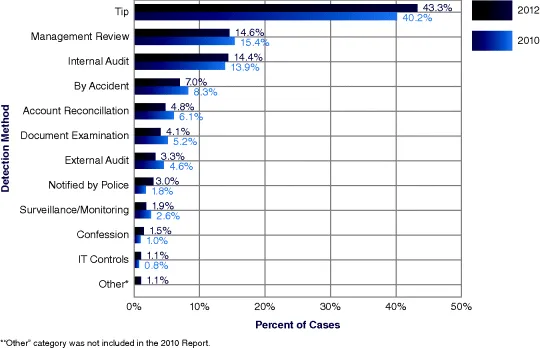

5 Figure 1.1 are results provided in order to “identify patterns and other interesting data regarding fraud detection methods,”6 the ACFE asked respondents to indicate how the frauds were uncovered. The results are shown in Figure 1.1.

Victims of Fraud

Occupational fraud is a significant threat to small businesses. The smallest organizations in our study suffered the largest median losses. These organizations typically employ fewer anti-fraud controls than their larger counterparts, which increases their vulnerability to fraud.

[T]he industries most commonly victimized in our current study were the banking and financial services, government and public administration, and manufacturing sectors.

The presence of anti-fraud controls is notably correlated with significant decreases in the cost and duration of occupational fraud schemes. Victim organizations that had implemented any of 16 common anti-fraud controls experienced considerably lower losses and time-to-detection than organizations lacking these controls.

…

Nearly half of victim organizations do not recover any losses that they suffer due to fraud. As of the time of our survey, 49 percent of victims had not recovered any of the perpetrator's takings; this finding is consistent with our previous research, which indicates that 40 to 50 percent of victim organizations do not recover any of their fraud-related losses.

7 Perpetrators of Fraud

Perpetrators with higher levels of authority tend to cause much larger losses. The median loss among frauds committed by owner/executives was $573,000, the median loss caused by managers was $180,000 and the median loss caused by employees was $60,000.…

The vast majority (77 percent) of all frauds in our study were committed by individuals working in one of six departments: accounting, operations, sales, executive/upper management, customer service, and purchasing. This distribution was very similar to what we found in our 2010 study.

Most occupational fraudsters are first-time offenders with clean employment histories. Approximately 87 percent of occupational fraudsters had never been charged or convicted of a fraud-related offense, and 84 percent had never been punished or terminated by an employer for fraud-related conduct.

In 81 percent of cases, the fraudster displayed one or more behavioral red flags associated with fraudulent conduct. Living beyond means (36 percent of cases), financial difficulties (27 percent), unusually close association with vendors or customers (19 percent) and excessive control issues (18 percent) were the most commonly observed behavioral warning signs.

8 The 2012 Report to the Nations research:

continues to show that small businesses are particularly vulnerable to fraud. These organizations typically have fewer resources than their larger counterparts, which often translates to fewer and less effective anti-fraud controls. In addition, because they have fewer resources, the losses experienced by small businesses tend to have a greater impact than they would in larger organizations. Managers and owners of small businesses should focus their anti-fraud efforts on the most cost-effective control mechanisms, such as hotlines, employee education and setting a proper ethical tone within the organization. Additionally, assessing the specific fraud schemes that pose the greatest threat to the business can help identify those areas that merit additional investment in targeted anti-fraud controls.9

Mining the Field: Fraud Analytics in its New Phase

In this book you will be introduced to seven fraud analytic (data mining) products that have offered many private companies, law enforcement, and financial institutions a broader scope in how to detect and prevent fraud in its truest form.

1. ACL Analytics 10. ACL Analytics 10 is one of the most domineering analytic tools on the market globally. It is highly regarded by many professionals in varying industries of the public, private and government sectors. ACL Analytics 10 is expedient in processing a plethora of data of all sorts. It allows for detection and monitoring of illicit transactions, allows for importing and exporting data into reports that are firmly clear and concise. ACL Analytics 10 has the capability to query scripts, looks for gaps, creates the capability of sampling different kinds of data, monitors control systems, and serves a positive approach of fraud detection. ACL Anal...