- English

- ePUB (mobile friendly)

- Available on iOS & Android

The Complete CPA Reference

About this book

The newly updated fast-reference problem solver

The Complete CPA Desk Reference —the convenient, comprehensive reference professionals have relied on for nearly fifteen years—is now updated in a new Fifth Edition to give today's busy executives and accountants the helpful information they need in a quick-reference format. Packed with practical techniques and rules of thumb for solving day-to-day accounting issues, the new edition helps you quickly pinpoint what to look for, what to watch out for, what to do, and how to do it. In an easy-to-use Q & A format, it covers such useful topics as IFRS standards, internal control over financial reporting financial measures, ratios, and procedures.

- Includes complete coverage of the Risk Assessment Auditing Standards and Standards of the PCAOB

- Incorporates Accounting Standards Codification (ASC) throughout the book

- Adds new chapters on professional ethics and quality controls for CPA firms

- Features a new section on International Financial Reporting Standards (IFRS)

Packed with checklists, samples, and worked-out solutions to a variety of accounting problems, this reliable reference tool is a powerful companion for the complex, ever-changing world of accounting.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

- Income statement preparation involves proper revenue and expense recognition. The income statement format is highlighted in this chapter along with the earnings per share computation.

- Balance sheet reporting covers accounting requirements for the various types of assets, liabilities, and stockholders’ equity.

- The statement of cash flows presents cash receipts and cash payments classified according to investing, financing, and operating activities. Disclosure is also provided for certain noncash investment and financial transactions. A reconciliation is provided between reported earnings and cash flow from operations.

- Interim financial reporting allows for some departures from annual reporting, such as the gross profit method to estimate inventory. The tax provision is based on the effective tax rate expected for the year.

- Personal financial statements show the worth of the individual. Assets and liabilities are reflected at current value in the order of maturity.

- Income statement format

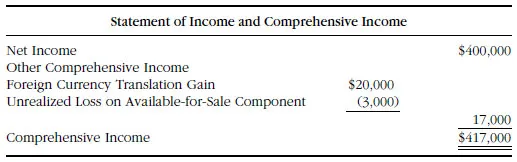

- Comprehensive income

- Extraordinary items

- Nonrecurring items

- Discontinued operations

- Revenue recognition methods

- Accounting for research and development costs

- Presentation of earnings per share

- Foreign currency translation gain or loss

- Unrealized gain or loss on available-for-sale securities

- Change in market value of a futures contract that is a hedge of an asset reported at present value

- “Unusual in nature” means the event is abnormal and not related to the typical operations of the entity.

- “Infrequent in occurrence” means the transaction is not anticipated to take place in the foreseeable future, taking into account the corporate environment.

- The environment of a company includes consideration of industry characteristics, geographical location of operations, and extent of government regulation.

- Materiality is considered by judging the items individually and not in the aggregate. However, if items arise from a single specific event or plan, they should be aggregated.

- Casualty losses

- Losses on expropriation of property by a foreign government

- Gain on life insurance proceeds

- Gain on troubled debt restructuring

- Loss from prohibition under a newly enacted law or regulation

Table of contents

- Cover

- Title Page

- Copyright

- Dedication

- About the Authors

- Acknowledgments

- Introduction

- Part I: Commonly Used Generally Accepted Accounting Principles

- Part II: Analyzing Financial Statements

- Part III: Managerial Accounting Applications

- Part IV: Auditing, Compiling, and Reviewing Financial Statements

- Part V: Taxation

- Part VI: Other Professional Standards

- Index

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app