![]()

Part One

The Investing Environment

The first section of this book paints the picture of the recent market environment. Similar to a screenplay, the characters and players are introduced. Once the stage is set, I will walk you through the various scenes that have captured investors' attention and, at times, have created numerous headaches for fixed income portfolio managers.

It is fair to say that the challenges asset managers face have changed over the past decade. Although there were some previously seen headwinds, the time period from 2005 through 2011 brought on numerous conflicts that investors could not have imagined.

I will take you along a journey highlighting the necessity to remain on top of the ongoing changes and evolve with the market. Although the market is not a living and breathing entity, more times than not, it gives the appearance that it is. This is felt by those participants who are engaged in its daily activities, who ride the ups, downs, highs, and lows in an attempt to outpace its returns.

![]()

Chapter 1

Expect the Unexpected

To succeed, you will soon learn, as I did, the importance of a solid foundation in the basics of education—literacy, both verbal and numerical, and communication skills.

—Alan Greenspan

It's 5:30 A.M. on Monday, September 15. The year is 2008. I am already on my third cup of coffee and riding on—at most—about eight hours of sleep since Friday. I'd spent the weekend glued to the television, watching the story unfold while strategizing my next move. I remember the day as if it were yesterday, sitting in the office, at my desk, staring at my four computer screens and TV, watching the headlines scroll by stating that Lehman Brothers had filed for bankruptcy. The stock was worthless; the company's senior debt was now trading near 27 cents on the dollar with its sub debt in the high teens. As the situation unfolded, the million dollar question that nobody knew how to answer was: How would the markets handle the news and subsequent headlines about Lehman's bankruptcy as they surfaced? Not only was I concerned about how the U.S. and global markets would handle the news, but also, how would the U.S. government, the Fed, and central banks around the world react? What would the repercussions be when the equity markets opened for trading in a few short hours? This was unthinkable. I asked myself, “How could this have happened?”

This should have unfolded differently. The government was expected to step in at some point and throw Lehman a lifeline, as it did when Bear Stearns had fallen into trouble six months prior and needed help. The government played matchmaker, assisting JPMorgan with the purchase of Bear Stearns. The Lehman events that transpired did not follow the “Bear Stearns model;” unfortunately, that model was the simple notion of investors and the media's hopes and dreams that clung tightly to government intervention. The dream did not come true.

THE MODEL HAS CHANGED

How could one of the top five investment banks just shut its doors? And not only shut its doors, but do so at an amazing speed. As reality set in over the subsequent trading days, it was becoming clear that the investment bank model had changed—and so had Wall Street. I had always viewed Lehman Brothers as one of the top five pure investment banks. Goldman Sachs, Merrill Lynch, Bear Stearns (before they fell and were purchased by JPMorgan), and JPMorgan rounded out the group. This list was quickly reduced to two. First, through the fire sale purchase of Bear Stearns by JPMorgan, and then, with the bankruptcy of Lehman Brothers, the reductions commenced. Shortly thereafter, Merrill Lynch struck a deal to be purchased by Bank of America, impacting the investment community once again. In the end, out of the original five, only two remain stand-alone entities with some sort of resemblance to pure investment banks.

From a technical perspective, the true investment bank breed is no longer. It is extinct. Why didn't the government attempt to save this company as it did with Bear Stearns? Didn't the government know or realize the implications? That question can be answered with ease. It is a simple no!

The investment banks that were left standing eventually converted to banking institutions. There was one simple reason for the conversion: The transformation provided them the ability to receive cash injections if needed. This is vital to many financial institutions in order to help fulfill the overnight funding requirements. Overnight funding is essential for financial institutions—in particular, investment banks—to support ongoing daily business. The catch in making this transformation—and there always is a catch—is that the lifelines or cash injections to help bolster the company's ailing balance sheet are from the government. Therefore, the government will, to some degree, have its hand in the business. If nothing else, its presence will be felt through added regulation. The invisible hand of the government has just become more visible.

LESSONS LEARNED

There were numerous lessons learned over the course of time, including the prior example of how quickly a company may shift from a going concern to going out of business. What differentiates top asset managers from the herd is that they learn from the lessons while the others do not. This holds very true within the world of investing. As far back as there are documented records, there are situations and examples providing lessons to learn. Don't worry; you don't have to dust off the history books or travel back that far to gain insight and for examples to surface.

To start, go back a decade or two and look at the bursting of the technology bubble. It provided some straightforward lessons. At one point in your life, someone (possibly your parents) told you, “Don't put all your eggs in one basket.” Sound familiar? If you translate that statement into financial jargon, it would read, “You had better diversify your portfolio to reduce risks.” This advice could potentially have saved portfolios—from pension funds to college savings accounts—millions upon millions of dollars, helping to mitigate losses when the markets turned south.

Since the bursting of the technology bubble, investors have navigated through unthinkable events such as terrorist attacks, corporate corruption, and mismanagement at various companies such as Enron, WorldCom, and even Freddie Mac. All these events impact markets, the investor psyche, and ultimately, the way individuals invest. We have also witnessed and lived through a recession in 2004, tied with a jobless recovery and what many call a near miss on a depression-type event with the popping of the mortgage market and structured securities sector a few short years later. This depression-like event changed the investment banking system and the Wall Street landscape forever.

The collapse of Bear Stearns and Lehman Brothers will never be forgotten. I have close friends and colleagues whose hard-earned life savings (in the form of company stock) were washed away in seconds. They were instantly unemployed in one of worst financial job markets in history. In one weekend, Bear Stearns went from a thriving company to just a memory and an asset on JPMorgan's books.

The crisis didn't affect only Wall Street and the individuals employed and living in the financial capital of the world. The crisis also hit Main Street and investors located all over the world; lifelong veterans and those who were right out of business school. The chain of events impacted everyone. This was reality, and it was overlooked by the media and government when headlines were written. This was just the beginning.

FROM BAD TO WORSE

It went from bad to worse. The day following Lehman Brothers' downfall, the Reserve Fund, the first money market fund created, notified investors that it had to close its doors, due primarily to its exposure to Lehman Brothers and securities it held within the financial sector. The fund's portfolio no longer traded “at the buck”—money market lingo meaning that each share was not worth one dollar anymore. The buck is the one trait a money market fund lives and, in this case, dies by.

The premise of a money market fund is that an investor deposits one dollar and at any time he or she is able to take a dollar out. Investments in a money market fund, prior to the closing of the Reserve Fund, were always revered as safe. In some instances, investors viewed money market funds as the next safest investment to a bank account. In any event, the shares of the Reserve Fund were worth less than the prior day's value due to losses from the collapse of the financial markets—usually a characteristic of a much riskier investment.

Most investors, if not all, want to forget exactly what happened, but it will take years, if not generations, for that to happen. With what seemed like crisis after crisis, economic and otherwise, the markets felt as if they never regained their true footing. There are many lessons to be learned from the credit crisis that started in 2007 and the events that helped shape the landscape following the initial downturn. When embraced, these lessons are life changing. Investing through the markets and reliving the events that unfolded from 2007 through 2009 will help define the type of investor that you are.

![]()

Chapter 2

Navigating through Troubled Water

I've learned that mistakes can often be as good a teacher as success.

—Jack Welch

Today's market is not yesterday's market. It is a simple statement, but it holds many implications. It cannot be stressed or said enough. Current markets hold a plethora of new and unique securities that are constantly evolving. Many of today's securities were not even available to market participants at the turn of the millennium. Adding to the complexity is the recent government intervention that has shaped the markets with regulation. Increased regulation creates a market environment that is in continuous flux, transforming and molding investor decisions as well as handcuffing them at times.

If, one morning, as you were scrolling through the early headlines you had read a prediction, made with one hundred percent certainty, that the U.S. government and its sovereign debt—such as Treasury securities—would lose its triple-A rating, would you have believed that it could happen? These are the Treasury securities that are 100 percent guaranteed by the government and categorized by every textbook and model as risk free.

What type of probability do you think most investors might have placed on the likelihood? Would you have placed a 5 percent probability on the occurrence? How about 10 percent, 50 percent, or maybe even more? Some might even have said that there is a better chance of winning the lottery. Realistically, most individuals, unless cynical in nature, would have said the odds were low. In the end, in a time of uncertainty and market turmoil, or in this case a staggering deficit, the odds of a downgrade resulting in the United States losing its triple-A rating started to increase. It doesn't matter that the United States is the largest economy or that the United States is a democratic nation. However you slice it, irrespective of the surroundings, the odds should have been low for a downgrade.

DEBT CEILING

The politicians didn't seem to show concern about how a downgrade might disrupt the current economic recovery or what the impact might be if there were to be an actual default. The discussions within the U.S. Congress intensified during late July and early August of 2011 in efforts to find some inkling of common ground or accord between parties on how to move forward and raise the U.S. debt ceiling—which they finally did.

To clarify, the debt ceiling is the maximum legal amount that the U.S. federal government is able to borrow. It is similar to your credit card limit. You have the ability to purchase against the card up to your limit without exceeding it. If you do exceed your stipulated limit, the credit card company likely will impose some type of penalty, such as an over-the-limit fee or a notification to the credit agency that calculates your credit score. The government has to follow rules as well: It can purchase up to the debt ceiling limit but not over. This is important, because if the debt limit is reached, the government is not able to borrow or write checks to pay bills. Although the government is required to follow the rules like everyone else, the fact is, we are talking about the government and the rules can be changed. For instance, they can just raise the ceiling. If the debt ceiling is reached without an increase, therefore limiting the availability of funds, consequences could include having to shut down national parks or even miss payments within the Social Security program. If that were not terrible enough, the possibility of the government defaulting on its own debt would be catastrophic. This activity would be debilitating to the U.S. markets and have implications on a global scale. Being responsible for negative repercussions on a global scale is something that the government does not want and can't afford to do. The government did come to an agreement and found a way to raise the debt ceiling.

TRIPLE A: LOST, BUT NOT FORGOTTEN

Although the odds were low, the unthinkable did happen. On August 5, 2011, the United States lost its triple-A rating. U.S. Treasury securities now only hold a triple-A rating from Moody's and a double-A rating from Standard & Poor's (S&P). The downgrade commenced even after the debt ceiling was increased. S&P downgraded the U.S. sovereign rating late in the evening on the Friday after the government raised the ceiling. Truth be told, there had been rumors for a few days prior that the downgrade was in the cards. It can't be said that the rating agencies' intentions were not telegraphed. This wasn't the first time investors heard about the potential downgrade. A few months earlier, S&P downgraded its credit outlook on the United States to negative. This was a warning that echoed through the investing community. A downgrade to the outlook is not the same as lowering the overall rating, just a change in the rating agencies' view. It is a warning sign, a red flag saying to get your act together. The fact that the government did not heed the warning represents how dysfunctional the government can be. Even with the transparency from the rating agencies, everyone was complacent about the possibility of action being taken until it happened.

It is unfortunate that investors even had to consider the possibility that the option of default was discussed. The thought that the United States could default is ludicrous…right? Well, not so fast. The United States did default in the past. The default occurred back in the spring of 1979. Many argue that this was not a default, but I view it differently and here is why. The reason many feel that this was not an actual default was that it constituted only a missed coupon payment. In any event, it is still a missed coupon payment. When an investor is expecting to receive a payment—whether coupon or principal, small or large—and they don't, in my mind, that is a default. As one would expect, the missed coupon payment was very small and the government corrected the matter, but it still produced a stir, as well as likely creating additional uncertainty within investors and the markets.

Just as the government did by dragging its feet on a resolution to the debt ceiling, the rating action by S&P created additional uncertainty at a time when certainty was needed. The U.S. economy was in the midst of expanding and facing various headwinds, resulting in setback after setback. To start, the labor market was weak, unemployment was running over 9 percent, and the housing market was struggling to find its footing. The economy was fighting tooth and nail to stay in an expansion mode and not fall back into negative growth. Now the economy was showing signs of improvement, but would the improvement be sustainable?

POSSIBLE, BUT NOT PROBABLE, CONSEQUENCES

If an agreement to raise the debt ceiling had not been reached, the probability of a global disruption would have been high. The unthinkable could have happened. The U.S. dollar might have been challenged for its status of reserve currency. This is possible, but not likely. What the dollar has going for it is that there are not too many contenders ready for the fight. The euro? I think not. There are too many problems and what seem to be conflicting agendas within the European Union to realistically believe that would happen. Even if its financial system wasn't on the cusp of failure, I believe it would be a hard sell to make.

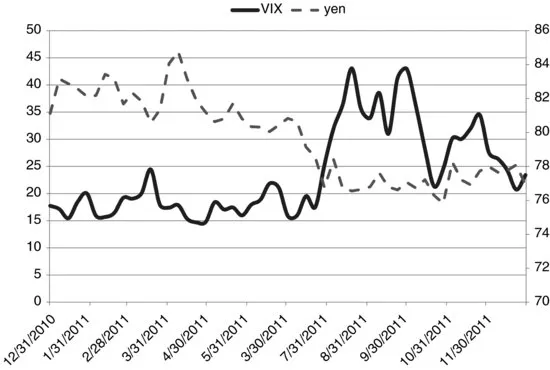

The yen? Well, it has its chances. There is always the flight-to-quality safe-haven bid in the market when trouble on a global scale arises. For instance, take the time period from December 2010 through December 2011 and see how the yen has performed. The right axis of Figure 2.1 reflects the massive rally of the yen versus the dollar. The solid line on the left axis of the chart represents the VIX index, a measure of volatility. The relationship between the two securities is negatively correlated, as you would expect. Statistically, the yen and the VIX carry a negative .77 correlation to one another. As fear and uncertainty gain traction in the marketplace, the VIX index starts to increase its level and move higher. You can see the M-shaped hump from July to September, which represents increased uncertainty. This makes complete sense on multiple fronts. To start, investor fear increased as the debt ceiling discussions—and ultimately the downgrade to U.S. treasuries—were taking place. Additionally, it makes sense that the yen would outperform the dollar in light of the looming and eventual downgrade to U.S. government debt. At the same time that the VIX was climbing, the yen was rallying off its previous highs versus the dollar. It broke the 80 barrier midsummer and continued on its path to the mid-70s as investors flocked to a safe-haven currency.

Figure 2.2 represents the same two securities in 2006. Keep in mind that this was before the housing bubble popped. Both lines carry a much flatter trajectory. The correlation is still negative, but to a lesser magnitude. For this time period, the two produce a negative .47 correlation. It would be expected that the negative correlation would increase as investors lived through the massive wave of defaults within the mortgage and structured security markets, as well as the changing of the landscape of Wall Street as we kne...