![]()

Part 1

How to Set Prices for Maximum Profits

In the first chapters, you’ll learn: - Just how much money you can make—or lose!—from your pricing decisions.

- Why most companies stink at it.

The biggest pricing problem for small to medium-sized companies is that you don’t often have extra time and a consulting budget to make the best pricing decisions. If researching the best price means weeks of work, a migraine headache, and a desire to slit your wrists rather than read even one more demand chart, then you’re more likely to join your competitors in making pricing mistakes. You’ll see those problems in Chapter 2.

But, now you don’t have to make their mistakes. You’ve got this book and its worksheets (found in the appendix and online at this book’s companion web site).

Setting Profitable Prices is a very practical book, because my interest in pricing is practical. Yes, I’m an academic who teaches pricing and marketing at a university. But that’s a new career for me. I’ve previously spent decades marketing for large and small companies, and decades as an entrepreneur. I’m only interested in pricing theory if it provably works.

![]()

Chapter 1

Why Pricing Is the Key to Your Success

Of all the marketing problems you face in launching a new product, pricing is the most important—and the most difficult!

Want proof?

If your new product costs you, say, $45 to produce, and you sell it for $69, your profit—what you can take home with you—is $24.

- If you price that same product $10 higher, you get to pocket the entire $10 extra—resulting in $34 profit instead of $24.

- If you price your product $10 lower, you lose out of your pocket the full $10—resulting in $14 profit instead of $24.

If you sell more of your products, the profit is reduced by your costs of making the extra products. For example, you get an extra sale that brings in $45, but only $24 of that is actual profit.

Raise Prices—or Sell More Products?

Ask most businesspeople what they could do to dramatically increase their profits, and their answers are usually:

- Increase my advertising

- Add more salespeople

- Add incentives to buy more

All three strategies would probably sell more products, but they are risky. The first two will increase your costs—for which you hope to then get a payoff in increased sales and (hopefully) profits. The third strategy will lower your profit margin, so you’re earning less per unit sold.

Yet these three answers miss the most obvious way to dramatically increase profits: a price raise.

Let’s analyze what is best for profits—10 percent more sales (units) or a 10 percent higher price.

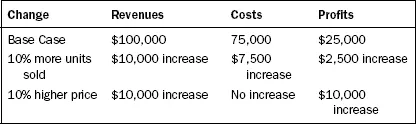

If you are currently selling $100,000 worth of a product, take a look at Exhibit 1.1 to see what would happen.

EXHIBIT 1.1 PRICE EFFECT ON PROFITS

Only with pricing does everything—plus or minus—fall to the bottom line.

You may object to Exhibit 1.1. You might figure that if you raise prices you will sell fewer products. That happens often, but not always.

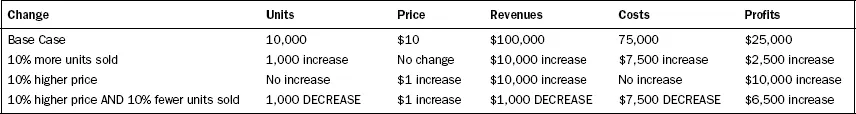

So let’s look at the same situation—if your units sold were to drop 10 percent when you raise prices 10 percent. Now it would look like Exhibit 1.2.

EXHIBIT 1.2 PRICE EFFECT ON PROFITS

Note that in Exhibit 1.2, you’d have:

- $2,500 more profits—selling 10 percent more units

- $10,000 more profits—with a 10 percent higher price

- $6,500 more profits—with a 10 percent higher price even if it lowered units sold by 10 percent

What has that meant for companies? What could it mean for you? Typically, with the cost structure at most companies, a 1 percent increase in price yields a 12 percent gain in profits (Dolan and Simon, 1996).

There’s simply no marketing decision you can make with as strong an impact on your profits as pricing.

Big-Company Case History

When Volkswagen launched the [new Beetle] in the United States, orders flooded in, quickly resulting in consumers waiting nine months for a car. The value customers placed on owning a new Beetle, coupled with the nostalgic effect, was clearly underestimated, and one could make the assumption that a $500 or $1,000 higher price might not have affected sales dramatically but would have significantly increased profits.

Butscher and Laker, 2000

Can you imagine the impact an extra $1,000 in the U.S. price would have had for Volkswagen (VW)? They sold 83,000 new Beetles in the U.S. in 1999. That means whoever picked the price for it may have lost Volkswagen $83 million in profits. Not just in sales—but in profits. And this only counts the first year, not subsequent years.

Yet in Germany, VW had the opposite problem. Their sales were poor due to a “steep” price that Butscher and Laker say overestimated the value Germans put on the car.

Another example is the launch of the Wii. Demand was so strong for the product that stores had waiting lists to get one. An extra $50 on the price wouldn’t have harmed sales at all. Instead consumers lucky enough to buy a Wii were able to resell immediately at a profit of $100 or $125 over the company’s price. So profits that could have (should have?) gone to Wii, went instead to scalpers!

Be sure you don’t throw away money like this!

Tiny-Company Case History

When I launched my first newsletter (Ancillary Profits) I wasn’t very smart about pricing. I knew that $100 was perceived as much bigger than $99 and I came out of the magazine publishing industry, not newsletters. In the magazine industry $20 was a big price. So I priced Ancillary Profits at $97—without even testing other prices.

Fortunately, I decided three months later to test higher prices. In addition to $97, I tested $117 and $127. The winner was $127. It not only gave me $30 more per subscription, but it even brought in 11 percent more orders. That means I was able to pocket 45 percent more profits from just a $30 price increase.

And I was still being stupid. The highest price I tested won. I should have tested even higher. When I did, I was able to get more profits from a $147 price! (Later, even more from $197.)

I calculated how much I lost from not starting at the higher price—and found I’d lost about $38,000 in profits. And if I hadn’t done the three tests within 12 months, it would have been much, much more. Moral of the story: Always test a price that is much higher than you think you can get.

Hopefully, you’re now convinced at how important pricing is to your bottom line.

The problem is that good pricing can be difficult. So difficult that most smaller companies just throw up their hands and take one of two “easy” ways out (both of which can cost you a lot of money!):

- Cost-plus pricing

- Match-your-competitors pricing

We’ll cover cost-plus and match-your-competitors pricing strategies in the next chapter.

![]()

Chapter 2

Why Most Companies Stink at Pricing (and How You Can Do Better!)

Pricing is a specialty topic in marketing—one with very few practitioners. You can get a doctorate in marketing (like I did) without ever taking a course on pricing. That’s because most marketing professors don’t know enough about the topic to be teaching it. There’s an annual pricing conference for academics and there are typically only 30 to 40 of us there each year—and that includes a number of professors from outside the United States.

Most people with specialized pricing skills are working in or have their own pricing consultancy. You can find me and the other pricing consultants at PricingSociety.com under their Pricing Experts Directory. Other pricing specialists work at very large companies and multinationals that can afford their own in-house pricing staff.

If you’re a new, small, or medium-sized company, this means there’s nobody who can give you the pricing help you need. Not unless you’ve got an extra $30–$250K you can afford for a consultant.

What can you do on your own? You can buy a book on pricing and hope to learn what you need from it. The best all-around book on pricing strategy is The Strategy and Tactics of Pricing by Nagle, Holden, and Zale. If you can take the time, I recommend it. I even use it when I teach pricing. However, it can be pretty rough going for a newbie. I was already a pricing specialist when I first read it, and it still took weeks of my time and most of my focus to process it. And it has an academic focus—which means it doesn’t give any of the quick answers business owners and marketers need.

Also, ask yourself what your goal is. Do you want to learn to become a pricing specialist? Or do you just want to price your products for maximum profit and then move on to the million other decisions you need to make?

Buying this book is a smart alternative. It won’t give you the all-around knowledge you’ll get from Nagle and Holden’s book. However, it will get you through your pricing decision in a day (if that’s all you have) or a week (if you can spare more time for a better decision). And it will leave you with a much better—more profitable—price than your competitors.

The “Myth” of Creating Demand Curves

One of the biggest headaches you’ll get from a textbook on pricing—and also in blogs and articles on pricing that are, in my opinion, worthless—is they will tell you to create demand curves to capture the price elasticity of demand.

In normal English, that means you are to track how many units you can sell at different prices—so you can find the most optimal price. Well, duh! If you already know that you can sell 6.5 percent more units at price “A” and 4.3 percent more at price “B,” then your decision is easy. You just calculate the profits and total sales at each price and your decision is made for you.

Just one teeny problem with this: It’s worthless advice for almost everyone. You’d firs...