![]()

PART ONE

Integrated Risk and Capital Management

![]()

CHAPTER 1

Real and Financial Capital

A firm is essentially a transformation function (held together as a “nexus of contracts”) that takes certain inputs and transforms them into outputs.1 In this transformation process, capital has two altogether distinct conceptual meanings. The first is the traditional notion of capital as a factor of production—some kind of asset that helps a firm transform inputs into widgets. In order to finance the required investments in such capital and to disperse the risks of the firm’s assets among a pool of investors, firms issue securities. These securities are also referred to as capital.

The two concepts are, of course, related—too related, unfortunately, despite representing different sides of the traditional corporate balance sheet. It is precisely this close connection that can lead to a fairly significant amount of confusion, especially when it comes to discussing the relation between risk and capital in a practical capital management exercise such as capital budgeting. A banker, for example, is quite likely to define capital budgeting as the allocation of capital to business units. The role played by risk in that exercise is in computing some risk-adjusted return on capital at risk that serves as the hurdle rate or performance measure for these attributions of risk capital to business risks. A corporate treasurer faced with a capital budgeting problem, by contrast, will more likely faithfully compute the net present values of all projects under consideration in order to decide which ones to pursue as new investments in hard assets. Risk comes into the picture through the weighted average cost of capital—itself a risk-adjusted measure of expected returns—used to discount the future risky cash flows on the investment project.

Neither perspective is wrong per se. In fact, we’ll see in Chapter 5 the conditions under which the two approaches imply the same decision rule for whether to accept a new investment project. Clearly, though, the potential for confusion is enormous. Our sole objective in this introductory chapter is to eliminate those sources of confusion by introducing the concepts of capital in a careful, systematic way—specifically, by considering the relationships of the market values of both real capital and financial capital to the market value of the firm. Not surprisingly, we will conclude that they are equal!

In the process of showing this result, we also accomplish two other objectives. First, we provide a quick review of how corporate securities can be viewed through an “options contract lens.” Second, we develop the notion of an economic balance sheet for a firm—a concept that will be very simplistic in this chapter, but which will play an important role and become increasingly complex as we move forward through Part One and the rest of the book.

REAL CAPITAL AND THE VALUE OF THE FIRM

A real asset is any asset that can be consumed or used directly.2 The ability of people or organizations to consume or use a real asset is what gives that asset its value.3 More colloquially, we sometimes say that real assets have value because we can either eat them, give them to someone else to eat, or use them to produce something edible.

A real capital asset—or just real capital—is a specific type of real asset that contributes to the production of a sequence of goods or services over time. What distinguishes a real capital asset from any other real asset is mainly the time dimension. Real capital is involved in medium- and long-term production, whereas real noncapital assets are often consumed immediately. A large dump truck is a real capital asset, for example, whereas an apple is a real noncapital asset intended more for immediate consumption. Other examples of real capital include plants, equipment, patented production processes and technologies, and the like.

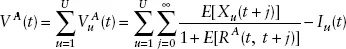

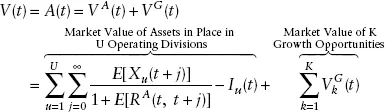

A firm is a collection of real assets held together through a nexus of contracts between various parties, including laborers and capitalists, contractors, customers, and the like. What gives the firm its value is the cash flow that the assets owned by and entrusted to the firm may produce over time. Myers (1977) usefully suggests that the market value of the real assets of the firm—denoted A(T) at any time t—be divided into two components:4

where VA(t) = time t market value of the firm’s assets in place

VG(t) = time t market value of the firm’s growth opportunities

Assets in Place

A firm’s assets in place at time t are those real capital assets that the firm has already bought and paid for with prior investments. The current market value of assets already in place is equal to the discounted present value (PV) of the future net cash flows on those assets plus the firm’s current-period net cash flow from operations, or

where X(t + j) = time t + j net cash flows on current assets

The future expected net cash flows are discounted at the rate of capitalization appropriate to the risk of the stream of future net cash flows—that is, at the expected return on current assets over the relevant time period, E[RA(t, t + j)].

In equation (1.2), net cash flows X are aggregated across all parts of the firm. We include in these quantities, moreover, any noncapital or other operating income and expenditures so that the value of current assets in place is an exhaustive representation of all the firm’s current and future cash flows excluding only the cash flows from growth opportunities (to be discussed shortly). We will retain this assumption through this book unless we explicitly state otherwise.

We can also view the firm as a portfolio or bundle of specific projects or business units. If the firm has U such units and the cash flows from these projects are all mutually exclusive and exhaustive relative to the representation in equation (1.2), then we can rewrite the current market value of the firm’s assets in place as the sum of the market values of the projects or operating divisions of the firm, any of which is denoted VjA(t) at time t:

where Xu(t + j) = time t + j net cash flows on current assets in business unit u

Iu(t) = time t investment expenditure on assets in business unit u

Growth Opportunities

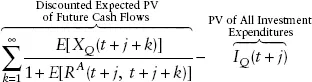

Myers (1977) defines growth opportunities as future opportunities the firm will have to acquire or develop an asset. If the firm decides to make a subsequent investment expenditure, the current growth opportunity will become a future asset in place. Otherwise, the growth opportunity will expire worthless. Growth opportunities may be either strategic decisions the firm faces that have value in their own right or actual future investment opportunities that can be identified today.

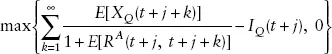

As an example, suppose the firm in question is a pharmaceutical company. At some future date t + j, the firm has the opportunity to begin developing a new drug that will be designated “Project Q.” The firm will incur a series of known future investment expenditures to develop the drug over time, but we treat this sequence of expenditures as a single expenditure made at time t + j equal to the discounted present value of all future investment expenditures for the drug’s development. Denote this investment expenditure as IQ(t + j) at time t + j. If the firm undertakes the project, its net present value will be

where future cash flows come from drug sales revenues, patent licensing revenues, and so on. Alternatively, the firm may decide not to incur the investment expense and to forgo the project. The value at time t + j of Project Q to develop the drug thus is

Growth opportunities are more commonly known as real options because of their call option–like features that are apparent in equation (1.5). Specifically, any particular growth opportunity can be viewed as a call option on the value of a future asset in place with a strike price equal to the investment expenditure required to develop or acquire that asset. We generally associate real options with strategic asset acquisitions or with latent and intangible assets, such as intellectual property.

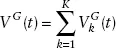

The market value of a growth opportunity at any time t is just the time t price of the real option that can be exercised at time t + j. The market value of all K growth opportunities the firm has identified is just the sum of all the real option prices corresponding to each of the K future projects, decisions, or opportunities:

Value of the Firm

The market value of a firm is equal to the market value of its real capital, which, in turn, is just the sum of the market values of the firm’s assets in place and growth opportunities:

FINANCIAL CAPITAL AND THE VALUE OF THE FIRM

A financial asset is just a claim on the cash flows generated by one or more real assets. Financial assets come in numerous forms and are created for a variety of reasons, all of which are intended in some way to assist individuals in the consumption, production, and/or exchange of real assets or to assist corporations in some aspect of their business activities.

When a financial asset is issued by a corporation, we call that asset financial capital for the corporate issuer. Corporations generally issue financial capital for several reasons. The first and most obvious function of financial capital is raising funds to help the issuing firm finance its investments by exchanging a claim on the future cash flows of the firm’s real assets for current cash. In addition, issuing financial capital pools investments in the firm’s assets to diversify the risks of those assets across multiple investors. Financial capital, of course, also carries the same benefits of other financial assets, such as facilitating a change of control of a bundle of assets (e.g., a firm) without forcing the real assets to be exchanged.

As was the case with real capital as compared to real assets, the ma...