![]()

Part 1

Market, instruments, and motivations

![]()

Chapter 1

Credit derivatives: Structure, evolution, motivations, and economics

Credit derivatives, an instrument that emerged around 1993–94, are a part of the market for financial derivatives. Since credit derivatives are mostly not traded on any of the organized exchanges, they are a part of the over-the-counter (OTC) derivatives market, even though attempts at exchange trading are currently on. Though still a relatively small part of the huge market for OTC derivatives, credit derivatives are growing faster than any other OTC derivative, the reasons for which are not difficult to understand.

Credit derivatives are derivative contracts that seek to transfer defined credit risks in a credit product or bunch of credit products to the counterparty to the derivative contract. The counterparty to the derivative contract could either be a market participant, or could be the capital market through the process of securitization. The credit product might either be exposure inherent in a credit asset such as a loan, or might be generic credit risk such as bankruptcy risk of an entity. As the risks, and rewards commensurate with the risks, are transferred to the counterparty, the counterparty assumes the position of a virtual or synthetic holder of the credit asset.

The counterparty to a credit derivative product that acquires exposure to the risk synthetically acquires exposure to the entity whose risk is being traded by the credit derivative product. Thus, the credit derivative trade allows people to trade in the generic credit risk of the entity, without having to trade in a credit asset such as a loan or a bond. Given the fact that the synthetic market does not have several of the limitations or constraints of the market for cash bonds or loans, credit derivatives have become an alternative parallel trading instrument that is linked to the value of a firm—similar to equities and bonds. Equities allow trading in the residual value of the firm. Debt allows a trade in the debt of a firm. Credit derivatives allow a trade in the risk of default or bankruptcy of a firm.

Coupled with the device of securitization, credit derivatives have been rendered into investment products. Thus, investors may invest in credit-linked notes (CLNs) and gain credit exposure to an entity, or a bunch of entities. Securitization linked with credit derivatives has led to the commoditization of credit risk.

Apart from commoditization of credit risk by securitization, there are two other developments that seem to have contributed to the exponential growth of credit derivatives—index products and structured credit trading.

In the market for equities and bonds, investors may acquire exposure to either a single entity’s stocks or bonds, or to a broad-based index. The logical outcome of the increasing popularity of credit derivatives was the development of credit derivatives indices. Thus, instead of gaining or selling exposure to the credit risk of a single entity, one may buy or sell exposure to a broad-based index, or sub-indices, implying risk in a generalized, diversified index of names.

The idea of tranching or structured credit trading is essentially similar to that of seniority in the bond market—one may have senior bonds, pari passu bonds, or junior bonds. In the credit derivatives market, this idea has been carried to a much more intensive level with tranches representing risk of different levels. These principles have been borrowed from the structured finance market. Thus, on a bunch of 100 names, one may take either the first 3 percent risk, or the 4–6 percent slice of the risk, or the 7–10 percent slice, and so on.

The combination of tranching with the indices leads to trades in tranches of indices, opening doors for a wide range of strategies or views to take on credit risk. Traders may trade on the generic risk of default in the pool of names, or may trade on correlation in the pool, or the way the different tranches are expected to behave with a generic upside or downside movement in the credit spreads, or the movement of the credit curve over time, etc.

Quite often, the development of the hedge fund industry has been associated with the development of credit derivatives. Hedge funds are prominent in credit derivatives trades, particularly in the case of the lower tranches of the structured credit spectrum. The hedge fund industry represents the segment of investor capital that is least regulated, risk neutral, out to seize opportunities arising out of mis-pricing, and so on. As the credit derivatives trades are almost completely unregulated and offer opportunities of short trades in credit not permitted by the bond market, the credit derivatives industry provides an excellent playing ground for the hedge funds.

Credit risk: The challenge of our times

This book is about credit derivatives, and credit derivatives are devices that provide for trading in generic credit risk of an entity, asset, or bunch of entities, or bunch of assets. Credit risk is the risk inherent in credit, and credit is the very basis of our present society.

Our present society lives on credit and rests (this word might be quite a misnomer!) on credit. From governments to the marginal consumer, every one increases current spending power based on credit. Credit allows us to consume far more than our current earnings sustain. Therefore, credit is the very basis of consumerism. Credit is the driving force of the world economy.

Credit is parting with value today against a promise for value in future. Credit risk is the risk that the promise may be broken. Obviously therefore, credit risk is the most important economic risk facing society. Over the past 10 years or so, the global economy has seen ballooning of credit.

Corporate defaults are reaching never-before dimensions, and have assumed a far-reaching impact. In the United States (US) alone, in 2001, 211 debt issuers defaulted on $115 billion in debt. The corporate default rate went up in 2002, but came down sharply in the 2003 to 2006 period. What is special is not the increasing number of defaults, but the increasing backlash of each such default—in terms of magnitude, loss of jobs, loss of investments, loss of taxpayers’ money, and finally, the loss of confidence in the corporate system. The largely benign credit environment over these years also bolstered corporate debt—including financial sector debt, the total credit amounted to some $20.7 trillion as of end-2006.1 The credit environment started deteriorating sharply towards later part of 2007 as a result of the sub-prime crisis, which continued to deepen all through 2008.

Derivatives: The building block of credit derivatives

The development of credit derivatives is a logical extension of the ever-growing array of derivatives trading in the market. The concept of a derivative is to create a contract that allows a trade in some risk or some volatility. This risk or volatility may relate to the price or performance of a reference asset, event, a market price, or any other economic or natural phenomenon. Such trade in risk does not mean a trade in the reference asset. The reference asset may remain with someone who is a complete stranger to the derivative contract. However, the derivative trade closely mimics the risks and returns of holding the underlying asset or a part thereof. Thus, derivatives bring about a completely independent trade in the risks/returns of an asset. For example, a trade in options or futures in equities may run completely independent of trades in equity shares.

Credit derivatives apply the same notion to a credit asset. Credit asset is the asset that a provider of credit creates, such as a loan given by a bank, or a bond held by a capital market participant. A credit derivative enables a generic trading in the risk of default of the issuer on its credit obligations. A debt issuer would default on its obligations when the issuer loses all its net worth—so, a credit derivative takes a view on the potential bankruptcy risk of the issuer.

Thus, credit derivatives essentially use the derivatives format to acquire or shift risks and rewards in credit assets, namely, loans or bonds, to other market participants. Like capital market derivatives, credit derivatives make it possible to continue to hold a credit asset, but transfer the risks of holding it, and replace the same by either a pure counterparty risk or risk in a safer asset. Reciprocally, credit derivatives make it possible to not hold a credit asset and yet synthetically2 create the position of risk and reward in a credit asset or portfolio of assets.

Securitization: The other building block

Much of the growth that credit derivatives enjoy today is because of the structuring techniques and the ability to embed a risk into a funded capital market instrument. These techniques were developed in the context of securitization and are today known as a part of a broader market for “structured finance.” Credit derivatives would have mostly been a closely held esoteric market, but for the introduction of a securitization device to commoditize a credit derivative and to bring it to the capital market.

Securitized credit derivatives, or synthetic securitization, are a device of embedding a credit derivative feature into a capital market security so as to transfer the credit risk into the capital markets. In the case of synthetic securitizations, the protection against the risk is ultimately provided by the capital markets.

The synthesis of credit derivatives with the securitization methodology has been complementary. Credit derivatives acquired a new meaning when they were turned into marketable securities using securitization techniques; securitization on the other hand received a new impetus by opening up the possibilities of keeping a whole portfolio of credit assets on books and yet transferring the credit risks of the portfolio. Many erstwhile securitizers in Europe and Asia prefer synthetic securitizations to cash transfers.

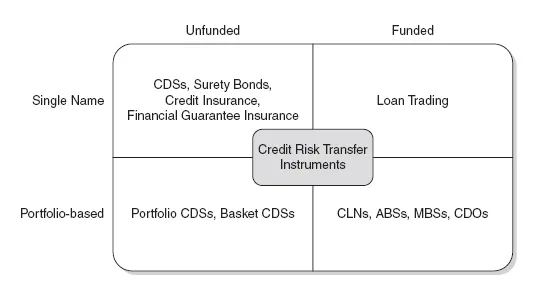

Instruments of credit risk transfer

Credit derivatives may be viewed as an instrument of credit risk transfer (CRT). CRT devices include a gamut of instruments including several funded and unfunded instruments, such as securitization, loan trading, and loan syndications, credit insurance, bond insurance and guarantees, and credit derivatives. Figure 1.1 illustrates different CRT devices.

Figure 1.1 Classification of CRT devices

The figure above also looks at various CRT devices from a viewpoint of being funded or unfunded. A CRT device is said to be funded when the risk transferee not only acquires the risk but also puts in funding; for example, in case of a loan trading transaction. If a risk transfer is unfunded, the transferee simply acquires the risk and makes a commitment to make a compensatory payment if the risk event materializes; for example, in the case of credit derivatives. In addition, CRT devices may relate to a single loan or a portfolio of loans.

Meaning of credit derivatives

What is a credit derivative?

A credit asset is the extension of credit in some form: normally a loan, accounts receivable, installment credit, or financial lease contract. Every credit asset is a bundle of risks and returns: every credit asset is acquired to make certain returns on the asset, and the probability of not making the expected return is the risk inherent in a credit asset. The credit asset may, of course, end up in a full or partial loss, which is also a case of volatility of return in that the return is negative.

There are several reasons why a credit asset may not end up giving the expecte...