Part I

Tax Facts

In this part . . .

Do you find the subject of taxation decidedly taxing? Does working out your tax bill leave you nursing a pounding headache? Never fear – this part is just for you and gently eases you into the basics of the UK tax system. Think of this part as the foundation stone on which you can build and broaden your knowledge – or the code-breaker that helps you understand the taxman’s gobbledegook.

In this part I tell you how the tax system works, what you have to do to keep on the right side of the law and how to make life easier for yourself by getting properly organised. I also explain the self-assessment system, so that you have a good understanding of how to complete the right forms, calculate your tax bill and pay anything you owe on the right date (so avoiding any nasty fines).

Chapter 1

Thinking About Tax

In This Chapter

Getting to grips with the main taxes

Understanding how you pay HMRC

Being tax-efficient with savings and investments

Thinking about retirement and benefits

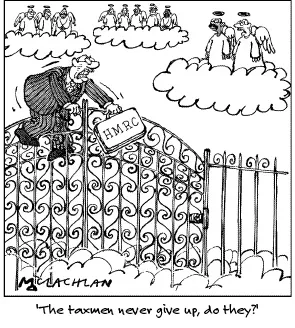

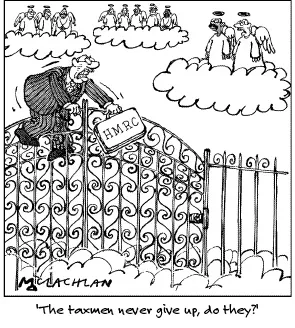

Much as you may hate paying it, tax is a fact of life. The government relies on taxing your income and savings in order to pay for the public services such as the National Health Service, education and the police. And try as you may (and I certainly don’t recommend that you do), you can’t hide from HM Revenue & Customs (HMRC).

Many people have no direct contact with HMRC whatsoever. If your earnings are about average and you don’t have a second home, overseas investments, a second job or any of a number of other sources of income, you may never meet the taxman. Your employer, banks or investment companies often pay any tax liabilities you have on your behalf. But even if you don’t currently have direct contact with HMRC, you may need to in the future, and so getting to grips with the basics of tax is important.

Chapter 2 gives you an overview of the legalities of the UK tax system. But to get you started, this chapter looks at which taxes we pay, why and how, and introduces you to key areas in which you can save tax.

Looking at Types of Tax

When I refer to ‘tax’, I’m really over-simplifying a vast and complex system for collecting the money that the government needs to pay for all the services, such as hospitals, schools and the police, which the country needs. Tax doesn’t just refer to the money that your employer deducts from your pay packet, it can also be payable when you buy goods or services (VAT), when you die (inheritance tax) or when you give something away (capital gains tax). Here is a summary of the main taxes you’re likely to encounter during your lifetime:

Capital gains tax (CGT) is generally charged on the profit you make when you sell (or give away) certain assets such as shares and properties. Between 6 April 2008 and 22 June 2010 capital gains tax was payable at a flat rate of 18 per cent. From 23 June 2010 onwards, CGT is still payable at 18 per cent for basic rate taxpayers, but if you are liable to income tax at the higher rate, you will have to pay CGT at the new rate of 28 per cent on any gains you make. Trustees and personal representatives also have to pay CGT on gains at the new rate of 28 per cent from 23 June 2010. Chapter 6 has more on CGT.

Corporation tax is payable by incorporated companies on their business profits. Rates currently vary between 21 per cent for companies with small profits, up to 28 per cent for companies with profits over £1.5 million. Corporation tax rates are being cut from 1 April 2011 – see Chapter 17 for information on incorporation and corporation tax rates.

Council tax is paid on your residence whether you own it or rent it. Discounts apply to people living on their own. The amount you pay depends on where you live and the value of the property you live in. Chapter 7 explains more.

Income tax is charged on earnings you receive from an employer, or profits you make if you’re self-employed and run your own business. You also have to pay income tax on most income you receive from savings and investments. Some state benefits, such as the state retirement pension, are also chargeable to income tax. Income tax is currently charged at 10 per cent, 20 per cent, 32.5 per cent, 40 per cent and 50 per cent – see Chapter 4 for more on this.

Inheritance tax is charged on the value of your estate when you die. Your executors (the people who sort out your affairs when you die) pay inheritance tax and it’s subject to a tax-free nil-rate band (£325,000 for 2010–11). You can transfer any unused inheritance tax nil-rate band on a person’s death to the estate of his or her surviving spouse or civil partner who dies on or after 9 October 2007. Take a look at Chapter 8 for more on inheritance tax.

National insurance is a tax on those who work and the people for which they work: both employees and employers have to pay. Special rules apply for self-employed people. You can pay national insurance even if you don’t earn enough to pay income tax. Paying voluntary contributions may enhance a future entitlement to state benefits. The rates are quite complicated, but most people pay 11 per cent (12 per cent from April 2011) across most of their earnings from work. Chapter 12 deals with employees’ national insurance and Chapter 15 deals with the special self-employment rules.

Stamp duty is paid on most property transactions and most stock market deals. Rates range from 1 per cent to 4 per cent depending on the value of the property being purchased. The tax doesn’t rise evenly – stamp duty is payable at 3 per cent on transactions up to £500,000 and at 4 per cent over £500,000. So you pay tax of £14,970 when you buy a property for £499,000 (£499,000 × 3 per cent) and £20,040 on a property of £501,000 (£501,000 × 4 per cent) – so just a £2,000 increase in property price can mean an extra £5,070 in tax! Flick to Chapter 7 for more on stamp duty.

Value Added Tax (VAT) is charged by registered businesses on most business transactions. VAT is also charged on the provision of most labour services. The end result is a sales tax on many items and services you buy. The standard rate of VAT was reduced from 17.5 per cent to 15 per cent from 1 December 2008, but only for a year. From 1 January 2010, it went back up to 17.5 per cent and it will rise again to 20 per cent from 4 January 2011. Some items, such as the installation of mobility aids for the elderly and related supplies of the mobility aids themselves, is charged at the reduced rate of 5 per cent. Chapters 15 a...