- English

- ePUB (mobile friendly)

- Available on iOS & Android

Frequently Asked Questions in Islamic Finance

About This Book

In Frequently Asked Questions in Islamic Finance, industry expert Brian Kettell answers some of the most frequently asked questions from his many years experience in working and teaching in Islamic finance and banking. From knowledge of the Qu'ran and Sharia'a Law, to new and old Islamic financial concepts, Islamic terms, and Islamic financial instruments and services, this book covers all the key areas that practitioners need to Islamic finance. The book addresses individual questions such as "what is Takaful?", and provide answers with a clear overview of the product or service, and an example, or illustration where appropriate, of how they work in practice. The book also features a question and answer section for readers to test and build their knowledge of the area.

Light, entertaining and varied in its approach, Frequently Asked Questions in Islamic Finance will prove popular for experienced practioners and novices alike.

Frequently asked questions

| 1890s | Barclays Bank opens its Cairo branch to process the financial transactions related to the construction of the Suez Canal. This is understood to be the first commercial bank established in the Muslim world. As soon as the bank’s branch was opened, Islamic scholars initiated a critique of bank interest as being the prohibited riba. |

| 1900-1930 | The critique also spreads to other Arab regions, and to the Indian subcontinent. In this debate, a majority of scholars subscribed to the position that interest in all its forms constitutes the prohibited riba. |

| 1930-1950 | Islamic economists also initiate the first critique of interest from the Islamic economic perspective and attempt to outline Sharia’a-compliant alternatives in the form of partnerships. |

| 1950s | Islamic scholars and economists start to offer theoretical models of banking and finance as a substitute for interest-based banking. By 1953, Islamic economists offered the first description of an interest-free bank based on two-tier Mudaraba (both collection of funds and extension of financing on a Mudaraba basis). Later they showed that financial intermediation can also be organised on a Wakala basis. |

| 1950s-1960s | First experimental Islamic banks develop interest-free savings and loans societies in Pakistan and the Indian subcontinent. Egypt and Malaysia experiment with pioneering ventures in the 1960s. New banks develop during the 1970s as oil money pours into the Gulf states. |

| 1960s | Banking applications and practices in finance based on Islamic principles begin in Egypt and Malaysia. The landmark events include the rise and fall of Mit Ghamr (Egypt) Saving Associations during the period 1961-1964 and the establishment of Malaysia’s Tabung Haji in 1962. Tabung Haji has since flourished and has become the oldest Islamic financial institution in modern times. |

| Operational mechanisms for institutions offering Islamic financial services (IFS) began to be proposed and a number of books on Islamic banking based on profit and loss sharing/bearing and leasing were published. | |

| 1970s | Islamic banks emerge with the establishment, in 1975, of the Dubai Islamic Bank and the Islamic Development Bank (IDB). Also in 1975, fuqaha (Muslim jurists) objections to conventional insurance became pronounced, laying the ground for an alternative structure, takaful. Murabaha was developed as the core mechanism for the investment of Islamic banks’ funds. |

| Academic activities were launched with the first International Conference on Islamic Economics, held in Mecca in 1976. The first specialised research institution - the Centre for Research in | |

| Islamic Economics - was established by the King Abdul Aziz University in Jeddah in 1978. The first takaful company was established in 1979. | |

| 1979 | Pakistan becomes the first nation to ‘Islamise’ banking practices at state level. The process continued until 1985. |

| 1980s | More Islamic banks and academic institutions emerge in several countries. Pakistan, Iran and Sudan announce their intention to transform their overall financial systems so as to be in compliance with Sharia’a rules and principles. The governors of central banks and monetary authorities of the Organisation of Islamic Conference (OIC) member countries, in their Fourth Meeting held in Khartoum on the 7th and 8th of March 1981, called jointly, for the first time, for strengthened regulation and supervision of Islamic financial institutions. The Islamic Research and Training Institute (IRTI) was established by the IDB in 1981. |

| In 1980, Pakistan passed legislation to establish Mudaraba companies. Other countries such as Malaysia and Bahrain initiated Islamic banking within the framework of the existing system. The International Monetary Fund (IMF) published working papers and articles on Islamic banking, while Ph D research and other publications on Islamic banking were on the increase in the West. | |

| The OIC Fiqh Academy and other Fiqh boards engaged in discussions as to how to apply Sharia’a principles to Islamic banks. | |

| Islamic mutual funds and other non-banking financial institutions emerged towards the middle of the 1980s. | |

| July 1983 | Malaysia opens its first official Sharia’a-compliant bank, Bank Islam Malaysia. |

| September 1983 | Sudan reforms its banking system on Islamic principles after President Jaafar al-Numeiri establishes Sharia’a law. Dual banking system develops; Islamic in the north and conventional in the south. |

| March 1984 | Iran switches to interest-free banking at the national level after passing a 1983 Islamic Banking law that was promised in the 1979 Islamic revolution. |

| By 1985 | Islamic financial products are offered by more than 50 conventional banks around the globe. Other major banks followed by the 1990s. |

| February 26, 1990 | International Islamic accounting standards organisation, the Accounting and Auditing Organisation for Islamic Financial Institutions (AAOIFI), is established in Bahrain by the IDB. |

| 1990s | Public policy interest in the Islamic financial system grows in several countries. |

| The first AAOIFI standards were issued. The development of Islamic banking products intensified. Interest in Islamic finance increased in Western academic circles, and the Harvard Islamic Finance Forum was established. Large international conventional banks started operating Islamic windows. The Dow Jones and Financial Times Islamic indexes were launched. Systemic concerns and regulation, supervision and risk management issues gathered momentum. Several countries introduced legislation to facilitate Islamic banking and its regulation and supervision. | |

| Commercial event organisers discovered Islamic banking and finance conferences as a source of lucrative business. | |

| 1991 | Indonesia’s first officially sponsored Islamic bank, Bank Muamalat, is established. |

| 2000s | Sovereign and corporate sukuk as alternatives to conventional bonds emerge and increase rapidly in volume. Bahrain issues Financial Trust Laws. |

| International Islamic financial infrastructure institutions such as the Islamic Financial Services Board (IFSB), International Islamic Financial Market (IIFM), General Council for Islamic Banks and Financial Institutions (GCIBFI) and the Arbitration and Reconciliation Centre for Islamic Financial Institutions (ARCIFI), as well as other commercial support institutions such as the International | |

| Islamic Rating Agency (IIRA) and the Liquidity Management Centre (LMC), were established. The systemic importance of Islamic banks and financial institutions has been recognised in several jurisdictions. | |

| The governments of United Kingdom and Singapore extended tax neutrality to Islamic financial services. | |

| By 2000 | About 200 Islamic financial institutions have over US$8 billion in capital, over US$100 billion in deposits and manage assets worth more than US$160 billion. |

| About 40% are in the Middle East, another 40% in South and Southeast Asia and the remaining 20% are split between Africa, and Europe and the Americas. | |

| 2001 | Malaysia’s Financial Sector Master plan sets a target for Islamic finance to make up 20% of the finance sector by 2010. By 2009, its share of financial assets was about 17%. |

| 2002 | International standard setting organisation, the Islamic Financial Services Board, is established in Kuala Lumpur, Malaysia. |

| 2004-2008 | Investor interest in Islamic finance products grows strongly amid steady rise in oil prices and petrodollars flowing through oil-producing states. World oil prices peaked at over US$147 per barrel in mid-2008 before sliding sharply. |

| 2004 | Islamic Bank of Britain, the European Union’s first Sharia’a-compliant high street bank, opens in the United Kingdom. |

| 2006 | Dubai’s main stock exchange, the Dubai Financial Market, announces that it is restructuring itself into the world’s first Islamic bourse. |

| 2008 | Global credit crisis and economic slowdown send conventional financial markets into steep tailspin. New Islamic bond issuance falls two-thirds to a three-year low of US$15.77 billion. |

Table of contents

- Previously Published Titles by the Author

- Title Page

- Copyright Page

- Dedication

- Frequently Asked Questions

- Preface

- Introduction

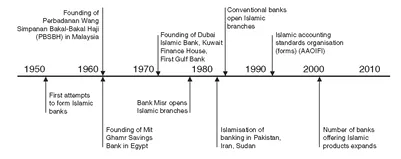

- Chapter 1 - The Islamic Banking Timeline (1890-2010)

- Chapter 2 - Frequently Asked Questions

- Chapter 3 - Why is Interest (Riba) Forbidden to Muslims?

- Chapter 4 - Derivatives and Islamic Finance

- Chapter 5 - How do you Establish an Islamic Bank?

- Chapter 6 - Islamic Banking and Finance Qualifications

- Chapter 7 - How Much Arabic do you Need to Know to Work in the Industry?

- Chapter 8 - Test Your Knowledge

- Chapter 9 - Further Reading

- Appendix - Answers to Chapter 8 Test Your Knowledge

- Index